Glutamic Acid Market Size 2025-2029

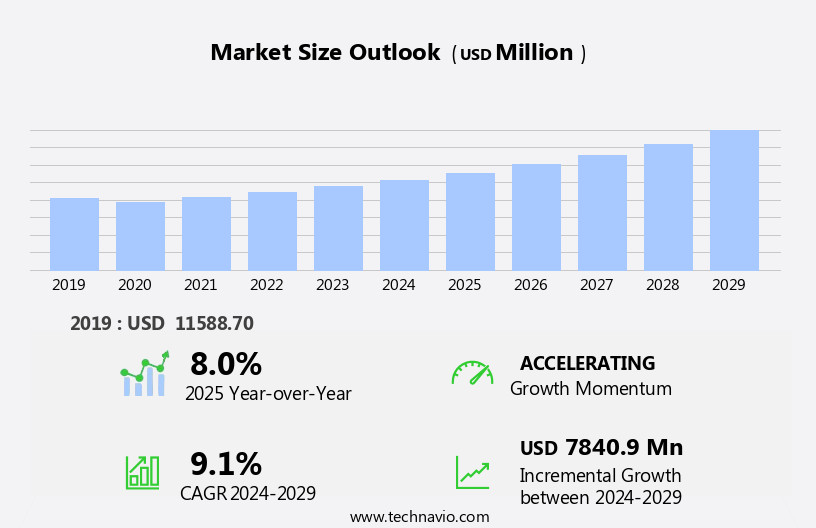

The glutamic acid market size is forecast to increase by USD 7.84 billion at a CAGR of 9.1% between 2024 and 2029.

- The market is experiencing significant growth due to increasing demand in various applications, particularly in the production of sports supplements. This trend is driven by the growing awareness of health and fitness, leading consumers to seek out nutritional supplements to enhance their performance. Another key driver is the increasing use of glutamic acid as an animal feed additive, which contributes to the growth of the livestock industry and the demand for this essential amino acid. However, the market faces challenges as well. The rise in raw material prices poses a significant obstacle for manufacturers, potentially increasing production costs and impacting profitability.

- Producers must navigate this challenge by exploring alternative sources or implementing cost-saving measures to maintain competitiveness in the market. Overall, the market presents opportunities for growth, particularly in the health and nutrition sector, while also requiring strategic planning to address the challenges of rising raw material costs. Companies seeking to capitalize on these opportunities must stay informed of market trends and adapt to changing market conditions to remain competitive.

What will be the Size of the Glutamic Acid Market during the forecast period?

- The market continues to evolve, driven by consumer preferences for natural and functional ingredients in various sectors. In the food industry, its applications extend beyond industrial-grade uses in food processing to include food additives and flavor enhancers in dairy products, soy sauce, and savory dishes. The dietary supplement sector also utilizes glutamic acid, particularly in the form of hydrolyzed vegetable protein, for its health benefits. Microbial fermentation and green chemistry are key production methods, while quality control and assurance remain crucial for ensuring product safety and consistency. The circular economy is gaining traction, with an increasing focus on sustainable supply chain practices and bio-based chemicals.

- Moreover, the market's dynamism extends to research and development in areas such as enzyme technology, personal care, animal nutrition, and pharmaceutical-grade applications. These advancements continue to unfold, shaping the market's evolving patterns and driving cost reduction and innovation. Glutamic acid's versatility spans various industries, from food processing and animal feed to bio-based chemicals and pharmaceuticals. As consumer awareness grows, the demand for high-quality, sustainable, and natural ingredients is fueling the market's continuous growth and transformation.

How is this Glutamic Acid Industry segmented?

The glutamic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Plant-based

- Animal-based

- End-user

- Food and beverages

- Pharmaceuticals

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Source Insights

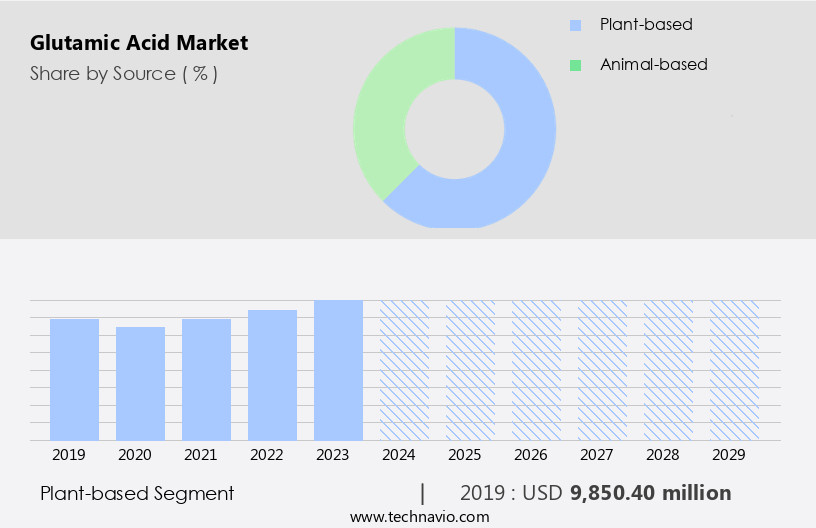

The plant-based segment is estimated to witness significant growth during the forecast period.

Glutamic acid, an essential amino acid naturally found in various foods, is produced through microbial fermentation, primarily from soy and wheat. Consumers prefer plant-based sources of this ingredient, leading to the growth of the market for non-allergic, non-animal-derived glutamic acid products. Dairy alternatives, such as soy sauce, hydrolyzed vegetable protein, and monosodium glutamate (MSG), are popular choices. The rise in consumer awareness and demand for clean-label products has fueled research and development in bio-based chemicals and enzyme technology for producing food additives. In the industrial sector, glutamic acid is used extensively in food processing, animal nutrition, and pharmaceutical applications. Cost reduction through efficient supply chain management and quality control measures is a key trend.

The circular economy approach is gaining traction, with companies focusing on recycling and reusing by-products from the production process. Beyond food and industrial applications, glutamic acid is used in personal care products and bio-based chemicals. Health benefits associated with glutamic acid, such as improved brain function and muscle development, make it a popular ingredient in dietary supplements. The market for these supplements is expected to grow as consumers seek natural alternatives for enhancing their health and wellness. Quality assurance and green chemistry principles are essential in the production and application of glutamic acid. Yeast extract, a rich source of glutamic acid, is produced through sustainable fermentation processes.

As the market evolves, biotechnology applications and animal feed industries are also expected to adopt glutamic acid as a key ingredient.

The Plant-based segment was valued at USD 9.85 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

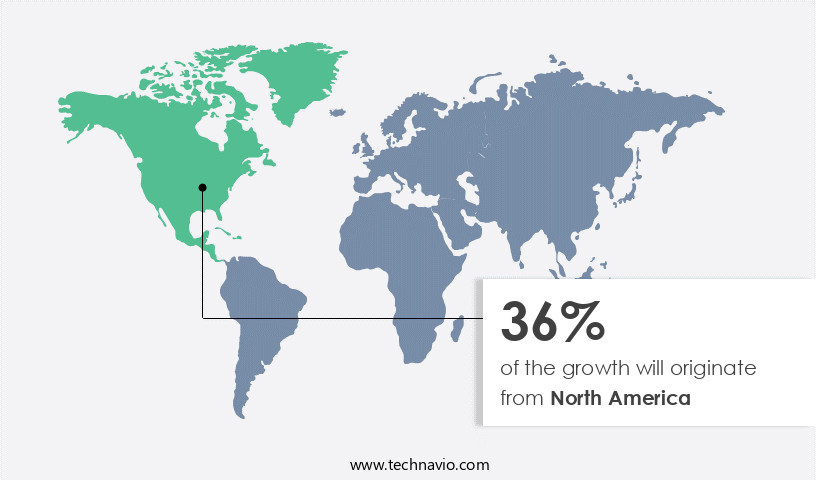

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing growth due to shifting consumer preferences towards natural and organic food options, particularly in the dairy and infant food sectors. Parents are increasingly concerned about food safety and are opting for plant-based protein sources in infant formulas, driving the demand for glutamic acid as a natural flavor enhancer and nutrient. Additionally, the rise of the organic baby food industry is contributing to market growth, as consumers prioritize health and safety. In the animal feed industry, the use of glutamic acid as an additive is also gaining traction, further fueling market expansion. Research and development in bio-based chemicals, enzyme technology, and green chemistry are also key trends, as companies seek to reduce costs and improve product quality through sustainable processes.

The circular economy is a growing focus, with a renewed emphasis on ingredient sourcing and supply chain transparency. In the personal care sector, glutamic acid is used as a preservative and pH adjuster, while in the pharmaceutical industry, it is used in the production of monosodium glutamate and hydrolyzed vegetable protein. The market is further propelled by advancements in food processing technology and the growing awareness of the health benefits of amino acids. Animal nutrition and biotechnology applications are also emerging areas of interest. Overall, the market in North America is poised for continued growth, driven by consumer preferences, research and development, and the evolving needs of various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Glutamic Acid Industry?

- The market is propelled forward by the increasing demand for its utilization in sports supplements.

- Glutamic acid, a non-essential amino acid, plays a crucial role in food processing and animal feed as it is a significant component of proteins, which are essential for muscle growth. Proteins, including those rich in branched-chain amino acids (BCAAs), such as leucine, isoleucine, and valine, are vital for athletes to support their energy needs and muscle recovery. These amino acids cannot be produced by the body and must be obtained through diet. Consumers are increasingly aware of the health benefits of glutamic acid, leading to a growing demand for its use as an ingredient in various applications.

- Moreover, the biotechnology industry has identified numerous applications for glutamic acid, including its use as a flavor enhancer, a nutritional supplement, and a functional ingredient in food and beverages. The health benefits of glutamic acid are numerous, including faster recovery from fatigue, improved endurance, increased mental focus, enhanced performance, greater fat burn, and reduced muscle soreness. Additionally, it has been shown to be effective in managing metabolic syndromes. In conclusion, the demand for glutamic acid is driven by its role in food processing, its use as an essential nutrient for athletes, and its numerous health benefits.

- As consumer awareness of these benefits continues to grow, the market for glutamic acid is expected to expand significantly.

What are the market trends shaping the Glutamic Acid Industry?

- The use of glutamic acid as an animal feed additive is gaining increasing popularity in the market. This trend reflects the growing recognition of its benefits for animal nutrition and productivity.

- Glutamic acid is a crucial feed additive in the global animal husbandry industry. This essential amino acid plays a significant role in the growth and development of livestock by contributing to various biochemical and metabolic processes. Glutamic acid is an integral component of muscles and tissues, making it essential for animal health and productivity. Feed additives, including glutamic acid, are incorporated into livestock feed to address nutritional requirements for optimal growth. The global animal feed market is driven by consumer preferences for high-quality dairy products and meat, necessitating the use of effective feed additives like glutamic acid.

- Research and development in bio-based chemicals and food additives continue to fuel innovation in the animal feed industry. Glutamic acid, as a feed additive, offers numerous benefits, such as antioxidative responses, improved fuel metabolism and digestion, cell signaling, fertility management, neurotransmission support, gene expression regulation, and immune response enhancement. The circular economy concept is gaining traction in the animal feed industry, with a focus on reducing waste and maximizing resource efficiency. Glutamic acid, derived from renewable sources, aligns with this approach, making it an attractive option for sustainable animal feed production. Quality control is paramount in the production and distribution of glutamic acid feed additives to ensure the highest standards of animal health and food safety.

- The global market for glutamic acid feed additives is expected to grow steadily due to the increasing demand for high-quality animal products and the ongoing research and development in the animal feed industry.

What challenges does the Glutamic Acid Industry face during its growth?

- The industry's growth is significantly impacted by the rising costs of raw materials, presenting a major challenge.

- Glutamic acid is an essential amino acid used extensively in various industries, including dietary supplements and personal care. The global supply chain for glutamic acid primarily relies on microbial fermentation, which involves the use of microorganisms to produce the compound. However, the rising cost of raw materials, including essential oils, plant extracts, chemicals, syrups, and vitamins, is a significant challenge for manufacturers. These raw materials are required for the extraction of glutamic acid from natural sources such as seeds, bark, and leaves. Stringent regulations for wastewater treatment and waste biomaterials further add to the production costs. The increasing global population and the resulting demand for food have put immense pressure on the industry to procure raw materials efficiently.

- In response, there is a growing emphasis on green chemistry and sustainable production methods to reduce the environmental impact and lower costs. Quality assurance is another critical factor in the market, with manufacturers focusing on ensuring the highest standards of purity and consistency. Yeast extract and monosodium glutamate (MSG) are common forms of glutamic acid used in the food industry, and their production processes must adhere to stringent quality control measures. Overall, The market faces significant challenges in raw material procurement and production costs, but the demand for this versatile compound continues to grow, particularly in the dietary supplements and personal care industries.

Exclusive Customer Landscape

The glutamic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the glutamic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, glutamic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co. Inc. - Glutamic acid, a versatile amino acid, holds significant importance in various industries, including cosmetics. Ajinomoto's glutamic acid, a leading choice, is extensively utilized in the production of skin care, makeup, and hair care products. This essential component enhances product performance, contributing to improved texture, increased moisture retention, and overall effectiveness. The use of Ajinomoto's glutamic acid ensures consumers receive high-quality, effective cosmetic solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co. Inc.

- Amino GmbH

- Anhui Keynovo Biotech Co. Ltd.

- Evonik Industries AG

- Fufeng Group

- Global Bio chem Technology Group Co. Ltd.

- Hefei TNJ Chemical Industry Co. Ltd.

- Iris Biotech GmbH

- Kyowa Hakko Bio Co. Ltd.

- Lanxess AG

- Medinex Group

- Ningxia Eppen Biotech Co. Ltd.

- Otto Chemie Pvt. Ltd.

- Sekisui Medical Co. Ltd.

- ShanDong look chemical Co. Ltd.

- Sichuan Tongsheng Amino acid Co. Ltd

- Suzhou Yuanfang Chemical Co. Ltd.

- Tocris Bioscience

- Tokyo Chemical Industry Co. Ltd.

- Wuhan Amino Acid Bio Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Glutamic Acid Market

- In January 2024, DuPont Nutrition & Biosciences, a leading global producer of food ingredients, announced the expansion of its glutamic acid production capacity by 30% at its manufacturing site in Tessenderlo, Belgium. This expansion aimed to cater to the increasing demand for glutamic acid in the food and beverage industry (DuPont Press Release, 2024).

- In March 2025, Ajinomoto Co. Inc., a leading player in The market, entered into a strategic partnership with Bio-Techne Corporation to expand its presence in the life science research market. Under this collaboration, Ajinomoto would supply Bio-Techne with its L-Glutamic Acid for use in various research applications (Ajinomoto Press Release, 2025).

- In July 2024, Corbion, a global market leader in biobased food ingredients, completed the acquisition of Veramaris, a joint venture between DSM and Evonik, which specialized in producing omega-3 fatty acids from algae. This acquisition expanded Corbion's portfolio to include glutamic acid derived from renewable sources, aligning with the growing trend towards sustainable food ingredients (Corbion Press Release, 2024).

- In October 2025, the European Food Safety Authority (EFSA) reaffirmed the safety of glutamic acid as a food additive, following a comprehensive review of its toxicological data. This approval further strengthened the market position of glutamic acid as a safe and widely used food ingredient (EFSA Press Release, 2025).

Research Analyst Overview

Glutamic acid, an essential amino acid, plays a crucial role in various industries, including food, pharmaceuticals, and agriculture. The market for glutamic acid is dynamic, driven by ongoing research and development in its production, purification, and applications. Glutamic acid testing is critical to ensure product quality and safety, with hydrolysis techniques used for analysis. Challenges in glutamic acid standards and regulations necessitate continuous innovation in synthesis methods, such as biosynthesis using glutamate synthase and glutamic acid dehydrogenase. Controversies surrounding glutamic acid safety and risks have led to stricter regulations on its packaging, storage, and handling. Opportunities exist in the development of sustainable production methods, such as fermentation and crystallization, to meet growing demand.

Glutamic acid's impact on the food industry is significant, with applications ranging from flavor enhancement to functional food ingredients. Regulations on glutamic acid production and metabolism are stringent, requiring adherence to quality standards and rigorous testing. Innovations in glutamic acid purification and analysis technologies enable manufacturers to meet these requirements while minimizing production costs. Despite these challenges, the market for glutamic acid remains robust, with ongoing research and development driving new applications and opportunities.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Glutamic Acid Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.1% |

|

Market growth 2025-2029 |

USD 7840.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

US, Canada, China, Japan, India, Germany, South Korea, UK, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Glutamic Acid Market Research and Growth Report?

- CAGR of the Glutamic Acid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the glutamic acid market growth of industry companies

We can help! Our analysts can customize this glutamic acid market research report to meet your requirements.