Gaming Console Market Size 2025-2029

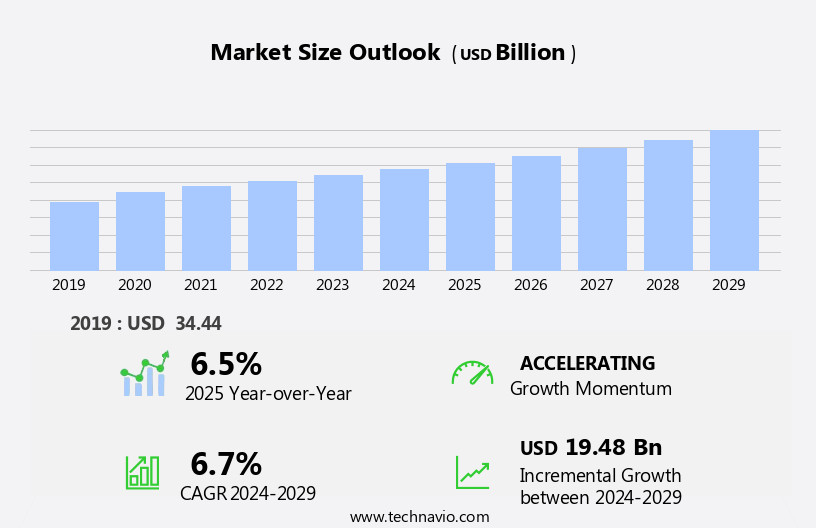

The gaming console market size is forecast to increase by USD 19.48 billion, at a CAGR of 6.7% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the introduction of next-generation consoles boasting enhanced features. These advanced devices not only offer superior graphics and processing power but also function as multipurpose media hubs, integrating streaming services, social media, and web browsing. This convergence of entertainment platforms aims to cater to evolving consumer preferences and behaviors. Simultaneously, the popularity of PC gaming continues to surge, fueled by advancements in hardware and software technology. PC gaming provides greater flexibility, customization, and access to a vast library of games. As a result, traditional console manufacturers face increasing competition from the PC gaming market, necessitating continuous innovation and differentiation to maintain market share.

- Companies must navigate these challenges by focusing on unique selling propositions, such as exclusive content, user-friendly interfaces, and affordable pricing. By capitalizing on the opportunities presented by next-generation consoles and addressing the challenges posed by PC gaming, market players can effectively position themselves in this dynamic and competitive landscape.

What will be the Size of the Gaming Console Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Home consoles, characterized by their optical drives and cooling systems, are constantly advancing, integrating haptic feedback and response time enhancements for immersive gaming experiences. Handheld consoles, meanwhile, prioritize wireless communication and battery life, offering accessibility features such as motion controls and user-friendly interfaces. In the realm of game development, digital downloads and subscription services are transforming the industry, enabling real-time updates and seamless access to a vast library of titles. Operating systems and game engines are evolving to support advanced technologies like ray tracing and AR, pushing the boundaries of 3D graphics and online gaming.

Moreover, the integration of VR support and haptic feedback adds a new dimension to gaming, providing a more immersive and interactive experience. The market's continuous dynamism is further highlighted by the ongoing advancements in power supply efficiency, headphone jack compatibility, and customer support services. As game design continues to innovate, the market's evolution remains a captivating spectacle, with each new development adding to the rich tapestry of the gaming console landscape.

How is this Gaming Console Industry segmented?

The gaming console industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- TV consoles

- Handheld consoles

- Usage

- Casual gamers

- Hardcore gamers

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

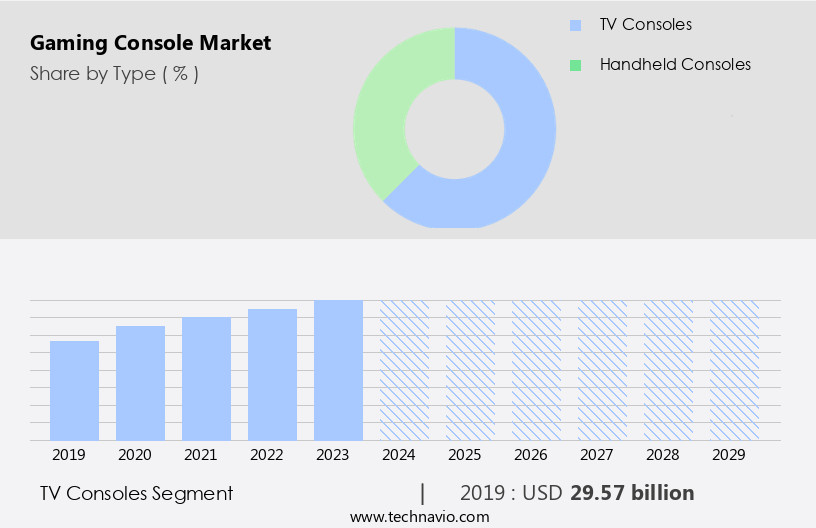

The tv consoles segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with the TV console segment leading the charge. This trend is fueled by advancements in audio-visual technology and the increasing preference for high-definition televisions, which significantly enhance the gaming experience. Consumers are increasingly seeking immersive and harmonious gaming environments, driving demand for TV consoles that offer features such as 4K and 8K resolutions, built-in wireless communication, and compatibility with external storage devices. These innovations enable superior graphics and sound quality, essential for engaging gameplay. In 2023, the PlayStation 5 emerged as the top-selling TV gaming console, boasting impressive sales of approximately 22 million units.

Additionally, the market is witnessing the integration of virtual reality (VR) support, motion controls, and haptic feedback to create a more immersive gaming experience. The availability of subscription services and digital downloads further enhances accessibility and convenience for consumers. The market's evolution also includes advancements in game development tools, such as game engines and operating systems, enabling developers to create more complex and visually stunning games. The growing popularity of online gaming and the integration of augmented reality (AR) support are further expanding the market's potential. With a focus on customer support, response time, and user interface, the market is poised for continued growth and innovation.

The TV consoles segment was valued at USD 29.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Asia Pacific region is a significant player in the global gaming market, with China leading the charge as it accounts for approximately a quarter of the industry. The rise of Electronic Sports (e-Sports) in developing countries like Taiwan, Malaysia, and Singapore is expected to fuel growth in this sector within the region. Major digital game companies, including Tencent and GungHo Online Entertainment from China, are based in APAC and drive innovation. Japan, home to gaming giants Sony and Nintendo, is also a hub for gaming technology advancements. Home consoles, such as PlayStation and Xbox, continue to dominate the market with their advanced operating systems, response times, and 3D graphics.

Handheld consoles, like Nintendo Switch, offer portability and accessibility features, appealing to gamers on-the-go. Wireless communication and Virtual Reality (VR) support have become essential features, enhancing the immersive gaming experience. Motion controls and haptic feedback add to the harmonious gameplay, while cooling systems and power supplies ensure uninterrupted gaming sessions. Digital downloads and subscription services provide convenience and flexibility, while game design, game engines, and online gaming offer endless possibilities for creators and players. Battery life and refresh rates are crucial factors for handheld consoles, while customer support and user interfaces contribute to the overall user experience.

Ray tracing and AR support are the latest gaming technologies, pushing the boundaries of visual realism. The gaming industry's continuous evolution underscores its potential for growth and innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and competitive industry, driven by innovation and consumer demand. Leading players in this market offer advanced technologies, immersive experiences, and expansive libraries of games. These consoles deliver stunning graphics, realistic sound, and seamless connectivity. Gamers seek out high-performance processors, large hard drives, and user-friendly interfaces. Cross-platform compatibility, virtual reality support, and subscription services are also key features. The market continues to evolve, with new consoles and accessories releasing regularly. Consumers eagerly anticipate the latest advancements in gaming technology, ensuring the market's ongoing growth and success.

What are the key market drivers leading to the rise in the adoption of Gaming Console Industry?

- The next-generation gaming consoles' enhanced features serve as the primary catalyst for market growth.

- The market continues to evolve, driven by consumer demand for enhanced audio and visual experiences. With the average gamer using consoles for approximately a decade, the industry releases new generations every five years, on average. The increasing disposable income enables consumers to invest in high-definition displays and TV sets, fueling the expectation for advanced graphics and connectivity features like HDMI and wireless networks. Moreover, the proliferation of high-end sound systems, such as home theatre setups, offers a more immersive gaming experience.

- Motion controls and VR support have also emerged as significant trends, providing gamers with a more harmonious and interactive experience. Digital downloads have gained popularity, allowing for instant access to games, while power supplies and headphone jacks remain essential components for optimal performance. Game design continues to evolve, with game cartridges giving way to digital downloads and cloud-based gaming services.

What are the market trends shaping the Gaming Console Industry?

- The production of multipurpose gaming consoles is currently a significant trend in the market. Companies are increasingly focusing on creating devices that offer various functionalities beyond just gaming.

- The market witnesses significant growth due to the increasing demand for multifunctional devices. Consumers seek gaming consoles that offer more than just gaming capabilities, such as streaming media, listening to music, and browsing the Internet. Apple's upcoming next-generation Apple TV, featuring an integrated gaming console, underscores this trend. To increase their market penetration, companies are focusing on developing multi-utility consoles. Moreover, advancements in technology, such as haptic feedback, optical drives, heat sinks, and response time, are enhancing the gaming experience. Ray tracing and augmented reality (AR) support are also gaining popularity, offering immersive and harmonious gaming experiences.

- Subscription services have become a significant revenue stream for gaming console manufacturers, providing access to a vast library of games and other content. Game development continues to be a critical driver of the market, with developers constantly pushing the boundaries of graphics, storytelling, and interactivity. As technology advances and consumer preferences evolve, The market is poised for continued growth during the forecast period.

What challenges does the Gaming Console Industry face during its growth?

- The surge in PC gaming popularity poses a significant challenge to the industry's growth trajectory.

- The gaming landscape has evolved significantly over the past decade, with PC gaming emerging as a formidable competitor to the traditional console market. Once viewed as an enthusiast-driven sector, PC gaming has become more accessible to casual gamers due to advancements in technology and affordability. Prior to 2000, PC gaming was dominated by tech-savvy individuals who built their systems from scratch. However, the advent of pre-built PCs and easy-to-download games made PC gaming a viable alternative to console gaming for a broader audience. The accessibility of PC gaming poses a substantial threat to The market.

- PC games now offer superior 3D graphics, immersive gameplay, and the flexibility of a game engine that caters to various genres. Furthermore, online gaming has become a norm, enabling players to connect and compete with others from around the world. Customer support, refresh rate, and user interface are essential factors that influence a gamer's decision to choose a platform. Console manufacturers have made strides in improving these aspects, but PC gaming offers more customization options, ensuring a personalized gaming experience. Battery life, a significant concern for console gamers, is not an issue with PC gaming.

- The use of a power source guarantees uninterrupted gaming sessions. In conclusion, the shift towards PC gaming, driven by its accessibility and advanced features, is impacting the market significantly.

Exclusive Customer Landscape

The gaming console market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gaming console market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gaming console market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amkette - The Atari VCS gaming console revolutionizes home entertainment with its advanced technology and classic gaming experience. This innovative device merges cutting-edge hardware with nostalgic software, providing limitless entertainment options for gamers. Its intuitive interface and versatile capabilities elevate user experience, setting a new standard in the gaming industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amkette

- Analogue Enterprises Ltd.

- Atari Inc.

- Bluestack Systems Inc.

- Hyperkin Inc.

- Intellivision Entertainment LLC

- Logitech International SA

- Mad Catz Global Ltd.

- Mattel Inc.

- Microsoft Corp.

- Nintendo Co. Ltd.

- NVIDIA Corp.

- PlayJam Ltd.

- PLAYMAJI Inc.

- Razer Inc.

- Sega Corp.

- SNK Corp.

- Sony Group Corp.

- Tommo Inc.

- Valve Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gaming Console Market

- In January 2024, Sony Interactive Entertainment launched the PlayStation 5, its next-generation gaming console, featuring enhanced graphics, faster loading times, and backward compatibility with select PlayStation 4 games (Sony Interactive Entertainment press release, 2024). In March 2024, Microsoft and Bethesda Softworks, a leading game developer, announced a strategic partnership, with Microsoft acquiring Bethesda and its publishing label, ZeniMax Media, expanding Microsoft's gaming portfolio significantly (Microsoft press release, 2024).

- In April 2025, Nvidia, a leading technology company, unveiled its GeForce Now cloud gaming service, allowing users to stream games from high-performance servers, making console-quality gaming accessible on various devices (Nvidia press release, 2025). In May 2025, Nintendo secured a major regulatory approval from the Chinese government, enabling the company to sell its Switch gaming consoles in the world's most populous country, marking a significant expansion into this key market (Nikkei Asia, 2025).

Research Analyst Overview

- The market is witnessing significant evolution, with indie games gaining traction alongside AAA titles. Data privacy concerns are at the forefront of consumer discussions, influencing purchasing decisions. Competitive gaming and game reviews shape public opinion, fueling the demand for high-quality journalism. Augmented reality glasses and virtual reality headsets are revolutionizing gaming experiences, while social media integration and biometric authentication enhance user engagement. Motion capture technology and software updates ensure a more immersive gaming experience. Parental controls and game pass subscriptions cater to diverse consumer needs. Game streaming services, AI opponents, and gesture control are shaping the future of gaming. In-app purchases, cross-platform play, and game patches keep the gaming community engaged.

- Firmware updates and gaming accessories extend the lifespan of consoles. Voice recognition and facial recognition add convenience, while game preservation maintains gaming history. Gaming culture continues to thrive, with casual gaming and procedural generation offering new experiences. Cloud gaming and game streaming services are transforming accessibility, making gaming more accessible to a wider audience.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gaming Console Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 19.48 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, South Korea, India, Germany, Canada, Japan, UK, France, Brazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gaming Console Market Research and Growth Report?

- CAGR of the Gaming Console industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gaming console market growth of industry companies

We can help! Our analysts can customize this gaming console market research report to meet your requirements.