Hair Styling Products Market Size 2024-2028

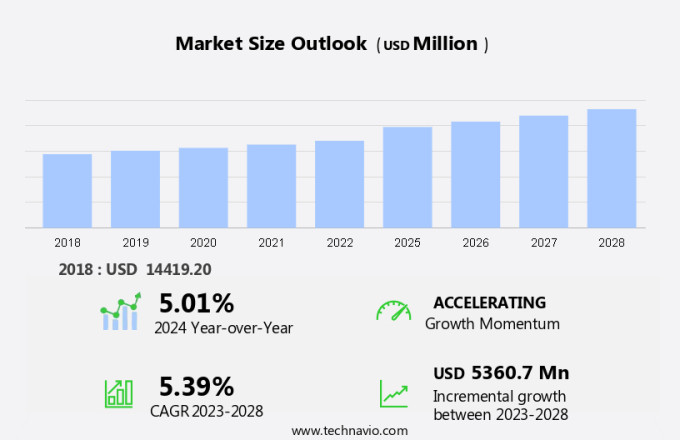

The hair styling products market size is forecast to increase by USD 5.36 billion at a CAGR of 5.39% between 2023 and 2028. The market is witnessing significant growth due to various trends and factors. Innovation and portfolio extension are key drivers, leading to product premiumization and the introduction of advanced hair care solutions, such as hair rejuvenation serums and hair colourant products. The increasing demand for natural and organic hair care products, fueled by consumer preferences for skin care and overall wellness, is another major trend.

However, the market also faces challenges, including the availability of counterfeit products and the growing competition from other personal care categories, such as skincare, makeup, fragrance, and even gym memberships. Men's hair care is also gaining traction, with a focus on desired hair aesthetics and advanced dermatology solutions. The annual expenditure on hair-related products is expected to continue rising, making the market an attractive investment opportunity for manufacturers and suppliers. Consumers are increasingly seeking natural curls and healthy hair, leading to the popularity of hair serums and other hair care innovations.

The market is witnessing a significant shift towards natural and plant-based ingredients. Consumers are increasingly seeking out hair styling products with bulldog skincare-inspired natural hero ingredients such as argan oil, shea butter, and Mediterranean sea salt. These ingredients offer various benefits, including adding volume and thickness to thin hair, enhancing natural curls, and providing frizz control. Hair Product offerings in the market include pomades, creams, sprays, gels, hair oils, hair styling clips, powders, collagen mousse, and hair serums. The trend towards premiumization is evident in the market, with an increasing number of consumers opting for high-end hair styling products. Sulfate-free shampoos and anti-frizz conditioners are popular choices for those with frizzy hair.

Moreover, the market also caters to gym-goers with dry shampoo and hair crème. E-commerce platforms have made it easier for consumers to access these products, with many offering vegan certification and post-consumer recycled, plant-based plastic packaging. The use of natural ingredients and sustainable packaging is a key trend in the market.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- HCGP

- Hair styling spray

- Dry shampoo

- Distribution Channel

- Offline

- Online

- Geography

- Europe

- Germany

- North America

- US

- APAC

- China

- Japan

- South America

- Brazil

- Middle East and Africa

- Europe

By Type Insights

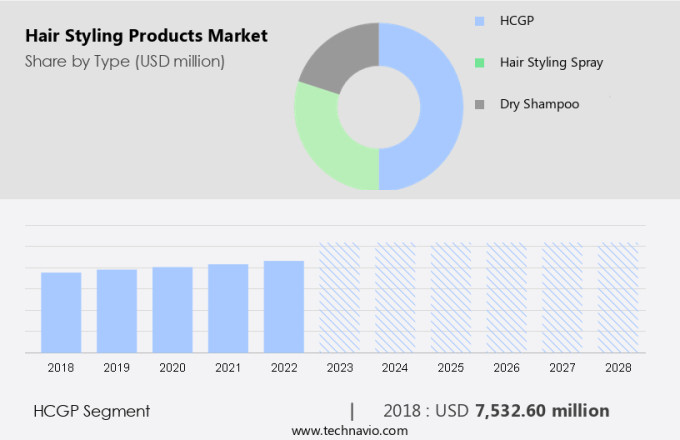

The HCGP segment is estimated to witness significant growth during the forecast period. The market encompasses hair cream, gel, pomade, paste, and heat protectants. This segment is projected to expand significantly during the forecast period, driven by heightened consumer interest in new hairstyles and the increasing demand for hair styling and grooming products among men. Consumers globally are becoming more knowledgeable about the advantages of these hair styling products. For example, hair creams not only help style and manage hair but also keep it healthy, protect from UV rays and pollution, and add shine. Additionally, they can strengthen hair, keep it intact, and reduce hair fall. Natural ingredients, such as essential oils and Murumuru butter, are gaining popularity in these products.

Brands like Oribe Hair Products offer rough-luxe texture and volume with their creams. Heat protectant mists, like Heat Cheat, are another essential product, shielding hair from damage caused by heat styling tools.

Get a glance at the market share of various segments Request Free Sample

The HCGP segment was valued at USD 7.53 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

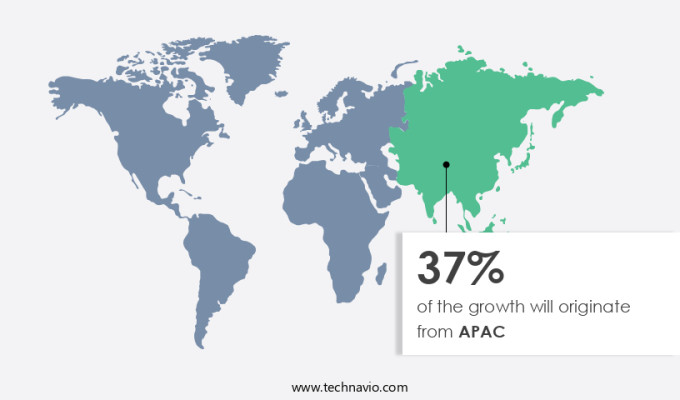

APAC is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European market is experiencing significant growth due to the region's strong consumer interest in new hairstyles and hair colors. Western Europe, known for its fashion-forward trends, is a major hub for luxury hair care brands. Despite a saturated market, the demand for hair styling products continues to rise, driven by innovative product offerings and celebrity endorsements. Europe is also home to a thriving spa industry, with countries like Germany, France, the UK, and Italy leading the way in spa services and treatments. Consumers are increasingly seeking out hair styling products with natural ingredients, such as essential oils and murumuru butter, and active ingredients for focused hair types.

Moreover, heat-protectant mists and creams, like those from Oribe Hair Products, are popular choices for achieving rough-luxe texture and volume. Overall, the European the market is expected to continue its growth trajectory, catering to the diverse needs and preferences of consumers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Innovation and portfolio extension leading to product premiumization is the key driver of the market. The market is witnessing significant growth due to the increasing demand for plant-based ingredients and natural hero ingredients. Brands like Bulldog SkinCare are leading this trend, offering pomades, creams, sprays, and other hair styling solutions infused with Argan oil, Shea butter, Mediterranean sea salt, and other natural ingredients. Social media influence, particularly among teenagers and millennials, is driving the demand for these products.

Market Trends

Growing demand for natural and organic hair styling products is the upcoming trend in the market. The increasing awareness of the potential negative effects of synthetic hair styling products on both hair and skin has led to a swell in demand for natural and organic alternatives. Synthetic hair styling products, such as pomades, gels, and sprays, can cause various issues including skin irritation, allergies, nerve damage, chemical burns, blisters on the scalp, hair breakage, and even some forms of cancer. In response to these concerns, many consumers are turning to organic hair styling products, which are made using natural and plant-based ingredients like aloe vera, sea salt, charcoal, coconut oil, argan oil, and moringa oil. Brands like Bulldog SkinCare and Natural Hero are leading the charge in this market, offering a range of natural hair styling products that cater to the needs of teenagers and millennials.

Moreover, the social media influence has played a significant role in promoting the use of these products, with influencers and celebrities endorsing natural hair styling products made from natural hero ingredients.

Market Challenge

Availability of counterfeit products is a key challenge affecting the market growth. The market is experiencing significant growth due to increasing consumer preference for plant-based ingredients and natural hero ingredients. Brands like Bulldog SkinCare are leading the charge in this trend, offering hair styling solutions free from harmful chemicals. However, the market also faces challenges from counterfeit hair styling products, which can cause hair damage and health issues. These counterfeits, often made from low-quality raw materials, contain harmful chemicals such as ammonia, peroxide, p-phenylenediamine, diaminobenzene, toluene-2,5-diamine, and resorcinol. These chemicals can lead to skin irritation, allergies, hair dryness, hair fall, and even cancer. Ammonia, commonly found in synthetic hair styling products like pomade and cream, can cause dry, brittle, unhealthy-looking hair and irritation to the nose, throat, respiratory system, eyes, and skin.

However, as social media influence continues to shape consumer behavior, teenagers and millennials are increasingly demanding natural and safe hair styling products. Popular hair styling product categories include Argan oil, Shea butter, Mediterranean sea salt, hair mousse, gels, and sun hair sprays, all of which are available butane-free options.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Unilever PLC - The company offers hair-styling products under its brand Nexxus Curl as its key offerings in the beauty and haircare segment. They offer hair care, skin cleansing, deodorants, skincare, and oral care products, along with other beauty and personal care products.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amorepacific Corp.

- Amway Corp.

- Flora and Curl Ltd.

- Godrej Consumer Products Ltd.

- Henkel AG and Co. KGaA

- Hoyu Co. Ltd.

- Kao Corp.

- LOreal SA

- Mandom Corp.

- NATULIQUE Ltd.

- Olaplex Holdings Inc.

- Oriflame Cosmetics S.A.

- Pai Shau Inc.

- Revlon Inc.

- Shiseido Co. Ltd.

- The Avon Co.

- The Estee Lauder Companies Inc.

- The Procter and Gamble Co

- Wella International Operations Switzerland Sarl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing consumer interest in achieving new hairstyles and desired hair aesthetics. The market caters to various hair types, including straight, curly, wavy, and frizzy, offering a wide range of products such as pomades, creams, sprays, gels, and mousse. Natural hero ingredients like argan oil, shea butter, Mediterranean sea salt, and essential oils are gaining popularity in hair styling products. Social media influence, especially among teenagers and millennials, is driving the demand for hair styling products. Brands are focusing on natural ingredients, plant-based plastic packaging, and vegan certification to cater to the changing consumer preferences.

Moreover, the market includes various types of products like sun hair sprays, heat cheat heat-protectant mists, and volume enhancer sprays. Hair styling tools, such as hair gel, hairspray, and other styling products, are also available in the market. Consumers can purchase these products from supermarkets/hypermarkets, specialist stores, e-commerce platforms, and cosmetics and personal care outlets. The market is witnessing a premiumization trend with luxury branding and upscale packaging. The beauty industry is expanding its offerings to include hair care items, such as sulfate-free shampoo, anti-frizz conditioner, and hair colorant products. Men's hair care is also a growing segment in the market.

The annual expenditure on hair-related products is expected to increase as consumers continue to prioritize holistic wellbeing, skin care, make-up, and men's grooming sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.39% |

|

Market growth 2024-2028 |

USD 5.36 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.01 |

|

Regional analysis |

Europe, North America, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 37% |

|

Key countries |

US, China, Germany, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amorepacific Corp., Amway Corp., Flora and Curl Ltd., Godrej Consumer Products Ltd., Henkel AG and Co. KGaA, Hoyu Co. Ltd., Kao Corp., LOreal SA, Mandom Corp., NATULIQUE Ltd., Olaplex Holdings Inc., Oriflame Cosmetics S.A., Pai Shau Inc., Revlon Inc., Shiseido Co. Ltd., The Avon Co., The Estee Lauder Companies Inc., The Procter and Gamble Co., Unilever PLC, and Wella International Operations Switzerland Sarl |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch