Professional Haircare Products Market Size 2024-2028

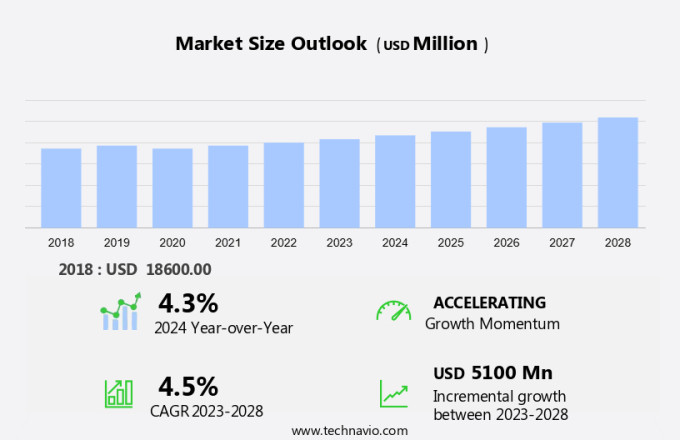

The professional haircare products market size is forecast to increase by USD 5.1 billion at a CAGR of 4.5% between 2023 and 2028.

- The market is witnessing significant growth due to several key trends and drivers. Innovation and portfolio extension are leading to product premiumization and customization, catering to the unique needs of consumers. The increasing penetration of multichannel marketing strategies is expanding the reach of professional haircare brands and making these products more accessible. Additionally, air pollution and its impact on hair damage, scalp issues, dandruff, and scalp infections are major concerns driving demand for effective professional haircare solutions. Moreover, specific ingredients, such as antioxidants, keratin, and essential oils, are at the heart of many professional hair care products. Consumers are seeking advanced formulations that address these issues and provide long-lasting solutions. Overall, the market is expected to continue its growth trajectory, driven by these trends and the evolving needs of consumers.

What will be the Size of the Market During the Forecast Period?

- The market is a dynamic and evolving industry, catering to the unique needs of hair care professionals and their clients. With a focus on superior formulas, specific ingredients, and innovative solutions, this market continues to thrive, meeting the demands of various hair concerns and issues. Hair care professionals, including stylists and colorists, rely on a wide range of products to deliver exceptional services in salons. These products include shampoos, conditioners, hair colorants, hair treatments, and styling tools. Each of these product categories is designed to address specific hair concerns, such as damage repair, color protection, and scalp issues.

- Damage repair and color protection are two essential aspects of professional hair care. Damage repair products help restore hair's natural strength and elasticity, while color protection formulas shield hair from fading and discoloration. Both of these concerns are increasingly relevant in today's world, where hair is exposed to various environmental stressors, such as air pollution and harsh styling tools. These ingredients help address various hair concerns, from dandruff and itchy scalp to frizzy hair and scalp infections. For instance, tea tree oil is known for its antimicrobial properties, making it an effective ingredient in scalp treatment products.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Regular haircare products

- Natural and organic products

- Product

- Hair colorants

- Shampoos and conditioners

- Hair styling products

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

- The offline segment is estimated to witness significant growth during the forecast period.

The market has witnessed significant growth in recent years, particularly in the online retailing sector. E-commerce platforms have become a preferred choice for consumers due to the convenience and accessibility they offer. Promotional activities, such as discounts and special offers, have further fueled the growth of the e-commerce retail market. Drop shipping has emerged as a popular online selling technique, allowing businesses to sell haircare products without holding inventory. Unisex packaging and gender-neutral products have broadened the customer base for professional haircare brands. Salons and spas continue to be a significant distribution channel for these products, catering to customers seeking expert advice and premium services.

Recommendations from medical clinics and institutes also contribute to the market's expansion. Online sales of professional haircare products are on the rise, with platforms like Hypermarkets, drugstores, department stores, and clubhouse stores offering a wide range of options. The convenience and affordability of purchasing haircare products online have made them increasingly popular, especially among those with busy schedules. As disposable income levels continue to rise, the demand for premium haircare products is expected to increase further.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 17.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

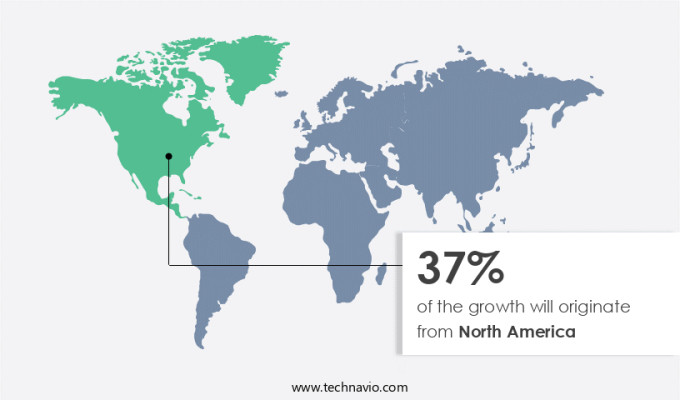

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth, driven by the increasing demand for superior formulas and specific ingredients. Damage repair and color protection are key features that consumers look for in these products, ensuring healthy and vibrant hair. The millennial population and the expanding workforce, leading to increased income levels and spending power, are primary contributors to this market expansion. Professional haircare products are no longer considered luxury items but essentials for styling and fashion statements. The growing popularity of online platforms for purchasing personal care products and the rising awareness and adoption of natural ingredients further fuel market growth.

Beauty influencers on social media play a significant role in promoting these products, making them more accessible and desirable to consumers. These companies invest in research and development to create innovative formulations and cater to the diverse needs of consumers. The market is expected to continue its steady growth during the forecast period, offering ample opportunities for new entrants and existing players alike.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Professional Haircare Products Market?

Innovation and portfolio extension leading to product premiumization and customization are the key drivers of the market.

- Professional haircare product manufacturers are prioritizing consumer demands by introducing advanced, innovative solutions. With growing concerns over air pollution and its impact on hair health, these companies are developing products that address skin and scalp issues, hair damage, and scalp infections such as dandruff. Frizzy hair is another common concern, leading to the launch of products offering UV ray protection and moisturizing benefits. Consumers seek efficient and novel offerings tailored to their needs and lifestyles, prompting an increase in product premiumization and line extensions. These advanced professional haircare products, priced higher than regular offerings, cater to the untapped market and offer superior benefits.

What are the market trends shaping the Professional Haircare Products Market?

Multichannel marketing is the upcoming trend in the market.

- In today's market, consumers' shopping behaviors have evolved, with an increasing number preferring the convenience of omnichannel shopping. This trend is particularly prominent in the market, where multichannel shoppers are the norm. These shoppers utilize various channels, including online and offline platforms, to purchase their preferred haircare items. Online shopping is facilitated by email, social media, and smartphone, while offline marketing is executed through specialty stores, hair salons, and spas. companies in this industry recognize the importance of maximizing product visibility through omnichannel marketing strategies. To cater to this need, they are implementing multichannel marketing initiatives. For instance, they are leveraging tutorial videos, social media, and e-commerce websites to reach a broader audience.

- Additionally, they are focusing on niche markets, such as scalp nourishment and damage-specific products, to differentiate themselves from competitors. Chemical-based products, such as anti-dandruff shampoos, continue to dominate the market, but there is a growing demand for natural alternatives, such as those containing aloe vera. In conclusion, the market is witnessing significant growth due to the increasing popularity of omnichannel shopping and multichannel marketing initiatives by companies. Consumers' preference for convenience shopping and the availability of a wide range of products across various channels are driving the market's expansion. companies are responding to this trend by providing maximum product visibility and catering to specific consumer needs, such as scalp nourishment and damage repair.

What challenges does the Professional Haircare Products Market face during the growth?

Growing penetration of DIY professional haircare solutions is a key challenge affecting the market growth.

- The market for DIY professional haircare solutions is experiencing significant growth as individuals seek to enhance their hair quality at home. Through various digital platforms, people exchange information about the benefits of using natural ingredients, such as herbs and hydrolyzed plant proteins, in DIY haircare solutions. These natural components offer various advantages, including preventing hair dryness, shielding hair from heat damage, and adding volume. For instance, hydrolyzed plant proteins and glycerin are commonly used for their conditioning and cleansing effects on the hair. The popularity of DIY haircare solutions is driven by their accessibility and the educational content provided by publishers, allowing consumers to gain a deeper understanding of the benefits of each ingredient.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avon Products

- Chatters GP Inc.

- Combe Inc.

- Coty Inc.

- Emami Ltd

- Henkel AG and Co. KGaA

- Johnson and Johnson Services Inc.

- Kao Corp.

- Kose Corp.

- LOreal SA

- Natura and Co Holding SA

- Revlon Inc.

- Shiseido Co. Ltd.

- The Estee Lauder Co. Inc.

- The Hain Celestial Group Inc.

- The Himalaya Drug Co.

- The Procter and Gamble Co.

- Unilever PLC

- World Hair Cosmetics Asia Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Professional hair care is a significant segment of the beauty industry, catering to the unique needs of hair care professionals and their clients in salons. This market encompasses a range of products, including styling tools, shampoos, conditioners, hair colorants, and hair treatments. These products are formulated with superior formulas and specific ingredients to address various hair concerns, such as damage repair, color protection, scalp health, and more. Social media and beauty influencers play a crucial role in promoting professional hair care products. Brands often collaborate with influencers to showcase their offerings, creating tutorial videos and sharing expert recommendations. Natural ingredients, such as aloe vera and herbal-based products, are increasingly popular due to growing consumer awareness and concerns about chemical-based products.

Damage from air pollution, skin issues, and scalp issues are common concerns for clients. Professional hair care brands offer damage-specific products and scalp nourishment solutions to address these issues. Hair loss, grey hair, and male grooming are also gaining attention in the market. Salon partnerships and promotional activities are essential for brands to reach their target audience. Online retailing, e-commerce, and drop shipping are popular selling techniques. Unisex packaging and gender-neutral products cater to a broader clientele. Retail chains, beauty salons, and barbershops are key distribution channels for professional hair care products. Organic ingredients and retail chains are becoming increasingly popular as consumers seek healthier and more sustainable options. Allergic reactions to certain ingredients are a concern, leading to the development of specialty stores and hair care services tailored to specific hair types and concerns.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 5.10 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.3 |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch