Glass Substrate Market Size 2024-2028

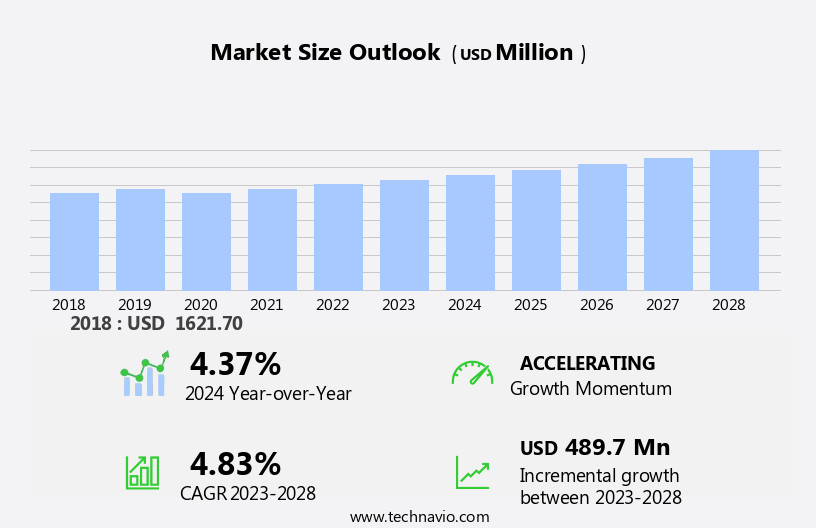

The glass substrate market size is forecast to increase by USD 489.7 million at a CAGR of 4.83% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary drivers is the increasing adoption of glass fiber composites In the automobile industry, leading to lighter and stronger vehicles. Another trend is the utilization of glass substrates in solar power-generating plants, contributing to the expansion of the renewable energy sector. Additionally, there is growing awareness of the environmental impact of glass production, leading to advancements in sustainable manufacturing processes. These factors, among others, are shaping the future of the market. Despite these opportunities, challenges persist, including the high cost of raw materials and the need for continuous innovation to meet evolving customer demands. The market is also influenced by trends in high-frequency applications, power management, and the adoption of advanced packaging technologies In the aerospace & defense, healthcare, solar power, and electronics industries. Overall, the market is poised for steady growth In the coming years.

What will be the Size of the Glass Substrate Market During the Forecast Period?

- The market encompasses the production and supply of glass materials used in various industries, including consumer durables, LCD technology for consumer electronics, and the automotive sector. This market is driven by the increasing demand for advanced displays in smart handheld devices and digital dashboards, as well as the semiconductor industry's reliance on glass substrates for semiconductor packaging. Borosilicate, silicon, ceramic, and quartz are common glass types used due to their high heat conductivity, low dielectric loss, and interoperability with semiconductor devices. The market's growth is underpinned by the continuous pursuit of improved performance and reliability In these sectors.

How is this Glass Substrate Industry segmented and which is the largest segment?

The glass substrate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Electronics

- Automotive

- Medical

- Solar

- Aerospace and defense

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

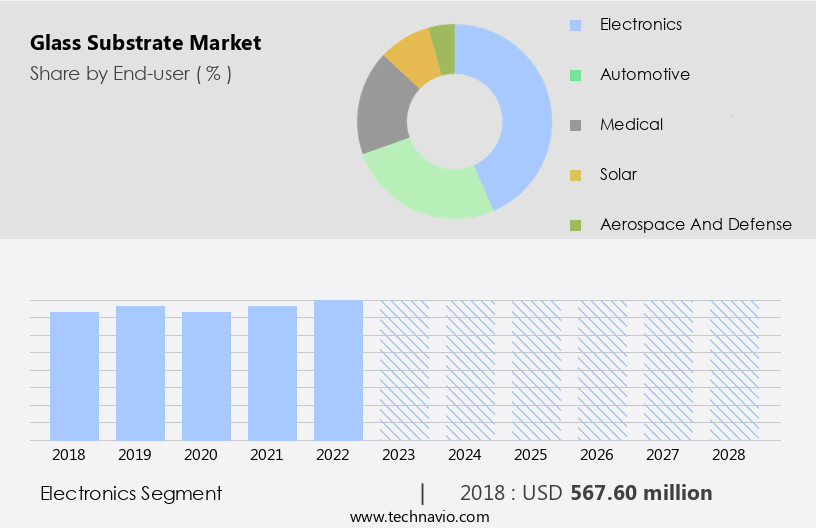

- The electronics segment is estimated to witness significant growth during the forecast period.

The market In the electronics industry encompasses various applications, including semiconductors, displays, telecommunications devices, and electronic components. Notably, glass substrates are integral to the manufacturing of consumer durables, such as smart handheld devices and flat panel displays. The market is fuelled by advancements in semiconductor and LCD technologies. Glass substrates play a crucial role In the semiconductor industry, contributing to the production of complementary metal-oxide semiconductors (CMOS), microelectromechanical systems (MEMS), image sensors, and light-emitting diodes (LEDs). In addition, they are employed In the automotive sector for digital dashboards, infotainment systems, heads-up displays, and solar power applications. The use of high-quality glass substrates, such as borosilicate-based, silicon-based, ceramic-based, fused silica, and quartz-based, is essential for maintaining display quality and meeting the stringent requirements of the semiconductor and consumer electronics industries. The market for glass substrates is poised for growth due to the increasing demand for high-density, cutting-edge packaging techniques, such as fan-out wafer-level packaging (FOWLP) and system-in-package, as well as the expansion of the solar energy sector and the proliferation of wearable electronics.

Get a glance at the Glass Substrate Industry report of share of various segments Request Free Sample

The electronics segment was valued at USD 567.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

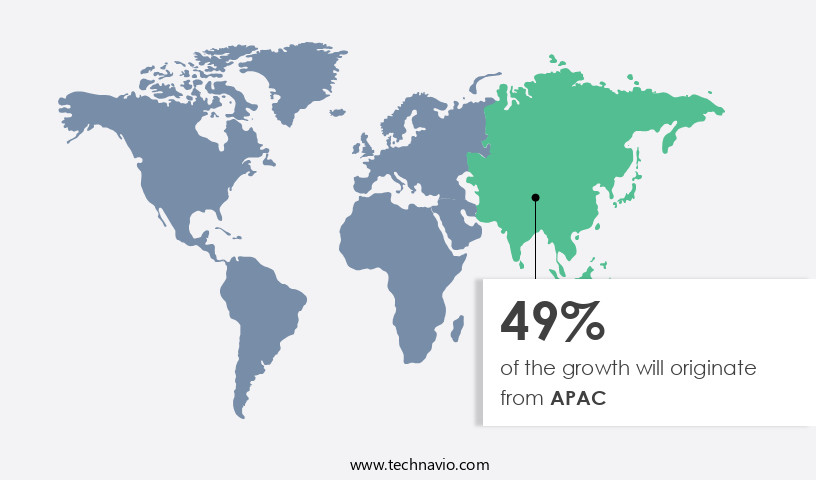

- APAC is estimated to contribute 49% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth, particularly In the Asia Pacific (APAC) region. In 2023, APAC held the largest market share, driven by the increasing production of consumer electronics in countries like China, India, and Japan. China's electronics industry is expanding due to rising disposable incomes and growing demand for electronic goods both domestically and internationally. LCD technology is a primary application for glass substrates, used in various consumer durables, smart handheld devices, automotive applications, and consumer electronics. Advanced packaging technologies, such as fan-out wafer-level packaging (FOWLP) and system-in-package, are also driving demand for high-quality glass substrates.

Additionally, the solar power application In the solar energy sector is another significant market for glass substrates, with applications in photovoltaic cells and solar panels. The market's growth is further fueled by increasing urbanization and rising living standards, leading to increased demand for high-tech medical devices, wearable electronics, and other consumer products. The semiconductor industry's performance in high-frequency applications, power electronics, and advanced packaging technologies also contributes to the market's growth. Quality requirements for display quality, interoperability, and dielectric loss are essential factors In the market. Borosilicate-based, silicon-based, ceramic-based, fused silica, and quartz-based glass substrates are used in various applications, including aerospace & defense, healthcare, electronics, and semiconductors.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Glass Substrate Industry?

Increasing adoption of glass fiber composites in automobiles is the key driver of the market.

- The market encompasses various types of glass, including borosilicate, silicon, ceramic, fused silica, and quartz-based, used in Consumer durables, such as LCDs for Consumer electronics like Smart handheld devices and Digital dashboards in Automotive applications. LCD technology's advancement In the Semiconductor industry has led to the integration of high-quality glass substrates in Infotainment systems, Heads-up displays, and Advanced packaging technologies like FOWLP and system-in-package. The Solar power application In the Solar energy sector is another significant market for glass substrates, with Photovoltaic cells and Solar panels requiring high-quality glass for optimal performance. The Renewable energy landscape's growth necessitates the use of high-tech materials to improve efficiency and reduce manufacturing costs and technology costs. Borosilicate-based glass substrates offer high heat conductivity and low dielectric loss, making them ideal for high-frequency applications In the Semiconductor industry, Power electronics, and Telecommunications. Silicon-based glass substrates are suitable for high-density, cutting-edge packaging techniques, while ceramic-based glass substrates are used in Micro-electro-mechanical systems, Image Sensors, LEDs, Logic ICs, and Optoelectronics.

- Furthermore, increasing Urbanization and rising living standards have led to an increase in demand for high-quality glass substrates in various industries, including Aerospace & Defense, Healthcare, and Wearable electronics like Smartwatches, Fitness trackers, and Wearable gadgets. The growing popularity of AI Pins, AI assistants, and other Humane technologies has further boosted the market's growth. Thus, the market is a dynamic and evolving industry that plays a crucial role in various sectors, including Consumer durables, Automotive applications, Semiconductor industry, Solar Power, and Electronics. The market's growth is driven by factors such as increasing demand for high-quality glass substrates, advancements in technology, and the growing need for energy efficiency and interoperability in various industries.

What are the market trends shaping the Glass Substrate Industry?

The adoption of glass substrates in solar power-generating plants is the upcoming market trend.

- The global market for glass substrates, a crucial component in various industries including Consumer durables, Smart handheld devices, Automotive applications, and the Semiconductor industry, is experiencing significant growth. LCD technology, a primary application for glass substrates, is driving this expansion in sectors such as Consumer electronics, Digital dashboards for Infotainment systems, Heads-up displays, and advanced packaging technologies like FOWLP and system-in-package. High-quality glass substrates, including borosilicate-based, silicon-based, ceramic-based, fused silica, and quartz-based, are essential for producing high-performance LCDs. The technology costs and manufacturing costs for these substrates have decreased, making them more accessible to various industries. The solar power application In the Solar energy sector is another growing market for glass substrates. Solar panels require high-quality glass for photovoltaic cells, and the renewable energy landscape's increasing importance is fueling demand. Quality requirements for display quality and interoperability with semiconductor devices, such as transistors and logic ICs, are critical factors In the market.

- Moreover, urbanization and rising living standards are increasing the demand for high-tech consumer electronics, wearable gadgets like smartwatches and fitness trackers, and advanced packaging techniques. The aerospace & defense, healthcare, and solar power industries also rely on glass substrates for their high heat conductivity and compatibility with complementary metal-oxide-semiconductor (CMOS), micro-electro-mechanical systems (MEMS), image sensors, LEDs, and ICs. Thus, the market is a dynamic and essential sector, driven by the growing demand for LCDs in various industries and the increasing importance of renewable energy sources. The market's continued growth is influenced by factors such as technological advancements, cost reductions, and the increasing demand for high-performance, energy-efficient solutions.

What challenges does the Glass Substrate Industry face during its growth?

The environmental impact of glass production is a key challenge affecting the industry's growth.

- The market encompasses the production and supply of high-quality glass substrates for various applications, including LCDs in Consumer durables, Smart handheld devices, and the Automotive industry. In the Semiconductor industry, LCD technology is extensively used in Consumer electronics, such as digital dashboards, infotainment systems, and Heads-up displays. High-quality glass substrates, like borosilicate-based, silicon-based, ceramic-based, fused silica, and quartz-based, play a crucial role in enhancing display quality. Manufacturing costs and technology costs are significant factors influencing the market's growth. Solar power applications In the Solar energy sector, such as photovoltaic cells and solar panels, also contribute to the market's expansion.

- The renewable energy landscape's increasing importance drives the demand for advanced packaging technologies, including FOWLP, system-in-package, and geometry, which require high-density, cutting-edge packaging techniques. The market's applications extend to various industries, including Aerospace & Defense, Healthcare, and Solar Power. The market's growth is influenced by factors such as urbanization, rising living standards, and the increasing demand for high heat conductivity, dielectric loss, interoperability, and semiconductor devices' performance in high-frequency applications. The market's future prospects are promising, with advancements in Complementary metal-oxide-semiconductor, Micro-electro-mechanical systems, Image Sensors, LEDs, Logic ICs, ICs, Optoelectronics, and OEMs. The market's growth is further fueled by the increasing disposable incomes and the middle-class population's expanding demand for high-tech medical devices and wearable electronics, such as smartwatches, fitness trackers, and AI-powered devices like smartphones, AI pins, and AI assistants.

Exclusive Customer Landscape

The glass substrate market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the glass substrate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, glass substrate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGC Inc.

- Apogee Enterprises Inc

- Corning Inc.

- DuPont de Nemours Inc.

- HOYA CORP.

- IRICO Group New Energy Co. Ltd.

- Kyodo International Inc.

- Laseroptik GmbH

- MTI Corp.

- Nippon Sheet Glass Co. Ltd.

- NOVA Electronic Materials LLC

- Ohara Inc.

- Otto Chemie Pvt. Ltd.

- Plan Optik AG

- SCHOTT AG

- Shilpa Enterprises

- Shin Etsu Chemical Co. Ltd.

- Solaronix SA

- Techinstro Industries

- Vedanta Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of applications, driven by the ever-evolving technology landscape. This sector plays a crucial role in various industries, including consumer durables and automotive, among others. The demand for high-quality glass substrates is fueled by the increasing need for advanced technology In these sectors. Liquid crystal displays (LCDs) have been a significant driver for the market. The consumer electronics industry, particularly smart handheld devices, has seen exponential growth in recent years, leading to a growth in demand for LCD glass. The automotive sector also utilizes glass substrates in various applications, such as digital dashboards, infotainment systems, and heads-up displays. The semiconductor industry is another major consumer of glass substrates. Borosilicate-based, silicon-based, ceramic-based, fused silica, and quartz-based glass substrates are used extensively in the manufacturing of semiconductor devices. The semiconductor industry's relentless pursuit of performance and high-frequency applications requires glass substrates with exceptional properties, such as high heat conductivity and low dielectric loss. The solar power application sector is another significant market for glass substrates. Glass substrates are used in the production of photovoltaic cells and solar panels, making them an essential component of the renewable energy landscape.

The increasing focus on sustainable energy sources and the growing demand for clean energy are expected to drive the demand for glass substrates in this sector. The aerospace & defense industry also utilizes glass substrates due to their high-performance characteristics. The industry's stringent quality requirements necessitate the use of advanced packaging technologies, such as Fan-Out Wafer Level Packaging (FOWLP), System-in-Package (SiP), and other cutting-edge techniques. These technologies require high-quality glass substrates to ensure the reliability and performance of the semiconductor devices used in aerospace and defense applications. The healthcare sector is another major consumer of glass substrates. High-tech medical devices, such as wearable electronics like smartwatches, fitness trackers, and wearable gadgets, require glass substrates with specific properties, such as high-density and geometry, to ensure their functionality and durability.

Thus, the market is influenced by various factors, including urbanization, living standards, and disposable incomes. The increasing urbanization and rising living standards in developing countries are expected to drive the demand for consumer electronics, automotive applications, and other sectors that utilize glass substrates. The growing middle-class population In these regions is also expected to contribute to the market's growth. Thus, the market is a dynamic and diverse sector, driven by various industries and applications. The demand for high-quality glass substrates is fueled by the relentless pursuit of advanced technology and performance in various sectors, including consumer electronics, automotive, semiconductors, solar power, aerospace & defense, and healthcare. The market's growth is influenced by various factors, including urbanization, living standards, and disposable incomes. Glass substrates play a crucial role in enabling the development and implementation of cutting-edge technologies In these sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 489.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Glass Substrate Market Research and Growth Report?

- CAGR of the Glass Substrate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the glass substrate market growth of industry companies

We can help! Our analysts can customize this glass substrate market research report to meet your requirements.