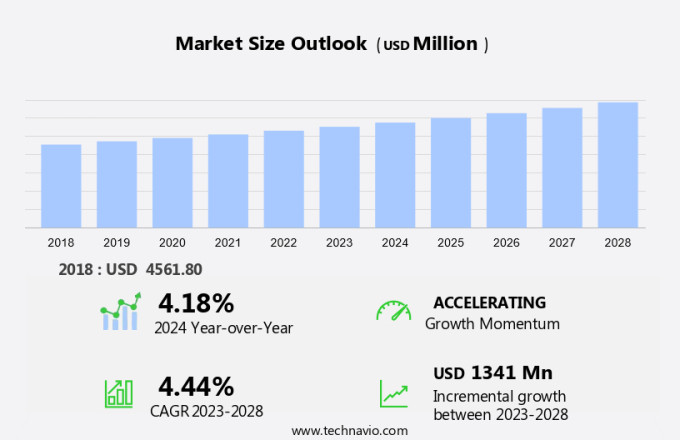

Fracking Water Treatment Market Size 2024-2028

The fracking water treatment market size is forecast to increase by USD 1.34 billion, at a CAGR of 4.44% between 2023 and 2028.

- The market is experiencing significant growth due to several key drivers. The increasing consumption of natural gas as a primary source of energy is one of the primary factors fueling market growth. Fracking is an essential process in natural gas extraction, and water treatment used in this process is crucial to ensure its reusability and minimize environmental impact. Another trend influencing market growth is the adoption of supercritical carbon dioxide (scCO2) in fracking processes. This technology offers several advantages, including reduced water usage and lower greenhouse gas emissions. However, the market faces challenges, including uncertainty in crude oil prices and the high cost of water treatment technologies. Despite these challenges, the market is expected to continue growing due to the increasing demand for natural gas and the need to minimize water usage and environmental impact in fracking operations.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing number of drilling projects using hydraulic fracturing (HF) technique for extracting hydrocarbons, including natural gas and crude oil. Hydraulic fracturing requires large volumes of water, which can lead to groundwater contamination and the presence of chemical constituents, pathogens, and other impurities in the produced water. To mitigate these issues, water recycling and wastewater treatment have become essential components of fracking operations. Horizontal drilling and advanced hydraulic fracturing techniques have increased the efficiency of hydrocarbon extraction, leading to an increased demand for water treatment solutions. The natural gas market's growth and hydrocarbon discoveries have also driven the demand for fracking water treatment.

- However, environmental concerns, such as water shortage and wastewater reuse, have led to the exploration of alternative water sources and the development of technologies for the treatment and reuse of produced water. The produced water contains dissolved solids, salts, hazardous metals, radionuclides, and chemical additives, making wastewater treatment a complex process. Biofuels and other industrial applications also contribute to the demand for wastewater treatment in the fracking industry. Overall, the market for fracking water treatment is expected to grow significantly due to the increasing demand for hydrocarbons and the need for environmental efficiency in fracking operations.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Treatment and recycle

- Deep well injection

- End-user

- Commercial

- Industrial

- Residential

- Geography

- North America

- Canada

- US

- Europe

- France

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

- The treatment and recycle segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for water in various industries, particularly in the Natural Gas market with the rise of horizontal drilling and hydraulic fracturing techniques. These processes consume vast quantities of water, leading to concerns over groundwater contamination and the depletion of freshwater resources. As a result, there is a growing emphasis on water recycling and wastewater treatment to ensure environmental efficiency and minimize the use of freshwater. The hydraulic fracturing process involves the injection of large volumes of water, along with chemical constituents, into shale formations to extract hydrocarbons. This process can lead to the introduction of pathogens, dissolved solids, salts, hazardous metals, and radionuclides into groundwater and surface water.

Moreover, the demand for crude oil and the increasing number of drilling projects further intensify the need for water treatment. Water treatment technologies play a crucial role in addressing the environmental considerations of the fracking process. These technologies enable the removal of contaminants, including chemical additives, from the wastewater, making it suitable for reuse in drilling operations or for other industrial purposes. However, regional nuances and potential challenges, such as the availability of water resources and the cost of treatment, may impact the market's growth trajectory. Industrialists are increasingly focusing on downhole water minimization techniques to lift water from deep reservoirs, reducing the need for freshwater in the hydraulic fracturing process.

Get a glance at the market report of share of various segments Request Free Sample

The treatment and recycle segment was valued at USD 2.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 84% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing demand for shale gas and stringent regulations governing the disposal of fracking wastewater. The treatment process involves removing impurities and contaminants, such as heavy metals and volatile organic compounds, to meet environmental standards. Inflationary pressures on raw materials and operational costs are key challenges for market participants. To mitigate these challenges, companies are adopting advanced technologies, such as membrane filtration and chemical treatment, to optimize water usage and reduce costs. The market is expected to continue its expansion, driven by the need for sustainable and cost-effective water treatment solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Fracking Water Treatment Market?

Increasing consumption of natural gas is the key driver of the market.

- The market is witnessing significant growth due to the increasing demand for natural gas, particularly in developing economies. Natural gas is a clean energy resource, known for its lower carbon emissions compared to coal and oil. The abundance and versatility of natural gas, coupled with its clean-burning properties, are driving its demand. According to the International Energy Agency (IEA), global natural gas demand grew by 5.3% in 2021, with APAC expected to account for 60% of the total increase during 2019-2024. The drilling activities associated with Horizontal Drilling and Hydraulic Fracturing (Hydraulic fracking technique) require large volumes of water, which can lead to Groundwater Contamination and the presence of Chemical Constituents, Pathogens, and other impurities.

- To mitigate these concerns, there is a growing focus on Water Recycling and Wastewater Treatment in the Natural Gas Market. Industrialists are adopting advanced Water Treatment Technologies to minimize the use of fresh water and ensure Environmental efficiency. The potential challenges include regional nuances, such as Water shortage and the presence of Dissolved solids, Salts, Hazardous metals, Radionuclides, and Chemical additives in the Wastewater. Additionally, the Hydrocarbon discoveries in Shale gas formations are increasing the need for effective Fracking Water Treatment solutions. Consumers and regulators are demanding greater focus on environmental considerations, making it crucial for companies to address these challenges and provide sustainable and cost-effective solutions.

What are the market trends shaping the Fracking Water Treatment Market?

The adoption of supercritical carbon in fracking is the upcoming trend in the market.

- The market is witnessing significant growth due to the increasing demand for natural gas and crude oil, leading to an increase in drilling projects. However, concerns over groundwater contamination from the fracturing process using large volumes of water and the production of hazardous wastewater are potential challenges. To mitigate these issues, research and development efforts are focused on water recycling and wastewater reuse technologies, such as supercritical carbon. This innovative technology reduces water usage as a fuel and can be easily captured and reused in the process. Additionally, supercritical carbon is more efficient in hydraulic fracturing, reducing the need for surface water and dissolved solids, salts, hazardous metals, radionuclides, and chemical additives.

- Environmental efficiency is a key consideration in the fracking industry, and industrialists are focusing on downhole water minimization and lifting water for reuse. Regional nuances and potential challenges, such as water shortages and hydrocarbon resource availability, are also driving the adoption of advanced water treatment technologies. The hydraulic fracking technique is used to extract hydrocarbons from shale formations, and the demand for this technique is expected to increase with hydrocarbon discoveries and the growing demand for fuel in the biofuels market. Consumers and regulators are increasingly demanding environmental considerations in drilling activity, making it essential for companies to invest in advanced water treatment technologies to ensure regulatory compliance and maintain a positive public image.

What challenges does the Fracking Water Treatment Market face during the growth?

Uncertainty in crude oil prices is a key challenge affecting the market growth.

- The market has gained significant attention due to the increasing drilling activities in the natural gas and crude oil industry. With the rise in hydrocarbon discoveries through horizontal drilling and hydraulic fracturing techniques, there is a growing concern for Groundwater Contamination from the use of large volumes of water, Chemical Constituents, Pathogens, and other impurities in the fracking process. The Natural Gas Market's growth has led to an increased focus on Water Recycling and Wastewater Treatment to ensure Environmental efficiency. The Hydraulic Fracturing process involves the use of large quantities of water, Surface water, and Ground water, which may contain Dissolved solids, Salts, Hazardous metals, Radionuclides, and Chemical additives.

- The reuse of wastewater in drilling projects is essential to mitigate water shortage and reduce the environmental impact of the Fracking Water Treatment process. Industrialists are investing in advanced Water treatment technologies to address the potential challenges of Groundwater Contamination and ensure the safe disposal of wastewater. The regional nuances and environmental considerations of different regions may impact the adoption of these technologies. Moreover, the demand for Biofuels and the need for Downhole water minimization techniques to Lift water from deep reservoirs are also driving the growth of the market. The market is expected to face potential challenges from regulatory restrictions and the high cost of treatment technologies.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Laval AB

- Anguil Environmental Systems Inc.

- Aquatech International LLC

- Baker Hughes Co.

- Calfrac Well Services Ltd.

- ChampionX Corp.

- DuPont de Nemours Inc.

- Ecologix Environmental Systems LLC

- Evoqua Water Technologies LLC

- Filtra Systems Co

- Fluence Corp. Ltd.

- Halliburton Co.

- Industrie De Nora Spa

- LiqTech International Inc.

- OriginClear Inc.

- RPC Inc.

- Schlumberger Ltd.

- Veolia Environnement SA

- WesTech Engineering LLC

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for natural gas and crude oil, leading to an increase in drilling projects. The hydraulic fracturing technique used in horizontal drilling requires large volumes of water, leading to concerns over groundwater contamination and the need for effective water treatment. The wastewater generated during the fracking process contains chemical constituents, pathogens, dissolved solids, salts, hazardous metals, radionuclides, and chemical additives. Environmental efficiency is a major consideration in the market, with consumers and industrialists seeking technologies that minimize water usage and maximize wastewater reuse. Water recycling and treatment are essential for the natural gas market, as water shortage is a potential challenge in some regions.

Further, the hydraulic fracturing process also generates wastewater, which requires treatment before it can be safely disposed of or reused. The hydrocarbon resource boom, driven by hydrocarbon discoveries in shale formations, has led to an increase in drilling activity. However, potential challenges include the need for downhole water minimization, lifting water to the surface, and treatment and rejection of wastewater. Water treatment technologies are being developed to address these challenges, with regional nuances and environmental considerations playing a crucial role in their adoption.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.44% |

|

Market Growth 2024-2028 |

USD 1.34 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.18 |

|

Key countries |

US, Canada, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.