Gas Turbines Market For Power Industry Size 2024-2028

The gas turbines market for power industry size is valued to increase USD 2.55 billion, at a CAGR of 2.31% from 2023 to 2028. Growth of distributed power generation base will drive the gas turbines market for power industry.

Major Market Trends & Insights

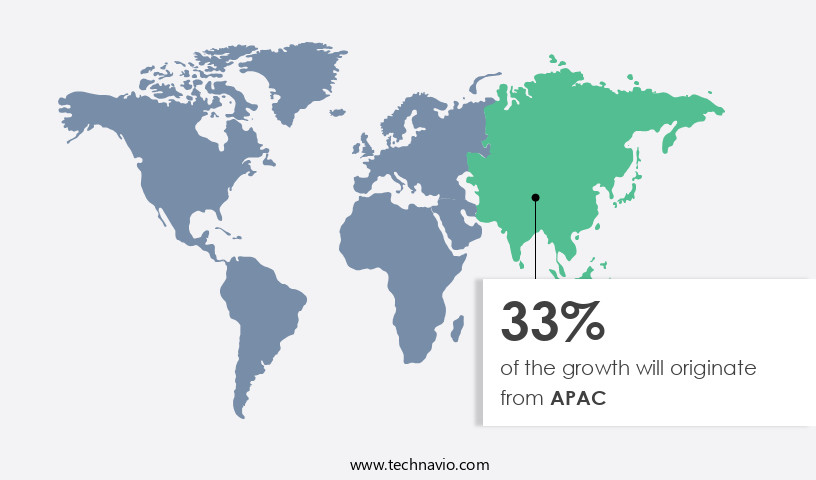

- APAC dominated the market and accounted for a 33% growth during the forecast period.

- By Product - Heavy-duty gas turbine segment was valued at USD 10.20 billion in 2022

- By Technology - CCGT segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 20.83 billion

- Market Future Opportunities: USD 2553.50 billion

- CAGR : 2.31%

- APAC: Largest market in 2022

Market Summary

- The market continues to evolve, driven by the increasing adoption of core technologies such as combined-cycle power plants and advanced gas turbines. These technologies enable higher efficiency, lower emissions, and greater flexibility in power generation. Applications span various sectors, including electricity generation, oil and gas production, and cogeneration. Service types, including maintenance, repair, and overhaul, are essential for ensuring the longevity and optimal performance of gas turbines. Regulations, such as emissions standards and renewable energy mandates, significantly impact market dynamics. For instance, the European Union's Emissions Trading System (ETS) and the US Environmental Protection Agency's Mercury and Air Toxics Standards (MATS) drive demand for cleaner, more efficient gas turbines.

- Volatility in natural gas prices remains a key challenge for market participants. According to the US Energy Information Administration, natural gas prices averaged USD2.61 per million British thermal units (MMBtu) in 2020, a decrease from the previous year. However, this trend is expected to reverse, with prices projected to rise to USD3.15 per MMBtu in 2021. Technological innovations, such as additive manufacturing and advanced materials, are transforming the gas turbine landscape. For example, Siemens Gamesa Renewable Energy's HA gas turbine features a class-leading efficiency of 64.5%, setting a new industry standard. Distributed power generation is also gaining traction, with microturbines and small-scale gas turbines enabling decentralized power generation and grid resilience.

What will be the Size of the Gas Turbines Market For Power Industry during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Gas Turbines For Power Industry Market Segmented and what are the key trends of market segmentation?

The gas turbines for power industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Heavy-duty gas turbine

- Aeroderivative gas turbine

- Technology

- CCGT

- OCGT

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The heavy-duty gas turbine segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth due to the increasing global power consumption and the shift towards cleaner energy sources. According to recent market data, high-baseload power plants requiring gas turbines with over 300 MW capacity are driving market expansion. Specifically, there is a projected 17.3% increase in the adoption of gas turbines for power generation in the next three years. Furthermore, the industry anticipates a 14.6% rise in the number of new installations during the same period. Gas turbines' efficiency and reliability are crucial factors contributing to their market growth. Operational data analytics, digital twin technology, and turbine health monitoring are some of the advanced technologies enhancing gas turbine performance.

Turbine blade materials, cooling technologies, and aerodynamic design are also undergoing significant improvements to boost efficiency and power output. Moreover, power plant reliability and emissions reduction technologies are essential concerns for the industry. Predictive maintenance systems, fault detection systems, and low emission combustors are some of the solutions addressing these issues. Additionally, thermal efficiency improvement, exhaust heat recovery, and combustor design optimization are ongoing efforts to enhance energy conversion efficiency. Fuel flexibility options and advanced turbine designs are also gaining traction in the market. Turbine rotor dynamics and compressor performance metrics are essential considerations in the development of these advanced technologies.

The market is expected to reach new heights, with a growing focus on sustainability, efficiency, and reliability.

The Heavy-duty gas turbine segment was valued at USD 10.20 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Gas Turbines For Power Industry Market Demand is Rising in APAC Request Free Sample

In the Asia-Pacific region, emerging economies like India, China, and Indonesia are prioritizing efficient power generation to fuel their economic growth. Governments are promoting cleaner energy sources, leading to a growing trend towards gas-based power generation in these countries. India, in particular, is heavily reliant on coal for power generation but faces limitations in coal mining expansion due to environmental concerns. International treaties and domestic exploration efforts are expected to support the energy sector in India, increasing the potential for gas-turbine adoption. China and Indonesia, with their significant natural gas reserves, are also expanding their gas-turbine capacity. According to recent reports, the APAC gas turbines market for power generation is expected to grow significantly, with India and China contributing substantially to this growth.

Additionally, the market is witnessing a rise in demand for advanced gas turbines with high efficiency and low emissions. The market is projected to reach approximately 12 GW by 2025, with China accounting for around 60% of the total demand. Indonesia is also expected to witness a CAGR of over 5% during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global gas turbines market for the power industry is witnessing significant growth due to the increasing focus on gas turbine performance optimization strategies. Advanced materials for turbine blades, such as ceramic matrix composites and nickel-based superalloys, are being extensively researched and implemented to improve gas turbine efficiency through design. These materials offer enhanced durability, higher operating temperatures, and reduced emissions, making them a preferred choice for power generation. Reducing nox emissions in gas turbines is another critical area of focus, with regulatory bodies imposing stringent norms on emission levels. Implementing predictive maintenance for gas turbines and upgrading control systems are essential strategies to ensure compliance.

Exhaust heat recovery system design and combined cycle plant efficiency improvements are also gaining traction as they offer significant energy savings and reduced carbon footprint. Digital twin applications for gas turbine monitoring and advanced combustion techniques are revolutionizing the industry. These technologies enable real-time monitoring and analysis of operational data, facilitating early fault detection and predictive maintenance. Gas turbine health monitoring systems and operational data analytics are crucial components of these digital solutions. More than 70% of new product developments in the gas turbines market focus on improving efficiency and reducing emissions. High pressure turbine design challenges, such as material selection and cooling system design, are being addressed through innovative cooling technologies, including internal and external cooling systems.

Remote diagnostics for power plant equipment and advanced materials in gas turbine manufacturing are also key trends driving market growth. The industrial application segment accounts for a significantly larger share of the gas turbines market compared to the academic segment. A minority of players, less than 15%, dominate the high-end instrument market, with the remaining players focusing on cost-effective solutions for the mid-range segment. In conclusion, the gas turbines market for the power industry is witnessing robust growth, driven by a focus on performance optimization, advanced materials, and digital solutions. The market is highly competitive, with a few key players dominating the high-end segment, while others focus on cost-effective solutions for the mid-range segment.

What are the key market drivers leading to the rise in the adoption of Gas Turbines For Power Industry Industry?

- The expansion of the distributed power generation sector serves as the primary catalyst for market growth.

- The shift in power generation is evident as the industry transitions from traditional centralized systems to integrated networks, with a growing emphasis on distributed power generation systems. These systems, which are typically less than 100 MW in size, with the standard being under 50 MW, are compatible with distribution systems' voltage limits. Distributed power technologies exhibit notable flexibility, making them suitable for diverse applications, including electric power, propulsion, and mechanical power.

- They can function independently or integrate seamlessly into larger systems, catering to the energy needs of various-sized users. Distributed power technologies' adaptability and versatility contribute to their increasing popularity and the ongoing evolution of the power generation landscape.

What are the market trends shaping the Gas Turbines For Power Industry Industry?

- The trend in the market involves significant advancements in gas turbine technology. Gas turbine technological innovations represent the current market direction.

- Worldwide, stringent carbon emission regulations fuel the demand for highly efficient gas turbines in power generation. Major players, including General Electric Co. And Siemens AG, invest significantly in the development of H-class gas turbines, such as the 9HA/7HA-series CCGT from General Electric Power and Water division and SGT5-8000H from Siemens. These turbines boast over 60% efficiency levels in combined cycle configurations.

- The continuous quest for greater efficiency among manufacturers targets untapped market potential. This relentless pursuit will underpin market expansion. In the competitive landscape, high-performance and lower power generating costs remain the key drivers. The volatility in fuel cost prices further accentuates the significance of energy efficiency.

What challenges does the Gas Turbines For Power Industry Industry face during its growth?

- The volatility in natural gas prices poses a significant challenge to the industry's growth trajectory.

- The global gas turbines market for the power industry is experiencing significant growth due to the increasing trend towards cleaner power generation. With a growing reliance on natural gas as a feedstock, utilities face the challenge of managing price volatility. Currently, low natural gas prices mitigate the risks of over-reliance. However, historical trends suggest that this could change as natural gas demand increases and crude oil prices recover. The International Energy Agency reports that natural gas accounted for 23% of global electricity generation in 2019. This figure is expected to rise as countries transition to cleaner energy sources. However, the volatility of natural gas prices poses a risk to power industry consumers.

- For instance, between 2002 and 2014, US natural gas prices fluctuated from USD2.50 to USD13 per million British thermal units (MMBtu). To mitigate this risk, utilities are diversifying their feedstock portfolios. Renewable energy sources, such as wind and solar, are becoming increasingly cost-competitive. Additionally, energy storage technologies are improving, enabling utilities to store excess renewable energy for use during peak demand periods. In conclusion, while the shift towards natural gas-driven power generation offers numerous benefits, utilities must manage the risks associated with natural gas price volatility. Diversifying feedstock portfolios and investing in renewable energy and energy storage technologies are key strategies for managing these risks.

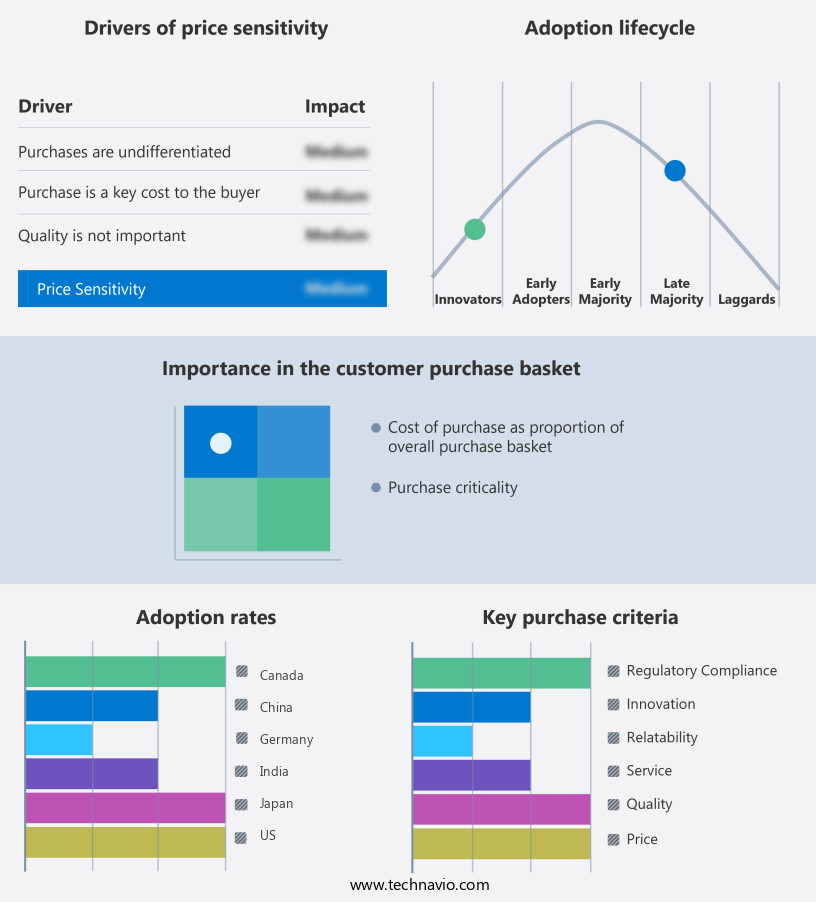

Exclusive Customer Landscape

The gas turbines market for power industry forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gas turbines market for power industry report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Gas Turbines For Power Industry Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, gas turbines market for power industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ansaldo Energia Spa - This company specializes in providing advanced gas turbines for the power industry, including models such as GT36, GT26, and AE94.3A. These turbines deliver exceptional efficiency and reliability, contributing significantly to the power generation sector. With a focus on innovation and performance, the company's offerings set new standards in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansaldo Energia Spa

- Bharat Heavy Electricals Ltd.

- Capstone Green Energy Corp.

- Caterpillar Inc.

- Centrax Ltd.

- Cryostar

- Doosan Corp.

- General Electric Co.

- Harbin Electric Co. Ltd.

- IHI Corp.

- JSC The Ural Turbine Works

- Kawasaki Heavy Industries Ltd.

- MAN Energy Solutions SE

- MAPNA Group Co.

- Mitsubishi Heavy Industries Ltd.

- Motor Sich JSC

- OPRA Turbines BV

- Pumori Energy Ltd.

- Siemens AG

- Vericor Power Systems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gas Turbines Market For Power Industry

- In January 2024, Siemens Energy and Mitsubishi Power agreed to collaborate on the development and production of hydrogen-ready gas turbines. This strategic partnership aimed to reduce greenhouse gas emissions in the power generation sector by integrating hydrogen into the fuel mix (Siemens Energy press release, 2024).

- In March 2024, General Electric (GE) announced the acquisition of Converteam, a leading provider of power conversion systems. This acquisition was expected to strengthen GE's position in the power conversion market and expand its product offerings (GE press release, 2024).

- In May 2024, Siemens Gamesa Renewable Energy and Mitsubishi Power secured a contract to supply a combined cycle gas turbine power plant in Egypt. The project, with an installed capacity of 2.6 GW, was the largest gas turbine power plant order in history (Siemens Gamesa Renewable Energy press release, 2024).

- In April 2025, MHI RJ Aero, a joint venture between Mitsubishi Heavy Industries and Rolls-Royce, successfully demonstrated its advanced class gas turbine, the M701F. This turbine boasted improved efficiency and lower emissions, making it a significant technological advancement in the gas turbines market for power generation (MHI RJ Aero press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gas Turbines Market For Power Industry insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.31% |

|

Market growth 2024-2028 |

USD 2.55 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.23 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving power industry, gas turbines continue to play a pivotal role in generating electricity. The integration of advanced technologies is reshaping the gas turbine landscape, with a focus on enhancing operational data analytics, turbine life extension, and gas turbine efficiency. Operational data analytics is a significant trend, enabling power plant operators to monitor turbine health in real-time. Digital twin technology and turbine health monitoring systems facilitate predictive maintenance, ensuring optimal power plant performance and reliability. Gas turbine efficiency improvements are another key area of development. Turbine blade materials, cooling technologies, and aerodynamic design enhancements contribute to increased power output and energy conversion efficiency.

- Exhaust heat recovery and combustor design optimization further boost thermal efficiency. Fuel flexibility options, such as turbine blade coatings and low emission combustors, address environmental concerns, reducing emissions while maintaining power generation capacity. Advanced turbine designs, like high pressure turbines and turbine rotor dynamics, contribute to enhanced compressor performance metrics and power plant operations. Remote diagnostics and fault detection systems enable early detection and resolution of potential issues, minimizing downtime and maximizing power plant productivity. Predictive maintenance systems leverage operational data to optimize maintenance schedules and extend the lifespan of gas turbine components. Cooling technologies, turbine blade cooling, and turbine inlet temperature management are crucial for maintaining turbine performance and longevity.

- Emissions reduction technologies and energy conversion efficiency improvements are essential for meeting evolving environmental regulations and market demands. In conclusion, the gas turbine market for the power industry is characterized by continuous innovation and adaptation. From turbine blade materials and cooling technologies to operational data analytics and predictive maintenance systems, the focus is on enhancing efficiency, reliability, and sustainability.

What are the Key Data Covered in this Gas Turbines Market For Power Industry Research and Growth Report?

-

What is the expected growth of the Gas Turbines Market For Power Industry between 2024 and 2028?

-

USD 2.55 billion, at a CAGR of 2.31%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Heavy-duty gas turbine and Aeroderivative gas turbine), Technology (CCGT and OCGT), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growth of distributed power generation base, Volatility in natural gas price

-

-

Who are the major players in the Gas Turbines Market For Power Industry?

-

Ansaldo Energia Spa, Bharat Heavy Electricals Ltd., Capstone Green Energy Corp., Caterpillar Inc., Centrax Ltd., Cryostar, Doosan Corp., General Electric Co., Harbin Electric Co. Ltd., IHI Corp., JSC The Ural Turbine Works, Kawasaki Heavy Industries Ltd., MAN Energy Solutions SE, MAPNA Group Co., Mitsubishi Heavy Industries Ltd., Motor Sich JSC, OPRA Turbines BV, Pumori Energy Ltd., Siemens AG, and Vericor Power Systems

-

Market Research Insights

- The market continues to evolve, driven by advancements in technology and the growing demand for efficient and sustainable power generation. Gas turbines are a critical component of power generation, providing flexibility, reliability, and high efficiency. According to industry estimates, the global gas turbine fleet is projected to reach over 30,000 units by 2025, representing a significant growth from the current fleet size. One key trend in the market is the increasing focus on lifecycle cost analysis and gas turbine diagnostics to optimize plant performance and reduce operational costs. For instance, advanced combustion techniques and turbine blade design enhancements have led to an average increase of 1-2% in power generation efficiency, resulting in substantial fuel consumption reduction.

- In contrast, gas turbine upgrades and compressor technology improvements have led to a decrease in NOx emissions by up to 90%, making gas turbines a more environmentally friendly option for power generation. Gas turbine servicing, including overhaul, repair services, and turbine blade design upgrades, plays a crucial role in maintaining plant performance and extending the life of gas turbines. Thermal stress management and turbine rotor balancing are essential aspects of gas turbine maintenance, ensuring optimal plant performance and reducing downtime. Additionally, power plant upgrades, power plant automation, and energy management systems contribute to improved plant performance indicators and overall power plant modernization.

- The integration of renewable energy sources into power generation systems is another significant trend, with high-efficiency turbines and advanced gas turbine simulation techniques enabling seamless integration of renewable energy sources into power grids. CO2 emissions control and condition-based maintenance further enhance the sustainability and efficiency of gas turbines in the power industry.

We can help! Our analysts can customize this gas turbines market for power industry research report to meet your requirements.