Frozen Breakfast Foods Market Size 2025-2029

The frozen breakfast foods market size is forecast to increase by USD 2.49 billion at a CAGR of 8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing consumer preference for convenience and on-the-go meals. The market is witnessing a in new product launches, with companies introducing innovative and healthier options to cater to evolving consumer demands. Additionally, the rising number of private-label brands is intensifying competition and increasing market fragmentation. However, frequent product recalls due to contamination concerns pose a significant challenge to market players. Companies must prioritize food safety and quality assurance to mitigate risks and maintain consumer trust.

- To capitalize on market opportunities, players should focus on product innovation, strategic partnerships, and expanding their reach in emerging markets. Effective supply chain management and cost optimization strategies will also be crucial in navigating market challenges and maintaining profitability.

What will be the Size of the Frozen Breakfast Foods Market during the forecast period?

- In today's fast-paced business world, the demand for convenient and health-conscious breakfast options continues to grow. Online retailers are capitalizing on this trend by offering a wide range of frozen breakfast foods catering to various dietary requirements, such as less fat and clean labels. Premium breakfast items, including fruits, cereal options, and ready meals, have become popular choices among health-conscious consumers. Dual-income households and hectic schedules have fueled the popularity of online grocery delivery services, making frozen breakfast foods an attractive option. Frozen breakfast foods provide quick meal solutions while maintaining nutritional value and offering health and wellbeing benefits.

- Freezing methods have advanced, allowing for the preservation of organic ingredients and natural nutrients. Consumers are increasingly seeking plant-based substitutes and protein-rich options to meet their dietary needs. Eco-friendly packaging is also a priority for many, ensuring a sustainable choice for businesses and consumers alike. Frozen breakfast foods offer a solution for those with less time to prepare a traditional breakfast. With the rise of e-commerce and the convenience of online platforms, businesses can efficiently meet the demand for quick and health-conscious breakfast options. The market for frozen breakfast foods is expected to continue evolving, as consumers prioritize health and wellbeing in their daily lives.

How is this Frozen Breakfast Foods Industry segmented?

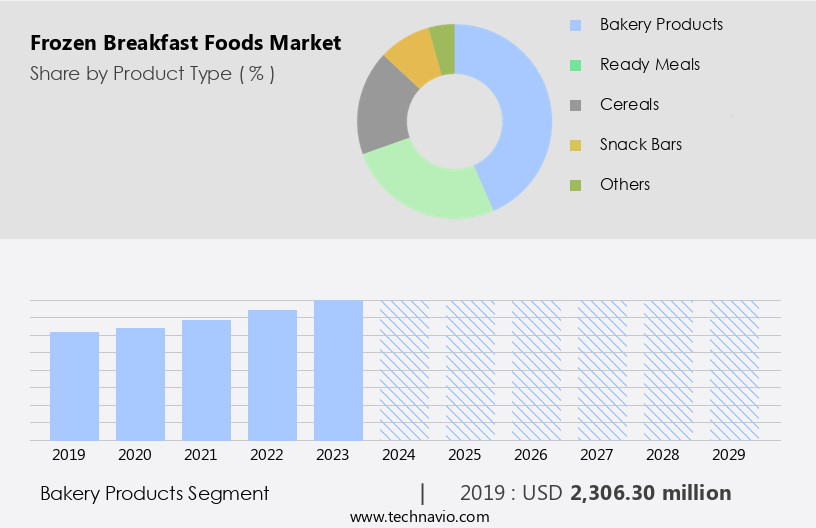

The frozen breakfast foods industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Bakery products

- Ready meals

- Cereals

- Snack bars

- Others

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- France

- Germany

- Italy

- Spain

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Europe

By Product Type Insights

The bakery products segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of offerings, including bakery products, pre-cooked meals, and ethnic options. Bakery products, such as waffles, pancakes, and pastries, dominate the market due to their extended shelf life and convenience. Retailers prioritize stocking these items to minimize losses. companies are expanding their production capacity to cater to this demand. Health-conscious consumers are driving the market's growth with their preference for time-saving, nutritious options. Plant-based diets, including veggie sausages and tofu scrambles, are gaining popularity. Freezing methods like flash-freezing and vacuum-sealing ensure the retention of nutritional value and freshness perception. E-commerce and online retailing have become significant retail formats, offering quick meal options for dual-income households and hectic schedules.

Ethical production methods, clean labels, and eco-friendly packaging are essential considerations for health-conscious consumers. Local farms and organic ingredients are increasingly incorporated to address health and wellbeing concerns. The market's trends include nutritional enhancements, less fat, and less sugar options, catering to various dietary requirements. Frozen sandwiches, burritos, and pizza are quick breakfast choices. Quick meal options, such as breakfast bowls and pre-cooked products, are convenient alternatives to traditional cooking. Retailers, including convenience stores and retail formats, are expanding their offerings to meet consumer demands. Ethical sourcing and responsible production methods are essential for companies to maintain market presence.

The market's future growth is expected to be influenced by the increasing awareness of health and environmental concerns, as well as the convenience and nutritional value of frozen breakfast foods.

Get a glance at the market report of share of various segments Request Free Sample

The Bakery products segment was valued at USD 2.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth, driven by the increasing preference for time-saving meals among health-conscious consumers. Frozen breakfast bowls, pre-cooked products, and frozen breakfast sandwiches are popular choices due to their convenience and nutritional value. Plant-based diets are gaining traction, leading to the demand for plant-based substitutes such as veggie sausages and tofu scrambles. Flash-freezing technology ensures the preservation of freshness and nutritional profiles. Specialist retailers and online retailers, including e-commerce platforms and online grocery delivery services, are expanding their offerings to cater to this market. Ethnic frozen breakfast options and international cuisines are also gaining popularity. Ethical production methods, organic ingredients, and clean labels are increasingly important considerations for consumers.

Whole grains, fruits, and vegetables are integral components of many frozen breakfast offerings. Retail formats, including retail stores and convenience stores, are adapting to meet the demand for quick breakfast options. Frozen waffles, pancakes, and burritos are among the popular choices. Nutritional enhancements, such as less fat and less sugar, are also being offered. Environmental consciousness is a growing concern, leading to the adoption of eco-friendly packaging and responsible sourcing. Frozen pizza and frozen breakfast burritos are also popular quick meal options for dual-income households with hectic schedules. Frozen breakfast foods offer a carbon footprint that is generally lower than that of traditional cooked breakfasts.

Frozen food manufacturers are focusing on innovation, with flavor innovations and protein-rich substitutes being key areas of development. Vacuum-sealing and recyclable packaging are also being used to maintain the freshness and sustainability of the products. The market is expected to continue growing, driven by these trends and the increasing demand for health-conscious choices.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Frozen Breakfast Foods Industry?

- Increasing launch of new products is the key driver of the market.

- The market exhibits a fragmented landscape, with numerous international and domestic companies contributing to the industry. These companies are introducing an array of frozen breakfast food products, fueled by continuous new product launches, to capture a larger consumer base and boost market presence. The market is expected to witness significant growth due to the increasing number of product innovations by manufacturers worldwide.

- For instance, in June 2022, Conagra Brands, Inc. Introduced new summer products to cater to consumers' mealtime challenges and cravings. This trend is anticipated to shape the market dynamics throughout the forecast period.

What are the market trends shaping the Frozen Breakfast Foods Industry?

- Rising number of private-label brands is the upcoming market trend.

- Private-label frozen breakfast food products have emerged as a significant growth driver in the global market. Retailers worldwide are increasingly focusing on these offerings to expand their product portfolios and boost their profitability. Major retailers, such as Tesco and Alibaba, are capitalizing on this trend by introducing a range of private-label frozen breakfast food products. For instance, Tesco offers a selection of frozen breakfast foods under its brand, Tesco All Day Breakfast 350G. Similarly, Alibaba sells various frozen breakfast items, including fresh frozen donuts and gourmet blueberries, under its own brand.

- The proliferation of private-label brands is anticipated to fuel the expansion of the market in the coming years. This trend is reflective of the increasing consumer preference for convenient and affordable breakfast options, which private-label brands are able to provide effectively.

What challenges does the Frozen Breakfast Foods Industry face during its growth?

- Frequent product recalls is a key challenge affecting the industry growth.

- The market has witnessed significant growth in recent years, driven by various factors such as increasing consumer preference for convenient and healthy breakfast options. However, market expansion is not without challenges. One major impediment to market growth is the rise in product recalls. These recalls occur due to the presence of contaminants like metal fragments, wood, and plastic in the products. In some instances, products are recalled due to undeclared ingredients or lack of regulatory compliance. In the US, the Food Safety and Inspection Service (FSIS), a division of the USDA, plays a crucial role in ensuring the safety of meat, poultry, certain fish, and processed egg products.

- The FSIS initiates recalls based on the severity and potential health risks associated with the recalled items. Ensuring regulatory compliance and maintaining product quality are essential for market players to mitigate the risks of recalls and maintain consumer trust.

Exclusive Customer Landscape

The frozen breakfast foods market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the frozen breakfast foods market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, frozen breakfast foods market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - The company specializes in providing a range of frozen breakfast options, including Yakithori chicken fried rice, vegetable yakisoba noodles, and shoyu ramen. These authentic Asian-inspired dishes offer consumers a convenient and flavorful alternative to traditional breakfast fare. With a focus on quality ingredients and culinary innovation, this company caters to the growing demand for diverse and delicious breakfast choices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Al Kabeer Group ME

- ALPHA FOODS

- Conagra Brands Inc.

- Corporativo Bimbo SA de CV

- Dr. August Oetker KG

- General Mills Inc.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- ITC Ltd.

- Kellogg Co.

- McCain Foods Ltd.

- Nestle SA

- Nomad Foods Ltd.

- Quirch Foods LLC

- Rich Products Corp.

- Ruiz Food Products Inc.

- The Kraft Heinz Co.

- Turano Baking Co.

- Tyson Foods Inc.

- Unilever PLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The frozen breakfast food market continues to gain traction as consumers seek time-saving solutions for their morning meals. This trend is particularly noticeable among health-conscious individuals who prioritize nutritious and convenient options. Specialist retailers have capitalized on this demand by expanding their offerings of frozen breakfast foods. One of the key factors driving the growth of this market is the increasing popularity of plant-based diets. Frozen breakfast bowls, waffles, and pancakes made with organic ingredients and plant-based substitutes, such as tofu scrambles and veggie sausages, are gaining favor among consumers. These products offer the convenience of a quick meal without compromising on health or ethical considerations.

Another trend in the frozen breakfast food market is the focus on less sugar and less fat. Consumers are increasingly conscious of their health and are looking for options that align with their dietary requirements. Frozen breakfast sandwiches, burritos, and pancakes with clean labels and nutritional enhancements are becoming popular choices. The freezing methods used in the production of frozen breakfast foods have also evolved. Flash-freezing and vacuum-sealing have become standard practices to preserve freshness and maintain the nutritional value of the products. Retailers are also exploring eco-friendly packaging options and ethical production methods to appeal to environmentally conscious consumers.

The rise of online retailing and online grocery delivery has further expanded the reach of frozen breakfast foods. Consumers can now easily access a wide range of options from the comfort of their homes, making it a convenient choice for busy households and dual-income families. The frozen breakfast food market is not limited to traditional options such as cereals and frozen sandwiches. Innovations in flavor and ethnic cuisines have introduced a diverse range of products, including frozen burritos, breakfast bowls, and waffles from international cuisines. These offerings cater to the evolving palates and dietary preferences of consumers. Retail formats have also adapted to the changing market dynamics.

Convenience stores and retail stores are increasingly stocking a wider selection of frozen breakfast foods to cater to the demands of their customers. Frozen pizza and frozen breakfast burritos are popular choices in this segment. The frozen breakfast food market is expected to continue its growth trajectory as consumers seek quick and convenient options that align with their health and ethical concerns. The market is likely to see further innovations in freezing methods, packaging, and product offerings to meet the evolving demands of consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8% |

|

Market growth 2025-2029 |

USD 2488 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.5 |

|

Key countries |

US, UK, Germany, Japan, France, Canada, China, Italy, India, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Frozen Breakfast Foods Market Research and Growth Report?

- CAGR of the Frozen Breakfast Foods industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the frozen breakfast foods market growth of industry companies

We can help! Our analysts can customize this frozen breakfast foods market research report to meet your requirements.