India Used Car Market Size 2025-2029

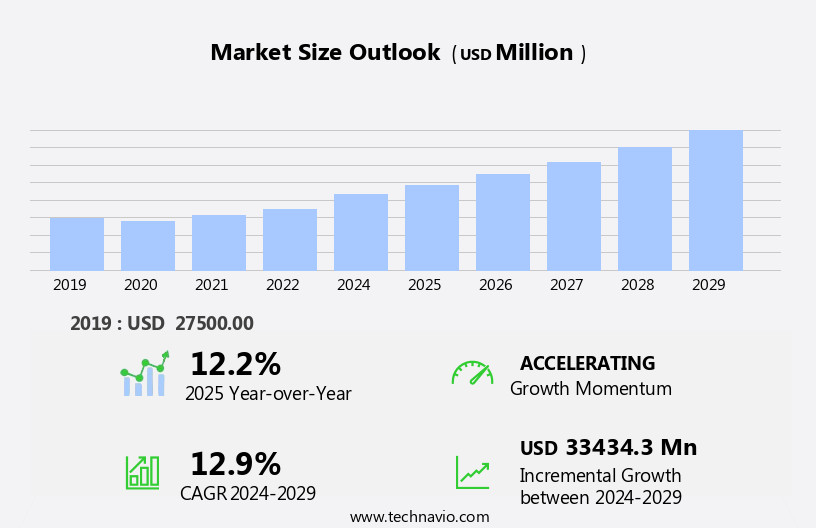

The India used car market size is forecast to increase by USD 33.43 billion at a CAGR of 12.9% between 2024 and 2029.

- The used car market presents a significant growth opportunity for businesses and investors alike, driven by several key factors. Firstly, the excellent value for money proposition of used cars continues to attract consumers, particularly in the current economic climate. This trend is further bolstered by the increasing preference for flexible mobility solutions, such as car subscription services, which offer the benefits of car ownership without long-term commitment. Furthermore, the emergence of car subscription services has added a new dimension to the market, offering flexibility and convenience to consumers. Another trend is the growing use of 3D printing in passenger car manufacturing, which offers benefits such as reduced production time and lower costs. However, this market is not without its challenges. The rise of e-commerce platforms and digital marketplaces has intensified competition, necessitating improved touchpoint management and customer experience to differentiate offerings.

- Additionally, regulatory changes and evolving consumer expectations around vehicle safety and emissions standards pose ongoing challenges for market participants. To capitalize on opportunities and navigate these challenges effectively, companies must stay abreast of market trends, invest in digital transformation, and prioritize customer satisfaction.

What will be the size of the India Used Car Market during the forecast period?

- The used car market continues to evolve, driven by shifting consumer preferences and advancements in automotive technology. Buying a used car is a popular choice for many, with the process increasingly influenced by digital tools and data-driven insights. Safety features and connectivity are key considerations, as consumers seek assurance and convenience. Car advertising and marketing strategies reflect these trends, highlighting the benefits of pre-owned vehicles in the connected car ecosystem. Autonomous vehicle development and the rise of mobility solutions, such as car sharing services, further impact the market.

- Hybrid car adoption continues to grow, contributing to changing depreciation rates and valuation dynamics. Repair and auction services remain essential components of the used car market, providing critical touchpoints in the customer journey. Overall, the used car market is a dynamic and evolving landscape, shaped by consumer needs, technological advancements, and industry trends. Diesel engines are losing favor due to environmental concerns and stricter regulations. EV charging stations and battery technology are advancing, with the Internet of Things (IoT) playing a significant role in optimizing charging and battery management.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Channel

- Offline

- Online

- Vehicle Type

- Compact car

- Mid size

- SUV

- Type

- Petrol

- Diesel

- Others

- Geography

- India

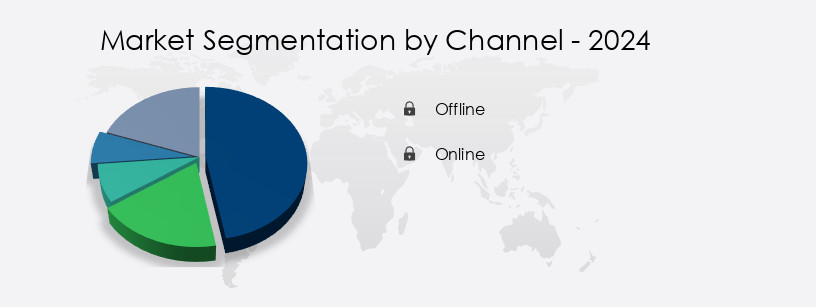

By Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The used car market in the global context is characterized by the significant presence of offline channels, which accounted for the largest market share in 2024. These channels consist of dealership chains and OEM-affiliated dealerships. Offline channels offer various advantages, including safeguards and guarantees for the original seller, smooth vehicle ownership transfer through local government tie-ups, and transparency about timelines and fees. Organized used car companies often provide technical expertise and capital support to customers. Furthermore, they have partnerships with financiers to offer better financing options, including NBFCs. Consumer reports play a crucial role in the used car market, influencing consumer decisions through data analytics, car safety ratings, and personalized recommendations based on automotive technology, fuel efficiency, environmental concerns, hybrid vehicles, electric vehicles, and maintenance records.

Car auctions, used car warranties, and car loan options are essential aspects of the used car market. Car financing, vehicle maintenance, and car value are crucial factors for consumers in the used car market. The market is expected to grow due to the increasing demand for used cars, advancements in automotive technology, and the growing popularity of electric and hybrid vehicles.

Get a glance at the market share of various segments Request Free Sample

The Offline segment was valued at USD 23903.00 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Used Car Market?

- Excellent value for money proposition of used cars is the key driver of the market. The used car market is experiencing significant growth due to the increasing number of automakers entering this sector and the rise of online used car dealerships. This trend has led to improved customer perception of used cars, as many opt for them due to their affordability. However, potential buyers remain cautious about the quality of these vehicles, as information regarding previous ownership and any post-purchase damage is often unclear, making warranties void. To build trust with customers, used car dealers offer additional services, such as extended warranties that allow for free servicing at the dealership for a specified time frame, starting from the date of purchase. This approach not only enhances customer confidence but also differentiates dealers in a competitive market.

- This dynamic is particularly pronounced in the context of autonomous driving and machine learning (ML), which are poised to revolutionize the automotive industry and create new opportunities for used car dealerships and online sales platforms. Another important consideration for consumers in the used car market is repair costs and resale value. Extended warranties and used car warranties can provide peace of mind and help mitigate the risks associated with purchasing a used vehicle. Car repair costs can vary significantly depending on the make and model, as well as the age and condition of the vehicle.

What are the market trends shaping the India Used Car Market?

- Improved touchpoint management is the upcoming trend in the market. Used car dealers and manufacturers are enhancing their online presence by implementing touchpoint management technologies on their websites. These sites serve as a crucial interface for customers to explore various car models during the research phase of their purchasing decision. Potential buyers invest significant time in examining car features, prices, and locations online. Consequently, it is essential for used car dealers to develop user-friendly and visually appealing websites to capture customer attention. Numerous online used car dealerships provide customized research services to cater to the diverse needs of buyers. To remain competitive, it is imperative for dealers to optimize their websites to facilitate seamless user experience and information accessibility.

- Online car marketplaces, digital retailing, and online sales platforms have gained popularity due to their convenience and access to extensive vehicle history reports and repair costs. Car buying guides, used car reviews, and vehicle inspections are essential resources for consumers in the used car market. Car ownership costs, including fuel efficiency, repair costs, resale value, extended warranties, and car insurance, are significant factors influencing consumer decisions. Emissions standards, maintenance records, and vehicle maintenance are essential considerations for consumers with environmental concerns. The used car market is influenced by various factors, including supply and demand, autonomous driving, machine learning, and car repair.

What challenges does India Used Car Market face during the growth?

- Increasing preference for car subscription services is a key challenge affecting the market growth. The car subscription model is a progressive business solution, gaining popularity among consumers seeking personal transportation without the long-term commitment and investment of owning a single vehicle. Subscription services enable users to select various models for a predetermined duration and mileage, offering financial relief by requiring only a fraction of the vehicle's cost. This trend may potentially decrease the demand for used car buyers, as the subscription model proves to be more economical compared to purchasing a pre-owned vehicle

- These factors is essential for making informed purchasing decisions and managing the ongoing costs of car ownership. Supply and demand dynamics also play a significant role in the used car market. Seasonal trends, economic conditions, and geopolitical factors can all impact the availability and pricing of used cars. Digital retailing and online sales platforms have made it easier for consumers to access a wide range of inventory from anywhere in the world, creating new opportunities for buyers and sellers alike. Car ownership costs, including insurance, financing, and maintenance, are also important considerations for consumers in the used car market.

How can Technavio assist you in making critical decisions?

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ALD SA - The company specializes in providing a wide selection of pre-owned luxury vehicles, including the BMW Infinity and BMW 3 Series 320d, as well as the BMW 3 GT 320d from the luxury line.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALD SA

- Auto Best

- Bayerische Motoren Werke AG

- Big Boy Toyz Pvt. Ltd.

- Cars24 Services Pvt. Ltd.

- CarWale India

- Classic Automotives

- Droom Technology Pvt. Ltd.

- Girnar software Pvt. Ltd.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Khivraj Motors

- Mahindra and Mahindra Ltd.

- NASPERS Ltd.

- Quikr India Pvt. Ltd.

- Suzuki Motor Corp.

- The VAISHNO MOTOR CO.

- Toqfactor Technologies Pvt. Ltd.

- Toyota Motor Corp.

- Valuedrive Technologies Pvt Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The used car market continues to be a significant segment of the global automotive industry, with consumers increasingly turning to online marketplaces for purchasing and researching vehicles. This trend is driven by several factors, including the convenience and accessibility offered by digital platforms, as well as the growing importance of data analytics and personalized recommendations in the car buying process. One key area of focus for consumers in the used car market is environmental concerns and fuel efficiency. Hybrid vehicles have gained popularity due to their reduced carbon footprint and cost savings over time. However, the rise of electric vehicles (EVs) is also transforming the landscape, as they offer even greater environmental benefits and increasingly competitive pricing. The used car market in India is a bustling hub of activity, offering buyers an affordable alternative to new cars. With the increasing demand for used cars, various services have emerged to facilitate used car sales and purchasing. Car valuation tools are essential for buyers and sellers to determine fair market prices. These tools use data-driven insights and automotive industry trends to provide accurate valuations. Car auction services provide a platform for buyers to bid on used cars, ensuring competitive pricing.

Car repair services are crucial for maintaining the condition of used cars. Keeping up with automotive technology trends and integrating advanced safety features and used car technology, such as car connectivity, is essential for repair services to stay competitive. Used car technology, including car data and data-driven car buying, is transforming the market. Buyers can access comprehensive vehicle history reports and make informed decisions based on real-time data. Car depreciation rates also impact used car purchasing, making it essential to understand the market trends and factors influencing depreciation. Marketing strategies for used cars have evolved, with dealers leveraging digital platforms and social media to reach potential buyers. As the used car market continues to grow, staying informed about car safety features, automotive technology trends, and market conditions is crucial for both buyers and sellers.

Automotive safety ratings and maintenance records are also crucial factors in the used car market. Consumers rely on objective data and expert opinions to assess the safety and reliability of different models. Car safety ratings provide valuable insights into the crashworthiness and protective features of vehicles, while maintenance records offer a window into the vehicle's history and potential issues. Emissions standards play a critical role in the used car market as well. Stricter regulations have led to significant improvements in vehicle technology, making older models less desirable and driving demand for newer, more efficient vehicles. Car insurance premiums can vary significantly depending on the make and model of the vehicle, as well as the driver's age and driving record. Auto financing options, including car loans and leases, can help make purchasing a used car more affordable, while vehicle history reports and maintenance records can help consumers make informed decisions about ongoing ownership costs. Customer experience is a key differentiator in the used car market, with dealerships and online platforms competing to offer the most convenient, personalized, and efficient buying experience possible. Connected car technology, such as vehicle inspection and digital retailing tools, can help streamline the buying process and provide valuable insights into the condition and value of different vehicles. The used car market is a dynamic and complex ecosystem driven by a range of factors, including environmental concerns, fuel efficiency, safety ratings, maintenance records, repair costs, resale value, and customer experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.9% |

|

Market growth 2025-2029 |

USD 33.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch