Gluten-Free Pasta Market Size 2024-2028

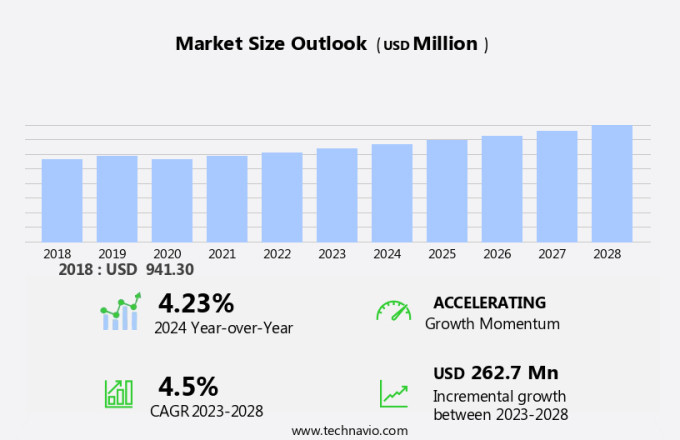

The gluten-free pasta market size is forecast to increase by USD 262.7 million at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to increasing health consciousness and the rising number of celiac disease patients. Western cuisine, particularly Italian, is adapting to this trend by offering gluten-free options such as multigrain, fiber-rich pasta varieties. Distribution channels, including restaurants, deli counters, and e-commerce platforms, are expanding their offerings to cater to this gluten-free food product demand. Convenience is also a driving factor, as fresh pasta, ravioli, tortelloni, and cappelletti are increasingly being sold in pre-cooked and ready-to-cook formats. Despite the growing demand, the high price point remains a challenge for some consumers. Organic gluten-free pasta, in particular, commands a premium price due to the additional costs associated with its production.

What will the size of the market be during the forecast period?

The market has gained significant traction in recent years due to the increasing awareness and adoption of healthy food products. This market caters to individuals with gluten intolerance, a condition that restricts the consumption of grains containing gluten, such as wheat, rye, and barley. Gluten-free pasta is prepared from various sources, including corn, chickpeas, lentils, grains, and a range of alternative grains like brown rice, quinoa, amaranth, and buckwheat. These grains offer various nutritional benefits, including a good source of protein, fiber, and essential amino acids. Consumption patterns of gluten-free pasta have been on the rise due to the health benefits associated with it. Gluten intolerance can lead to conditions like anemia, headaches, and constipation. By opting for gluten-free pasta, consumers can enjoy their favorite dishes while managing their health conditions. Fresh pasta varieties like ravioli, tortelloni, and cappelletti are also available in gluten-free options. These pasta types are often filled with plant-based ingredients, adding to their nutritional value. However, processed gluten-free pasta is also popular due to its long shelf life and ease of preparation.

Further, the protein content in gluten-free pasta varies depending on the source. For instance, chickpea pasta is a high-protein option, while rice pasta has a lower protein content. Consumers looking for protein-rich gluten-free pasta can opt for quinoa or lentil pasta. The market also intersects with the plant-based cheese industry. Plant-based cheese alternatives can be used to enhance the taste and texture of gluten-free pasta dishes. These alternatives offer a lactose-free and vegan option for consumers. In conclusion, the market presents a promising opportunity for businesses catering to health-conscious consumers and those with gluten intolerance. The market offers a diverse range of products, from fresh pasta varieties to processed options, catering to various dietary needs and preferences. The nutritional benefits associated with gluten-free pasta, including protein, fiber, and essential amino acids, make it a popular choice for consumers seeking healthy alternatives to traditional pasta.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- France

- Italy

- North America

- US

- APAC

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

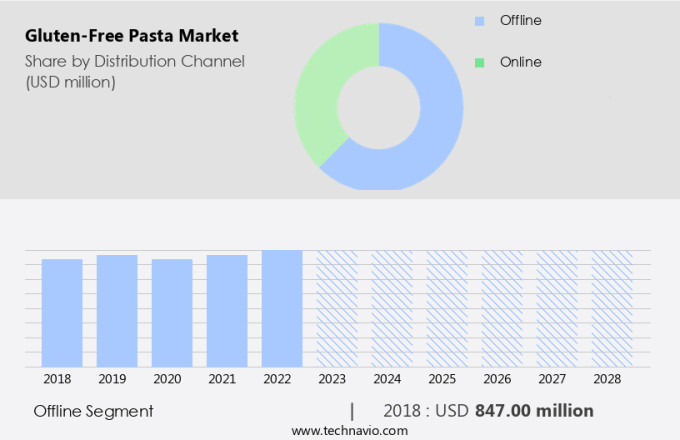

The offline segment is estimated to witness significant growth during the forecast period. The market caters to consumers with celiac disease and those following a gluten-free diet for health reasons. This market segment includes various types of pasta, such as multigrain, fresh pasta, ravioli, tortelloni, and cappelletti. Health benefits, including increased fiber intake and improved digestion, are driving the demand for gluten-free pasta in the US. Western cuisine heavily relies on pasta dishes, making the US a significant market for gluten-free pasta. Major retailers, including Walmart and Target, have dedicated sections for gluten-free food products. These retailers employ marketing strategies like branding and promotional discounts to attract customers. The offline distribution channels consist of departmental stores, supermarkets, hypermarkets, convenience stores, and restaurants.

Tesco, Walmart, and Target are some of the leading retailers that stock gluten-free pasta. companies in the market prioritize factors like geographical presence, ease of production, and inventory management for their retail operations. E-commerce platforms, such as Amazon and Thrive Market, are increasingly popular distribution channels for gluten-free pasta. Consumers appreciate the convenience of shopping online and having their orders delivered to their doorstep. As the demand for gluten-free pasta continues to grow, companies are exploring new distribution channels to expand their reach.

Get a glance at the market share of various segments Request Free Sample

The Offline segment accounted for USD 847.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Gluten-free pasta has gained significant popularity in Europe, with consumers adhering to this diet even in the absence of medical necessities. Italy, France, the UK, and Germany are the major contributors to the European market. The Italian government provides vouchers worth 140 euros monthly to celiac patients to purchase gluten-free food. Furthermore, over 4000 gluten-free restaurants in Italy, recognized by the Italian Celiac Association, cater to the growing demand.

Additionally, the rising export of Italian pasta is expected to fuel the market growth. Gluten-free alternatives to wheat-based pasta, such as those made from baked goods like Rye, Buckwheat, Amaranth, Rice, and Quinoa, are preferred by individuals suffering from anemia, headaches, constipation, gas, fatigue, and diarrhea caused by gluten intolerance. These alternatives provide essential nutrients and proteins, making them a healthier choice for those following a gluten-free diet.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing awareness about the health benefits of gluten-free food is the key driver of the market. Gluten, a protein found in wheat and its derivatives, is commonly used in baking due to its ability to provide a desirable texture. However, for individuals with celiac disease, the consumption of gluten can lead to serious health issues, including intestinal damage and digestive system disturbances. This condition necessitates a gluten-free diet. The benefits of such a diet extend beyond just managing celiac disease. Gluten-free foods contribute to improved cholesterol levels, enhanced digestion, and a reduction in intestinal inflammation. Moreover, children with autism often exhibit sensitivity to certain peptides and proteins found in gluten and casein-containing foods. Eliminating gluten from their diet can help alleviate associated reactions.

Market Trends

Growing demand for organic gluten-free pasta is the upcoming trend in the market. Gluten-free pasta, derived from grains such as corn, chickpeas, lentils, and brown rice, is gaining popularity among health-conscious consumers in the US. The preference for these pasta varieties stems from their nutritional benefits, which include providing essential amino acids and fiber. Consumption patterns indicate a growing trend towards healthy food products, particularly among those with celiac disease or genes linked to wheat sensitivity. The demand for organic gluten-free pasta is expected to continue growing, as consumers prioritize health and wellness. Several market companies cater to this demand by offering a range of organic gluten-free pasta products, made from various grains and legumes. These offerings provide consumers with a diverse selection of options to meet their dietary needs and preferences.

Market Challenge

The high price of gluten-free pasta is a key challenge affecting the market growth. The market in the United States is still in its developmental stages and holds a smaller market share compared to traditional pasta products. The production of gluten-free pasta involves intricacies, leading to increased costs. Instead of wheat, corn, rice, and potato flour and starch are utilized as primary ingredients. These alternatives are more expensive, contributing to the higher production costs. Additional expenses incurred during the manufacturing process include certifications, specialized transportation to prevent cross-contamination, and exclusive supply chains. Gluten-free pasta is available in various forms, including legume-based, konjac-based, vegetable-based, cassava-based, and quinoa or chickpea pasta. As awareness and demand for gluten-free food options continue to grow, the market for gluten-free pasta is expected to expand.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Barilla G. e R. Fratelli Spa: The company offers gluten-free pasta such as Rotini, Penne, and elbow pasta.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Doves Farm Foods Ltd.

- Dr. Schar AG Spa

- Ebro foods SA

- Jovial Foods Inc.

- LIVIVA Foods

- Pedon SpA

- Quinoa Corp.

- The Hain Celestial Group Inc.

- The Kraft Heinz Co.

- Tribe 9 Foods LLC

- Windmill Organics Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Gluten-free pasta has gained significant popularity in the global food industry due to the increasing number of consumers adopting healthy food habits. This market caters to individuals with celiac disease, gluten intolerance, and those following plant-based diets, lactose intolerant individuals, or dairy allergies. The consumption of gluten-free pasta is driven by the nutritional benefits it offers, such as high fiber content, rich minerals like calcium, iron, and magnesium, and amino acids. Grains like brown rice, quinoa, and multigrain, as well as legumes such as chickpeas, lentils, and beans, form the base for gluten-free pasta. These ingredients offer various health benefits, including improved digestion, energy levels, and skin health. The market also includes pasta made from alternative grains like amaranth, buckwheat, and rice, and plant-based alternatives like konjac-based vegetable, and cassava-based pasta.

Further, the distribution channels for gluten-free pasta include residential and commercial sales, with convenience being a significant factor in its popularity. E-commerce and brick-and-mortar stores cater to the demand, with fresh pasta, ravioli, tortelloni, cappelletti, and various shapes available. The market is also influenced by the growing trend of plant-based diets, with flexitarians and vegans being key consumers. Chefs in restaurants and deli counters are increasingly incorporating gluten-free pasta into their menus to cater to diverse consumer needs. However, it's important to note that some processed gluten-free pasta may contain additives, so consumers should read labels carefully. Overall, the market is expected to continue growing as consumers seek healthier alternatives to traditional wheat-based pasta.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 262.7 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 34% |

|

Key countries |

US, Italy, Switzerland, France, and Greece |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Barilla G. e R. Fratelli Spa, Doves Farm Foods Ltd., Dr. Schar AG Spa, Ebro foods SA, Jovial Foods Inc., LIVIVA Foods, Pedon SpA, Quinoa Corp., The Hain Celestial Group Inc., The Kraft Heinz Co., Tribe 9 Foods LLC, and Windmill Organics Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch