Greece Life and Non Life Insurance Market Size 2024-2028

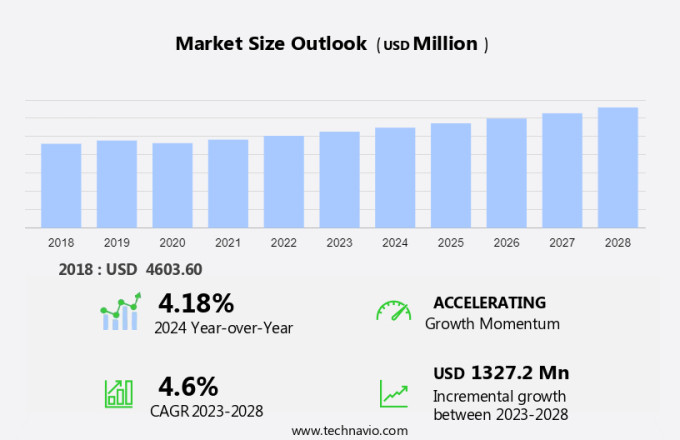

The life and non life insurance market in Greece size is forecast to increase by USD 1.33 billion at a CAGR of 4.6% between 2023 and 2028. The market is driven by the digitalization of the insurance industry, with Insurance enterprises integrating IT and analytic solutions to enhance customer experience and streamline operations. The economy and the banking system serve as the main drivers of the market's growth. The integration of digital technology is a significant trend in the market, with insurers like Ethniki and NN Hellenic investing in advanced technologies to improve efficiency and competitiveness. However, data privacy and security concerns pose challenges to the market's growth, as insurers must ensure the protection of sensitive customer information in the digital age. Overall, the Greek insurance market is poised for growth, with digitalization and data security being key areas of focus.

The life insurance market in Greece has witnessed significant growth over the past few years. The market, on the other hand, recorded gross written premium of â¬7.5 billion during the same period. The loss ratio for life insurance stood at 65.5%, while non-life insurance recorded a loss ratio of 72%. The Greek insurance industry is regulated by the Hellenic Financial Stability Fund and industry associations such as Ethniki and NN Hellenic. The economy and banking system play a crucial role in the insurance market's growth. The industry's digital transformation is gaining momentum, with insurers embracing digital insurance to enhance customer experience and streamline operations.

Furthermore, the life insurance industry's major product categories include individual and group life, health, and pension insurance. The penetration rate for life insurance is relatively low at 2.6%, presenting significant growth opportunities. Premium ceded to reinsurers stood at 15% for life insurance and 30% for non-life insurance, with cession rates varying among insurers. Demographics and segment dynamics significantly impact the Greek insurance market. The aging population and increasing awareness of the need for insurance products are driving the growth of the life insurance sector. Competitive advantages include customized solutions, innovative products, and excellent customer service. Data from the National Statistic Offices and the Hellénic Statistical Authority provide valuable insights into the Greek insurance market's trends and developments. The industry's future growth is expected to be driven by a focus on innovation, digitalization, and customer-centricity.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Type

- Life insurance

- Non-life insurance

- Distribution Channel

- Agency

- Direct

- Banks

- Geography

- Greece

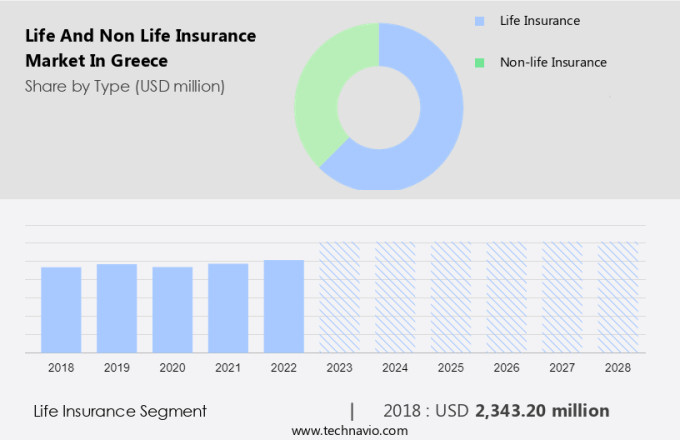

By Type Insights

The Life insurance segment is estimated to witness significant growth during the forecast period.The life insurance industry in Greece has experienced notable growth in the product category of life insurance policies. This trend can be attributed to the growing recognition of the importance of securing financial security for oneself and one's family. Life insurance policies serve as a vital safety net, providing financial assistance to policyholders' dependents in the unfortunate event of the policyholder's demise. The protection offered by life insurance policies extends to covering outstanding debts such as mortgages, financing children's education, and meeting other financial obligations that can place a significant burden on the family. Furthermore, some life insurance policies offer savings or investment components, enabling policyholders to accumulate wealth over time.

Furthermore, the segment dynamics of the life insurance market in Greece are influenced by various demographic factors and competitive advantages of insurers. Premiums ceded and cession rates continue to shape the market landscape, making it an intriguing area for investment and growth.

Get a glance at the market share of various segments Request Free Sample

The Life insurance segment was valued at USD 2.34 billion in 2018 and showed a gradual increase during the forecast period.

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Digitalization of insurance industry is the key driver of the market. The insurance sector in Greece has undergone substantial transformation due to digitalization, leading to enhanced convenience, efficiency, and personalized services for clients. Allianz, AIA, AXA Life Insurance, Garanta, Ethniki Asfalistiki Cyprus, and other prominent insurers have embraced technology to cater to evolving customer needs.

Furthermore, digitalization has revolutionized customer interaction, enabling easier access to and purchase of insurance policies. Insurtech companies are at the forefront of this transformation. These tech-driven entities are innovating with tailored insurance products and services, disrupting traditional distribution channels by selling policies directly to consumers. This shift towards digitalization and the emergence of Insurtech players are set to redefine the Greek insurance market.

Market Trends

Integration of IT and analytic solutions is the upcoming trend in the market. The market in Greece is witnessing significant advancements, with key players integrating IT and analytic solutions to optimize their operations and sales. These analytic tools enable effective marketing strategies and underwriting services, while data analytics facilitates product-design enhancements and customer targeting.

Furthermore, data analytics employs simulation and stochastic techniques to forecast potential market trends, providing valuable insights into customer data and maintaining a competitive edge. By analyzing key performance indicators, market players can assess the current market scenario and adapt their strategies accordingly.

Market Challenge

Data privacy and security concerns is a key challenge affecting the market growth. The Life and Non-Life Insurance market in Greece has witnessed significant advancements in technology, with key players integrating digital solutions to streamline their operations. CVC Capital, NBG, and other insurers have also adopted technology for easier processing of claims and customer service. However, these technological advances come with risks, particularly in terms of data security.

Furthermore, the vulnerability of online and on-device data storage to cyber theft and hacking poses a significant threat to the industry. Any breach in cybersecurity or misuse of data can result in substantial financial losses and damage to an organization's reputation. Despite these challenges, the insurance industry in Greece continues to invest in technology to improve efficiency and customer experience.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Allianz SE: The company offers life and non-life insurance services such as international health, life, and disability insurance, as well as a wide range of health and protection services to private individuals, families, organizations, and partners.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Achmea B.V.

- Allianz SE

- AXA Group

- Fairfax Financial Holdings Ltd.

- Generali Hellas Insurance Co. S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The life insurance industry in Greece has witnessed steady growth in recent years. The industry's loss ratio hovered around 75%, indicating a balanced relationship between premiums and claims. The bottom-up approach to market analysis reveals that insurance consumer spending on life insurance constituted 1.5% of the country's gross domestic product (GDP). Key drivers of the life insurance market in Greece include the economy's recovery, the banking system's role in distribution, and the increasing adoption of digital technology. The insurance consumer base is diverse, with insurers focusing on various lines of business, including endowment, direct marketing, e-commerce, bancassurance, and agencies.

Furthermore, industry associations, such as the Hellenic Insurance Association (ELA), and national statistical offices, like the Hellenic Statistical Authority (ELSTAT), provide valuable data on gross written premiums, gross claim payments, and other relevant market indicators. Demographics also play a significant role, as the aging population increases the demand for life insurance products. Competitive advantages of insurance enterprises include regulatory compliance, competitive pricing, and innovative product offerings. The use of advanced tools like exponential trend smoothing (Holt-Winters method) and data analytics, including artificial intelligence and wearable technology, is transforming the industry landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

108 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market Growth 2024-2028 |

USD 1.32 billion |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.18 |

|

Key companies profiled |

Achmea B.V., Allianz SE, AXA Group, Fairfax Financial Holdings Ltd., and Generali Hellas Insurance Co. S.A. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles,market forecast , fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Greece

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch