Hair Care Appliances Market Size 2025-2029

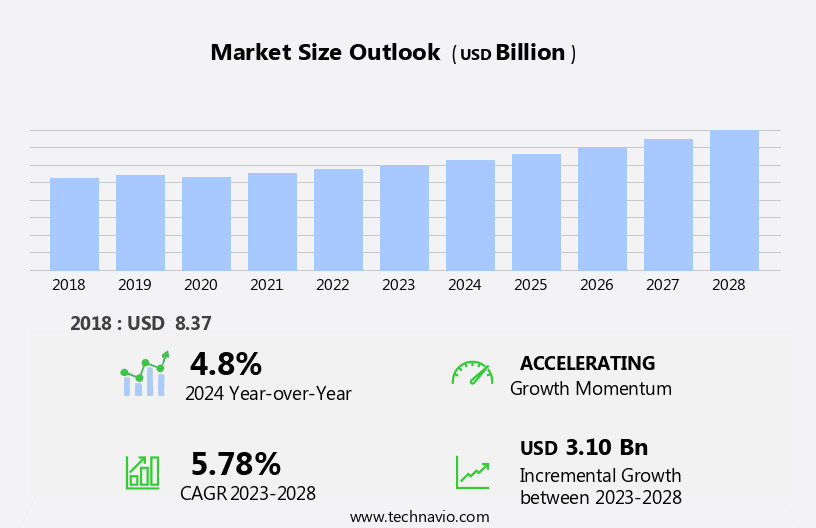

The hair care appliances market size is forecast to increase by USD 3.19 billion, at a CAGR of 5.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by evolving fashion trends in hair styling and the rising preference for at-home styling by consumers. The market is also witnessing the emergence of smart hair dryers, which offer advanced features such as infrared heating, monitoring, and connectivity to mobile apps for customized settings and styling results. These trends reflect the increasing importance of personal appearance and the convenience of using hair care appliances for achieving desired styles in the comfort of one's own home. However, the market faces challenges, including the availability of counterfeit products. This issue poses a threat to both consumers and legitimate market players, as counterfeit appliances can compromise safety and quality, potentially damaging hair and causing health concerns.

- Companies in the market must focus on ensuring product authenticity and consumer education to mitigate this challenge and maintain market trust. Additionally, staying abreast of fashion trends and consumer preferences, as well as investing in research and development, will enable businesses to capitalize on market opportunities and remain competitive in this dynamic and evolving industry. Young working populations are driving demand for advanced hair care tools, such as smart, connected devices, keratin treatments, and ionic technology. Capitalizing on these trends will help in fueling the market growth.

What will be the Size of the Hair Care Appliances Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Anti-static technology, for instance, is gaining traction as consumers seek to minimize flyaways and frizz. Scalp health is another area of focus, with eco-friendly materials and ergonomic designs prioritized for comfort and effectiveness. Tourmaline technology, known for its ability to emit negative ions, is increasingly used in hair straighteners and curling irons for smooth, shiny results. Retail distribution channels are expanding, with online retailers and direct-to-consumer brands gaining popularity. Regulatory requirements and safety standards are also shaping the market, ensuring that hair care appliances are safe and effective.

Hair damage is a persistent concern, leading to the development of heat protection features and temperature control settings. Energy efficiency is another key consideration, with many manufacturers focusing on reducing power consumption. Hair treatments, such as ionic technology and heat damage repair, are complementing hair care routines, offering solutions for various hair types and textures. Hair styling products and techniques continue to influence the market, with hair dryers, hair trimmers, and hair clippers catering to different needs. Rechargeable batteries and cordless operation are becoming standard features, adding to the convenience of hair care appliances. Personalized hair care and customer reviews are also shaping consumer decisions, with brand loyalty a significant factor in purchasing choices. Salon-grade appliances and professional hairdressing continue to influence the market, with hair extensions and hair care services offering additional revenue streams. The ongoing dynamism of the market ensures that innovation and adaptation are essential for success.

How is this Hair Care Appliances Industry segmented?

The hair care appliances industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Dryers

- Straighteners

- Others

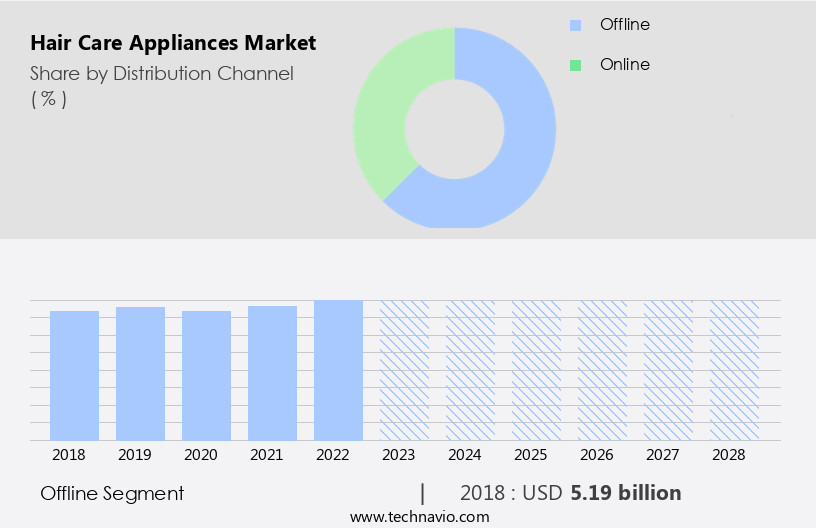

- Distribution Channel

- Offline

- Online

- Gender

- Female

- Male

- Kids

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Product Insights

The dryers segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth, driven by consumer preferences for scalp health, eco-friendly materials, and advanced technologies. Tourmaline technology and ionic technology are popular choices for reducing hair damage during styling. Ergonomic designs and temperature control features cater to user comfort, while energy efficiency and cordless operation address environmental concerns. Retail distribution channels, including direct-to-consumer brands and online retailers, expand market reach. Regulatory requirements and safety standards ensure product quality and consumer safety. Professional hairdressing and salon appointments continue to influence market trends, with salon-grade appliances offering superior performance. Hair types and textures dictate the demand for various hair care tools, such as hair dryers, hair straighteners, curling irons, and hair trimmers.

Heat protection features, heat settings, and anti-static technology are essential considerations for minimizing hair damage and breakage. Hair care routines involve a range of products, including hair styling products and hair treatments, to enhance hair growth and manage hair loss. Rechargeable batteries, product ratings, and customer reviews play a crucial role in brand loyalty and personalized hair care. The market is also witnessing the emergence of AI-powered hair care tools and electric brushes for efficient hair styling and maintenance. Despite the benefits, there are concerns regarding power consumption and potential hair damage from prolonged use of hair styling tools. Ceramic heating elements and heat protection features address these concerns, ensuring a balanced approach to hair care. The market's evolution reflects the ongoing quest for innovative, effective, and sustainable hair care solutions.

The Dryers segment was valued at USD 7.25 billion in 2019 and showed a gradual increase during the forecast period.

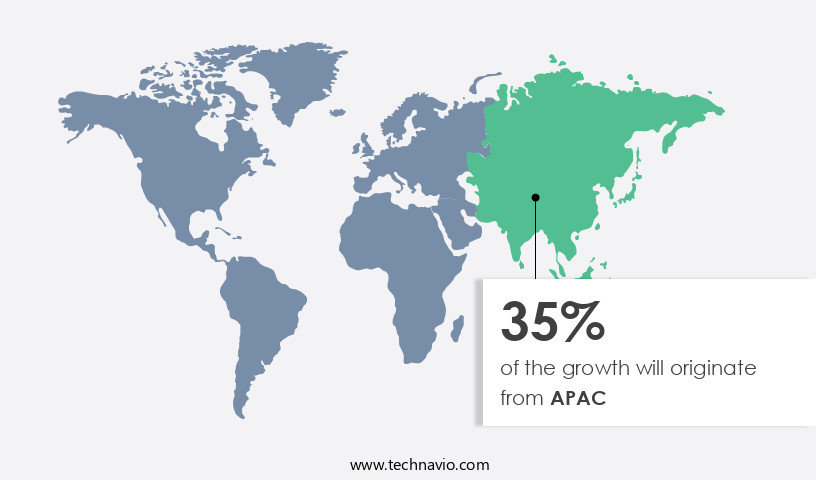

Regional Analysis

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth due to shifting consumer spending habits and rising disposable income. Young working populations are driving demand for advanced hair care solutions, making this region a prime market for beauty product manufacturers. Advanced technologies, such as anti-static, tourmaline, and ionic, are being integrated into hair care appliances to address scalp health and hair damage concerns. Wet hair styling appliances, such as wet-to-dry straighteners and curlers, are also on the rise, allowing users to achieve various hairstyles without the need for chemical treatments. Eco-friendly materials and energy efficiency are also becoming essential features in these appliances. Retail distribution channels, including both brick-and-mortar stores and online retailers, are expanding their offerings to cater to the increasing demand.

Hair salons and spas are key distribution channels for these products, providing professional services and retailing various hair styling equipment and care products. Regulatory requirements and safety standards are also being prioritized, ensuring consumers have access to high-quality, safe products. Hair styling tools, such as hair straighteners, curling irons, and hair trimmers, are popular choices for consumers. Heat protection features, temperature control, and cordless operation are essential considerations for these appliances. Hair dryers, hair styling products, and hair care routine essentials, such as hair clippers and electric brushes, are also in demand. The market for hair extensions, hair treatments, and hair care services is also growing, with increasing awareness about hair growth, hair loss, and hair textures.

Rechargeable batteries and lightweight construction are important factors for consumers when choosing hair care appliances. Brands are focusing on customer reviews, brand loyalty, and product ratings to differentiate themselves in a competitive market. Professional hairdressing and salon appointments continue to be popular choices for consumers seeking expert advice and high-quality hair care services. Incorporating ergonomic design and heat settings into hair care appliances is essential to cater to the diverse needs of consumers. Overall, the market in the Asia Pacific region is expected to continue growing, driven by increasing consumer awareness, disposable income, and technological advancements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hair Care Appliances Industry?

- Fashion industry innovations and hair style trends are the main drivers, significantly influencing the market's growth. Hair care appliances have gained significant popularity in the market due to the influence of fashion trends on consumer preferences. The ever-evolving hairstyles for various occasions, such as daily looks, parties, weddings, and festivals, drive the demand for advanced hair styling tools. These appliances cater to diverse hair textures and types, including thin and thick hair, vintage styles, and celebrity-inspired looks. Professional hairdressers and salon-grade appliances play a pivotal role in setting industry standards. Features like cordless operation, temperature control, lightweight construction, and safety standards are essential for both professionals and consumers.

- Millennials, as a key customer segment, contribute significantly to the sales of hair care appliances. Their fashion consciousness and personal grooming trends have created a growing market for these products. With the increasing demand for professional-grade hair styling tools, manufacturers focus on developing innovative and high-quality appliances to cater to the diverse needs of consumers.

What are the market trends shaping the Hair Care Appliances Industry?

- Consumers are increasingly favoring at-home styling as the latest market trend. This preference marks a significant shift towards convenient and personalized fashion solutions. The market is experiencing significant growth due to the increasing preference for at-home styling among consumers. This trend is driven by several factors, including the desire for convenience, flexibility, and cost-effectiveness. With busy lifestyles and hectic schedules, individuals find it more practical to invest in hair care appliances that offer salon-quality results at home. This shift away from frequent salon visits not only saves time but also reduces long-term expenses associated with professional styling services. Moreover, the rise of social media platforms has democratized beauty standards and empowered consumers to experiment with different hairstyles and trends.

- As a result, there is a growing demand for versatile and easy-to-use hair care appliances that cater to various hair types and styles. Advancements in technology have led to the development of innovative features such as anti-static technology, scalp health benefits, eco-friendly materials, tourmaline technology, ergonomic design, and ceramic heating elements. These features not only enhance the performance of hair care appliances but also address common concerns such as hair damage and heat protection. Regulatory requirements and consumer safety concerns are also driving the market towards the adoption of advanced technologies such as ionic technology and ceramic heating elements.

What challenges does the Hair Care Appliances Industry face during its growth?

- The proliferation of counterfeit hair care appliances poses a significant challenge to the industry's growth, as consumers are often drawn to these imitations due to their lower prices, potentially undermining the reputation and sales of authentic products. The market experiences significant growth due to increasing consumer demand for styling tools with advanced features, such as heat protection and adjustable heat settings. Popular appliances include curling irons, hair trimmers, and hair dryers. However, the rise of counterfeit hair care appliances poses a challenge to market players. These counterfeit products, often made with subpar materials, can lead to hair breakage and heat damage. Consumers may find it difficult to distinguish between genuine and counterfeit appliances due to their similar appearances and low prices. This trend negatively impacts the sales and pricing strategies of legitimate companies in the market.

- Energy efficiency is another crucial factor driving market growth, with consumers preferring appliances that minimize power consumption. The integration of AI-powered hair care technology and the increasing popularity of direct-to-consumer brands and online retailers further influence market dynamics. Despite these opportunities, companies must address the issue of counterfeit products to maintain their market position and ensure customer satisfaction.

Exclusive Customer Landscape

The hair care appliances market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hair care appliances market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hair care appliances market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABV Group Inc. - This company specializes in advanced hair care appliances, including the DigitalAIRE, a revolutionary dryer with intelligent temperature control, and the Quick Styling Salon Dryer, designed for efficient blowouts.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABV Group Inc.

- Conair Corp.

- Coty Inc.

- Dyson Group Co.

- Elchim Spa

- Farouk Systems Inc.

- FHI Heat

- Glen Dimplex Group.

- Havells India Ltd.

- JINRI

- John Paul Mitchell Systems

- Koninklijke Philips NV

- Kossof Beauty

- Lange Hair Inc.

- Panasonic Holdings Corp.

- Spectrum Brands Inc.

- Sultra Inc.

- T3 Micro Inc.

- The Cricket Co. LLC

- Vega

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hair Care Appliances Market

- In February 2024, Conair Corporation, a leading player in the market, introduced the Infinitipro by Conair hair straightener with adjustable temperature control and micro-adjustable plates, aiming to cater to the growing demand for customizable hair styling solutions (Conair Corporation Press Release).

- In May 2024, Philips and Dyson announced a strategic partnership to develop and commercialize innovative hair care appliances, combining Philips' technology expertise and Dyson's engineering capabilities. This collaboration is expected to result in advanced hair care solutions, further intensifying the competition in the market (BusinessWire).

- In October 2024, Remington Products, Inc. completed the acquisition of the Sunbeam Corporation's personal care business, including the Sunbeam, Oster, and BaByliss brands. This strategic move strengthened Remington's position in the market, expanding its product portfolio and market reach (BusinessWire).

- In January 2025, the European Union approved new regulations for energy efficiency labels for hair dryers, requiring manufacturers to display energy labels based on the appliance's energy consumption during use and standby mode. This initiative aims to encourage consumers to make more informed purchasing decisions and reduce energy consumption in the market (European Commission Press Release).

Research Analyst Overview

- The hair care industry continues to evolve, with innovation driving market growth in various areas. Safety features, such as automatic shut-off mechanisms, are increasingly prioritized in hair styling appliances to address consumer concerns. Hair styling trends, from blow-drying to hair straightening and curling, shape the demand for diverse product offerings. A robust distribution network ensures these appliances reach consumers efficiently. Brand positioning and intellectual property protection are crucial in a competitive market. Manufacturers employ various strategies, including patent protection and content marketing, to differentiate their offerings. Price sensitivity remains a key factor, with e-commerce platforms and influencer marketing enabling wider reach and affordability.

- Supply chain management, from raw material sourcing to after-sales support, plays a significant role in maintaining customer satisfaction. Heat distribution technology and user interface design are critical aspects of product development, focusing on both performance and ease of use. Customer acquisition and retention strategies, such as excellent customer service and repair and maintenance services, help build brand loyalty. The lifespan of hair care appliances, from clipper blades to curling iron barrels, influences purchasing decisions and repeat business. Innovations in manufacturing processes, like the use of advanced materials and energy-efficient technology, contribute to the industry's ongoing development.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hair Care Appliances Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2025-2029 |

USD 3.19 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, China, Germany, Japan, UK, Canada, Brazil, India, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hair Care Appliances Market Research and Growth Report?

- CAGR of the Hair Care Appliances industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hair care appliances market growth of industry companies

We can help! Our analysts can customize this hair care appliances market research report to meet your requirements.