Hoist Sling Chains Assemblies Market Size 2025-2029

The hoist sling chains assemblies market size is forecast to increase by USD 434.6 million, at a CAGR of 4.3% between 2024 and 2029.

- The market is driven by the increasing demand from the construction industry, where these assemblies are essential for lifting heavy loads in various applications. Product innovation is another key driver, as manufacturers continually develop stronger and more durable chains to meet the evolving needs of customers. However, the market faces challenges from the fluctuation in raw material costs, which can significantly impact the pricing strategy and profitability of companies. Effective supply chain management and strategic sourcing of raw materials are crucial for businesses seeking to mitigate this challenge and maintain competitiveness in the market.

- Companies that can navigate these dynamics and capitalize on the growth opportunities in the construction sector, while also addressing the raw material cost challenges, are well-positioned to succeed in the market.

What will be the Size of the Hoist Sling Chains Assemblies Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The hoist sling chains market continues to evolve, driven by the dynamic nature of industrial handling applications across various sectors. Chain sling suppliers play a crucial role in providing solutions that adhere to stringent working load limits and safe lifting practices. Forklift attachments and lifting points require hoist sling chains with specific chain length, design, and material properties for optimal performance. Chain lubrication, heat treatment, and maintenance are essential aspects of ensuring the longevity and safety of hoist sling chains. Proof load testing, rigging techniques, and chain replacement criteria are integral to material handling processes. Sling maintenance procedures, sling inspection checklists, and chain wear indicators help identify potential issues before they become critical.

Safety factors, breaking strength, and load distribution are essential considerations in hoist system design. Swivel hooks, hook types, and rigging hardware are essential components of the lifting process. Overhead crane operation and construction lifting require specialized hoist sling chains, such as wire rope assemblies, to meet the unique demands of these applications. OSHA regulations and EN standards dictate strict safety guidelines for hoist sling chains, including load securement, sling failure analysis, and lifting capacity. Custom chain slings and chain certification are essential for meeting specific industry requirements. Chain sling manufacturers and distributors provide training and guidelines for proper chain sling storage and handling.

Chain grade, corrosion resistance, and non-destructive testing are critical factors in ensuring the reliability and longevity of hoist sling chains. The market for hoist sling chains remains dynamic, with ongoing advancements in materials, design, and technology driving innovation and growth.

How is this Hoist Sling Chains Assemblies Industry segmented?

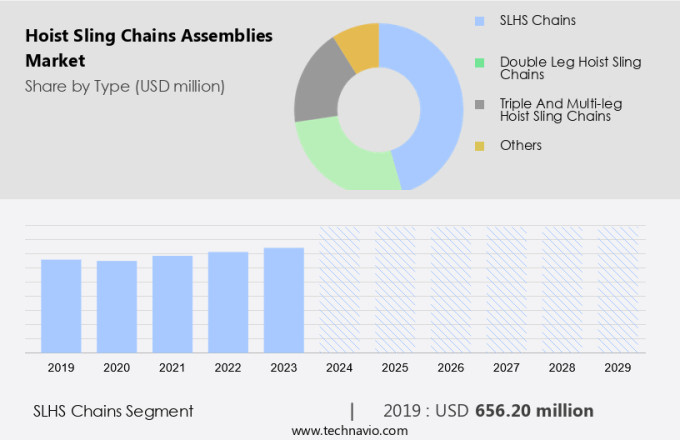

The hoist sling chains assemblies industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- SLHS chains

- Double leg hoist sling chains

- Triple and multi-leg hoist sling chains

- Others

- Application

- Construction

- Mining

- Manufacturing

- Oil and gas

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Type Insights

The SLHS chains segment is estimated to witness significant growth during the forecast period.

The hoist sling chains assembly market encompasses various types of lifting solutions, with SLHS chains holding a substantial share. SLHS chains, characterized by a single lifting point, are favored for their simplicity and versatility. This design is ideal for handling loads requiring central stability and precision, such as pipes, machinery components, and other items. The straightforward attachment and detachment process of SLHS chains boost operational efficiency and safety. Material handling applications extensively utilize SLHS chains due to their working load limit capabilities and compatibility with forklift attachments. The lifting point ensures load distribution and safe lifting practices, adhering to OSHA regulations and ASME standards.

Chain sling manufacturers prioritize chain length, heat treatment, and material grade to enhance the strength and durability of SLHS chains. Proper chain lubrication and maintenance procedures, including inspection checklists and rigging techniques, ensure optimal performance and longevity. Chain sling distributors offer custom sling solutions, training, and storage guidelines to cater to diverse industry needs. Winch systems and proof load testing are integral to the hoist sling chain assembly market, ensuring safe and efficient lifting operations. Safety factors, load securement, and rigging hardware are essential considerations in the design and application of hoist sling chains. The market is continually evolving, with advancements in materials, technology, and design, ensuring the highest levels of safety and productivity.

The SLHS chains segment was valued at USD 656.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The hoist sling chains assembly market is witnessing substantial growth worldwide, with the APAC region leading the charge. This expansion is primarily due to the region's substantial investments in infrastructure and real estate, particularly in countries like India. India aims to reach an economic growth target of USD5 trillion by 2025 and is focusing on enhancing its infrastructure. Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) have raised over USD15.60 billion collectively in the past four years until March 2024. The region's robust economic development and urbanization fuel the demand for advanced lifting solutions, such as hoist sling chains assemblies.

These assemblies are essential for various applications in construction, manufacturing, transportation, and logistics, which are integral to the infrastructure projects in the region. Hoist sling chains assemblies adhere to stringent safety standards, including OSHA regulations and EN standards, ensuring safe lifting practices. They come in various configurations, such as chain sling designs, chain lengths, and hook types, catering to diverse applications. Chain sling manufacturers prioritize chain maintenance procedures, including chain lubrication, heat treatment, and non-destructive testing, to ensure optimal performance and longevity. Chain sling distributors offer custom chain slings, chain certification, and training to meet specific customer requirements.

The market's evolution includes advancements in hoist systems, load securement, and sling inspection checklists, enhancing the overall efficiency and safety of lifting operations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Hoist Sling Chains Assemblies Industry?

- The construction industry's increasing demand plays a pivotal role in driving market growth.

- The hoist sling chains assembly market is experiencing significant growth due to the increasing demand from the construction industry. In 2024, the construction sector in Singapore reported a noteworthy increase of 12% in productivity, surpassing the overall GDP growth rate. This growth in productivity underscores the construction industry's vital role in driving the demand for hoist sling chains assemblies. Several initiatives have fueled construction activity in Southeast Asia, including the enhanced Contractors Registration System (CRS), the Productivity Innovation Project (PIP), the Future Energy Fund, and the Energy Efficient Grant. These programs have been instrumental in supporting the expansion of the construction sector and, consequently, the demand for hoist sling chains assemblies.

- Safety remains a top priority in the hoist sling chains assembly market. Compliance with ASME standards and lifting equipment standards is essential to ensure load distribution and maintain a safety factor. Proper chain sling training, sling storage guidelines, chain inspection, and non-destructive testing are crucial practices to prevent accidents and ensure the longevity of the equipment. Corrosion resistance is a critical factor in the selection of hoist sling chains assemblies. The use of high-quality materials, such as galvanized or stainless steel, can significantly enhance the equipment's durability and longevity. Regular inspections and maintenance, including non-destructive testing, are essential to maintain the chains' integrity and prevent corrosion.

- Key considerations for selecting hoist sling chains assemblies include the center of gravity, eye bolt selection, and chain size. Proper selection and use of these components can ensure efficient and safe lifting of heavy equipment.

What are the market trends shaping the Hoist Sling Chains Assemblies Industry?

- Product innovation is an essential trend in today's market. Companies that prioritize new product development and improvement are more likely to stay competitive and attract customers.

- The industrial handling sector relies on hoist sling chains assemblies for efficient and safe lifting operations. Chain sling suppliers continue to innovate, designing solutions that cater to diverse applications, particularly in emergency and rescue operations. For instance, Gunnebo Industries' chain rescue kits have gained popularity due to their versatility and effectiveness. These kits attach to vehicle pillars and connect to a forklift or winch system, offering advantages over traditional ram jacks. They streamline rescue processes by allowing medical personnel unobstructed access to patients.

- The chain sling design ensures safe lifting practices, with working load limits clearly indicated. Regular chain maintenance, including lubrication and heat treatment, is essential for optimal performance and longevity. In case of damage, professional chain sling repair services are available to restore functionality.

What challenges does the Hoist Sling Chains Assemblies Industry face during its growth?

- The volatility in the cost of raw materials poses a significant challenge and significantly impacts the growth trajectory of the industry.

- The hoist sling chains assembly market is subject to the volatility of raw material costs, posing a significant challenge for market participants. This instability can lead to increased production costs, pricing strategies adjustments, and market instability. For instance, in October 2024, ArcelorMittal, a leading global steel producer, announced a price increase for rolled products across Europe due to market instability and rising raw material costs. The price hike affected various long-rolled products, including rebar, beams, and wire rods, by USD 21 per ton. This decision underscores the financial uncertainty that raw material price fluctuations create for companies throughout the supply chain.

- Proof load testing, rigging techniques, chain replacement criteria, material handling, sling maintenance procedures, chain wear indicators, chain grade, construction lifting, wire rope assemblies, sling inspection checklists, hoist systems, load securement, and sling failure analysis are essential aspects of the market. Ensuring adherence to these factors can help mitigate risks associated with raw material price volatility and maintain the integrity of lifting operations.

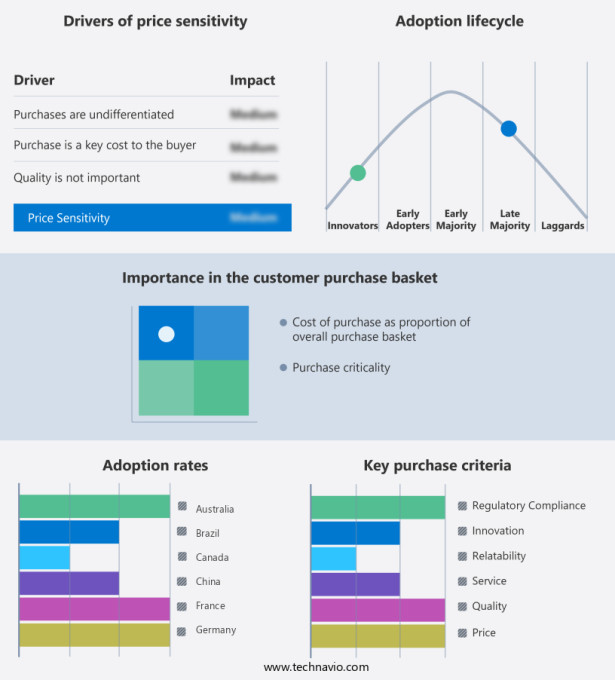

Exclusive Customer Landscape

The hoist sling chains assemblies market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hoist sling chains assemblies market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hoist sling chains assemblies market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apex Tool Group LLC - The company specializes in manufacturing and supplying hoist sling chain assemblies for various industries, including construction, mining, and maritime sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apex Tool Group LLC

- BEM Co. Pvt. Ltd.

- Columbus McKinnon Corp.

- Gunnebo Industries AB

- JD Theile GmbH and Co. KG

- KITO corp

- Peerless Industrial Group Inc

- Pewag International GmbH

- RUD Ketten Rieger and Dietz GmbH u. Co. KG

- Vulcan Brands

- WW Grainger Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hoist Sling Chains Assemblies Market

- In March 2024, leading hoist sling chains assembly manufacturer, Chainmaster, introduced its new high-strength alloy Grade 100 hoist sling chain assembly, enhancing its product portfolio and catering to the increasing demand for durable and reliable lifting solutions in heavy industries (Chainmaster Press Release, 2024).

- In July 2024, Trelleborg Group, a global industrial solutions provider, announced a strategic partnership with Lifting Solutions, a leading provider of lifting equipment and services, to expand its market presence in the oil and gas sector through the integration of Trelleborg's hoist sling chains assemblies into Lifting Solutions' product offerings (Trelleborg Press Release, 2024).

- In October 2025, Forged Products, a leading manufacturer of hoist sling chains assemblies, completed the acquisition of its major competitor, Chainco, significantly increasing its production capacity and market share in the North American hoist sling chains assembly market (Forged Products Press Release, 2025).

- In December 2025, the European Union passed the new Lifting Equipment Directive (LED), which sets stringent safety requirements for hoist sling chains assemblies and other lifting equipment, ensuring higher safety standards for workers and end-users in the European market (European Parliament and Council of the European Union, 2025).

Research Analyst Overview

- The hoist sling chains market encompasses a range of sling types, including nylon and synthetic slings, such as webbing and flat slings, as well as wire rope and polyester slings. Rigging operations rely on these slings for heavy duty lifting applications, with varying sling ratings and configurations to accommodate different load management requirements. Sling safety training and damage assessment are crucial components of ensuring proper usage and longevity. Sling testing, inspection, and certification are essential for maintaining sling safety procedures and extending their life cycle.

- Sling replacement and repair techniques are also vital in addressing sling degradation and ensuring compliance with sling standards. The market for lifting equipment continues to evolve, with advancements in sling technology and increasing emphasis on safety and load capacity. Sling attachment, length, width, and configuration all play significant roles in the efficiency and effectiveness of lifting operations.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hoist Sling Chains Assemblies Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

200 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 434.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, China, Japan, India, Germany, Canada, South Korea, France, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hoist Sling Chains Assemblies Market Research and Growth Report?

- CAGR of the Hoist Sling Chains Assemblies industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hoist sling chains assemblies market growth of industry companies

We can help! Our analysts can customize this hoist sling chains assemblies market research report to meet your requirements.