North America Hardwood Flooring Market Size 2024-2028

The North America hardwood flooring market size is forecast to increase by USD 2.07 billion, at a CAGR of 5.91% between 2023 and 2028.

- The market is witnessing significant growth due to increasing construction and real estate projects. The demand for hardwood flooring in various sectors such as restaurants, cafes, retail stores, offices, gymnasiums, basketball courts, hospitals, and tourism infrastructure drives this trend. Hardwood flooring's long lifecycle and sustainability as a building material make it an attractive choice for these establishments. Moreover, the growing emphasis on sound absorption properties in commercial spaces further fuels the market's growth. However, the market faces challenges such as the shortage of skilled labor in the construction industry, which may hinder market expansion.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing an ascending demand, fueled by various factors that underscore its significance in the real estate sectors and interior decoration. This market encompasses a wide array of floor covering solutions, including engineered wood flooring and deck flooring, which cater to diverse consumer preferences. The renovation and remodeling of old housing structures have emerged as key drivers for the growth of the hardwood flooring industry. Homeowners and businesses alike recognize the value of hardwood flooring in enhancing the natural look and longevity of their spaces.

- The reliability and enhanced features of hardwood flooring, such as abrasion resistance and dimensional accuracy, make it an attractive choice for those seeking floor covering solutions that offer both beauty and durability. The real estate sector has also contributed to the market's expansion, as potential buyers increasingly prefer properties with hardwood flooring. The natural look and longevity of hardwood flooring are desirable attributes that can significantly increase a property's value. The wood flooring industry is witnessing a shift towards engineered wood flooring due to its improved performance characteristics. Engineered wood flooring offers the authentic look of solid hardwood, combined with the benefits of enhanced dimensional stability and ease of installation.

How is this market segmented and which is the largest segment?

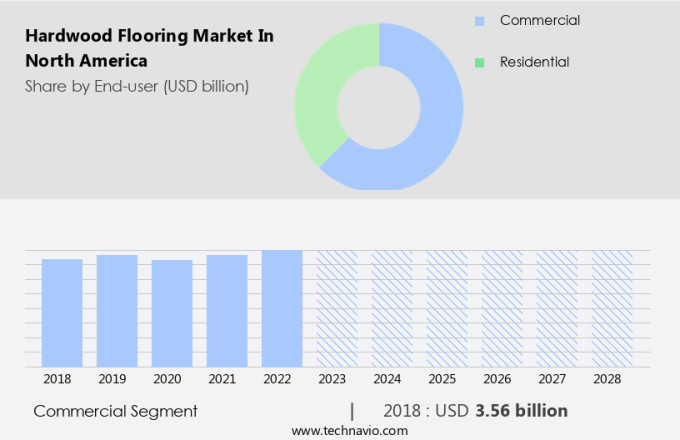

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Commercial

- Residential

- Type

- Engineered wood

- Solid wood

- Geography

- North America

- Canada

- Mexico

- US

- North America

By End-user Insights

- The commercial segment is estimated to witness significant growth during the forecast period.

The North American hardwood flooring market caters primarily to the residential and commercial sectors. In the commercial sector, which encompasses buildings in education, healthcare, hospitality, retail, and office segments, the preference for hardwood flooring is on the rise. This trend can be attributed to several factors, including the natural look and longevity of hardwood flooring, as well as its enhanced features, such as reliability, abrasion resistance, and dimensional accuracy. Commercial buildings require flooring that can withstand the weight of heavy furniture and continuous foot traffic. Hardwood flooring meets these requirements, offering not only durability but also contributing to noise reduction and elevating the interior aesthetic.

The increasing investment in office spaces and institutional constructions, coupled with the growing importance of employee comfort, is driving the demand for hardwood flooring in the commercial sector. Engineered wood flooring, a popular choice in commercial applications due to its improved dimensional stability, is expected to dominate the market. Deck flooring, another segment of the hardwood flooring industry, is also witnessing significant growth due to its versatility and suitability for outdoor spaces. Overall, the market is poised for continued growth, offering ample opportunities for market participants.

Get a glance at the market share of various segments Request Free Sample

The commercial segment was valued at USD 3.56 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

The market is expected to maintain its largest share in the global floor-covering solutions market, driven by the region's strong economy and increasing consumer focus on interior decoration and property value enhancement. Consumer awareness regarding the environmental conservation aspects of various flooring materials is another factor influencing the market. Bamboo and glass flooring, for instance, are gaining popularity as eco-friendly alternatives to traditional hardwood flooring. The demand for hardwood flooring is not limited to residential applications; it is also prevalent in commercial spaces. The versatility of hardwood flooring, coupled with its durability and aesthetic appeal, makes it an ideal choice for various commercial applications. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the market?

Rising construction and real estate projects is the key driver of the market.

- The market is experiencing an ascending demand due to the growing renovation and remodeling activities in both residential and commercial sectors. Old housing structures are being upgraded with hardwood flooring to enhance their interior decoration and increase property value in the real estate market. Hardwood flooring's natural look, longevity, and enhanced features such as dent resistance, scratch resistance, and dimensional accuracy make it a preferred choice for floor covering solutions. The largest share of the market is held by hardwood, including red oak and white oak (Quercus alba), known for their straight-grained, longer rays, and water resistance.

- Engineered wood flooring, composite wood, wooden products, and wood-based panels are also gaining popularity due to their reliability, abrasion resistance, and improved design requirements that meet international standards. The repair and maintenance segment is another significant contributor to the market growth, driven by consumer awareness and environmental conservation. Sustainable building materials like bamboo, glass, rubber, cork, linoleum, and hardwood are increasingly being used to reduce the carbon footprint and promote efficient construction practices. The commercial segment, including commercial buildings, hotels, restaurants, cafes, offices, gymnasiums, basketball courts, hospitals, and other institutions, is a major consumer of hardwood flooring due to its long lifecycle and sound absorption properties.

What are the market trends shaping the market?

The emerging trend of remodeling and renovation is the upcoming trend in the market.

- The market is experiencing ascending demand due to the increasing trend of renovation and remodeling activities in the US and Canada. With government policies and programs encouraging home upgrades, replacements, and routine maintenance, the hardwood flooring industry is poised for growth. Consumers are prioritizing interior decoration and design requirements, leading to an emphasis on floor-covering solutions that offer a natural look and longevity. Engineered wood flooring, with its enhanced features such as reliability, abrasion resistance, dimensional accuracy, and dent resistance, is currently holding the largest share in the market. Additionally, consumer awareness towards environmental conservation and the availability of domestic and international hardwood species, including red oak and white oak (Quercus alba), are further driving market growth.

- The commercial segment, including commercial buildings, hotels, restaurants, cafes, retail stores, offices, gymnasiums, basketball courts, hospitals, and tourism infrastructure, is also contributing significantly to the market's expansion. Efficient construction practices and the requirement for sustainable building materials with longer lifecycles are further boosting the demand for hardwood flooring. Other flooring options, such as terrazzo, vinyl, carpet, and composite materials like bamboo, glass, rubber, cork, linoleum, wooden products, and wood-based panels, are also gaining popularity due to their unique features and design requirements. The hardwood flooring industry is continually evolving to meet international standards, offering solid core, dent resistance, scratch resistance, water resistance, and smooth texture options to cater to diverse consumer preferences.

What challenges does the market face during the growth?

Shortage of skilled labor in the construction industry is a key challenge affecting market growth.

- The market is witnessing an ascending demand due to the preference for highly durable and natural-looking flooring solutions in interior decoration and renovation projects. The real estate sectors, particularly old housing structures, are major contributors to this trend. The wood flooring industry offers a range of products, including engineered wood, solid wood, composite wood, and wooden panels, catering to various design requirements and international standards. The repair and replacement segment of the hardwood flooring market is also gaining traction, as consumers become increasingly aware of the longevity and sustainability benefits of wood flooring. However, the shortage of skilled labor is a significant challenge for the industry, with the high demand for labor in the construction sector exacerbating the issue.

- To mitigate this, key players are investing in equipment and technology to enhance the features of their flooring solutions, such as dimensional accuracy, dent resistance, and scratch resistance. Moreover, the market is witnessing an increased focus on environmental conservation, with alternatives such as bamboo, glass, rubber, cork, linoleum, and various composite materials gaining popularity. The commercial segment, including commercial buildings, hotels, restaurants, cafes, offices, gymnasiums, basketball courts, hospitals, and other facilities, is a significant contributor to the market's growth. The long lifecycle and sustainable building materials' appeal make hardwood flooring an attractive choice for commercial construction projects. Efficient construction practices and sound absorption properties are also essential factors driving the market's growth.

Exclusive North America Hardwood Flooring Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B and M Noble Co.

- Barlinek SA

- Brumark Corp.

- Canfor Corp.

- Fritz Egger GmbH and Co. OG

- Gerflor Group

- Goodfellow Inc.

- Gordon Brothers Commercial and Industrial LLC

- Home Legend LLC

- Interfor Corp.

- Koch Industries Inc.

- Mannington Mills Inc.

- Mohawk Industries Inc.

- Provenza Floors Inc.

- Q.E.P. Co. Inc.

- Shaw Industries Group Inc.

- Somerset Hardwood Flooring

- Weyerhaeuser Co.

- Beaulieu International Group

- Tarkett

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing an ascending demand due to the renewed focus on interior decoration and renovation of old housing structures. With a natural look and longevity, wood flooring has become a preferred choice for both residential and commercial sectors. The real estate industry recognizes the value of floor covering solutions that offer reliability, abrasion resistance, and dimensional accuracy. Engineered wood flooring, a popular variant, boasts enhanced features such as dent and scratch resistance. Solid wood and composite wood flooring, including engineered and composite materials, cater to various design requirements. The wood flooring industry offers a wide range of options, including solid core, red oak, white oak (Quercus alba), and various types of hardwood.

Furthermore, consumers are increasingly aware of the environmental conservation benefits of using sustainable building materials like bamboo, glass, rubber, cork, linoleum, and hardwood. Repair and maintenance are essential aspects of the wood flooring industry. Adhesives, interlocked tiles, and international standards ensure long lifecycles for these flooring solutions. Wood-based panels, composite materials, and flooring industry innovations continue to meet the evolving design requirements of various sectors. The replacement segment includes terrazzo, vinyl, carpet, and other flooring types. Wood flooring is suitable for new residential and commercial construction, as well as high urbanization areas. The commercial segment includes hotels, restaurants, cafes, offices, gymnasiums, basketball courts, hospitals, and other commercial buildings. Wood flooring offers a long lifecycle, making it a sustainable and efficient construction practice for tourism infrastructure. Additionally, its sound absorption properties contribute to efficient construction practices.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.91% |

|

Market Growth 2024-2028 |

USD 2.07 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.21 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch