Heated Holding Cabinet Market Size 2025-2029

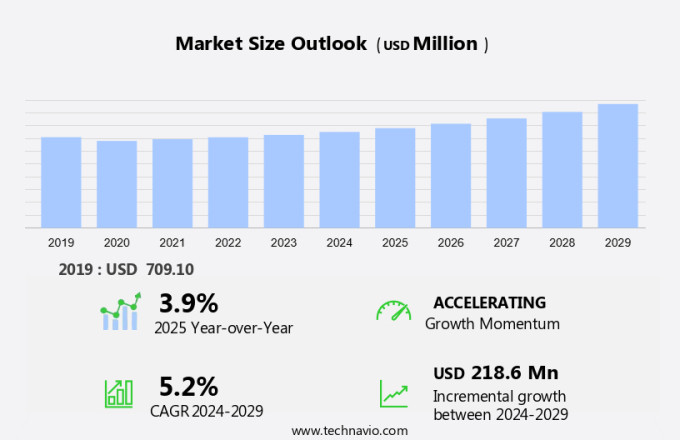

The heated holding cabinet market size is forecast to increase by USD 218.6 million, at a CAGR of 5.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing expansion of Quick Service Restaurants (QSRs) worldwide. These establishments require efficient and reliable holding cabinets to maintain food quality and temperature, leading to a surge in demand for this market. Additionally, product launches in advanced technology and energy-efficient holding cabinets are introducing innovation and competition. However, the market faces challenges with the high prices of raw materials, particularly stainless steel and insulation materials, which can impact the affordability of these products for some businesses.

- Companies in the market must navigate these challenges while capitalizing on the growing demand from the QSR sector. Strategic partnerships, cost optimization, and technological advancements can help businesses stay competitive and meet the evolving needs of their customers.

What will be the Size of the Heated Holding Cabinet Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic needs of various sectors, including food retail and food service. These cabinets are integral to maintaining food quality and safety, offering features such as easy cleaning, digital controls, and food preservation. Durable construction and temperature uniformity are essential for long-term use, while energy consumption and energy efficiency are key considerations for operational costs. Foodborne illness prevention is a critical aspect, with temperature sensors ensuring compliance with safety standards and regulations. Food preparation processes are seamlessly integrated, with heating elements, fan systems, and humidity control maintaining optimal conditions. LED lighting and glass or solid doors enhance food display and presentation.

Maintenance requirements are essential for prolonging the life of these cabinets, with training programs and technical support available from manufacturers. Shelf configuration and stainless steel construction contribute to the cabinets' durability, while HACCP compliance and thermal insulation prevent food spoilage. Buffet service, catering operations, and the hospitality industry rely on heated holding cabinets for food warming and temperature control. Air circulation and moisture control further ensure food quality and safety. Installation services are available to facilitate seamless integration into existing food service operations.

How is this Heated Holding Cabinet Industry segmented?

The heated holding cabinet industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Restaurants

- Hospitals and healthcare facilities

- Educational institutes

- Others

- Type

- Mobile

- Stationary

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

By End-user Insights

The restaurants segment is estimated to witness significant growth during the forecast period.

The market caters to various industries, notably food retail and food service, including restaurants and cafeterias. These establishments prioritize food preservation and temperature control to ensure food quality and customer satisfaction. Heated holding cabinets, such as Alto-Shaam's 1200-UP model, are essential for maintaining food temperature with features like gentle Halo Heat technology, which prevents food from drying out or losing texture using even heat distribution without fans or harsh elements. Restaurants, ranging from fine dining to casual eateries, invest in these cabinets for their capacity to store large food quantities at precise temperatures. The market offers a variety of options, including those with digital controls for easy temperature adjustments and energy efficiency, ensuring minimal food spoilage and reduced operational costs.

Durable construction and stainless steel materials ensure longevity, while temperature sensors and fan systems maintain uniformity and air circulation. Safety standards and compliance regulations are met with features like moisture control, humidity control, and HACCP compliance. Installation services and technical support are also available for seamless integration into food preparation and buffet service areas. Training programs are offered to ensure proper usage and maintenance, while energy consumption remains a concern, leading to the development of energy-efficient heating elements and thermal insulation. The hospitality industry's growing demand for efficient food warming and catering operations continues to propel market growth.

Shelf configurations and door types cater to various food holding times and food display preferences. Overall, the market's focus on food safety, temperature control, and operational efficiency drives its evolution.

The Restaurants segment was valued at USD 277.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

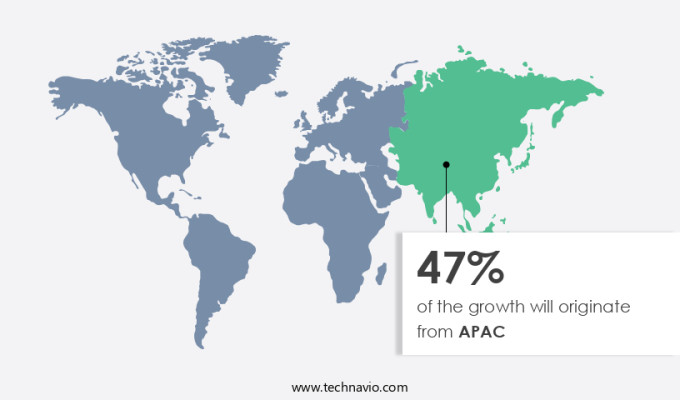

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in the Asia Pacific region. Government initiatives and the increasing demand for efficient food service solutions are driving this trend. For instance, in August 2024, the government of Himachal Pradesh in India launched the Mukhyamantri Bal Paushtik Aahar Yojana to provide nutritious food to children in government-run schools. This scheme supplements the existing midday meal program and targets students from nursery to Class 8 in 15,181 schools. Heated holding cabinets play a crucial role in ensuring temperature uniformity and food preservation, reducing foodborne illnesses and food spoilage. These cabinets are designed with durable construction, digital controls, and energy efficiency, making them a preferred choice for food retail, restaurant equipment, and food service equipment.

Maintenance requirements are minimal, with easy cleaning and temperature sensors ensuring optimal performance. Training programs are available for proper usage and safety standards, ensuring HACCP compliance and adherence to compliance regulations. The market offers various door types, including glass and solid doors, with LED lighting and heating elements for food display and warming. Installation services and technical support are readily available, making these cabinets a reliable investment for the hospitality industry, catering operations, and buffet service. With thermal insulation and fan systems, these cabinets maintain temperature control and air circulation, preventing moisture build-up and ensuring food quality. Shelf configuration options cater to different food holding times and food types, making them versatile and suitable for various applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Heated Holding Cabinet Industry?

- The expansion of Quick Service Restaurants (QSRs) serves as the primary catalyst for market growth.

- The global market for heated holding cabins is experiencing notable growth due to the expanding Quick Service Restaurant (QSR) sector. With an increasing number of new QSR openings and expansions, there is a heightened demand for efficient food storage solutions. Heated holding cabins, with their ability to maintain optimal food holding temperatures and preserve food quality, are becoming essential for QSRs and catering operations in the hospitality industry. These cabinets come with various configurations, including stainless steel construction, door types, and fan systems, to meet diverse food warming requirements.

- Thermal insulation ensures food holding times are maintained, while adherence to HACCP compliance regulations adds to their appeal. Heated holding cabinets offer an immersive and harmonious food warming experience, making them indispensable for businesses seeking to enhance their food offerings and customer satisfaction.

What are the market trends shaping the Heated Holding Cabinet Industry?

- Product launches have emerged as the latest market trend. It is essential for businesses to stay informed and prepared for upcoming product launches to remain competitive.

- The market is experiencing notable progress due to the introduction of advanced products. These innovations aim to improve the functionality, efficiency, and adaptability of heated holding cabinets, addressing the evolving requirements of the food service sector. In February 2024, Valentine and CuisinEquip unveiled the Locher Hot Star hot-holding cabinet. This new electric model utilizes advanced technology to preserve the warmth and optimal quality of pre-prepared and cooked food. The Hot Star is constructed from durable stainless steel and features handles for easy transportation and storage, making it suitable for mobile catering applications. This development enables food to be transported swiftly and effectively, ensuring it remains in pristine condition upon arrival.

- The market's growth is further driven by the increasing focus on energy efficiency and foodborne illness prevention. Digital controls and temperature sensors facilitate precise temperature uniformity, while easy cleaning features minimize maintenance requirements. Energy consumption is a significant concern, and manufacturers are addressing this by producing energy-efficient models. In conclusion, the market is witnessing substantial growth as a result of these technological advancements and the evolving needs of the food service industry.

What challenges does the Heated Holding Cabinet Industry face during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory.

- The market is influenced by several factors, including operational costs and advanced features such as humidity control, temperature control, and LED lighting. In food retail, restaurant equipment, and food service industries, these cabinets are essential for maintaining food quality and preserving freshness. Heated holding cabinets come in various designs, including glass doors and solid doors, catering to diverse business needs. However, the market faces challenges due to the high cost of raw materials, particularly stainless steel. The price of stainless steel is influenced by the prices of its key components, including nickel, molybdenum, and iron ore.

- In 2024, nickel prices experienced a significant surge, reaching approximately USD16,040 per tonne, due to concerns over Indonesia's mining policies. This increase in nickel prices has resulted in higher manufacturing costs for heated holding cabinets, potentially impacting their affordability. To mitigate these challenges, market players invest in training programs and technical support to optimize the efficiency of their operations and reduce waste. Additionally, they explore alternative materials and manufacturing processes to minimize their reliance on expensive raw materials. Overall, the market continues to evolve, driven by advancements in technology and the growing demand for high-quality food preservation solutions.

Exclusive Customer Landscape

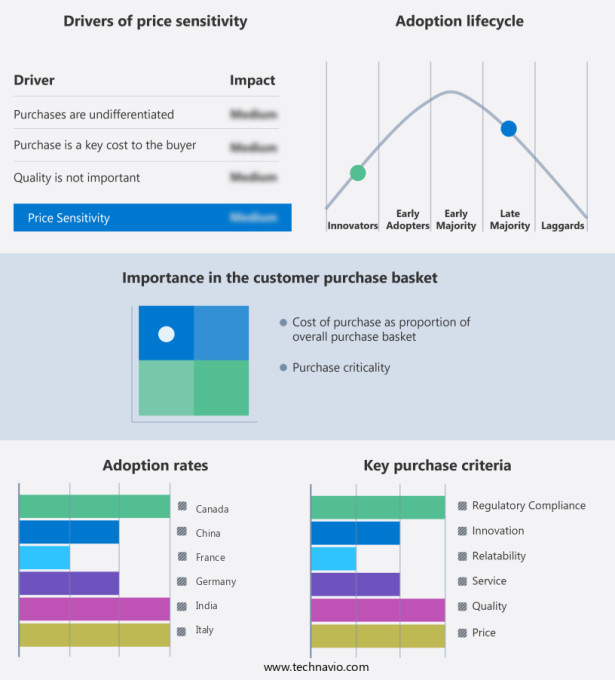

The heated holding cabinet market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the heated holding cabinet market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, heated holding cabinet market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alto Shaam Inc. - The company specializes in providing advanced heating solutions for various applications through its range of high-performance holding cabinets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alto Shaam Inc.

- Ascolia

- BevLes

- Broaster Co

- Caddie Hotel Srl

- Carter-Hoffmann

- crescor.com

- Emainox

- Fire Magic

- FORBES GROUP

- Henny Penny Corp.

- Hugentobler Schweizer Kochsysteme AG

- Kalamazoo Outdoor Gourmet LLC

- MASBAGA

- Matfer Bourgeat Group

- Salvis AG

- SICO Inc.

- The Delfield Company

- Tournus Equipment

- Vulcan

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Heated Holding Cabinet Market

- In February 2023, Thermo Fisher Scientific, a leading life sciences solutions provider, introduced the new Heracell Viability Station 3000 series, an advanced line of heated holding cabinets designed for cell and gene therapy applications (Thermo Fisher Scientific Press Release, 2023). This innovative product launch caters to the growing demand for advanced storage solutions in the biopharmaceutical sector.

- In July 2024, Merck KGaA, a renowned pharmaceutical and life science company, announced a strategic partnership with BioCision, a biotech firm specializing in automated sample preparation systems. This collaboration aims to integrate BioCision's sample preparation solutions with Merck KGaA's life science offerings, enhancing the overall value proposition for their customers (Merck KGaA Press Release, 2024).

- In March 2025, Panasonic Healthcare, a global healthcare solutions provider, completed the acquisition of a majority stake in Medela, a leading medical technology company specializing in breastfeeding and maternity solutions. This strategic move expands Panasonic Healthcare's product portfolio and strengthens its presence in the healthcare market (Panasonic Healthcare Press Release, 2025).

- In May 2025, the European Medicines Agency (EMA) approved the use of a new type of heated holding cabinet for storing certain vaccines at temperatures between 2°C and 8°C. This approval marks a significant milestone in the development of advanced temperature-controlled storage solutions for the pharmaceutical industry (European Medicines Agency Press Release, 2025).

Research Analyst Overview

- The market encompasses a range of food displays and kitchen design elements, integrating green technology, food quality management, and food safety certification to ensure optimal food safety and cost control in food service operations. Catering carts and buffet stations benefit from thermal engineering advancements, enabling precise temperature monitoring systems and energy management. Food preparation areas and ingredient storage units employ material science and food technology to maintain food quality, adhering to industry standards.

- Cleanliness and sanitation are paramount, with food handling procedures strictly enforced. Steam tables and food warmers are essential components, providing environmental control and temperature consistency. Food safety audits are routine, reinforcing the importance of food industry standards and food science in maintaining a successful business.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Heated Holding Cabinet Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

201 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.2% |

|

Market growth 2025-2029 |

USD 218.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.9 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, UK, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Heated Holding Cabinet Market Research and Growth Report?

- CAGR of the Heated Holding Cabinet industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the heated holding cabinet market growth of industry companies

We can help! Our analysts can customize this heated holding cabinet market research report to meet your requirements.