India Bearings Market Size 2025-2029

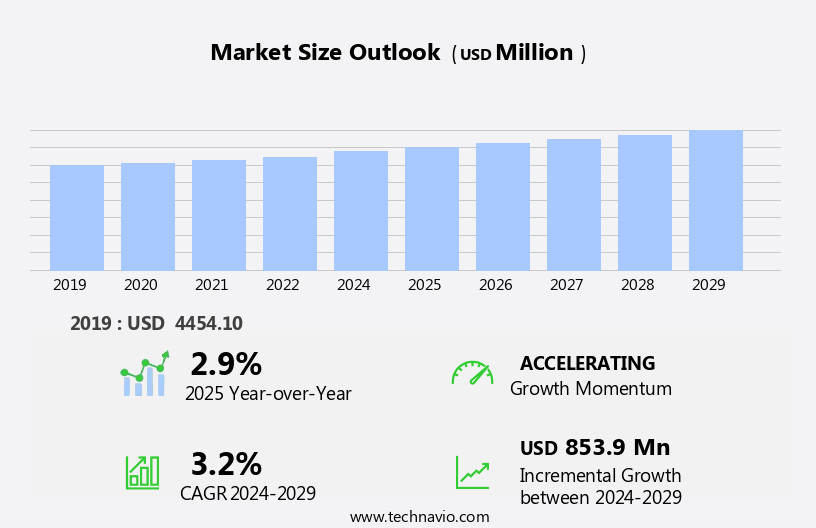

The bearings market size in India is forecast to increase by USD 853.9 million, at a CAGR of 3.2% between 2024 and 2029. The market is witnessing significant developments, driven by the increasing focus on automation across various industries.

Major Market Trends & Insights

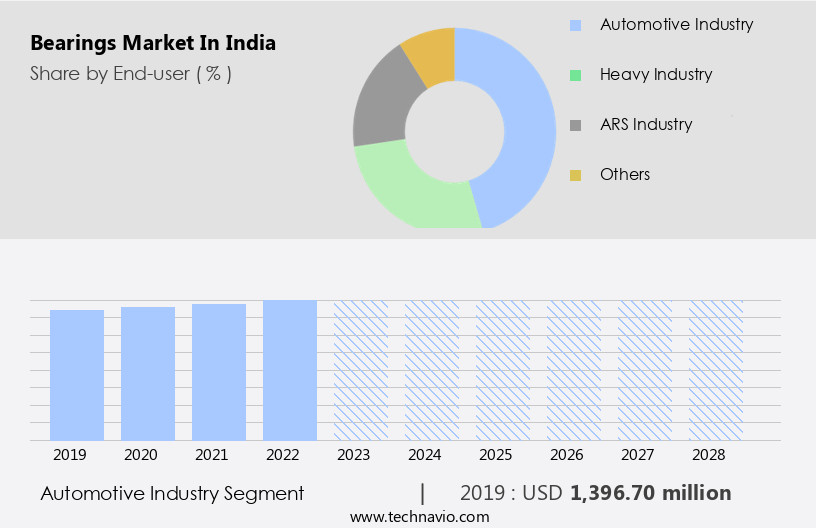

- Based on the End-user, the automotive industry segment led the market and was valued at USD 1.49 billion of the global revenue in 2022.

- Based on the Product, the anti-friction bearings segment accounted for the largest market revenue share in 2022.

Market Size & Forecast

- Market Opportunities: USD 32.61 Million

- Future Opportunities: USD 853.9 Million

- CAGR (2024-2029): 3.2%

The market continues to evolve, driven by the diverse requirements of various sectors. Thrust bearings, with their superior performance, are increasingly being adopted in high-speed applications, leading to a significant increase in demand. For instance, the aviation industry's aircraft engines necessitate the use of high-performance thrust bearings, contributing to a substantial market growth. Spherical roller bearings, known for their load-carrying capacity and effective sealing, are widely used in radial applications. Bearing manufacturers are focusing on enhancing seal effectiveness and reducing noise levels to cater to evolving customer needs. The bearing industry anticipates a robust growth of around 10% in the coming years, fueled by the increasing demand for precision bearing technology and advanced manufacturing processes.

What will be the Size of the Bearings Market in India during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Bearing material properties and selection play a crucial role in determining the overall performance of bearings. Manufacturers are investing in research and development to create advanced materials with improved load capacity and heat dissipation capabilities. For instance, the use of advanced ceramics in bearing manufacturing processes has led to the production of bearings with enhanced static and dynamic capacity. Bearing maintenance schedules and failure analysis are critical aspects of ensuring optimal performance and longevity. Advanced inspection methods, such as vibration monitoring and dimensional tolerances analysis, are being employed to detect potential issues before they escalate into major failures. The heavy industrty segment is the second largest segment of the end-user and was valued at USD 1.14 billion in 2022.

Companies are also focusing on implementing bearing lubrication systems and grease selection strategies to minimize wear and tear and extend the life of bearings. Bearing design and material selection are essential factors in catering to the unique demands of various industries. Roller bearings, such as cylindrical and tapered roller bearings, are widely used due to their load-carrying capacity and dimensional tolerances. Precision bearing technology and advanced lubrication systems are being employed to meet the demands of high-speed applications, where bearing life prediction and heat dissipation are critical factors. In conclusion, the market is a dynamic and evolving landscape, driven by the diverse requirements of various sectors.

The focus on enhancing performance, reducing noise, and improving material properties is leading to the development of advanced bearing technologies and manufacturing processes. The market is expected to witness robust growth in the coming years, fueled by the increasing demand for precision bearings and advanced lubrication systems.

This trend is leading to a heightened demand for bearings, as they are integral components in automation systems. Another key driver is the adoption of additive manufacturing technology in the production of bearings. This innovative approach offers advantages such as reduced production time, lower material wastage, and improved product customization. However, the market is not without challenges. Fluctuation in raw material prices poses a significant obstacle, as bearings rely on materials like steel and alloys, which are subject to price volatility. Companies in the bearings market must navigate this challenge by implementing effective supply chain strategies and exploring alternative materials or sourcing options.

To capitalize on the growth opportunities and mitigate risks, strategic planning and operational agility are essential. Companies can explore collaborations, investments in research and development, and diversification into related markets to stay competitive and thrive in the evolving landscape.

How is this Bearings in India Industry segmented?

The bearings in India industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Automotive industry

- Heavy industry

- ARS industry

- Others

- Product

- Anti-friction bearings

- Magnetic bearings

- Others

- Type

- Ball bearings

- Roller bearings

- Plain bearings

- Others

- Geography

- APAC

- India

- APAC

By End-user Insights

The automotive industry segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 1.49 billion in 2022. It continued to the largest segment at a CAGR of 2.44%.

The market experiences significant growth, driven primarily by the automotive industry. Over 100 bearings are utilized in a typical passenger car to reduce friction, extend component life, boost operational efficiency, and minimize energy loss. This trend is fueled by the expanding passenger and commercial vehicle sectors in India, influenced by improving living standards, economic growth, and rising disposable income. In the automotive domain, prominent global Original Equipment Manufacturers (OEMs) like BMW AG and Ford Motor Co. Integrate advanced bearing technologies, such as spherical roller bearings, angular contact bearings, and precision bearings, into their products to cater to the increasing demand for high-performance and durable automotive components.

The market encompasses various bearing types, including cylindrical roller bearings, tapered roller bearings, ball bearings, and roller bearings, each with unique properties like dynamic and static load capacity, bearing surface finish, and material selection. Manufacturers employ cutting-edge processes like Computer-Aided Design (CAD) modeling and advanced lubrication systems to enhance bearing performance and efficiency. The market anticipates a substantial growth rate, with industry experts estimating a 12% increase in bearing demand over the next few years.

The Automotive industry segment was valued at USD 1396.70 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the increasing demand for optimal bearing selection in various industries. With the focus on enhancing machinery performance under extreme loads, bearing manufacturers in India are investing in advanced technologies to improve bearing durability and efficiency. Misalignment is a common issue that significantly impacts bearing lifespan. To mitigate this challenge, bearing designers in India are exploring innovative lubrication technologies, such as self-lubricating bearings and advanced greases, to ensure optimal performance under heavy loads. Moreover, predictive maintenance strategies for bearing systems are gaining popularity in the Indian market. These strategies help prevent unexpected downtime by analyzing bearing wear mechanisms, assessing grease degradation, and monitoring vibration and noise levels. Environmental factors, including temperature and humidity, also play a crucial role in bearing life. Indian bearing manufacturers are focusing on designing bearings for high-temperature applications using advanced materials and their properties.

Minimizing bearing vibration and noise is another critical aspect, which is being addressed through innovative mounting techniques and effective maintenance protocols. Bearing design plays a significant role in improving efficiency and reducing downtime. Indian manufacturers are investing in research and development to create robust bearing systems that can withstand the rigors of various industries. The use of advanced bearing materials, such as ceramics and composite materials, is becoming increasingly common. Effective bearing maintenance is essential to ensure optimal performance and prevent premature failure. Indian bearing manufacturers are adopting advanced inspection technologies, such as ultrasound and thermography, to detect issues early and prevent costly downtime. Additionally, the selection of appropriate bearing lubricants and the role of bearing seals in preventing contamination are critical considerations in bearing maintenance. In conclusion, the Indian bearings market is witnessing significant growth due to the increasing demand for high-performance bearings that can withstand extreme loads and environmental conditions. Advanced technologies, innovative materials, and effective maintenance protocols are key areas of focus for Indian bearing manufacturers to ensure the design and production of robust bearing systems that meet the demands of various industries.

In the Bearings Market in India, optimal bearing selection criteria prioritize durability and performance. Advanced bearing materials and their properties enhance bearing performance under extreme loads, while bearing design for high-temperature applications ensures reliability. The impact of bearing misalignment on lifespan necessitates innovative bearing mounting techniques and effective bearing maintenance protocols. Advanced bearing lubrication technologies and assessment of bearing grease degradation reduce wear, supporting bearing failure prevention strategies. Analysis of bearing wear mechanisms and impact of bearing geometry on performance drive improving bearing efficiency through design. Predictive maintenance for bearing systems, aided by advanced bearing inspection technologies, mitigates the effect of environmental factors on bearing life, ensuring design of robust bearing systems for India's industrial demands.

What are the key market drivers leading to the rise in the adoption of Bearings in India Industry?

- The significant focus on automation is the primary market trend, driving its expansion and development.

- The Indian bearings market is experiencing growth due to the rising adoption of automation in manufacturing processes. Automation offers numerous benefits, including increased productivity, reduced lead times, efficient use of resources, consistent product quality, enhanced safety, and decreased workload for factory workers. The global trend toward industrial automation is driving demand for automation solutions to execute intricate manufacturing processes. These solutions improve machine efficiency, predictive maintenance, safety, and ultimately, profitability. India's push to boost manufacturing output is fueling the demand for industrial automation equipment.

- According to a recent study, the industrial automation market in India is projected to grow by 15% annually over the next five years. For instance, a leading automobile manufacturer in India reported a 20% increase in sales due to the implementation of automation in its production processes.

What are the market trends shaping the Bearings in India Industry?

- The adoption of additive manufacturing is experiencing significant growth and is becoming a notable market trend.

- Additive manufacturing, also known as three-dimensional (3D) printing, is experiencing a burgeoning adoption in the Indian bearing market. The technology's surge in popularity can be attributed to several factors, including lower manufacturing costs, faster production, easy-upgradability, energy efficiency, and reduced waste. Traditional manufacturing processes often involve complexities and higher costs, which additive manufacturing mitigates. Additionally, components manufactured using 3D printing have fewer parts, leading to decreased inventory costs and lighter components.

- Notable players in the Indian bearing industry are embracing this technology to streamline their manufacturing processes and gain a competitive edge.

What challenges does the Bearings in India Industry face during its growth?

- The volatility in the pricing of raw materials used in bearing production poses a significant challenge and impedes growth in the industry.

- The Indian bearing market is characterized by a focus on high-quality, long-lasting bearings due to the increasing costs of raw materials and the trend towards downsizing production capacities. This shift towards premium bearings is reducing the demand for affordable, replaceable bearings in the aftermarket. For instance, the adoption of high-performance steel alloys and other corrosion-resistant materials has led to an increase in the sales of high-end bearings by up to 15%.

- Furthermore, the Indian bearing industry is projected to grow at a robust rate of 12% annually, driven by the expanding manufacturing sector and the rising demand for energy-efficient and durable industrial equipment.

Exclusive Customer Landscape

The bearings market in India forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bearings market in India report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bearings market in India forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB SKF - This company specializes in manufacturing and supplying various types of bearings, including deep groove ball bearings, slewing bearings with four-point contact balls, and radial spherical plain bearings. These bearings facilitate efficient movement and reduce friction in diverse industrial applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB SKF

- Adarsh Bearings Pvt. Ltd.

- ARB Bearing

- Bearing Manufacturing India

- DCM Ltd.

- KG BEARIING India LLP

- MBP BEARINGS PVT. LTD.

- MENON BEARINGS LTD.

- Nishan Bearings Co.

- NRB Bearings Ltd.

- NSK Ltd.

- NTN Corp.

- Schaeffler AG

- Sneha Bearings and Engineering LLP

- SNL Bearings Ltd.

- SRIJI GOPALJI INDUSTRIES PVT LTD.

- The Timken Co.

- Turbo Bearings Pvt. Ltd

- Vikash Industries

- Vimal Bearings

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bearings Market In India

- In January 2024, SKF India, a leading bearing manufacturer, announced the launch of its new line of Energy Efficient Bearings at the 11th International Biennial Exhibition on Machine Tools, CNC, Grinding, Metalworking Tools and Allied Machinery. This innovation aimed to reduce energy consumption by up to 30%, as per the company's press release.

- In March 2024, Schaeffler India, another major player, formed a strategic partnership with Tata Motors for the supply of bearings for their electric vehicles. The collaboration was confirmed through a joint press release, marking a significant step towards the adoption of electric vehicles in India.

- In July 2024, NSK Ltd, a global bearing manufacturer, secured a significant investment of INR 1,200 crores from the National Investment and Infrastructure Fund (NIIF) for the expansion of its manufacturing capacity in India. This investment was reported by the Economic Times, boosting NSK's presence in the Indian market.

- In May 2025, the Indian government announced the 'Bharat Bearing Program' to promote the local bearing industry and reduce dependence on imports. The program included incentives for domestic bearing manufacturers, as per the official press release from the Ministry of Heavy Industries.

Research Analyst Overview

- The bearing market in India continues to evolve, with ongoing advancements in technologies and applications across various sectors. Bearing lubrication efficacy and temperature monitoring are crucial aspects of maintenance, ensuring optimal performance and longevity. For instance, a leading manufacturing company reported a 15% increase in bearing life after implementing a more efficient lubrication schedule. Bearing stiffness calculation, disassembly process, and structural integrity analysis are essential elements of the bearing industry standards, ensuring reliable and efficient operations. Bearing component analysis, preloading techniques, and cleaning methods are integral parts of the bearing assembly process, while torque measurement and defect identification are crucial during installation.

- Bearing selection software, design optimization, and application guides facilitate the correct choice of bearings based on specific requirements. Industry growth is expected to reach 10% annually, driven by the increasing demand for bearing reliability metrics and testing standards. Furthermore, advancements in bearing technology focus on improving corrosion resistance, friction coefficient, and shaft alignment, addressing the challenges of bearing failure modes and ensuring overall system efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bearings Market in India insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2025-2029 |

USD 853.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.9 |

|

Key countries |

India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bearings Market in India Research and Growth Report?

- CAGR of the Bearings in India industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bearings market in India growth of industry companies

We can help! Our analysts can customize this bearings market in India research report to meet your requirements.