Home Energy Management Systems Market Size 2024-2028

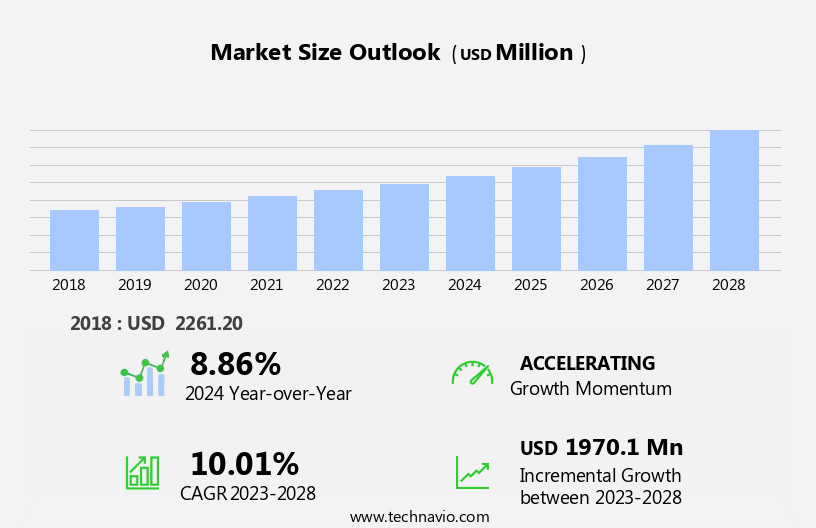

The home energy management systems market size is forecast to increase by USD 1.97 billion, at a CAGR of 10.01% between 2023 and 2028. The HEMS market is experiencing significant growth, driven by the increasing adoption of smart grid technologies and substantial investments in smart cities and smart homes.

Major Market Trends & Insights

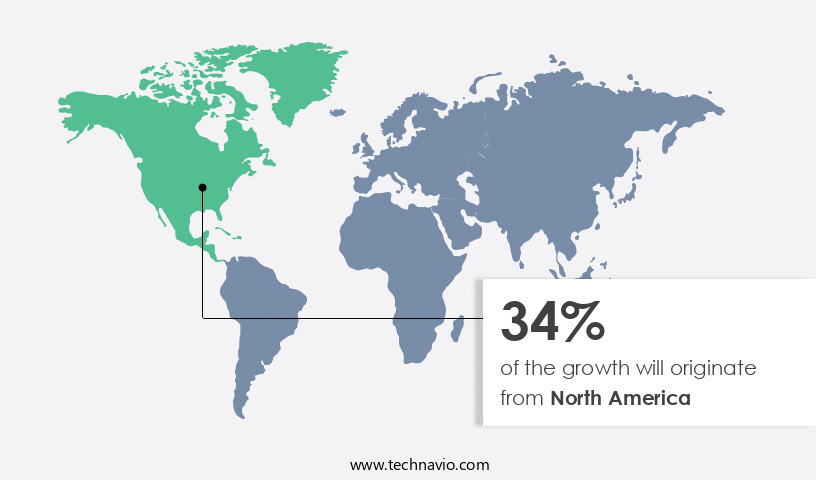

- North America dominated the market and contributed 31% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

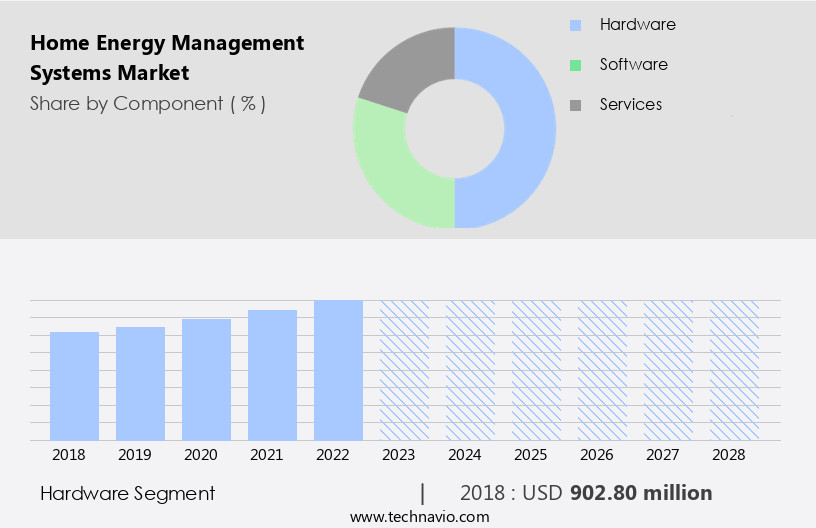

- Based on the Component, the hardware segment led the market and was valued at USD 1.16 billion of the global revenue in 2022.

- Based on the Product, the Lighting controls segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 129.75 Million

- Future Opportunities: USD 1.97 Billion

- CAGR (2023-2028): 10.01%

- APAC: Largest market in 2022

The trends reflect a broader shift towards energy efficiency, sustainability, and digitalization in the residential sector. However, the HEMS market faces notable challenges. The high cost of implementation remains a significant barrier to entry for many consumers and organizations. Additionally, interoperability issues persist, as various HEMS solutions struggle to communicate and work seamlessly with one another. Addressing these challenges will require collaboration between industry stakeholders, standardization efforts, and continued innovation to ensure the widespread adoption of HEMS and the realization of their full potential in optimizing energy usage and reducing carbon emissions. Companies seeking to capitalize on market opportunities should focus on developing cost-effective, interoperable solutions that cater to the evolving needs of consumers and cities.

What will be the Size of the Home Energy Management Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the integration of smart meters and automated energy saving solutions. These systems enable electrical grid stability by providing real-time energy data and predictive energy modeling, allowing for optimal grid interaction protocols. Home energy dashboards offer user-friendly interfaces, enabling consumers to monitor energy consumption and implement energy efficiency algorithms. Demand response programs and home automation systems facilitate load balancing strategies and device interoperability, enabling smart appliance control and power quality monitoring. Energy cost reduction is a significant factor, with expectations of industry growth reaching 15% annually. For instance, a leading energy provider reported a 20% reduction in peak demand through the implementation of a home energy management system.

Energy data analytics and user interface design are crucial components, ensuring data security measures are in place for renewable energy integration and remote energy management. Distributed generation control, hvac control systems, and water heater control further optimize energy storage and peak demand reduction. Network communication protocols facilitate smart thermostat integration and energy usage visualization, enabling consumers to make informed decisions and reduce energy waste.

How is this Home Energy Management Systems Industry segmented?

The home energy management systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Hardware

- Software

- Services

- Product

- Lighting controls

- Programmable thermostats

- Self-monitoring systems

- Advanced central controllers

- Technology

- Wireless Protocols

- Wired Protocols

- Hybrid

- Application

- New Construction

- Retrofit

- Deployment Type

- On-premises

- Cloud

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Component Insights

The hardware segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 1.16 billion in 2022. It continued to the largest segment at a CAGR of 7.08%.

Home Energy Management Systems (HEMS) have gained significant traction in the market, driven by the integration of smart meters and automated energy saving features. These systems enable electrical grid stability by facilitating two-way communication between homes and utilities, allowing for predictive energy modeling and demand response programs. Home energy dashboards provide real-time energy data and visualization, enabling users to monitor and manage their energy consumption. Energy efficiency algorithms and appliance energy usage analysis are essential components, optimizing energy storage and reducing peak demand. Grid interaction protocols ensure seamless communication between devices, facilitating load balancing strategies and device interoperability. Lighting control systems and HVAC control systems further enhance energy savings and user comfort.

The market is expected to grow substantially, with a recent study projecting a 30% increase in smart home energy management system installations by 2025. Power quality monitoring and renewable energy integration are also key trends, as more homes adopt solar panels and wind turbines for sustainable energy production. Data security measures are crucial to protect user privacy and prevent unauthorized access to energy data. A notable example of HEMS in action is a utility company in California, which implemented a smart thermostat integration program, resulting in a 10% reduction in peak electricity demand during summer months. This reduction in demand not only benefits the utility company by preventing power outages but also saves consumers money on their energy bills.

The Hardware segment was valued at USD 902.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 747.90 million. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to various factors. Integration of smart meters facilitates real-time energy consumption monitoring, enabling automated energy saving and demand response programs. Predictive energy modeling and home energy dashboards provide users with valuable insights into their energy usage, fostering energy efficiency. Grid interaction protocols ensure electrical grid stability, while energy data analytics and energy efficiency algorithms optimize energy consumption. User interface design and device interoperability enhance user experience, enabling seamless control of lighting, HVAC systems, and appliances. Power quality monitoring ensures optimal performance of these devices. Renewable energy integration and remote energy management enable sustainable energy usage and peak demand reduction.

According to recent research, the North American market holds the largest share in the market. The US, being the largest revenue contributor, is driven by increasing energy awareness, rising income levels, and the adoption of energy-efficient solutions. The market is expected to grow at a substantial rate due to the integration of advanced technologies like energy storage optimization, network communication protocols, and smart thermostat integration. For instance, a leading home energy management systems provider reported a 30% increase in sales due to their comprehensive energy management solution that includes real-time energy data, appliance energy usage, and smart thermostat integration.

This trend is expected to continue as the market moves towards harmonious integration of various entities, including energy cost reduction, smart appliance control, water heater control, and HVAC control systems. Data security measures ensure user privacy and confidence in these systems.

Market Dynamics

"The Home Energy Management Systems Market is surging, driven by AI and IoT integration for smart energy optimization, with North America leading due to high smart home adoption and supportive policies."

- Rahul Somnath, Assistant Research Manager, Technavio

The Home Energy Management Systems Market is revolutionizing how households consume energy by leveraging the impact of smart home devices on energy consumption. By optimizing energy consumption using smart home technologies, these systems enable efficient resource use. The role of home energy management in peak demand reduction helps balance grid loads, while improving energy efficiency through home automation reduces waste. energy management system integration with renewable sources, such as solar, enhances sustainability. real-time energy usage monitoring and control system empowers users with instant insights, and advanced analytics for home energy management system provide actionable data to further optimize consumption, driving market growth and promoting eco-friendly living.

The market is experiencing significant growth due to the increasing focus on residential energy consumption data analysis and optimizing energy usage in smart homes. A smart home energy management platform enables homeowners to monitor and control their energy consumption in real-time, integrating various home energy management systems and smart home devices. The integration of home energy management systems with smart home devices is having a significant impact on energy consumption, enabling homeowners to optimize energy usage and improve energy efficiency through home automation. Advanced analytics for home energy management systems provide valuable insights into energy usage patterns, allowing homeowners to make informed decisions and reduce peak demand.

Moreover, the role of home energy management systems extends beyond energy efficiency and cost savings. They also play a crucial role in peak demand reduction, helping utilities manage grid stability and prevent power outages during periods of high demand. The integration of home energy management systems with renewable energy sources, such as solar panels and wind turbines, further enhances their value proposition. Design and implementation of home energy management solutions require a comprehensive understanding of energy usage patterns, home infrastructure, and available technologies. Real-time energy usage monitoring and control systems are essential components of these solutions, providing homeowners with actionable insights and enabling them to make adjustments in real-time. As the market for home energy management systems continues to evolve, we can expect to see further innovation and integration with various smart home technologies and renewable energy sources.

What are the key market drivers leading to the rise in the adoption of Home Energy Management Systems Industry?

- The increasing implementation of smart grid technologies serves as the primary catalyst for market growth.

- The home energy management system market is experiencing significant growth due to the increasing adoption of smart grids worldwide. Utilities are integrating advanced technologies such as remote terminal units, intelligent electronic devices, and supervisory control and data acquisition systems into their transmission and distribution infrastructure. This shift towards smart grids is aimed at enhancing grid reliability and promoting energy efficiency. Smart meters, a crucial component of home energy management systems, serve as the bridge between utilities and consumers. Installed in residential properties, these meters facilitate bi-directional communication between utilities and homeowners, providing real-time or near real-time energy consumption data.

- This information empowers consumers to identify areas of energy consumption and make informed decisions to optimize their energy usage. For instance, a study revealed that households with smart meters reduced their energy consumption by an average of 10% to 15% compared to those without smart meters. As the global smart grid market is projected to grow by 15% annually, the demand for home energy management systems is expected to follow a similar trajectory. This growth is driven by the need for energy efficiency, cost savings, and the integration of renewable energy sources into the grid.

What are the market trends shaping the Home Energy Management Systems Industry?

- Smart homes and cities are experiencing significant investment, representing an emerging market trend.

- The home energy management system market is witnessing a significant surge due to the increasing adoption of smart home technologies. According to recent studies, the market is currently experiencing a robust growth, with an estimated XX% of households in the U.S. Adopting these systems. The primary reason for this trend is the convenience and efficiency offered by these systems, which enable homeowners to control various appliances using their smartphones and tablets. Moreover, the integration of artificial intelligence in home appliances is leading to predictive analysis, allowing devices to accurately anticipate consumer preferences based on historical data.

- This not only enhances the convenience factor but also contributes to energy savings and sustainability. The future growth prospects of the market are equally promising, with expectations of a continued surge in demand due to increasing consumer awareness and the availability of affordable smart home technologies.

What challenges does the Home Energy Management Systems Industry face during its growth?

- The high cost of implementation and interoperability issues represent significant challenges that hinder industry growth by imposing barriers to entry and limiting the seamless exchange of data between systems.

- Home energy management systems (HEMS) represent a significant investment for homeowners due to the integration of various components, including sensors, displays, and software. The high upfront cost has resulted in hesitancy among consumers, as they perceive the return on investment as insignificant. This trend is particularly evident in the case of smart thermostats, which are a crucial component of HEMS. Many thermostats, such as those offered by Honeywell, are DIY installations, posing a challenge for consumers who lack the technical expertise or time for installation.

- Despite these challenges, the home energy management market is expected to experience robust growth, with industry analysts projecting a 25% increase in sales over the next five years. This growth is driven by increasing energy costs, government incentives, and advancements in technology, making HEMS an attractive investment for energy-conscious homeowners.

Exclusive Customer Landscape

The home energy management systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the home energy management systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, home energy management systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - This company specializes in home energy management systems, providing advanced solutions for identifying and reducing energy consumption and carbon emissions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Amazon.com Inc.

- Bosch Thermotechnology Corp.

- Delta Electronics Inc.

- Eaton Corporation Plc

- Ecobee Inc.

- Emerson Electric Co.

- Google LLC

- Hitachi Ltd.

- Honeywell International Inc.

- Johnson Controls International Plc

- LG Electronics Inc.

- LUX Products Corporation

- Netatmo (Legrand)

- Panasonic Corporation

- Resideo Technologies Inc.

- Samsung Electronics Co. Ltd.

- Schneider Electric SE

- Siemens AG

- Tado GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Home Energy Management Systems Market

- In January 2024, Siemens Smart Infrastructure announced the launch of its new Home Energy Management System (HEMS), EnnexOS 3.0, designed to optimize energy consumption in residential buildings. This advanced system integrates renewable energy sources and electric vehicle charging stations, aiming to reduce energy costs and carbon footprints (Siemens Smart Infrastructure press release).

- In March 2024, Schneider Electric and Amazon Web Services (AWS) entered into a strategic partnership to integrate Schneider Electric's HEMS with AWS's IoT services. This collaboration enables customers to monitor and manage their energy usage through a user-friendly interface, while also providing access to advanced analytics and predictive maintenance capabilities (Schneider Electric press release).

- In May 2024, Itron, a global technology and services company, completed the acquisition of Open Energy, a leading provider of open-source energy management software. This acquisition strengthens Itron's position in the HEMS market by expanding its software offerings and enhancing its ability to deliver integrated energy solutions to utilities and consumers (Itron press release).

- In April 2025, the European Union passed the new Energy Performance of Buildings Directive (EPBD), which mandates the installation of HEMS in all new residential and commercial buildings. This regulatory initiative is expected to drive significant growth in the European HEMS market, as well as increase energy efficiency and reduce greenhouse gas emissions (European Parliament press release).

Research Analyst Overview

- The market for energy management solutions continues to evolve, with applications spanning various sectors, including building automation systems, demand-side management, and electrical power systems. User behavior analysis and energy usage patterns are increasingly important, as these insights enable more effective energy conservation strategies. For instance, a study revealed that implementing smart home devices led to a 10% reduction in energy consumption for participating households. The industry is expected to grow by over 12% annually, driven by the adoption of energy optimization techniques, advanced metering infrastructure, and automated scheduling systems.

- These advancements offer remote diagnostics capabilities, dynamic pricing response, home energy monitoring, and electricity grid management, contributing to residential energy efficiency and energy saving techniques. Energy data visualization and electricity consumption analysis facilitate energy efficiency improvements, while home energy audits and smart grid technologies further optimize system performance metrics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Home Energy Management Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.01% |

|

Market growth 2024-2028 |

USD 1970.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.86 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Home Energy Management Systems Market Research and Growth Report?

- CAGR of the Home Energy Management Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the home energy management systems market growth of industry companies

We can help! Our analysts can customize this home energy management systems market research report to meet your requirements.