Game Development Software Market Size 2025-2029

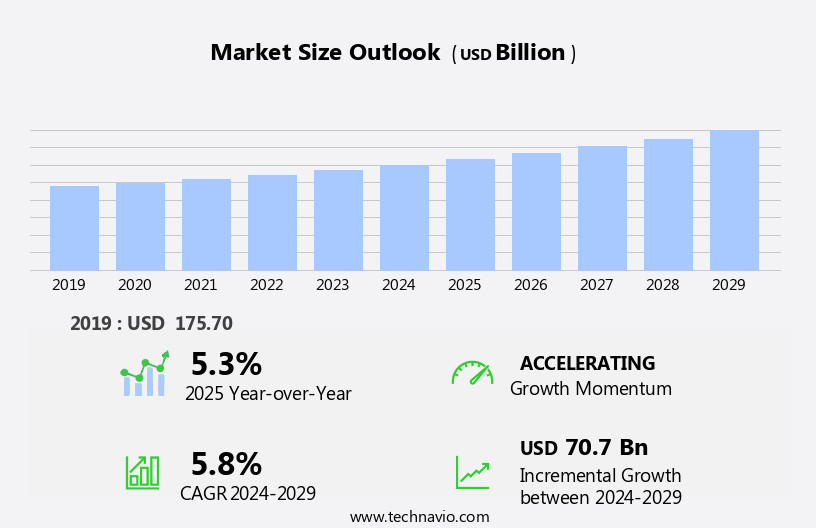

The game development software market size is forecast to increase by USD 70.7 billion at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand for PC games and gaming consoles. According to recent reports, the global gaming market is projected to reach a value of USD159.3 billion by 2023, with PC games and consoles accounting for a substantial share. Another key trend shaping the market is the growing popularity of Augmented Reality (AR) and Virtual Reality (VR) games. As AR and VR technologies continue to advance, the demand for specialized game development software to create immersive experiences is expected to increase. However, the market also faces several challenges.

- One significant challenge is the availability of open-source game development software. While this can be advantageous for smaller studios and independent developers, it can also lead to intense competition and price pressure. Additionally, the rapid evolution of technology can pose challenges for developers, requiring them to constantly update their software to remain competitive. Another challenge is the need for high-performance hardware to develop and run complex games, which can be a significant investment for both developers and consumers. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on innovation, continuous improvement, and strategic partnerships to stay ahead of the competition.

What will be the Size of the Game Development Software Market during the forecast period?

- The market continues to evolve, with dynamic shifts shaping its landscape. Game development frameworks, such as Unity and Unreal Engine, facilitate the creation of immersive experiences for various sectors, including mobile games, console game development, and PC games. Level editors and level designers are essential tools for constructing engaging game environments, while player retention strategies, monetization models, and artificial intelligence enhance user engagement. Indie game development thrives on game development IDEs and scripting languages, while asset management and source code control ensure efficient production. Procedural generation and machine learning contribute to the creation of dynamic game content.

- Game development SDKs cater to cross-platform development, enabling developers to reach broader audiences. Game publishers and studios leverage game development services and game design tools to bring innovative titles to market. Animation software, debugging tools, and game engine solutions optimize performance and ensure high-quality output. Game marketing, cloud gaming, and game streaming platforms expand the reach of games, while game analytics and API integration provide valuable insights for developers. In the realm of AAA game development, RPG games, FPS games, strategy games, puzzle games, simulation games, and VR game development continue to captivate audiences with their unique offerings.

- In-app purchases, game development libraries, and audio middleware further monetize and enrich the gaming experience. User engagement remains a top priority, with game designers focusing on performance optimization, user experience, and storytelling.

How is this Game Development Software Industry segmented?

The game development software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Game engine

- Audio engine

- End-user

- Enterprises

- Individual

- Application

- Indie Developers

- Large Studios

- Type

- Game Engines

- Asset Creation Tools

- Testing Tools

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

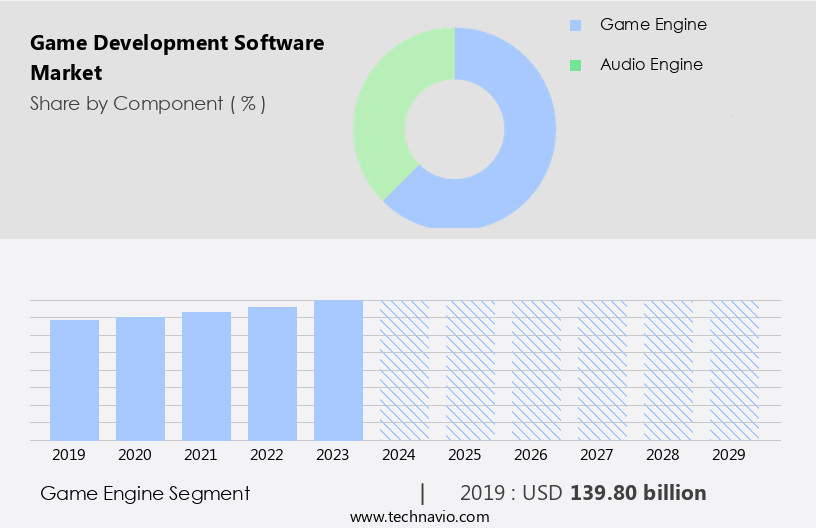

By Component Insights

The game engine segment is estimated to witness significant growth during the forecast period.

Game development software plays a pivotal role in creating immersive and engaging experiences for players. Game engines, integral to this process, provide a robust foundation with features like physics engines, rendering engines, animation, and artificial intelligence. These engines handle memory management and graphics rendering, enabling developers to build games more efficiently using preset libraries, modules, tools, and effects. The mobile gaming sector is experiencing significant growth due to the widespread adoption of mobile devices and high Internet penetration. Large-screen mobile devices offer enhanced cloud gaming experiences with high display resolutions. Additionally, diverse connectivity options such as 4G, 3G, Bluetooth, and Wi-Fi fuel the popularity of new and existing games.

Indie game developers and studios increasingly rely on game development ide (integrated development environments) and scripting languages for creating unique games. Game testers ensure the quality of these games by identifying and reporting bugs and issues. Game publishers and development services support the distribution and monetization of these games through various channels. Cross-platform development, machine learning, and procedural generation are key trends in the game development industry. Game engines like Unity and Unreal Engine support these features, making it easier for developers to create games for multiple platforms and implement advanced functionalities. Player retention is a critical aspect of game development, and game designers focus on creating engaging user experiences through level design, animation software, and performance optimization.

Game marketing tools help developers reach their target audience and monetize their games through in-app purchases, subscriptions, and advertising. Console game development continues to thrive, with AAA game development companies investing heavily in creating immersive experiences for players. RPG games, FPS games, strategy games, puzzle games, simulation games, and VR game development are popular genres that cater to diverse audiences. Game development SDKs, game analytics, and API integration help developers optimize their games' performance and user engagement. Debugging tools and version control systems ensure the development process runs smoothly, while 3D modeling software and audio middleware enhance the overall gaming experience.

In summary, the market is dynamic and evolving, with game engines, mobile gaming, and cross-platform development leading the way. Developers, designers, and publishers leverage various tools and technologies to create engaging and immersive experiences for players.

The Game engine segment was valued at USD 139.80 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

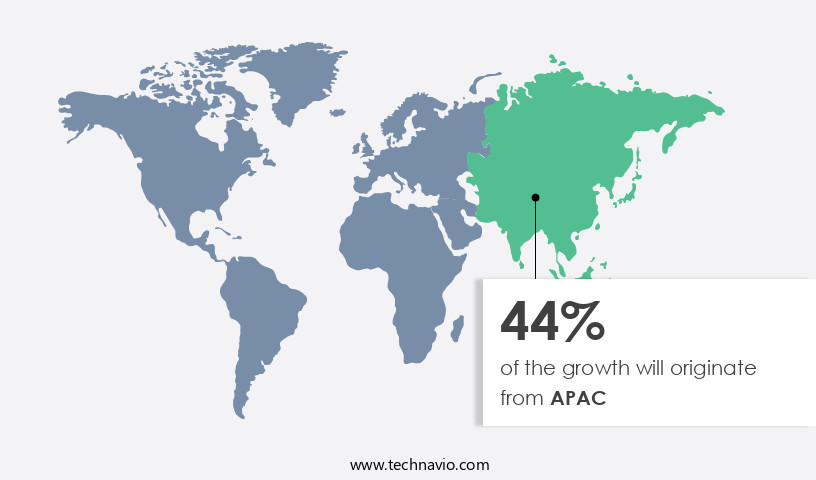

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American the market is experiencing growth due to the rising demand for console games. Game developers and publishers are responding to this trend by launching new titles and upgrading existing ones for console platforms. Although PC and online games continue to generate substantial revenue, console games are gaining traction, leading to an increased focus on console game development. Game development ide, scripting languages, and level editors are essential tools for developers in creating console games. Game engines, such as Unreal Engine and Unity, support console development and offer features like physics engines, artificial intelligence, and performance optimization.

Game development services, including asset management and debugging tools, are also in high demand to ensure the successful release of console games. Game publishers are investing in game development studios to create high-quality console games. Cross-platform development allows game developers to target multiple platforms, including consoles, PCs, and mobile devices, which is a significant trend in the industry. Console game development also involves player retention strategies, game monetization, and user engagement tools. Machine learning and procedural generation are increasingly being used in console game development for more immersive and harmonious gameplay experiences. RPG, FPS, puzzle, strategy, and simulation games are popular genres in console development.

Game marketing, cloud gaming, and API integration are crucial aspects of console game development, ensuring successful game releases and ongoing player engagement.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Game Development Software Industry?

- The surge in demand for PC games and gaming consoles serves as the primary catalyst for market growth in this sector.

- The market has witnessed significant growth due to the increasing popularity of professional and community gaming. With the advent of advanced technology, gaming has evolved from traditional board games to immersive, harmonious experiences. This transformation is driven by several factors, including performance optimization, audio middleware, and the integration of APIs for in-app purchases, game analytics, and game development libraries. Mobile game development, including strategy games, simulation games, and casual games, has gained considerable traction. Virtual Reality (VR) game development is also on the rise, offering players a more immersive gaming experience. Game streaming services have further expanded the reach of the gaming industry, enabling players to access games from anywhere, at any time.

- Major players in the market focus on delivering innovative solutions to cater to the evolving needs of game developers. For instance, they offer tools for audio middleware, game analytics, and simulation games, enabling developers to create engaging and interactive gaming experiences. Performance optimization is another critical area of focus, ensuring seamless gameplay and minimal latency. In conclusion, the market is expected to continue its growth trajectory, driven by advancements in technology and the increasing popularity of gaming. Companies are investing in research and development to offer innovative solutions, catering to the diverse needs of game developers and enhancing the overall gaming experience.

What are the market trends shaping the Game Development Software Industry?

- The growing popularity of augmented reality (AR) and virtual reality (VR) games represents a significant market trend in the professional gaming industry. These immersive technologies are increasingly gaining traction among gamers and technology enthusiasts alike, offering unique and engaging experiences that go beyond traditional gaming platforms.

- The market is experiencing significant growth due to the increasing popularity of augmented reality (AR) and virtual reality (VR) gaming. AR/VR gaming integrates visual and audio content in real time with a user's environment, leading to an immersive and harmonious gaming experience. This trend is driving the adoption of AR/VR devices, as developers shift from traditional gaming devices. Several enterprises are responding to this demand by launching AR/VR devices and developing AR/VR games. Asset management and scripting language are essential tools for game developers, enabling efficient production and testing processes. Indie game developers and game studios rely on game development IDEs and SDKs for creating and publishing their games.

- Game publishers and game development services also utilize these tools to ensure high-quality output. Procedural generation and machine learning are advanced technologies enhancing game development. Procedural generation automates the creation of game content, while machine learning improves gameplay and player experience. Game testers play a crucial role in ensuring the quality of the final product by identifying and reporting bugs and issues. PC game development continues to dominate the market due to its accessibility and affordability. However, the market for console and mobile game development is also growing rapidly. Overall, the market is expected to continue its growth trajectory, driven by technological advancements and increasing consumer demand for immersive gaming experiences.

What challenges does the Game Development Software Industry face during its growth?

- The growth of the game development industry is significantly influenced by the availability and utilization of open-source software, posing both opportunities and challenges for professionals in this field.

- Open-source game development software is gaining traction in the global market, presenting a notable challenge to traditional game development software solutions. This trend is particularly prominent in developing economies like India and China, where open-source software can be downloaded and utilized across various platforms without significant upfront investment. Cloud-based game development software also offers affordability compared to on-premises solutions, but some enterprises may still find these options out of reach. Open-source software's appeal lies in its low upfront costs and flexibility, making it an attractive choice for small and medium-sized enterprises (SMEs) and individual developers.

- The software market responds to this demand by offering open-source solutions tailored to game development. Game development frameworks, such as Unity and Unreal Engine, are popular open-source options that support various genres, including mobile games, console game development, RPG games, and first-person shooter (FPS) games. These frameworks offer advanced features like level editors, artificial intelligence, physics engines, and cross-platform development capabilities. Level designers and game developers benefit from these tools, as they can create immersive, harmonious gaming experiences that emphasize player retention and game monetization strategies. The open-source nature of these frameworks allows for a collaborative development process, fostering innovation and growth within the gaming industry.

Exclusive Customer Landscape

The game development software market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the game development software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, game development software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Unity Technologies - This company specializes in game development software, featuring advanced automation for orchestrating fleet scaling through container image uploads. The software streamlines the process, enhancing efficiency and productivity. By utilizing container images, developers can effortlessly manage and deploy applications at scale. This innovative solution empowers game creators to focus on their core competencies, while the software handles the intricacies of fleet management and scaling.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Unity Technologies

- Epic Games Inc.

- Autodesk Inc.

- Crytek GmbH

- Amazon Web Services Inc.

- Blender Foundation

- Godot Engine

- GameMaker Studio (YoYo Games)

- Adobe Inc.

- Microsoft Corporation

- SideFX (Houdini)

- Perforce Software Inc.

- Havok (Microsoft)

- Cocos2d-x

- Oculus (Meta)

- Construct 3 (Scirra Ltd.)

- Solar2D

- RPG Maker (Kadokawa Corporation)

- Unreal Engine (Epic Games)

- Frostbite (EA)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Game Development Software Market

- In February 2023, Unity Technologies, a leading game development software provider, announced the launch of Unity 2023, which includes significant advancements in real-time ray tracing, machine learning, and multi-platform support (Unity Technologies Press Release, 2023). This new version aims to streamline game development and enhance visual effects for creators.

- In October 2024, Epic Games, the Fortnite developer, and Apple reached a groundbreaking agreement, allowing the Unreal Engine, Epic's game development software, back on the App Store after a lengthy dispute (Bloomberg, 2024). This resolution opens up opportunities for game developers using Unreal Engine to distribute their games on iOS devices once again.

- In March 2025, Autodesk, a leading 3D design software company, acquired Cinesite, a renowned visual effects and animation studio, for USD325 million (Autodesk Press Release, 2025). This strategic acquisition strengthens Autodesk's position in the game development market by providing access to Cinesite's expertise and resources in creating high-quality visual effects.

- In July 2025, Google announced the beta release of Google Game Engines, a free, open-source game development platform, to compete with Unity and Unreal Engine (Google Developers Blog, 2025). This entry into the market could potentially disrupt the current landscape by offering an alternative solution to developers, particularly those with limited budgets.

Research Analyst Overview

The market is experiencing dynamic growth, with key technologies shaping its trajectory. Unreal Engine and Godot Engine lead the charge in 3D graphics, while 2D graphics continue to thrive in niche markets. App stores dominate game distribution, with beta testing and quality assurance ensuring a seamless user experience. Game balancing, physics, and collision detection are essential for engaging gameplay, while user interface design and UX ensure player retention. Social gaming, multiplayer gaming, and online gaming are driving community engagement, with blockchain gaming adding a new layer of security and economic opportunity.

Game economy, audio design, music composition, sound effects, animation rigging, and motion capture further enrich the gaming experience. Game testing and game UI are critical for ensuring high-quality output, as digital distribution channels expand the reach of indie and AAA titles alike.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Game Development Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 70.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.3 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Game Development Software Market Research and Growth Report?

- CAGR of the Game Development Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the game development software market growth of industry companies

We can help! Our analysts can customize this game development software market research report to meet your requirements.