Froth Flotation Chemicals Market Size 2024-2028

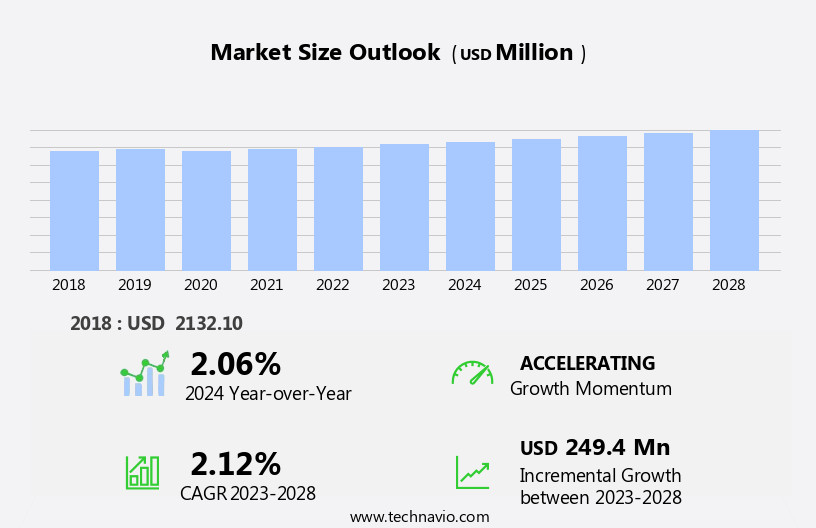

The froth flotation chemicals market size is forecast to increase by USD 249.4 million at a CAGR of 2.12% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for froth flotation in the mining industry. This process is essential for separating and purifying minerals, making it a crucial aspect of mining flotation chemicals. A notable trend in the market is the growing utilization of mixed collectors during the flotation process.

- Mixed collectors offer enhanced efficiency and selectivity, leading to improved mineral recovery rates. However, the high cost of froth flotation remains a challenge for market growth. Despite this, the market is expected to continue expanding due to the essential role of froth flotation and mining chemicals in the mining industry and the ongoing research and development efforts aimed at reducing costs and enhancing efficiency.

What will be the Size of the Froth Flotation Chemicals Market During the Forecast Period?

- The market encompasses a range of specialized chemicals utilized In the mineral processing industry for separating and concentrating valuable minerals, such as iron ore, feldspar, quartz, calcite, potash, barite, phosphate, fluorspar, base metals, and precious metals. These chemicals facilitate the attachment of hydrophobic minerals to hydrophilic bubbles in a froth, enabling their selective separation from the pulp. End-users industries, including mining, pulp and paper, sewage treatment, and produced water treatment, drive market demand.

- Key trends include the adoption of environmentally friendly chemicals, increasing urbanization leading to higher demand for paper goods and municipal water treatment, and the integration of froth flotation technologies in industrial waste management.

- Industrialization and rising literacy rates further fuel market growth. MOSPI, hydrophobic and hydrophilic materials, paper recycling, and wastewater treatment are additional areas of application.

How is this Froth Flotation Chemicals Industry segmented and which is the largest segment?

The froth flotation chemicals industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Collectors

- Frothers

- Modifiers

- Flocculants

- End-user

- Mining industry

- Pulp and paper industry

- Wastewater treatment

- Plastic recycling industry

- Geography

- APAC

- China

- India

- Europe

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

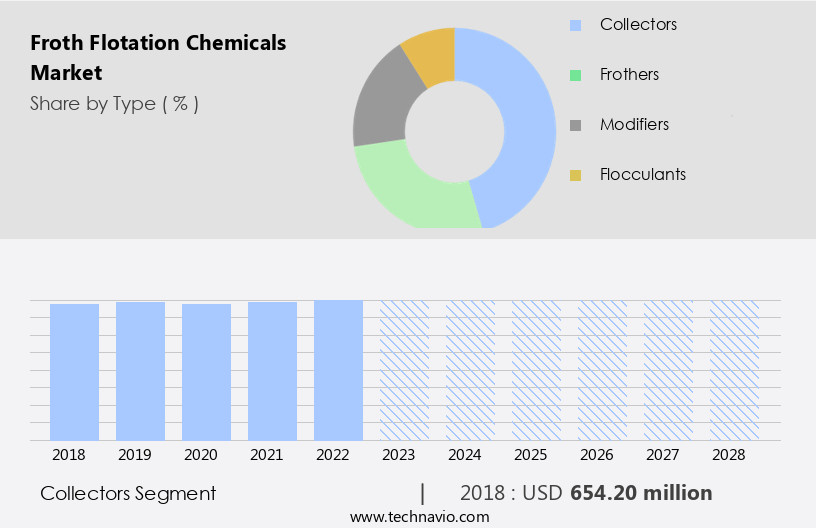

- The collectors segment is estimated to witness significant growth during the forecast period.

Collectors, a crucial category of flotation reagents, function by modifying mineral surfaces to exhibit hydrophobic properties during the flotation process. These compounds, featuring a polar group and a non-polar hydrocarbon chain, are essential for enhancing mineral recovery, particularly for those that are naturally hydrophilic. Anionic and cationic collectors are the two primary types employed in both direct and reverse flotation processes. Mineral processing industries, including those dealing with iron ore, feldspar, quartz, calcite, potash, barite, phosphate, fluorspar, base metals, precious metals, and sewage treatment, heavily rely on these collectors. The mining, pulp, paper, hydrophobic, and hydrophilic materials sectors also utilize these chemicals in mineral processing, paper recycling, wastewater treatment, and urbanization. Supply chain disorders, raw materials, industrialization, economic growth, regulatory framework, innovation, and product segments are significant factors influencing the demand for collectors.

Get a glance at the Froth Flotation Chemicals Industry report of share of various segments Request Free Sample

The Collectors segment was valued at USD 654.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

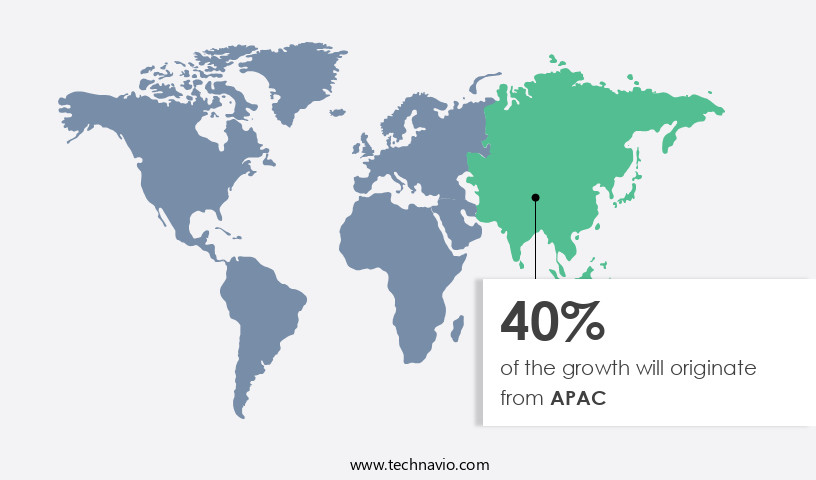

- APAC is estimated to contribute 40% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region is anticipated to dominate the market due to the significant demand from the mineral processing industry. The expanding mining sector in APAC, driven by the increasing requirement for raw materials like iron, aluminum, and others from developing economies, fuels the market growth. With substantial mineral reserves of aluminum, coal, iron, and more, countries such as China, India, Australia, Malaysia, and others witness intensive mining operations. Froth flotation chemicals play a crucial role In the mining industry by facilitating mineral recovery from slurries, impurity separation, and other applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Froth Flotation Chemicals Industry?

Increasing demand for froth flotation in mining industry is the key driver of the market.

- Froth flotation chemicals play a crucial role In the mining industry by facilitating the separation of valuable minerals from their ores during the froth flotation process. These chemicals, including collectors, dispersants, and frothers, enable minerals to attach to air bubbles, improving their wettability characteristics and reducing the mixture's stability. The use of froth flotation chemicals is increasingly important due to the decline In the grade of mineral ores and the need for efficient mineral processing. Froth flotation chemicals are utilized In the extraction of various minerals such as iron ore, feldspar, quartz, calcite, potash, barite, phosphate, fluorspar, base metals, and precious metals.

- In addition, they find applications in industries like pulp and paper, sewage treatment, wastewater treatment, urbanization, and paper recycling. The demand for froth flotation chemicals is influenced by several factors, including supply chain disorders, raw materials availability, consumer preferences, industrial policy amendments, geopolitical tensions, economic growth, and regulatory framework. The market is expected to witness significant growth due to the increasing adoption of environment-friendly chemicals in mining technologies, the expansion of end-user industries, and the recovery of industrial waste for reuse. The market is segmented into various product segments, including collectors, dispersants, frothers, and modifiers. Technological advancements and innovation are driving the development of new and improved froth flotation chemicals, leading to shifts in demand and the emergence of new applications.

- The supply chain dynamics of the market are influenced by factors such as procurement, inventory management, product portfolios, capabilities, and regional specific strategies. The market is also impacted by economic slowdowns, stagflation, and supply chain concerns, making it essential for market players to stay informed of the latest developments and trends. Despite the challenges, the outlook for the market is positive, with increasing revenues, prices, and production expected In the estimated year and beyond. The market is expected to be driven by the growth of the manufacturing sector, the energy transition, and the demand for biochemicals and materials in various end markets and geographies.

What are the market trends shaping the Froth Flotation Chemicals Industry?

Growth in use of mixed collectors during flotation is the upcoming market trend.

- The market encompasses a range of substances used In the mineral processing industry to enhance the selectivity and recovery of valuable minerals and metals during the froth flotation process. These chemicals include collectors, which are hydrophobic materials that promote the attachment of hydrophilic minerals to air bubbles for separation. Mixed collector systems, comprised of anionic or nonionic and anionic or cationic collectors, have gained popularity due to their ability to improve selectivity and reduce costs. Mixed collectors offer several advantages In the froth flotation process, such as increased froth carrying capacity, improved grades, less entrainment into final concentrate, improved middling particle flotation, and overall cost reduction.

- These benefits are particularly valuable In the flotation of various minerals and metals, including iron ore, hematite, magnetite, quartz, feldspar, calcite, potash, barite, phosphate, fluorspar, base metals, precious metals, and more. For instance, In the flotation of phosphate, using oleic acid alone as a collector results in an inefficient process. However, employing a mixed collector system of oleic acid, linoleic acid, and linolenic acid significantly enhances the recovery of phosphate flotation. This system's advantages extend to various industries, including mining, pulp and paper, sewage treatment, water treatment, urbanization, and paper recycling. The market is influenced by several factors, including supply chain disorders, raw materials availability, industrial waste, economic growth, regulatory framework, innovation, and consumer preferences.

- These factors impact the market's dynamics, revenues, prices, production, and logistics, necessitating regional-specific strategies and incentives for growth. In summary, the market plays a crucial role In the mineral processing industry by enhancing the selectivity and recovery of valuable minerals and metals. Mixed collector systems offer several advantages, including improved froth carrying capacity, grades, and cost reduction, making them a popular choice for various industries and applications. The market's growth is influenced by various factors, necessitating strategic approaches to address supply chain concerns, consumer preferences, and regulatory frameworks.

What challenges does the Froth Flotation Chemicals Industry face during its growth?

High cost of froth flotation process is a key challenge affecting the industry growth.

- The market is driven by the demand for minerals such as Iron ore, Feldspar, Quartz, Calcite, Potash, Barite, Phosphate, Fluorspar, Base metals, and Precious metals. These chemicals play a crucial role In the mineral processing industry, particularly In the froth flotation process. However, the high cost of these chemicals is a significant challenge for end-user industries, including mining, pulp and paper, sewage treatment, and water treatment. The cost is attributed to the rising expenses of raw materials like flotation reagents and flocculants, as well as processing, logistics, and transportation. To mitigate these costs, manufacturers are focusing on innovations and technologies to improve efficiency and reduce waste.

- Additionally, the increasing urbanization and literacy rates, coupled with the growth of paper goods industries, are expected to boost demand for these chemicals. However, supply chain disorders, industrial waste, and regulatory frameworks pose challenges to market growth. The market outlook is promising, with potential opportunities in industrial waste treatment, incentives for environmentally friendly chemicals, and the energy transition towards renewable sources. The market is segmented into various product types, technologies, and applications, with leading end-users being the mining, paper recycling, and municipal water treatment industries. The historical years have shown steady growth, with estimated revenues and prices continuing to increase In the outlook period.

- Despite challenges such as economic slowdown, stagflation, and supply chain dynamics, the market is expected to witness significant growth due to shifts in demand and product types.

Exclusive Customer Landscape

The froth flotation chemicals market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the froth flotation chemicals market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, froth flotation chemicals market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema SA

- BASF SE

- Celanese Corp.

- Chevron Phillips Chemical Co. LLC

- Clariant International Ltd.

- Dow Inc.

- Ecolab Inc.

- Huntsman Corp

- Nasaco International Ltd

- Nouryon

- Qingdao Sesame Chemical Co. Ltd.

- Quadra Chemicals Ltd.

- Senmin International Pty Ltd.

- Solenis

- Solvay SA

- Y and X Beijing Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad spectrum of substances employed In the mineral processing industry to enhance the separation of valuable minerals from their host rocks. These chemicals play a crucial role In the mineral processing industry, particularly In the concentration of base metals, precious metals, and industrial minerals such as iron ore, feldspar, quartz, calcite, potash, barite, phosphate, fluorspar, and others. The froth flotation process relies on the selective adherence of hydrophobic minerals to hydrophilic collector molecules, which are then transported to the froth layer at the surface of the pulp for collection. The choice of flotation chemicals depends on the specific mineral composition and the desired product quality.

The market dynamics of froth flotation chemicals are influenced by several factors. Industrialization and urbanization have led to an increase in demand for minerals and metals, driving the need for efficient mineral processing technologies. The mining industry's focus on reducing production costs and improving recovery rates has also spurred innovation in flotation chemicals. The supply chain for froth flotation chemicals is subject to various disruptions, including raw material availability and price fluctuations. The mining industry's shift towards more environmentally friendly practices has also led to a growing demand for chemicals that minimize water consumption and reduce wastewater generation.

The paper and pulp industry is a significant end-user of froth flotation chemicals, particularly In the recycling process. The industry's growth is influenced by consumer preferences for sustainable and eco-friendly products, as well as economic growth and industrial policy amendments. The packaging industry is another major consumer of froth flotation chemicals, particularly In the production of paper and paper-based products. The industry's growth is influenced by economic factors such as credit availability, consumer preferences, and geopolitical tensions. The procurement and inventory management practices of end-user industries also impact the market. Companies are increasingly focusing on optimizing their product portfolios and capabilities to meet changing market demands and supply chain concerns.

The energy transition and manufacturing sector growth are also significant factors influencing the market. The demand for biochemicals and materials used in renewable energy is growing, and the mining industry is adapting to meet this demand. Despite these growth opportunities, the market faces challenges such as supply chain disorders, raw material availability, and price volatility. Regulatory frameworks and geopolitical tensions can also impact the market's growth prospects. In conclusion, the market is a dynamic and complex industry that plays a crucial role in the mineral processing and manufacturing sectors. The market's growth is influenced by various factors, including industrialization, urbanization, consumer preferences, and regulatory frameworks. Companies operating in this market must stay abreast of these trends and adapt to meet changing market demands to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.12% |

|

Market growth 2024-2028 |

USD 249.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.06 |

|

Key countries |

China, US, India, Russia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Froth Flotation Chemicals Market Research and Growth Report?

- CAGR of the Froth Flotation Chemicals industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the froth flotation chemicals market growth of industry companies

We can help! Our analysts can customize this froth flotation chemicals market research report to meet your requirements.