Hot And Cold Water Dispensers Market Size 2024-2028

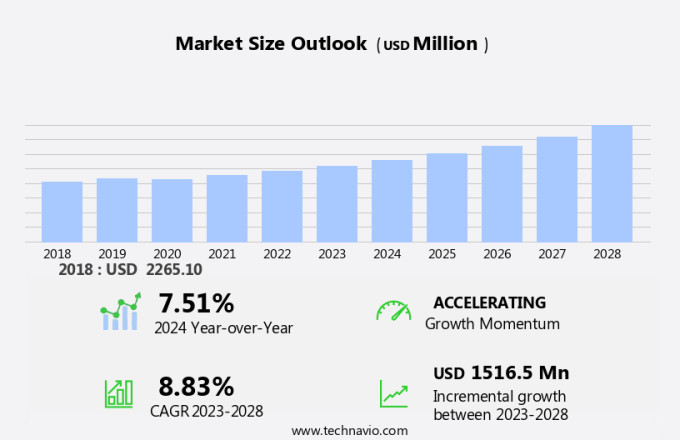

The hot and cold water dispensers market size is forecast to increase by USD 1.51 billion at a CAGR of 8.83% between 2023 and 2028. In the market, the demand for hot and cold water dispensers continues to grow due to several key factors. The increasing emphasis on health and hygiene is driving the adoption of these devices, as they provide easy access to safe drinking water. Additionally, the trend toward energy efficiency is leading to the widespread use of hot and cold water dispensers, which consume less power than traditional water heating systems. The growing popularity of smart home technologies has led to the integration of water coolers and smart faucets, offering homeowners greater control and efficiency in managing their water usage and overall comfort. Another factor contributing to the market's growth is the extended intervals between product replacements, making these appliances a cost-effective solution for both residential and commercial applications.

What will be the Size of the Market During the Forecast Period?

The market for water dispensers, which provide both hot and cold water temperatures, has gained significant traction in recent years. These electronic appliances have become essential in various settings, including homes, offices, and public spaces, due to their ability to offer clean, convenient, and diverse hydration options. Water dispensers cater to the increasing demand for safe drinking water, surpassing the reliance on traditional methods such as tap water and water pitchers. The product replacement cycle for these appliances is typically longer than that of other household or office appliances, making them a worthwhile investment.

Moreover, in the realm of energy departments and appliance standards, hot and cold water dispensers are designed with energy efficiency in mind. Portability is another key feature, allowing users to easily move the appliance from one location to another. The integration of filters in water dispensers ensures the delivery of clean and safe water, addressing concerns regarding water quality. The dispenser faucet offers a contactless dispensing feature, enhancing the overall user experience and promoting hygiene. Hot water dispensers are particularly popular in homes and offices, as they provide the convenience of instant hot water for various purposes, such as making tea, coffee, or soups.

Furthermore, cold water dispensers, on the other hand, are preferred in settings where large quantities of cold water are required, such as in schools, hospitals, and offices. In conclusion, the market for hot and cold water dispensers continues to grow, driven by the need for convenient, clean, and diverse hydration options in various settings. These appliances cater to the evolving needs of consumers and offer numerous benefits, including energy efficiency, portability, and improved water quality.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Bottles

- Plumbed-in

- End-user

- Commercial

- Residential

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

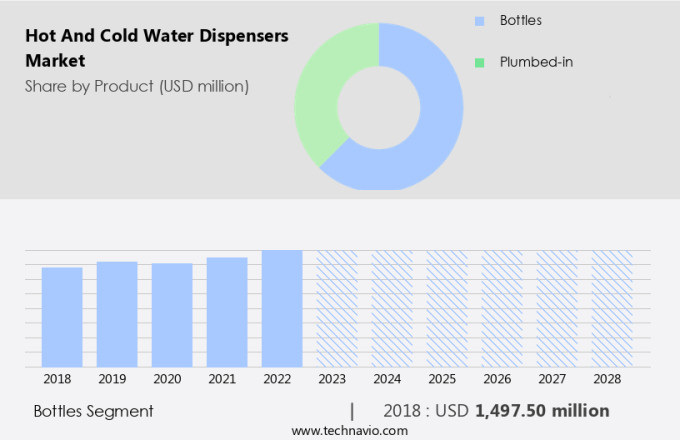

The bottles segment is estimated to witness significant growth during the forecast period. Hot and cold water dispensers have gained popularity in the US market due to their ability to provide a refreshing and customizable drinking experience. The bottles segment is a significant component of this market, offering a practical solution for accessing clean and safe water. These dispensers accommodate bottled water, ranging from small 5-gallon jugs to larger 20-liter containers. With temperature control options, users can enjoy hot or cold water at their preferred temperature. For households with children, safety locks ensure that the dispensers remain secure and prevent accidental usage. Advanced filtration systems are integrated into these dispensers to remove impurities and contaminants, providing a healthier drinking experience.

Furthermore, installation flexibility allows for easy integration into various water supply systems, making it a convenient choice for both residential and commercial applications. Bottled water offers a more sustainable alternative to traditional bottled water, reducing the need for frequent deliveries and the associated environmental impact. The market is experiencing growth as consumers increasingly seek energy-efficient models with advanced insulation to maintain water temperature while reducing energy consumption.

Get a glance at the market share of various segments Request Free Sample

The bottles segment accounted for USD 1.49 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

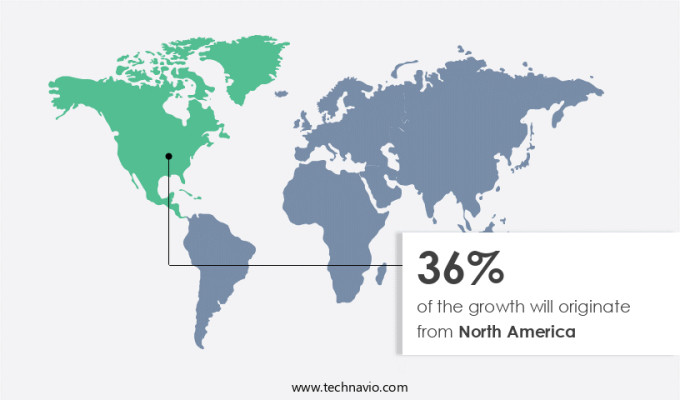

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is projected to expand due to several factors. Key industry players, a rising focus on clean and safe drinking water, and increasing investments in commercial and residential appliances are driving the market's growth. Climate conditions and population growth are additional factors contributing to the market's expansion. To boost market penetration, companies are investing in advertising and marketing efforts to showcase the device's benefits, such as energy efficiency and the convenience of having hot and cold water readily available from a single unit. This streamlined vertical configuration offers simplicity and space efficiency, making it an attractive solution for businesses and homes alike. The hot and cold water dispenser market in North America is poised for significant growth during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rising awareness of health and hygiene is the key driver of the market. In today's modern lifestyles, the demand for clean and safe drinking water is at an all-time high. Hot and cold water dispensers have emerged as a popular solution for individuals seeking an alternative to traditional water sources such as tap water or bottled water. These advanced appliances are equipped with state-of-the-art filtration systems that ensure water undergoes pre-treatment and contactless operation for enhanced hygiene. Sensor-based monitoring and hands-free dispensing technology further add to the convenience and efficiency of these technology-driven water dispensers. The market for hot and cold water dispensers is witnessing significant growth due to the increasing focus on water purification methods and the integration of advanced filtration techniques such as UV purification, carbon filtration, and antimicrobial technologies.

Moreover, product replacement cycles are becoming more frequent as consumers prioritize the importance of maintaining a clean and healthy water supply. The integration of modern technologies such as touchless operation and sensor-based monitoring ensures that the water dispensed is free from impurities and contaminants, providing peace of mind to consumers. Overall, hot and cold water dispensers offer a reliable and efficient solution for individuals seeking clean and safe drinking water in their homes and workplaces.

Market Trends

Increasing adoption of energy-efficient hot and cold water dispensers is the upcoming trend in the market. The market for hot and cold water dispensers in the United States is witnessing an upward trend due to the rising demand for energy-efficient appliances. With increasing awareness about hygiene and the need for convenient access to hot and cold water, these dispensers have become a popular choice for both residential and commercial applications. Small living spaces, a common feature in urban areas, make energy-efficient hot and cold water dispensers an attractive option. These appliances not only save energy but also contribute to environmental consciousness.

Advanced technologies and insulation materials used in their design help minimize energy consumption. Additional features such as temperature control options and energy-saving modes further enhance their appeal. As consumers become more environmentally conscious and seek to reduce their carbon footprint, the demand for energy-efficient hot and cold water dispensers is expected to continue growing.

Market Challenge

A low product replacement cycle is a key challenge affecting market growth. Hot and cold water dispensers are essential electronic devices used in both commercial and residential settings as water dispensing solutions. These appliances are constructed with high-quality materials to ensure extended usage intervals, making them a worthwhile investment. The replacement cycle for these appliances is typically lengthy due to their durable and superior build. While some high-end models may carry a higher initial cost, the minimal maintenance and cleaning expenses over their lifespan make them cost-effective. As part of the growing trend towards intelligent household technologies, hot and cold water dispensers offer convenience and safe drinking water for remote work environments and home use.

Countertop water dispensers are a popular choice for their portability and ease of use. Consumers' investment in these appliances is protected by appliance standards and regulations, ensuring a safe and reliable product. The low replacement cycle of these electronic appliances makes them a wise investment for both personal and professional use.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atlantis: The company offers hot and cold water dispensers such as Atlantis blue normal and cold floor standing water dispenser, Atlantis hot normal and cold table top water dispenser, and Atlantis frosty plus normal hot cold water dispenser with floor standing.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avalon Water Coolers

- Avanti Products LLC

- Blue Star Ltd.

- Breville Group Ltd.

- Celli Spa

- Clover Co. Ltd

- Culligan International Co.

- Haier Smart Home Co. Ltd.

- Honeywell International Inc.

- KENT RO Systems Ltd.

- LUQEL Ltd

- Midea Group Co. Ltd.

- Panasonic Holdings Corp.

- Pentair Plc

- Primo Water Corp.

- Sas Bakery Equipments.

- Tata Sons Pvt. Ltd.

- Waterlogic Holdings Ltd

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

In today's fast-paced world, the demand for hot and cold water dispensers has grown significantly in various environments, including homes, offices, and public spaces. These appliances cater to diverse hydration needs, offering hot beverages like tea and coffee, as well as a refreshing cold water option. Temperature control is a key feature, allowing users to customize their preferences. Safety is a top priority, with features like temperature locks ensuring the safety of children and households. Advanced filtration systems remove impurities and contaminants, providing a healthier drinking experience. Installation flexibility is essential, as water dispensers can be connected to a main water supply or use bottled water.

Furthermore, the water dispenser industry is an essential resource, providing essential services in the face of challenges such as a diminished workforce, scarcity of raw materials, and constrained timelines. Energy efficiency is a major concern, with the adoption of energy-efficient electronic appliances and smart grids. Advanced water dispensers are compact, smart, and energy-efficient solutions, offering basic temperature requirements and plumbing compatibility for both commercial and residential usage. They are reliable and accessible sources of water for cooking and hydration in commercial settings, businesses, and modern lifestyles. Technological progress has led to advanced purification methods and filtering components, ensuring safe drinking water.

Moreover, contactless operation and sensor-based monitoring enhance hygiene, while hands-free dispensing technology provides enhanced convenience. The product replacement cycle for electronic appliances is extended, making them resourceful problem-solver in unforeseen circumstances. In conclusion, hot and cold water dispensers are essential appliances that cater to diverse hydration needs, prioritize safety, and offer advanced filtration systems for a healthier drinking experience. Their flexibility, energy efficiency, and technological advancements make them a valuable investment for households and businesses alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.83% |

|

Market Growth 2024-2028 |

USD 1.51 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.51 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Atlantis, Avalon Water Coolers, Avanti Products LLC, Blue Star Ltd., Breville Group Ltd., Celli Spa, Clover Co. Ltd, Culligan International Co., Haier Smart Home Co. Ltd., Honeywell International Inc., KENT RO Systems Ltd., LUQEL Ltd, Midea Group Co. Ltd., Panasonic Holdings Corp., Pentair Plc, Primo Water Corp., Sas Bakery Equipments., Tata Sons Pvt. Ltd., Waterlogic Holdings Ltd, and Whirlpool Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch