Hair Products Market Size 2024-2028

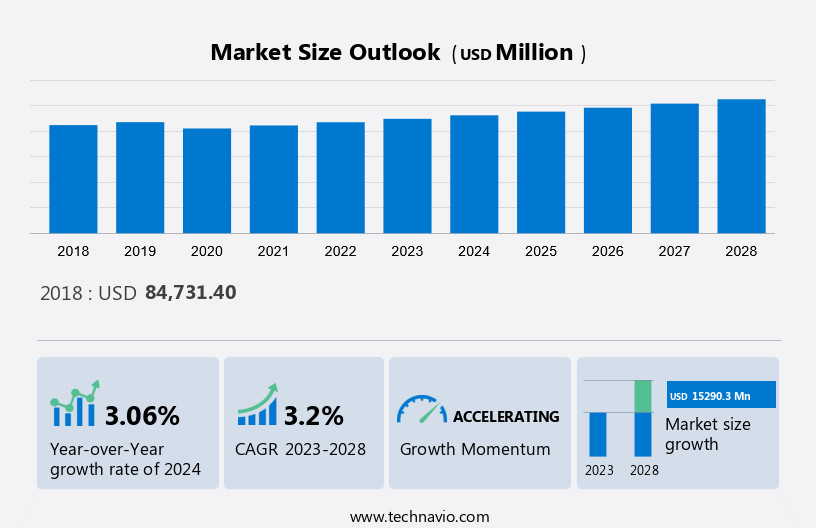

The hair products market size is projected to increase by USD 15.29 billion, at a CAGR of of 3.2% between 2023 and 2028.

What will be the Size of the Hair Products Market During the Forecast Period?

To learn more about this market report, View Report Sample

Hair Products Market Segmentation

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Product Outlook

- Hair products market

- Hair styling products

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

By Distribution Channel

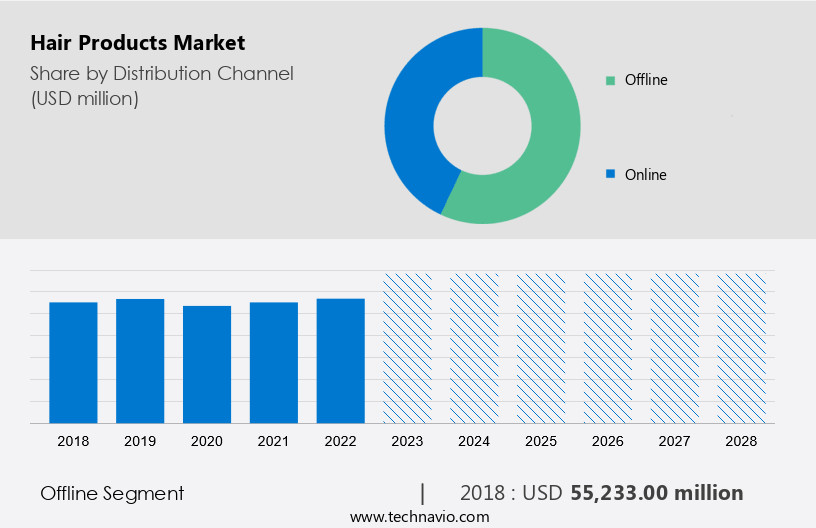

The market share growth by the offline segment will be significant during the forecast period. The rise in business and expansion of business by retailers are increasing the demand. Salons and spas are becoming increasingly popular among consumers with hectic work schedules. These stores offer rejuvenating treatments along with grooming. Men's and women's hair styling and hair care trends fuel the market growth which is expected to continue during the forecast period.

Get a glance at the market contribution of various segments. View PDF Sample

The offline segment was valued at USD 55.23 billion in 2018. Online sales have increased in the last quarter alone. Consumers prefer specialty stores for retail purchases. Professionals prefer to purchase hair products from specialty stores because of the wide range of products available at specialty stores. Companies focus on online-to-offline (O2O) business strategies to drive digital experiences while increasing sales through offline distribution channels. O2O channels offer shoppers a variety of benefits, including in-store pickup of online purchases, online purchases in physical stores, and returns of online purchases in select physical stores. Therefore, sales of hair care and styling products and professional haircare products via offline channels will increase, driving the growth of the market during the forecast period.

Product Analysis

The market has witnessed significant growth, with shampoos, conditioners, and additional products leading the product segment. Shampoos account holds a major share of the market. Natural and organic hair products have witnessed a steady growth rate during the forecast period. Hair serums and oils constitute a significant market share. A recent study on the global hair care market revealed a substantial growth rate, particularly in Japan, Italy, and Spain, among others. Kao Corporation, a key player, has capitalized on the rising demand. Instances of increased usage and availability of innovative hair care solutions have contributed to market expansion. Despite the effects of the pandemic, customers continue to prioritize hair care, leading to sustained growth. Competitors are actively introducing new hair care formulations, including specialized products like hair sprays, to cater to evolving consumer preferences. In addition, hair wigs and extensions are popular hair products that provide versatile styling options and can enhance or change one's appearance quickly.

Regional Analysis

For more insights on the market share of various regions, Download PDF Sample now!

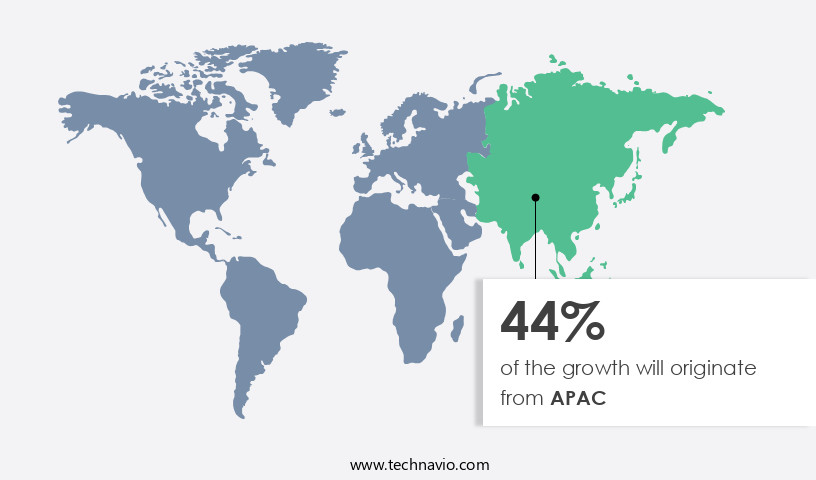

Europe is estimated to contribute 44% to the growth of the market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. UK, France, and Germany are the largest contributors to the market in the European region. The market is expected to grow significantly during the forecast period, owing to intense competition among vendors, especially in Western European countries, owing to the expansion of distribution networks and adoption of multi-channel marketing strategies.

The Asia Pacific region holds the majority share in the market, with a comprehensive market share analysis revealing insights into the diverse cultural preferences influencing the demand for hair conditioners, dyes, and scalp care products. The executive summary, compiled in Jan-21, outlines the dynamic economy shaping this market, emphasizing the significance of product quality in addressing concerns such as hair fall. A thorough examination of the database highlights the importance of understanding regional cultures and preferences, as well as the role of email communication (email ID) in reaching consumers across the globe in this ever-evolving hair care landscape.

Hair Products Market Dynamics

In the realm of hair care and hair styling product, consumers seek effective solutions for various needs, from hair nourishment to styling and treatment. Embracing the trend towards natural and organic products, many opt for perms and relaxants that offer botanical and plant-inspired ingredients. Products like organic hair oils and serums enriched with high-end botanical ingredients cater to those seeking holistic hair care experiences. The market offers a plethora of options, including shampoos, conditioners, and hair styling products and hair care appliances in various forms, such as liquid, gel, and cream, available in convenience stores, pharmacies, and drug stores for added accessibility. However, consumers remain vigilant about the presence of harmful chemicals like parabens and aluminum compounds, preferring nature-inspired alternatives for addressing diverse hair issues while ensuring overall hair health and vitality. Opting for an organic product, such as a conditioner or serum enriched with natural ingredients and soothing aromas, can reduce exposure to active chemicals found in conventional hair colorants.

Key Market Driver

Increasing hair-related issues are notably driving the market growth. Problems such as hair loss, dandruff, split ends, and dry, frizzy, and dull hair are pushing consumers to purchase the market. In today's generation, consumer purchasing decisions are greatly influenced. Healthy hair is essential because it reflects maintaining a youthful appearance that gives you a sense of well-being. Although they do not cause physical discomfort, the psychological impact is great. About 95% of hair loss in men is due to male pattern baldness or generalized male pattern baldness (MPB), and about 50% of all women have been found to start losing hair by age 50.

Further, contrary to popular belief, most men who suffer from MPB are very dissatisfied with their situation and will do anything to change it. Hair loss affects all aspects of a person's life. These factors have increased the market demand that prevents hair loss. At the same time, increasing fashion awareness, growing awareness of the benefits of premium and organic personal care products, increasing urbanization, and a growing population of millennials will boost the growth of the market during the forecast period.

Significant Market Trends

Growing demand for natural and organic hair products is a key market growth and trends. Awareness of hair and skin-related problems caused by artificial products for hair care and hair styling has increased the demand for natural and organic products. Regular use of synthetic hair products can lead to hair and skin problems such as skin irritation, skin allergies, nerve damage, chemical burns and blisters on the scalp, hair loss, and some types of cancer. Organic products are made from natural and organic ingredients such as botanical extracts, natural oils, and other natural ingredients. Other natural ingredients used in organic products include aloe vera, sea salt, charcoal, coconut oil, and argan. Manufacturers of the market are increasingly turning to organic skin care products. Therefore, expanding the product line also helps differentiate their offer.

However, organic hair styling products are free of harmful ingredients such as petrochemicals, sulfates, and ammonia. These organic products meet high purity standards set by various governing bodies in different countries. Therefore, the increasing popularity of natural and organic products is expected to increase the demand and drive the growth of the market during the forecast period.

Major Market Challenges

Regulatory compliances for product composition, labeling, and packaging are challenging the market. There are several regulatory requirements worldwide that hair product manufacturers must comply with. For example, in the United States, the Food and Drug Administration (FDA) regulates chemical ingredients in hair and other personal care products. Products that do not comply with standard regulations will not be approved. The use of chemical ingredients can lead to health risks if not used in proper amounts.

Moreover, government regulations also apply to product labels followed by hair product manufacturers. For example, some may contain parabens, fragrances, and phthalates as ingredients that can be harmful to hair health. All ingredients must be listed on the label and packaging of the product. For product labeling and packaging, the FDA regulates cosmetics, including market, under both the Federal Food, Drug, and Cosmetic Act (FD and C Act) and the Fair Packaging and Labeling Act (FPLA). Manufacturers looking to enter the market must comply with specific labeling and packaging regulations. This makes it difficult for vendors to enter new markets.

Customer Landscape

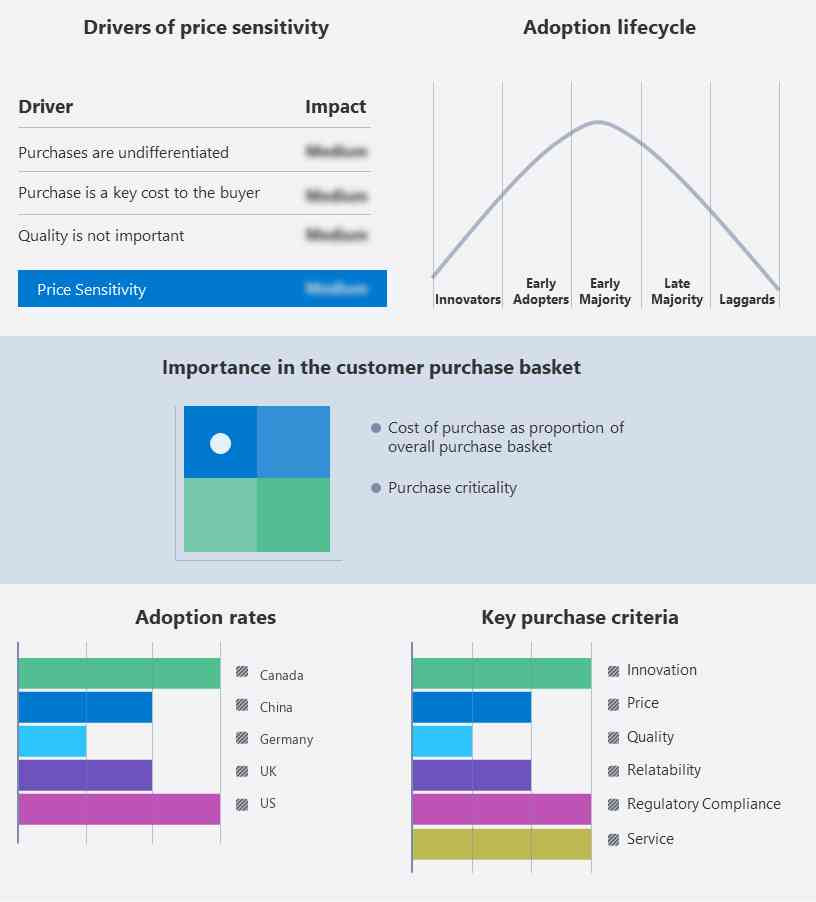

The market exhibits promising growth, as evidenced by thorough market research and growth analysis. Market trends and analysis, coupled with strong forecasting, highlight the industry's trajectory. A comprehensive market analysis and report provide valuable insights into evolving consumer preferences, positioning the market for sustained growth and trends. The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Key Hair Products Market Players

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Colgate Palmolive Co: The company offers hair products such as Palmolive classic apple shampoo, Palmolive classic egg shampoo, and many more.

The market growth and forecasting report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Amway Corp.

- Coty Inc.

- Flora and Curl Ltd.

- Godrej Consumer Products Ltd.

- Henkel AG and Co. KGaA

- John Paul Mitchell Systems

- Johnson and Johnson

- Kao Corp.

- LOreal SA

- NATULIQUE Ltd.

- Natura and Co Holding SA

- OUAI Hair Care

- Pai Shau Inc.

- Revlon Inc.

- Shiseido Co. Ltd.

- ST. TROPICA Inc.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

Latest Market Developments and News

-

In November 2024, L'Oréal launched a new line of hair care products formulated with sustainable ingredients, targeting environmentally conscious consumers. This product expansion responds to the growing demand for eco-friendly and cruelty-free hair care solutions in the market.

-

In October 2024, Procter & Gamble introduced a new hair growth treatment under its popular Pantene brand, designed to promote thicker and healthier hair. This launch caters to the increasing consumer interest in hair products that address hair thinning and loss, a growing concern among many individuals.

-

In September 2024, Unilever debuted a new range of hair products for curly and textured hair, offering customized solutions for different curl types and needs. This move reflects the increasing focus on inclusivity and personalized hair care products for diverse hair textures in the beauty industry.

-

In August 2024, Johnson & Johnson launched an advanced shampoo and conditioner duo under its Neutrogena brand, formulated to address scalp health and dandruff issues. This product release targets the growing trend of consumers seeking solutions for both hair care and scalp care within one product range.

Market Analyst Overview

The market is witnessing a notable shift toward natural and sustainable options, reflecting consumer preferences for chemical-free solutions. Liquid and lotion formulations cater to diverse hair needs, including nourishing dry or oily hair and addressing damaged scalp issues. With the rise in hair coloring trends, the demand for veg keratin products and cruelty-free options has increased. Market players offer herbal extracts and plant-based materials to avoid toxic chemicals such as sodium lauryl sulfate. Consumers are also turning to online stores for convenience, seeking organic and vegan hair care products endorsed by celebrities. Anti-dandruff products and hair loss treatment products remain popular, with a focus on premium, nature-inspired ingredients like essential oils, rosemary leaf extract, and ginseng oil to combat hair issues effectively in today's lifestyle patterns.

Moreover, the market is a dynamic landscape shaped by diverse consumer needs and trends. From addressing concerns like dry hair to following the latest long hair trend, consumers seek solutions for various hair care needs. This has led to the proliferation of hair care establishments offering a wide range of products, including hair coloring options and hairdressing products catering to different styles. With concerns over allergic reactions, many consumers turn to herbal products and organic hair care products, endorsed by celebrities for added credibility. There's also a growing demand for premium products infused with natural ingredients like fruit extracts and essential oils to combat issues like dullness and brittleness. Retail channels ranging from supermarkets to drug stores offer a diverse array of options, while the rise of online shopping provides convenience and access to specialty products like organic hair oils. As consumers become more conscious of harmful chemicals like paraben and aluminum compounds, they increasingly opt for certified organic and natural alternatives. This evolving market is not just driven by beauty trends but also factors like stress levels, ethnicity, and air pollution, reflecting a broader shift towards healthier and more sustainable hair care practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 15.29 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 44% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amway Corp., Colgate Palmolive Co., Coty Inc., Flora and Curl Ltd., Godrej Consumer Products Ltd., Henkel AG and Co. KGaA, John Paul Mitchell Systems, Johnson and Johnson Services Inc., Kao Corp., LOreal SA, NATULIQUE Ltd., Natura and Co Holding SA, OUAI Hair Care, Pai Shau Inc., Revlon Inc., Shiseido Co. Ltd., ST. TROPICA Inc., The Estee Lauder Companies Inc., The Procter and Gamble Co., and Unilever PLC |

|

Market dynamics |

Parent market analysis, market forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market forecast report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Hair Products Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research and growth report to meet your requirements. Get in touch