Gastrointestinal Diseases Therapeutics Market Size 2025-2029

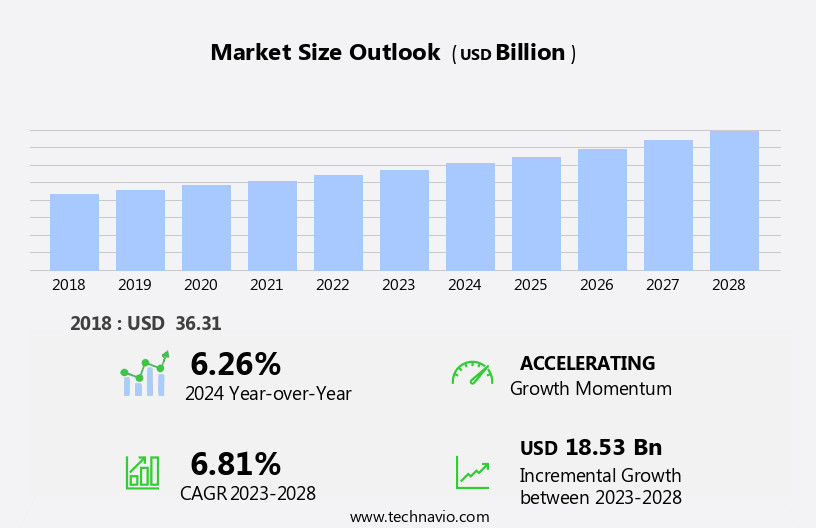

The gastrointestinal diseases therapeutics market size is forecast to increase by USD 20.68 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is witnessing significant growth due to the rising incidence of gastrointestinal diseases. This trend is driven by various factors, including an aging population, unhealthy lifestyle choices, and increasing awareness and diagnosis of gastrointestinal disorders. The Simethicone market is also growing due to its effectiveness in treating symptoms of GERD, such as bloating and burping. A key trend in the market is the availability of nutritional therapies, which offer an alternative treatment approach for managing gastrointestinal diseases. However, the high cost of gastrointestinal therapeutics poses a significant challenge for both patients and healthcare systems. This challenge is compounded by the complex nature of these diseases, which often require long-term treatment and frequent monitoring.

- Additionally, investments in research and development of targeted therapies and personalized medicine approaches could help address the unmet needs of patients and improve treatment outcomes. Over-the-counter (OTC) drugs, including anti-emetics and laxative preparations, are also part of the market landscape. Overall, the market holds immense potential for innovation and growth, with opportunities for companies to differentiate themselves through cost-effective solutions, targeted therapies, and strategic partnerships. To capitalize on market opportunities, companies must focus on developing cost-effective therapies and exploring partnerships with payers and healthcare providers to improve patient access.

What will be the Size of the Gastrointestinal Diseases Therapeutics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market encompasses a diverse range of conditions, including Crohn's disease, ulcerative colitis, irritable bowel syndrome, gastroesophageal reflux disease, inflammatory bowel disease, gastrointestinal cancers, rheumatoid arthritis, multiple sclerosis, type 1 diabetes, and other chronic digestive disorders. Novel therapies are gaining traction in this market, with a focus on targeted drugs that address the underlying causes of these autoimmune diseases. Gi drugs are increasingly being developed to provide more effective and personalized treatment options. The market is driven by the growing prevalence of these conditions and the unmet medical needs of patients. Gastrointestinal disorders impact millions of individuals worldwide, leading to significant morbidity and mortality.

- The development of new therapies and treatments is crucial to improving patient outcomes and reducing the burden on healthcare systems. Inflammatory bowel disease, for instance, affects over 3 million Americans, with Crohn's disease and ulcerative colitis being the most common forms. The market for gi drugs is expected to grow at a steady pace, driven by the increasing prevalence of these conditions and the development of new, targeted therapies. Gastrointestinal cancers, such as colorectal cancer, are another significant area of focus, with ongoing research into new treatments and therapies. The use of biologics and targeted drugs in the treatment of gastrointestinal disorders is becoming increasingly common, offering more effective and personalized treatment options for patients.

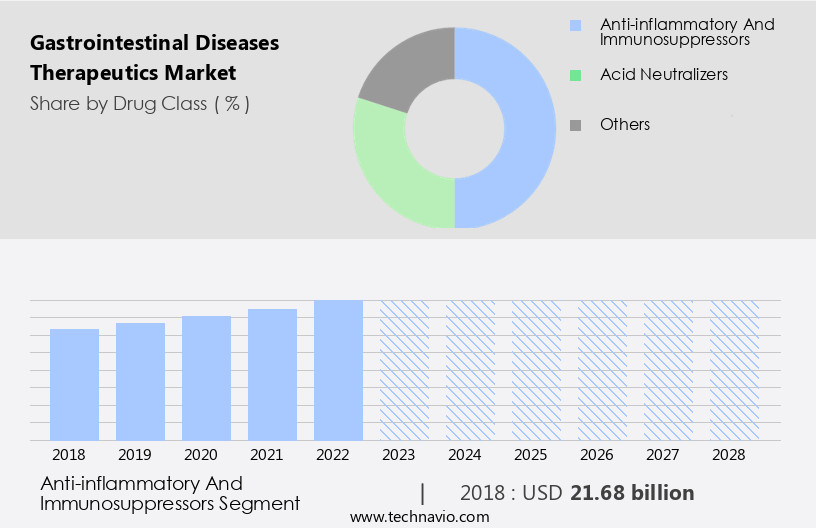

How is this Gastrointestinal Diseases Therapeutics Industry segmented?

The gastrointestinal diseases therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Drug Class

- Anti-inflammatory

- Acid neutralizers

- Others

- Type

- Branded

- Generics

- Route Of Administration

- Parenteral

- Oral

- Rectal

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Drug Class Insights

The anti-inflammatory segment is estimated to witness significant growth during the forecast period. The market encompasses various segments addressing a spectrum of conditions, including inflammatory bowel diseases (IBD), gastroesophageal reflux disease (GERD), gastrointestinal cancers, and chronic digestive diseases. IBD, such as Crohn's disease and ulcerative colitis, necessitate anti-inflammatory treatments. This segment's growth is driven by the escalating prevalence of these diseases, the increasing focus on biologics development, and promising treatment outcomes. TNF blockers, injectable anti-inflammatory drugs, and targeted therapies are key players in this segment. Moreover, other conditions like GERD, gastric ulcers, and duodenal ulcers are treated with proton pump inhibitors and H2 antagonists. Laxative preparations cater to patients with constipation and irritable bowel syndrome.

The market also includes treatments for autoimmune diseases, such as rheumatoid arthritis, and diabetes-related gastrointestinal complications. Retail pharmacies and hospital pharmacies play significant roles in distributing these gastrointestinal drugs, while online pharmacies and providers expand accessibility. Clinical trials continue to explore novel therapies, further fueling market expansion. The market's diversity underscores the importance of catering to the unique needs of each condition, ensuring patient-centric care. The market encompasses a diverse range of chronic conditions, including gastroesophageal reflux disease, inflammatory bowel diseases such as Crohn's and ulcerative colitis, irritable bowel syndrome, gastrointestinal cancers, and various autoimmune diseases like type 1 diabetes, multiple sclerosis, rheumatoid arthritis, lupus, psoriasis, and scleroderma.

The Anti-inflammatory segment was valued at USD 22.87 billion in 2019 and showed a gradual increase during the forecast period.

The market for gi drugs is expected to continue growing, driven by the increasing prevalence of these conditions and the development of new, targeted therapies. The integration of advanced technologies, such as artificial intelligence and machine learning, is also expected to drive innovation in the market, leading to the development of more effective and personalized treatment options. Overall, the market is a dynamic and evolving field, with a focus on developing new, targeted therapies to address the unmet medical needs of patients. Telemedicine and online providers are also gaining popularity for the convenience and accessibility they offer.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the market is experiencing significant growth due to the increasing incidence and prevalence of chronic gastrointestinal conditions, such as inflammatory bowel diseases (IBDs), gastroesophageal reflux disease (GERD), ulcerative colitis, and Crohn's disease. Factors contributing to this growth include rising healthcare expenditure, a growing geriatric population, and the preference for therapeutics over surgical procedures. Pharmaceutical and biotechnology companies are increasingly focusing on research and development to create novel drugs for IBDs and other gastrointestinal conditions. Chronic gastrointestinal diseases, including GERD, are influenced by various factors, such as smoking, certain medications, and obesity. For instance, smoking and obesity are significant contributors to the development of GERD.

Furthermore, the presence of a large number of global and regional players in the market, including retail pharmacies, hospital pharmacies, online pharmacies, and drug stores, is fueling market growth. The injectable segment, which includes TNF blockers, is a significant contributor to the market's growth due to its effectiveness in treating various gastrointestinal diseases, such as Crohn's disease and ulcerative colitis. Novel therapies, such as targeted drugs and online providers, are also gaining popularity due to their convenience and effectiveness. Additionally, clinical trials for autoimmune diseases, such as multiple sclerosis and rheumatoid arthritis, are driving the development of new therapies for gastrointestinal diseases.

Moreover, the increasing prevalence of chronic digestive diseases, such as gastric ulcer and duodenal ulcer, is driving the demand for proton pump inhibitors and H2 antagonists. Furthermore, the availability of over-the-counter (OTC) drugs for conditions like irritable bowel syndrome and anti-emetics for nausea and vomiting is expanding the market's reach. The generic segment is also growing due to the availability of affordable alternatives to branded drugs. The market in North America is experiencing significant growth due to the increasing incidence and prevalence of chronic gastrointestinal diseases, rising healthcare expenditure, and the preference for therapeutics over surgical procedures.

Pharmaceutical and biotechnology companies' focus on research and development, the growing geriatric population, and the presence of a large number of global and regional players are also driving market growth. The injectable segment, novel therapies, and the availability of OTC drugs are contributing to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Gastrointestinal Diseases Therapeutics market drivers leading to the rise in the adoption of Industry?

- The rising prevalence of gastrointestinal diseases serves as the primary catalyst for market growth in this sector. Gastrointestinal diseases, including inflammatory bowel disease (IBD), gastric ulcer, and duodenal ulcer, have seen a notable rise in prevalence worldwide. Factors such as an unhealthy diet, sedentary lifestyle, stress, food sensitivity, and bacterial or viral infections contribute significantly to the increasing incidence of these conditions. Chronic gastrointestinal diseases can lead to various complications and disabilities if left untreated. IBD, a common gastrointestinal disease, causes inflammation of the gastrointestinal tract. Crohn's disease and ulcerative colitis are the two primary forms of IBD.

- The therapeutic market for these diseases is substantial, with various treatment options available, including TNF blockers in the injectable segment. Online and hospital pharmacies provide easy access to these medications. As the prevalence of gastrointestinal diseases continues to rise, the demand for effective therapeutics is expected to increase. The market dynamics remain influenced by factors such as disease prevalence, treatment advancements, and patient demographics.

What are the Gastrointestinal Diseases Therapeutics market trends shaping the Industry?

- The trend in the market is shifting towards the availability of nutritional therapies. These evidence-based approaches to health and wellness are gaining increasing recognition and popularity. Gastrointestinal diseases, such as irritable bowel syndrome (IBS), ulcerative colitis, Crohn's disease, and peptic ulcer disease, require effective therapeutic interventions to manage symptoms and improve patients' quality of life. Novel therapies, including targeted drugs, are increasingly being explored in clinical trials for these conditions. For instance, monoclonal antibodies and Janus kinase inhibitors have shown promise in treating autoimmune diseases like Crohn's disease and ulcerative colitis. Online providers offer convenient access to information and resources for individuals seeking to manage their gastrointestinal conditions. These resources include dietary guidance, support groups, and educational materials. Nutritional therapies, including specialized diets and dietary supplements, play a significant role in managing gastrointestinal diseases.

- For example, the low-FODMAP diet, which restricts fermentable carbohydrates, can help individuals with IBS manage their symptoms. Certified food products and resources support patients following this diet. Individuals with celiac disease or non-celiac gluten sensitivity must adhere to a strict gluten-free diet. The availability of gluten-free products and resources is crucial for these patients. The market is driven by the growing need for effective treatments and the increasing availability of resources for patients, including online providers and nutritional therapies. Clinical trials for novel therapies offer hope for individuals with chronic gastrointestinal conditions.

How does Gastrointestinal Diseases Therapeutics market face challenges during its growth?

- The escalating costs of developing and manufacturing gastrointestinal therapeutics poses a significant challenge to the industry's growth trajectory. Gastrointestinal diseases, including chronic conditions such as Crohn's disease and ulcerative colitis, require ongoing treatment to prevent recurrence and potential complications. The total expense of gastrointestinal disease therapy consists primarily of drug costs, doctor fees, and hospital visits or stays. Ulcerative colitis treatment costs typically range from USD 6,000 to USD 12,000, while Crohn's disease treatment costs can reach up to USD 30,000 to USD 32,000. Biologic drugs, like infliximab and vedolizumab, are infused for various chronic gastrointestinal diseases. Infliximab, marketed as Remicade by Johnson and Johnson, usually costs between USD 6,000 and USD 6,500, while Takeda Pharmaceutical's vedolizumab, known as Entyvio, typically ranges from USD 8,500 to USD 8,700.

- Proton pump inhibitors and anti-emetics are common GI drugs, while over-the-counter (OTC) drugs are also used for managing gastrointestinal symptoms. Type 1 diabetes, which can lead to gastrointestinal complications, requires specific treatment. The high cost of gastrointestinal disease therapies underscores the importance of ongoing research and development in this area. The gastrointestinal disease therapeutics market is significant due to the high prevalence of chronic gastrointestinal conditions and the need for long-term treatment. The cost of therapy is substantial, with a significant portion attributed to prescription drugs. Understanding the financial implications of gastrointestinal disease treatment can help patients and healthcare providers make informed decisions.

Exclusive Customer Landscape

The gastrointestinal diseases therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gastrointestinal diseases therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gastrointestinal diseases therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in developing therapeutic solutions for gastrointestinal diseases, encompassing treatments for irritable bowel syndrome, intrahepatic cholestasis, colon rhythm regulation, and pancreatic exocrine insufficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- AstraZeneca Plc

- Bayer AG

- Biogen Inc.

- Boehringer Ingelheim International GmbH

- Boston Scientific Corp.

- Eisai Co. Ltd.

- Eli Lilly and Co.

- Evoke Pharma Inc.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Merck and Co. Inc.

- Novartis AG

- Olympus Corp.

- Ovesco Endoscopy AG

- Pfizer Inc.

- Salix Pharmaceuticals Inc.

- Takeda Pharmaceutical Co. Ltd.

- UCB SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gastrointestinal Diseases Therapeutics Market

- In January 2025, Takeda Pharmaceutical Company Limited announced the approval of Entyvio (vedolizumab) for the treatment of pediatric Crohn's disease by the European Commission. This expansion of Entyvio's indication marks a significant advancement in addressing unmet medical needs for pediatric patients suffering from this debilitating condition (Takeda Press Release, 2025).

- In March 2025, Pfizer Inc. and Ionis Pharmaceuticals, Inc. entered into a strategic collaboration to develop and commercialize IONIS-2927, an antisense medicine for the treatment of irritable bowel syndrome with constipation (IBS-C). This partnership combines Pfizer's expertise in gastrointestinal disorders and Ionis's innovative antisense technology, potentially leading to a novel therapeutic solution for IBS-C patients (Pfizer Press Release, 2025).

- In April 2025, Allergan plc completed the acquisition of Viral Burn, a privately-held biotechnology company focused on developing novel therapeutics for gastrointestinal diseases. The acquisition adds Viral Burn's lead asset, VB-201, a first-in-class, oral, non-systemic antiviral therapy for the treatment of norovirus gastroenteritis, to Allergan's pipeline (Allergan Press Release, 2025).

- In May 2025, the U.S. Food and Drug Administration (FDA) granted Breakthrough Therapy Designation to Fitbiotics' FitBiotics-101, a microbiome-based therapeutic for the treatment of recurrent Clostridioides difficile infection (CDI). This designation accelerates the development and regulatory review process for this promising new therapy, which could significantly impact the treatment landscape for CDI patients (FDA Press Release, 2025).

Research Analyst Overview

The market continues to evolve, driven by ongoing research and development in various sectors. Irritable bowel syndrome, ulcerative colitis, peptic ulcer disease, and Crohn's disease are among the chronic digestive conditions that require continuous treatment. Novel therapies, including targeted drugs, are gaining traction, with a focus on specific disease mechanisms. Online providers and pharmacies are increasingly playing a significant role in delivering these therapies, offering convenience and accessibility. H2 antagonists and proton pump inhibitors have dominated the market, but patent expirations are paving the way for generics. Clinical trials are underway for various gastrointestinal diseases, including gastroesophageal reflux disease, inflammatory bowel disease, and gastrointestinal cancers.

Autoimmune diseases, such as rheumatoid arthritis, are also linked to gastrointestinal symptoms, expanding the therapeutic landscape. The injectable segment, including TNF blockers, is a growing area of interest for treating inflammatory conditions. Antiemetics and laxative preparations cater to specific symptoms, while OTC drugs offer relief for less severe conditions. The market dynamics remain fluid, with ongoing developments in GI drugs and the emergence of new players.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gastrointestinal Diseases Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

215 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 20.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Canada, Germany, Japan, UK, India, France, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gastrointestinal Diseases Therapeutics Market Research and Growth Report?

- CAGR of the Gastrointestinal Diseases Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Asia, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gastrointestinal diseases therapeutics market growth of industry companies

We can help! Our analysts can customize this gastrointestinal diseases therapeutics market research report to meet your requirements.