China Glass Container Packaging Market Size 2024-2028

The China glass container packaging market size is forecast to increase by USD 2.93 billion at a CAGR of 4.8% between 2023 and 2028.

- The market is experiencing significant growth, driven by several key trends. One of the primary factors fueling market expansion is the increasing demand from the e-commerce industry. As more consumers turn to online shopping, there is a growing need for secure and attractive packaging solutions. The market's size is substantial, with high shipment volumes of glass packaging for beverages, including beer, soft drinks, ciders, and non-alcoholic beverages. Another trend shaping the market is the advent of smart packaging, which offers features such as temperature control, freshness indicators, and product tracking. Additionally, fluctuations in raw material prices can impact the market, requiring manufacturers to adapt and find cost-effective solutions. Overall, these trends present both opportunities and challenges for players In the market.

What will be the size of the China Glass Container Packaging Market during the forecast period?

- The market has experienced significant growth, driven by the increasing demand for reusable and eco-friendly packaging solutions in various industries. Glass containers, including bottles and tubes, are widely used In the health and personal care sectors for products such as cosmetics, pharmaceuticals, and food and beverages. Health and safety concerns, as well as recycling initiatives, have fueled the market's expansion. China's recycling rates for glass containers are increasing, making glass an attractive choice for companies looking to reduce their environmental footprint.

- Lightweight glass, such as borosilicate glass, offers thermal resistance and chemical inertness, making it suitable for various applications, including single-serving beverages and returnable glass bottles. Despite the growth, glass container packaging faces competition from substitute products like aluminum cans and plastic containers. However, the market's trend towards eco-friendly packaging and the unique benefits of glass, such as its recyclability and ability to preserve the taste and quality of contents, are expected to continue driving demand.

How is this market segmented and which is the largest segment?

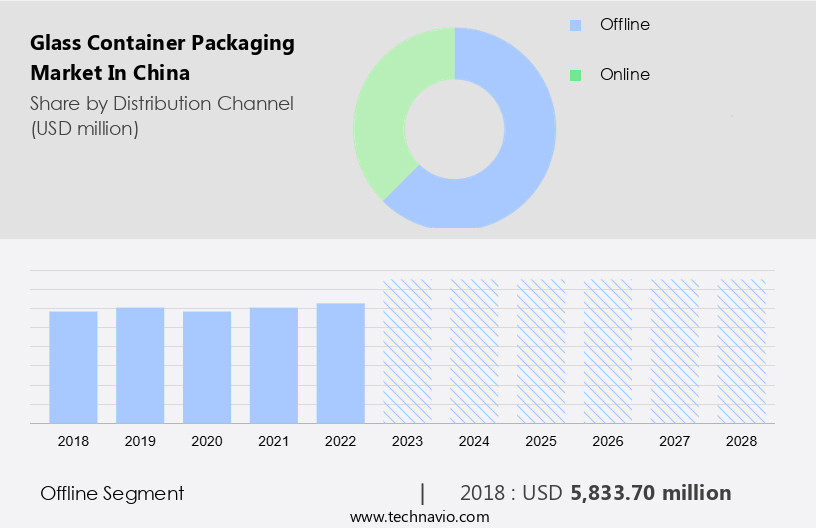

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Food and beverage

- Personal care

- Pharmaceutical

- Others

- Geography

- China

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for glass packaging in various industries, particularly in food and beverages, personal care, cosmetics, pharmaceuticals, and healthcare packaging. The market is driven by factors such as the health and safety benefits of glass containers, high recycling rates, and the growing trend towards eco-friendly packaging. Glass containers are widely used for beverages, including beer, soft drinks, ciders, and non alcoholic beverages, as well as for food, thermal shocks, and pharmaceutical packaging. The market is also influenced by the increasing production of chronic illnesses, vaccine production, and alcohol consumption. Lightweight glass containers, such as those used for single-serving beverages, are gaining popularity due to their sustainability and eco-friendliness.

Get a glance at the market share of various segments Request Free Sample

The offline segment was valued at USD 5.83 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of China Glass Container Packaging Market?

Rising demand from e-commerce industry is the key driver of the market.

- The market experiences significant growth due to the expanding e-commerce industry. With the increasing number of online consumers and the rising middle class, there is a shift in consumer behavior toward purchasing goods from the comfort of their homes. This trend results In the first point of contact between consumers and brands being the glass packaging of the delivered products. Glass containers, including bottles and tubes, are popular choices for various industries such as food and beverages, personal care, cosmetics, and pharmaceuticals. These industries value glass packaging for its health and safety benefits, recyclability, and eco-friendliness. In China, glass packaging is used extensively for beverage production, including beer, soft drinks, ciders, and non-alcoholic beverages.

- The glass packaging market in China also caters to industries like healthcare, where glass containers are used for sterilization devices, medical tourism, and pharmaceutical packaging for chronic illnesses and vaccine production. Glass packaging's thermal resistance and chemical inertness make it suitable for alcohol consumption and luxury manufacturers. The recycling rates for glass containers in China are high, making it a sustainable packaging solution. Single-serving beverages, ampoules, and vials are also produced using glass containers due to their preservation properties. The market for glass containers is expected to continue growing due to the increasing demand for eco-friendly packaging and the ongoing plastic ban.

What are the market trends shaping the China Glass Container Packaging Market?

Advent of smart packaging is the upcoming trend In the market.

- Glass packaging, including bottles and tubes, plays a significant role in various industries such as food and beverages, personal care, cosmetics, and pharmaceuticals. In China, glass containers are widely used for health and safety reasons, as they are eco-friendly and offer recycling benefits. Recycling rates for glass packaging are high, making it an attractive choice for industries producing beverage products, including beer, soft drinks, ciders, and non-alcoholic beverages. Glass containers are also used In the production of wine and dairy products, as well as in healthcare packaging for pharmaceuticals, chronic illnesses, vaccine production, and sterilization devices. Lightweight glass containers offer thermal resistance and chemical inertness, making them suitable for single-serving beverages and eco-friendly packaging.

- The market for glass packaging in China is driven by the increasing demand for health and safety, recyclability, and sustainability. Borosilicate glass, which offers high thermal resistance and chemical inertness, is used In the production of ampoules and vials for chemical healthcare and luxury manufacturers. The glass packaging market in China is expected to grow due to rising healthcare expenditure, food manufacturing activities, and the increasing popularity of eco-friendly packaging solutions. Despite the advantages of glass packaging, it faces competition from substitute products such as aluminum cans and plastic containers. However, the trend towards sustainable packaging and the implementation of plastic bans in some regions is expected to boost the demand for glass containers.

What challenges does China Glass Container Packaging Market face during the growth?

Fluctuations in raw material prices is a key challenge affecting the market growth.

- Glass container manufacturing relies on raw materials such as sand, soda ash, and limestone. Price fluctuations of these materials, particularly soda ash, which makes up over half of the total raw material costs, significantly impact the industry. Since 2018, soda ash prices have risen and then decreased, causing container manufacturers to pass on these increased costs to consumers through higher product prices. This trend is observed across various glass container applications, including food and beverages, personal care, cosmetics, pharmaceutical, and healthcare packaging. Beverage products, such as beer, soft drinks, ciders, and non-alcoholic beverages, account for a substantial portion of the glass container market.

- In response to rising raw material costs, manufacturers also focus on eco-friendly and sustainable packaging solutions, such as lightweight glass and recyclable containers, to maintain competitiveness. Additionally, the shift towards eco-friendly packaging due to environmental concerns and potential plastic bans further bolsters the demand for glass containers. The glass packaging market encompasses various applications, including bottles, tubes, jars, and ampoules and vials, among others. The market caters to diverse industries, including food manufacturing, beverage production, pharmaceutical packaging, and healthcare packaging, among others. Key applications include wine production, dairy, and vaccine production. The market's growth is driven by factors such as increasing healthcare expenditure, rising alcohol consumption, and the need for sterilization devices In the healthcare sector.

Exclusive China Glass Container Packaging Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- East Asia Glass Ltd.

- Hualian Glass Manufacturers Co. Ltd.

- Huaxing Glass

- Jiangsu Rongtai Glass Products Co. Ltd.

- Jining Baolin Glass Products Co. Ltd.

- Ruisheng Glass Bottle Wholesale Co. Ltd.

- Shanghai Misa Glass Co. Ltd.

- Shanghai Vista Packaging Co. Ltd

- Tai an Maidao Industry Co. Ltd.

- Unipack Glass Co. Ltd.

- Xuzhou Huihe International Trade Co. Ltd.

- Zhangjiagang Guochao Glassware Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by the increasing demand for reusable and eco-friendly packaging solutions across various industries. Glass containers, which include bottles, tubes, and jars, have gained popularity due to their inherent properties such as health and safety, recycling, and suitability for a wide range of applications. In the food and beverage sector, glass containers are widely used for packaging a diverse range of products, including beverages, dairy, and wine. The beverage industry, in particular, has seen an increase in demand for glass containers due to their ability to maintain the taste and quality of the product, as well as their resistance to thermal shocks.

In addition, this is especially important for alcoholic beverages, such as beer, ciders, and wine, which require specific temperature conditions during production and storage. The personal care and cosmetics industries also utilize glass containers due to their aesthetic appeal and ability to preserve the product's quality. Borosilicate glass, which offers high thermal resistance and chemical inertness, is commonly used for packaging luxury cosmetics and pharmaceutical products. The healthcare sector is another significant market for glass container packaging in China. Glass containers are used for packaging various healthcare products, including medicines, vaccines, and sterilization devices. The rising healthcare expenditure and increasing focus on medical tourism have fueled the demand for glass packaging in this sector.

Furthermore, despite the numerous benefits of glass container packaging, there are challenges that the market faces. One of the main challenges is the high cost of glass containers compared to substitute products such as aluminum cans and plastic containers. However, the growing trend towards eco-friendly packaging and the increasing awareness of the environmental impact of plastic waste are driving the demand for glass containers. Another challenge is the recycling rates of glass containers in China. While glass is one of the most recyclable materials, the recycling rates for glass containers are relatively low due to the high energy consumption required for the recycling process and the lack of infrastructure for collecting and processing glass waste.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

112 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 2.93 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.4 |

|

Competitive landscape |

Leading Companies, Market Report, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across China

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch