Industrial Adsorbents Market Size 2025-2029

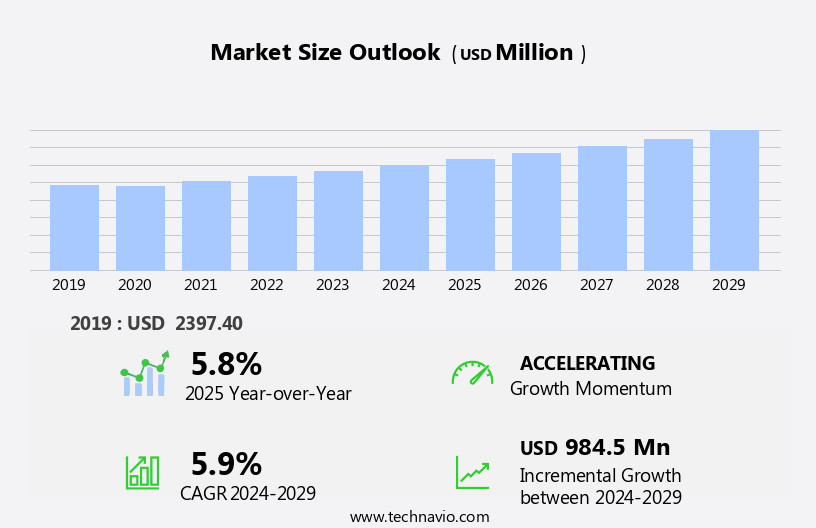

The industrial adsorbents market size is forecast to increase by USD 984.5 million, at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the launch of new oil and gas projects and strategic partnerships. These factors are increasing the demand for industrial adsorbents in various applications, particularly in the petrochemical and refining industries, water purification and air quality improvement, particularly in sectors such as food processing, air separation, and drying processes. However, the high cost of raw materials poses a significant challenge for market participants. This obstacle, as stated in the input, is putting pressure on manufacturers to find cost-effective solutions or alternative sources to maintain profitability. Companies seeking to capitalize on market opportunities must focus on innovation and efficiency to remain competitive.

- Additionally, strategic collaborations and partnerships can help mitigate the impact of raw material costs and expand market reach. Overall, the market is expected to continue its growth trajectory, with key players navigating the challenges presented by raw material costs to maximize profitability and market share.

What will be the Size of the Industrial Adsorbents Market during the forecast period?

The market continues to evolve, driven by the diverse applications across various sectors. Carbon nanotubes, with their unique properties, are increasingly utilized in odor control and moving bed adsorption systems. Surface area, a critical factor in adsorption efficiency, is maximized through advancements in adsorbent media, such as activated clay and silica gel. Chemical processing relies on adsorption for gas separation and catalyst support, while air purification applications demand high adsorbent capacity and low ash content. VOC removal and humidity control are essential in food processing and pharmaceutical manufacturing.

Moving bed adsorption and swing adsorption technologies offer improved bed life and efficiency. Adsorbent columns are integral to water treatment and industrial gases applications, with pore size distribution and bulk density key considerations. The ongoing research and development in adsorbents ensure continuous innovation and market dynamism.

How is this Industrial Adsorbents Industry segmented?

The industrial adsorbents industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Activated carbon

- Molecular sieves

- Silica gel

- Activated alumina

- End-user

- Petrochemical

- Water treatment

- Oil and gas

- Pharmaceutical

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

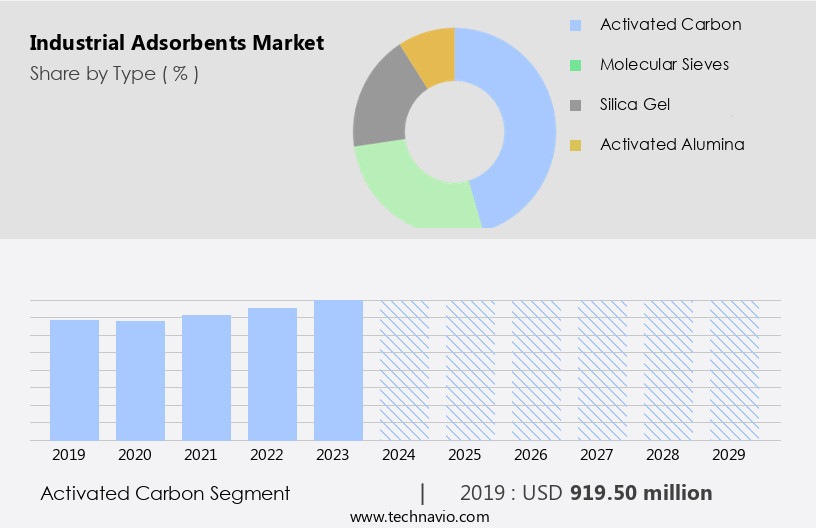

The activated carbon segment is estimated to witness significant growth during the forecast period.

Activated carbon plays a pivotal role in the market, recognized for its versatility and efficiency in eliminating various contaminants from both liquid and gas phases. Its adsorption capacity, which signifies the amount of contaminants it can adsorb per unit volume, is a crucial factor determining its effectiveness. The porous structure of activated carbon, offering an extensive surface area for adsorption, enhances its ability to capture and hold a substantial amount of contaminants, making it indispensable in purification processes. Molecular sieves, another essential component in the market, are known for their uniform pore size distribution and high selectivity towards specific gases.

They are extensively used in gas separation processes, particularly in the production of industrial gases like hydrogen, nitrogen, and oxygen. Adsorbent filters, a type of adsorbent media, are employed in water treatment and air purification applications to remove impurities and improve overall quality. Fixed bed adsorption, a common method used in industrial applications, involves passing a contaminated fluid or gas through a bed of adsorbent media. Breakthrough curves are essential in evaluating the performance of adsorbent media in fixed bed adsorption systems. The bulk density and particle size of adsorbent media significantly impact their performance in fixed bed adsorption.

Adsorbent cartridges, which house adsorbent media, are widely used in various industries, including food processing, pharmaceutical manufacturing, and chemical processing. Moving bed adsorption, an alternative to fixed bed adsorption, offers advantages such as increased capacity and improved efficiency. Surface area, an essential parameter, plays a significant role in determining the adsorption capacity of adsorbent media. Catalyst support, which is often used in conjunction with adsorbents, enhances their catalytic activity and extends their life. Ash content and moisture content are critical factors in evaluating the quality of adsorbent media. Carbon nanotubes, a relatively new entrant in the market, offer unique properties such as high surface area and excellent conductivity, making them suitable for various applications, including VOC removal and gas chromatography.

Adsorbent columns, which house large quantities of adsorbent media, are commonly used in industrial applications for humidity control, swing adsorption, and gas chromatography. Adsorption isotherms, which describe the relationship between the amount of adsorbate and the concentration in the gas or liquid phase, are crucial in designing and optimizing adsorption systems. Pore size distribution, a critical property of adsorbent media, influences their selectivity and efficiency in adsorbing specific contaminants. Silica gel, a widely used adsorbent media, is known for its high surface area and ability to adsorb water and moisture. In summary, the market is driven by the diverse applications of adsorbents in various industries, including food processing, pharmaceutical manufacturing, water treatment, and chemical processing.

The market is characterized by the versatility and efficiency of adsorbents in removing contaminants, their porous structures, and their ability to enhance catalytic activity. Continuous research and development efforts are focused on improving the performance, selectivity, and efficiency of adsorbents, making them indispensable tools in industrial applications.

The Activated carbon segment was valued at USD 919.50 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

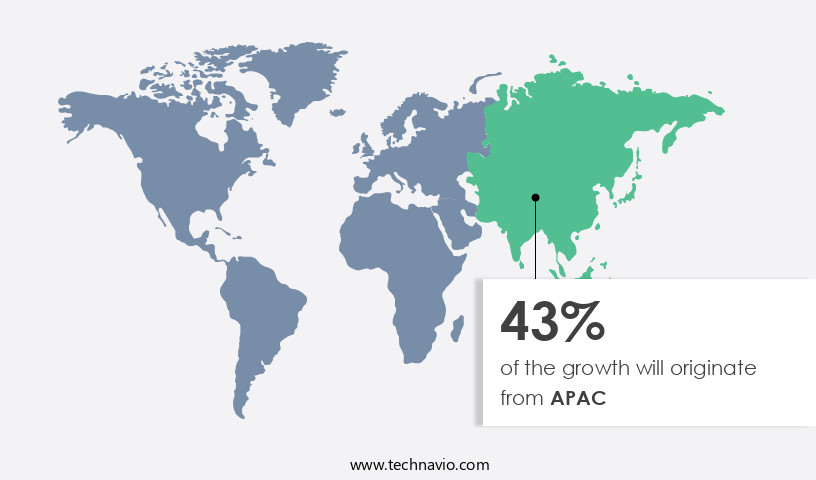

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth in the Asia Pacific region due to rapid industrialization, urbanization, and stringent environmental regulations. Advanced adsorbent technologies are increasingly being adopted to address environmental challenges and enhance industrial processes. For instance, in India, the state of Kerala is pioneering a new approach to wastewater management by introducing underground sewage treatment plants (STPs) in July 2024. This initiative, led by the local self-government department (LSGD), aims to tackle water pollution while addressing land constraints and public resistance to traditional waste treatment facilities. Molecular sieves and other adsorbents play a crucial role in various industries, including food processing, pharmaceutical manufacturing, water treatment, and chemical processing.

Adsorption isotherms and breakthrough curves are essential parameters in optimizing the performance of adsorbent beds. Fixed bed adsorption and moving bed adsorption are two common methods used for gas separation and air purification. Adsorbent media, such as silica gel and activated carbon, are widely used for VOC removal and odor control. Adsorbent filters and cartridges are essential components of adsorption systems, with particle size and bulk density being critical factors in their design and selection. Catalyst support and adsorbent capacity are essential considerations in catalytic processes. Surface area and pore size distribution are essential properties of adsorbent media that impact their adsorption capacity and selectivity.

Moisture content and ash content are essential parameters in evaluating the performance and cost-effectiveness of industrial adsorbents. Humidity control and swing adsorption are important applications of adsorbents in various industries. Gas chromatography is a common analytical technique used to evaluate the adsorption capacity and selectivity of adsorbent media. Activated clay and carbon nanotubes are emerging adsorbent materials with unique properties that offer enhanced performance in various applications. Industrial gases, such as hydrogen and nitrogen, are commonly separated using adsorbents. Adsorbent columns are used to separate and purify gases and liquids in various industries. Overall, the market is dynamic and evolving, driven by the diverse applications and performance requirements of various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Adsorbents Industry?

- The initiation of new oil and gas projects serves as the primary catalyst for market growth.

- The market is experiencing notable growth due to the increasing demand from various industries such as food processing, pharmaceutical manufacturing, water treatment, and industrial gases. Advanced adsorbents, including activated clay, are integral to purification and separation processes in these sectors. For instance, in food processing, adsorbents help remove impurities and improve product quality. In pharmaceutical manufacturing, they are used for the production of Active Pharmaceutical Ingredients. In water treatment, adsorbents play a vital role in removing contaminants and improving water quality. Similarly, in water treatment and industrial gases, adsorbents are used for Air Pollution Control and gas separation, respectively. The particle size and bulk density of adsorbents are critical factors that influence their performance in these applications.

- Moreover, the moisture content of adsorbents affects their bed life and overall efficiency. The global market for industrial adsorbents is expected to grow significantly due to the increasing demand from these industries and the ongoing research and development efforts to improve the properties of adsorbents.

What are the market trends shaping the Industrial Adsorbents Industry?

- Strategic partnerships have emerged as a significant market trend. By forming alliances with other businesses or organizations, companies can expand their reach, share resources, and leverage each other's expertise to drive growth and innovation.

- The market is experiencing a notable trend towards strategic collaborations and mergers, with companies seeking to combine expertise and enhance product offerings. One such instance is the recent merger between Sorbead India and Swambe Chemicals in 2024, forming Sorbchem India Private Limited. This union brings together the strengths of both entities, enabling the delivery of superior desiccant and adsorbent solutions, and ensuring continuous innovation and excellence. Moving bed adsorption technology, which utilizes carbon nanotubes for increased surface area, is a significant driver in the market.

- This technology plays a crucial role in chemical processing, air purification, and odor control, as well as VOC removal through adsorbent columns. The ash content of adsorbents is another key consideration, as it impacts the overall efficiency and cost-effectiveness of the adsorption process. Companies are focusing on developing advanced adsorbents with lower ash content to meet the evolving demands of various industries.

What challenges does the Industrial Adsorbents Industry face during its growth?

- The escalating costs of raw materials pose a significant challenge to the industry's growth trajectory.

- The market is currently experiencing increased costs due to the rising price of raw materials, particularly alumina. Alumina, a significant component in zeolite production, has seen a surge in prices during the second quarter of 2024. This trend can be attributed to sanctions on Russian metals and supply restrictions, leading to limited alumina production and heightened demand from aluminum smelters. Consequently, the cost of zeolites, a critical type of industrial adsorbent, has risen significantly, reaching USD728 per metric ton in the US and USD764 per metric ton in India during the first half of 2024. This upward pressure on raw material costs poses a challenge for the market, impacting the affordability and competitiveness of various applications, including humidity control, swing adsorption, and gas chromatography.

- Despite these challenges, the market continues to prioritize adsorbent capacity, pore size distribution, and the effectiveness of adsorbent beds in meeting the demands of industries such as pharmaceuticals, food and beverage, and chemical processing.

Exclusive Customer Landscape

The industrial adsorbents market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial adsorbents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial adsorbents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albemarle Corp. - This enterprise specializes in industrial adsorbents, including lithium-based solutions. These innovative products boast exceptional adsorption capacity, thermal stability, and chemical resistance, making them ideal for various industrial applications. By utilizing advanced technology and research, the company consistently delivers high-performing adsorbents that cater to diverse industries' needs. The lithium-based adsorbents' unique properties enable them to effectively address complex challenges, ensuring optimal process efficiency and product quality.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albemarle Corp.

- Arkema

- Asahi Kasei Corp.

- Axens group

- BASF SE

- Clariant International Ltd

- Ecovyst Inc.

- Fuji Silysia Chemical Ltd.

- Honeywell International Inc.

- KNT Group

- Luoyang Jalon Micro-nano New Materials Co. ltd

- PQ Group Holdings Inc.

- SILKEM Doo

- Sorbchem India Pvt Ltd.

- Spectrum Laboratory Products Inc.

- Tosoh Corporation

- W. R. Grace and Co.

- Zeochem AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Adsorbents Market

- In February 2023, DuPont Water & Process Solutions, a leading provider of water treatment and process technologies, introduced a new line of activated carbon adsorbents, Raschig Activated Carbon RX Series. These advanced adsorbents offer enhanced performance in the removal of organic contaminants, including pharmaceuticals and industrial chemicals, making them suitable for various industrial applications (DuPont Press Release, 2023).

- In November 2022, Linde plc and Praxair, Inc. Completed their merger, creating Linde plc, the world's largest industrial gases company. This merger brought together their extensive adsorbents product portfolios, enabling them to cater to a broader customer base and strengthen their market position (Linde plc Press Release, 2022).

- In May 2021, 3M introduced its new molecular sieve adsorbent, 3M⢠Puradol⢠40X8, designed for the removal of hydrogen sulfide and carbon dioxide in natural gas applications. This product launch expanded 3M's adsorbents portfolio and addressed the growing demand for cleaner natural gas production (3M Press Release, 2021).

- In March 2020, the European Union's REACH regulation approved the use of Zeochem's ZEOSORB® 350S zeolite adsorbent for the removal of nitrogen oxides from exhaust gases. This approval marked a significant milestone for Zeochem, enabling them to expand their market presence in the European emissions control market (Zeochem Press Release, 2020).

Research Analyst Overview

- The adsorbent industry continues to evolve, driven by advancements in adsorbent material science and technology. Adsorbent solutions are increasingly utilized in various industries due to their efficiency in separating, purifying, and storing gases and liquids. Adsorbent simulation and modeling play a crucial role in optimizing adsorbent process design and enhancing adsorbent performance. Adsorbent sustainability and cost-effectiveness are key considerations for businesses. The lifecycle of adsorbent materials, including regeneration systems, is a significant focus for improving overall adsorbent economics. Adsorbent innovation and engineering are essential for developing new adsorbent applications and improving existing ones. Adsorbent safety and reliability are paramount, with stringent regulations governing their use.

- Adsorbent testing and certification are essential to ensure compliance and maintain industry standards. Adsorbent manufacturing processes are continually evolving to improve durability and efficiency. Adsorbent services, including design, engineering, and optimization, are vital for businesses seeking to maximize the benefits of adsorbent technology. The adsorbent market is diverse, with a range of suppliers offering various adsorbent solutions and services. Adsorbent regulations and industry standards continue to shape the market landscape, driving innovation and collaboration among stakeholders.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Adsorbents Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 984.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, China, India, Germany, Canada, Japan, France, Brazil, UK, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Adsorbents Market Research and Growth Report?

- CAGR of the Industrial Adsorbents industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial adsorbents market growth of industry companies

We can help! Our analysts can customize this industrial adsorbents market research report to meet your requirements.