HVAC Services Market Size 2025-2029

The hvac services market size is valued to increase USD 46.04 billion, at a CAGR of 8.8% from 2024 to 2029. Rapidly growing surface temperature will drive the hvac services market.

Major Market Trends & Insights

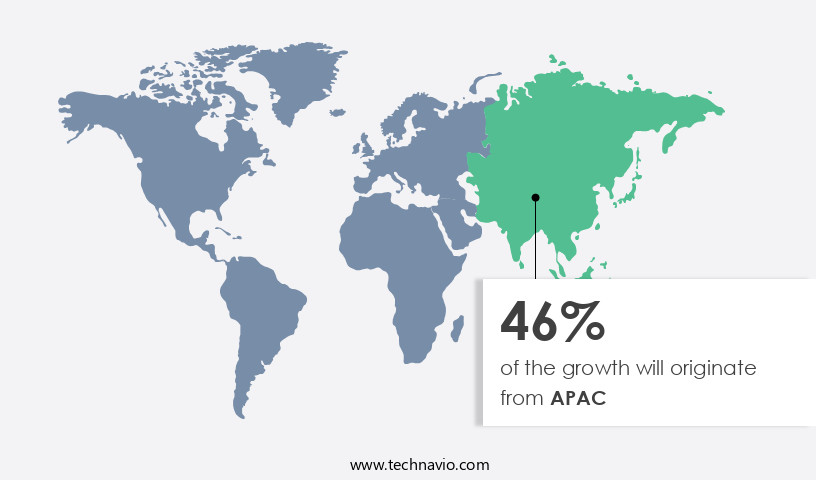

- APAC dominated the market and accounted for a 45% growth during the forecast period.

- By Service Type - Air conditioning services segment was valued at USD 35.94 billion in 2023

- By End-user - Non-residential segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 87.92 million

- Market Future Opportunities: USD 46036.80 million

- CAGR : 8.8%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving industry, driven by advancements in core technologies and applications. Rapidly growing sectors include the adoption of surface temperature advanced monitoring systems and intelligent technologies, which are transforming the way businesses and households manage their climate control needs. These innovations offer significant opportunities for market growth, yet face challenges from fluctuating prices of HVAC system raw materials. With the increasing demand for energy efficiency and sustainability, service types such as maintenance, repair, and installation continue to be in high demand.

- According to recent reports, The market is expected to account for over 50% of the total HVAC market share by 2025. This underscores the importance of staying informed about the latest trends and developments in this continuously evolving sector.

What will be the Size of the HVAC Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the HVAC Services Market Segmented and what are the key trends of market segmentation?

The hvac services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service Type

- Air conditioning services

- Heating services

- Ventilation services

- End-user

- Non-residential

- Residential

- Distribution Channel

- Online

- Offline

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Service Type Insights

The air conditioning services segment is estimated to witness significant growth during the forecast period.

Air conditioning systems have become an essential component of modern indoor spaces, with their application extending to various sectors including residential, commercial, and industrial buildings. The global market for HVAC services is experiencing significant growth due to the increasing demand for energy-efficient solutions, integration of building automation systems, and the expanding construction industry. Energy efficiency ratings play a crucial role in the selection of HVAC systems, with building energy modeling and thermal comfort standards guiding the design process. Humidity control systems, cooling system efficiency, and preventive maintenance schedules are essential considerations for maintaining optimal indoor environments. Heating system capacity and HVAC system upgrades are key areas of focus for businesses seeking to improve energy efficiency and reduce operational costs.

Air filtration systems, chilled water systems, and smart HVAC controls are increasingly popular solutions for enhancing indoor air quality and optimizing energy usage. The market for HVAC services is expected to grow substantially in the coming years, with a significant increase in demand from emerging markets. Preventive maintenance schedules, heat pump technology, and airflow optimization techniques are some of the trends driving this growth. Maintenance contract options and the HVAC equipment lifecycle are important factors influencing market dynamics. Thermal insulation materials, refrigeration cycle analysis, commissioning and testing, boiler system maintenance, energy monitoring software, and variable refrigerant flow are some of the key areas of innovation in the HVAC industry.

Retrofit projects, ductwork design standards, refrigerant charge calculations, air quality monitoring, and demand-controlled ventilation are also gaining traction as businesses seek to optimize their HVAC systems and reduce energy consumption. According to recent market research, The market is projected to grow by 15% in the next three years. Additionally, the market for building automation systems is expected to expand by 20% during the same period. These trends reflect the ongoing evolution of the HVAC industry and the increasing importance of energy efficiency and indoor environmental quality in modern buildings.

The Air conditioning services segment was valued at USD 35.94 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How HVAC Services Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing significant expansion due to population growth, extreme climatic conditions, and increasing urbanization. The construction sector's rise, particularly in commercial and residential projects, fuels the demand for HVAC systems. Energy-efficient HVAC systems are gaining popularity in the region due to green building initiatives in countries like China and India. Additionally, substantial investments in the real estate sector further propel the market's growth.

The APAC the market's dynamics are continuously evolving, with the adoption of advanced technologies and increasing focus on energy efficiency shaping future trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global HVAC systems market continues to evolve as organizations adopt strategies that balance performance, sustainability, and cost efficiency. Selecting the optimal HVAC system configuration for commercial buildings is becoming increasingly important as it directly impacts energy consumption, indoor air quality, and overall building operation costs. Reducing energy consumption in HVAC systems through advanced control technologies and data-driven optimization is central to lowering greenhouse gas emissions while meeting global efficiency standards.

Market research indicates that implementing energy-efficient HVAC technologies can cut operating expenses by as much as 25% compared to conventional systems. HVAC system retrofits for improved energy efficiency, combined with HVAC system design for LEED certification, are driving greater adoption across commercial facilities. Efficient refrigerant management practices further support sustainability goals, while strategies for enhancing HVAC system reliability ensure consistent performance in mission-critical environments.

To achieve long-term value, building operators are focusing on HVAC system maintenance for extended lifespan and techniques for minimizing HVAC system downtime. Implementing preventative maintenance programs enables proactive management of components, reducing unexpected failures and managing HVAC maintenance costs effectively. Calculating HVAC system return on investment using performance data highlights how advanced HVAC control system implementation and improving HVAC system response time contribute to optimized outcomes. By ensuring HVAC system compliance with building codes and adopting continuous monitoring, the market is aligning toward smarter, cleaner, and more reliable climate control solutions that enhance both environmental and economic performance.

What are the key market drivers leading to the rise in the adoption of HVAC Services Industry?

- The rapid increase in surface temperature serves as the primary driver for the market's growth.

- The market is experiencing a significant shift due to the increasing surface temperatures around the world, driven by climate change. This trend is leading to increased demand for cooling systems in both residential and commercial sectors, particularly in regions that were previously considered temperate. As a result, HVAC service providers are expanding their capacity, improving system efficiency, and incorporating sustainable technologies to meet evolving consumer expectations and regulatory requirements.

- High-efficiency heat pumps, solar-powered HVAC units, and smart thermostats are gaining popularity as energy-efficient solutions to address escalating utility costs and environmental concerns. This ongoing evolution in the market reflects the continuous adaptation to changing climate patterns and consumer needs.

What are the market trends shaping the HVAC Services Industry?

- Advanced monitoring systems and intelligent technologies are becoming the market trend. Advanced monitoring systems and intelligent technologies are gaining popularity in various industries.

- Intelligent technologies and monitoring systems are revolutionizing The market. These innovations enable HVAC systems to regulate energy output effectively, while monitoring devices measure building energy consumption. The HVAC industry is capitalizing on the Internet of Things (IoT) integration to generate new revenue streams. The commercial building sector is expected to be an early adopter of this technology. IoT connects network-enabled devices to the Internet, facilitating data exchange. Although the adoption of IoT is still in its infancy, it offers significant potential for the HVAC industry.

- By leveraging IoT, HVAC systems can optimize energy usage, reduce operational costs, and enhance overall system performance. The integration of intelligent technologies and monitoring systems in HVAC services is a game-changer, transforming the industry landscape and opening up new opportunities for growth.

What challenges does the HVAC Services Industry face during its growth?

- The HVAC industry faces significant growth challenges due to the volatile pricing of its raw materials.

- The market experiences significant fluctuations due to the impact of raw material prices. Stainless steel, iron, bronze, and copper are essential components in HVAC equipment manufacturing. The prices of these materials are influenced by factors such as inflation, production levels, and supply. For instance, a 10% increase in the price of stainless steel could lead to a corresponding rise in the cost of HVAC equipment production. Small HVAC companies, unable to enter long-term contracts with suppliers, are more vulnerable to these price changes. Consequently, they face challenges in maintaining profitability and competitiveness. According to recent data, The market size was valued at USD200 billion in 2020, with a year-on-year growth rate of approximately 5%.

- Despite this growth, the market remains dynamic, with ongoing shifts in raw material prices and production costs affecting market trends. In summary, the market is influenced by the price volatility of key raw materials. Companies that can effectively manage these price fluctuations through strategic supplier relationships and operational flexibility are better positioned to succeed in this evolving market.

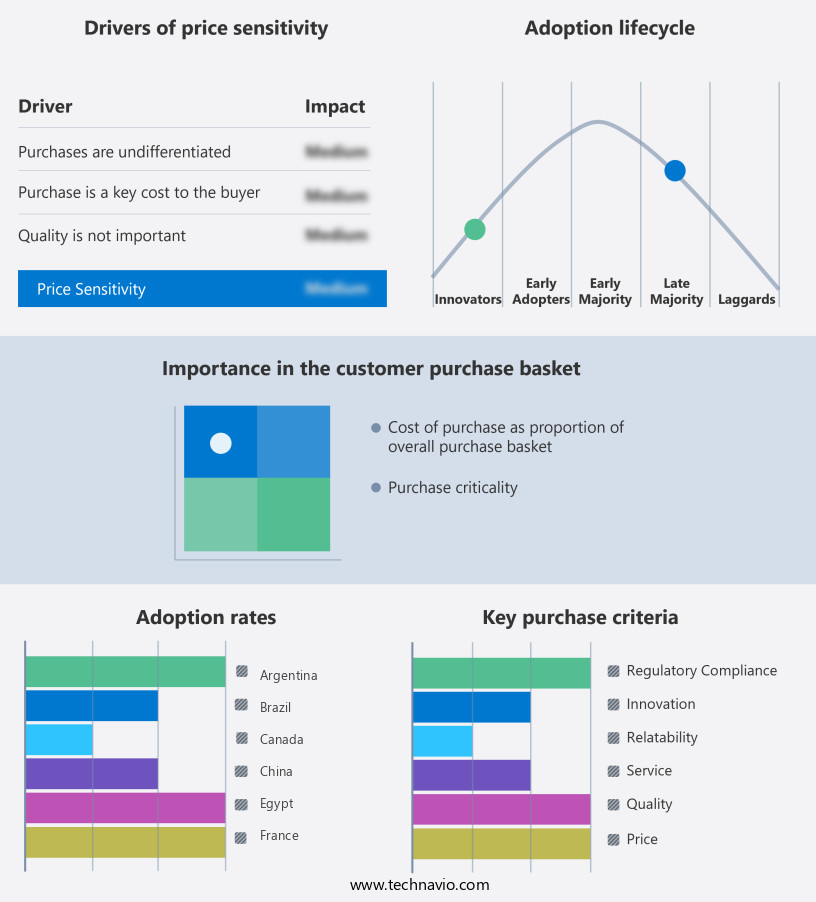

Exclusive Customer Landscape

The hvac services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hvac services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of HVAC Services Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, hvac services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABM Industries Inc. - This company specializes in providing HVAC services, including preventative testing and commissioning, ensuring optimal system performance and energy efficiency for various industries. Their expertise lies in enhancing indoor environments through comprehensive maintenance solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABM Industries Inc.

- Air Comfort

- Alexander Mechanical Inc.

- Blue Star Ltd.

- Carrier Global Corp.

- Daikin Industries Ltd.

- EMCOR Group Inc.

- Emerson Electric Co.

- ENGIE SA

- Ferguson plc

- Fujitsu General Ltd.

- Ingersoll Rand Inc.

- J and J Air Conditioning

- Johnson Controls International Plc

- Lennox International Inc.

- LG Electronics Inc.

- Nortek

- Samsung Electronics Co. Ltd.

- Service Logic

- Siemens AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in HVAC Services Market

- In January 2024, Carrier Global Corporation, a leading HVAC manufacturer, announced the launch of its new line of energy-efficient air conditioning units, the AquaEdge 19DV centrifugal chiller, at the AHR Expo (Source: Carrier Global Corporation Press Release). This innovative product is designed to reduce energy consumption by up to 10% compared to previous models.

- In March 2024, Johnson Controls, another major player in the HVAC market, entered into a strategic partnership with Google to integrate its OpenBlue digital platform with Google's Building IoT (Source: Johnson Controls Press Release). This collaboration aims to enhance energy efficiency and optimize building operations using advanced analytics and machine learning.

- In May 2024, United Technologies Corporation completed the acquisition of Honeywell International's Home and Building Technologies business, significantly expanding its presence in the market (Source: United Technologies Corporation Press Release). The acquisition added approximately USD7.8 billion in revenue to United Technologies' portfolio.

- In February 2025, the European Union passed the revised Energy Performance of Buildings Directive (EPBD), mandating stricter energy efficiency standards for new and existing buildings (Source: European Parliament Press Release). This policy change is expected to drive demand for energy-efficient HVAC systems in Europe.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled HVAC Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.8% |

|

Market growth 2025-2029 |

USD 46036.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.9 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, UK, Canada, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving realm of HVAC services, energy efficiency ratings have emerged as a significant driving force. Building automation systems, which integrate HVAC components with other building systems, are increasingly adopted to optimize energy usage. Building energy modeling, a crucial aspect of design, enables the prediction and analysis of energy consumption patterns. Humidity control systems ensure thermal comfort by maintaining optimal indoor conditions, while troubleshooting HVAC issues is essential for maintaining cooling system efficiency. Preventive maintenance schedules, a proactive approach, help extend heating system capacity and reduce downtime. HVAC system upgrades, incorporating advanced technologies like air filtration systems and chilled water systems, enhance overall performance.

- Smart HVAC controls, such as thermal comfort standards and airflow optimization techniques, facilitate energy savings and improved indoor air quality. Variable refrigerant flow and demand-controlled ventilation systems adapt to changing conditions, further increasing efficiency. Maintenance contract options offer peace of mind, ensuring professional upkeep of HVAC equipment throughout its lifecycle. Thermal insulation materials, a critical component in HVAC design, reduce energy loss and improve system efficiency. Refrigeration cycle analysis and commissioning and testing are essential steps in ensuring optimal HVAC performance. Boiler system maintenance and energy monitoring software further enhance efficiency and cost savings. Retrofit projects, incorporating heat pump technology and ductwork design standards, transform older systems into energy-efficient powerhouses.

- Refrigerant charge calculations and air quality monitoring are integral to maintaining system health and performance. Overall, the market continues to evolve, with a focus on energy efficiency, advanced technologies, and proactive maintenance strategies.

What are the Key Data Covered in this HVAC Services Market Research and Growth Report?

-

What is the expected growth of the HVAC Services Market between 2025 and 2029?

-

USD 46.04 billion, at a CAGR of 8.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Service Type (Air conditioning services, Heating services, and Ventilation services), End-user (Non-residential and Residential), Distribution Channel (Online and Offline), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rapidly growing surface temperature, Fluctuating prices of HVAC system raw materials

-

-

Who are the major players in the HVAC Services Market?

-

Key Companies ABM Industries Inc., Air Comfort, Alexander Mechanical Inc., Blue Star Ltd., Carrier Global Corp., Daikin Industries Ltd., EMCOR Group Inc., Emerson Electric Co., ENGIE SA, Ferguson plc, Fujitsu General Ltd., Ingersoll Rand Inc., J and J Air Conditioning, Johnson Controls International Plc, Lennox International Inc., LG Electronics Inc., Nortek, Samsung Electronics Co. Ltd., Service Logic, and Siemens AG

-

Market Research Insights

- The market encompasses a diverse range of offerings, from system design and installation to maintenance, repair, and optimization. According to industry estimates, the global HVAC market size was valued at USD203.4 billion in 2020 and is projected to expand at a steady rate, driven by the increasing demand for energy efficiency and sustainability. One key trend shaping the market is the integration of advanced technologies, such as system redundancy design, remote monitoring capabilities, and duct sealing techniques, to enhance performance and reduce energy consumption. For instance, the adoption of sensors and data acquisition systems enables real-time monitoring and analysis of system performance, leading to improved energy savings and occupant comfort.

- Moreover, the growing emphasis on sustainability certifications and compliance regulations is driving the market's evolution, with companies focusing on thermal bridging reduction, refrigerant leak detection, and air pressure balancing to minimize environmental impact. Performance benchmarking data and occupant comfort surveys are essential tools for assessing the effectiveness of these measures and optimizing system design and maintenance strategies accordingly. In contrast, non-compliance with safety regulations and inadequate maintenance can lead to significant costs, including parts replacement, emergency shutdown procedures, and potential damage to indoor environmental quality. Effective maintenance log records and infiltration control measures are crucial for minimizing these risks and ensuring long-term system reliability.

- Overall, the market is characterized by continuous innovation and a focus on energy efficiency, sustainability, and regulatory compliance. By leveraging advanced technologies and best practices, companies can deliver high-performing, cost-effective, and environmentally responsible HVAC solutions for buildings of all sizes and types.

We can help! Our analysts can customize this hvac services market research report to meet your requirements.