Industrial Chain Market Size 2025-2029

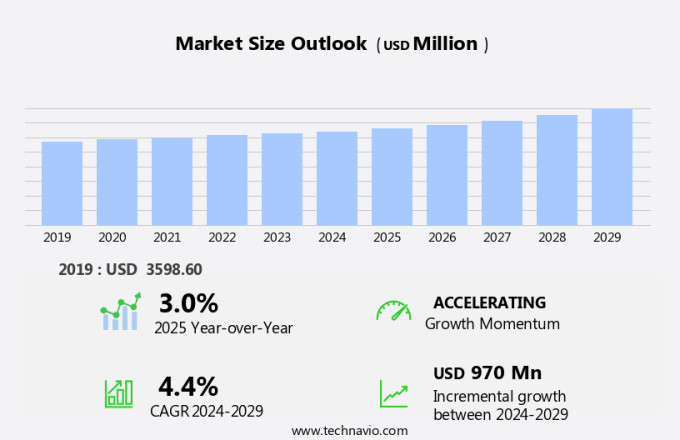

The industrial chain market size is forecast to increase by USD 970 billion at a CAGR of 4.4% between 2024 and 2029.

- The market encompasses hydraulic systems, direct drive systems, and power transmission systems, all essential components of industrial automation. This market is driven by the increasing industrialization and urbanization, leading to a heightened demand for automation solutions. companies in this market continue to introduce innovative products to meet the evolving needs of industries.

- However, fluctuations in raw material prices pose a significant challenge. Hydraulic systems, for instance, rely on oil prices, while direct drive systems depend on the availability and cost of rare earth magnets. Incorporating advanced technologies like double-pitch chains in power transmission systems can enhance efficiency and productivity, making them a popular choice for automation applications.

What will be Industrial Chain Market Size During the Forecast Period?

- The market encompasses various industries such as mining, agricultural equipment, construction, consumer goods, and transportation. This market plays a crucial role in the production and distribution of raw materials and finished products. In the upstream sector, the focus is on the extraction and processing of raw materials. The availability of cheap raw materials is a significant factor driving the market. Power transmission components, including roller chains, leaf chains, and chain drives, are essential in this stage to transport and convey materials from one process to another.

- Moving towards the midstream sector, the market plays a vital role in the transformation of raw materials into semi-finished and finished products. Automation and cost-efficient materials are essential in this stage to increase productivity and reduce costs. Material handling tools, conveyors, and sorting systems are some of the key components used in this sector. Lastly, in the downstream sector, the market facilitates the transportation of finished products to various industries and end-users. Cargo transportation and e-commerce are two significant applications in this sector. The efficient and timely delivery of finished products is crucial to maintain customer satisfaction and ensure business growth.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following industrial chain market segment

- Type

- Roller chains

- Leaf chains

- Others

- End-user

- Automotive

- Food and beverage

- Agriculture

- Mining and construction

- Oil and gas

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- South America

- Middle East and Africa

- APAC

By Type Insights

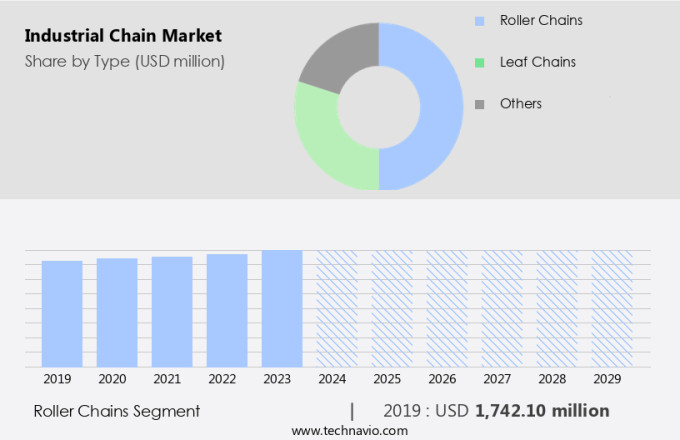

- The roller chains segment is estimated to witness significant growth during the forecast period.

Roller chains play a vital role in the transfer of mechanical power and material handling in numerous industries, including food and beverage, electronics, and transportation. These chains function by connecting to rotating sprockets linked to motors, enabling efficient power transmission or material conveyance. The roller chain structure consists of two types of links: inner links and outer links. Inner links, which include rollers and bushings between two plates, ensure smooth movement. Outer links, made up of two plates joined by pins, pass through the inner links' bushings, ensuring the chain operates optimally. Roller chains' application extends to various sectors, notably in the power transmission of industrial machinery and product conveyance within manufacturing facilities.

The food and beverage industry utilizes roller chains for processing and packaging equipment, while electronics manufacturing relies on them for assembly lines. In transportation, roller chains are essential for material handling systems, such as conveyor belts and lift trucks. Additionally, the availability of cheap raw materials contributes to the market's growth in these industries. In summary, roller chains are indispensable components in industries that require power transmission and material handling. Their versatility and efficiency make them a popular choice in food and beverage, electronics, and transportation sectors. The availability of affordable raw materials further bolsters the market's growth in these industries.

Get a glance at the market report of share of various segments Request Free Sample

The Roller chains segment was valued at USD 1742.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

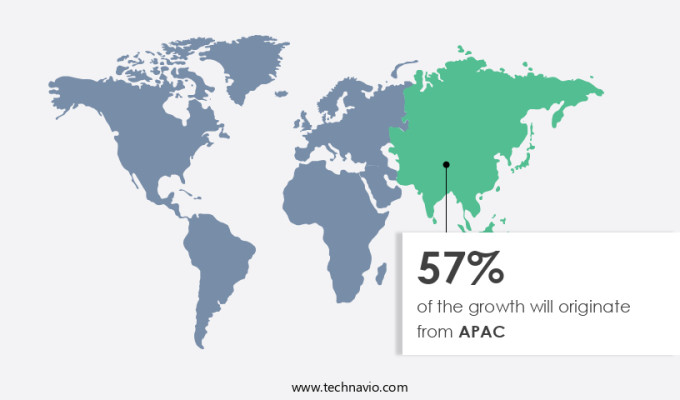

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

As per Industrial Chain Regional Insights the Asia-Pacific (APAC) will be playing a pivotal role in the market due to its thriving manufacturing, construction, mining, and agricultural sectors. In China, the world's leading manufacturing hub, industrial chains are essential for various applications, including consumer goods production and heavy machinery. For instance, the Chinese automotive sector experienced steady growth from January to September 2024, producing around 21.4 million units, a 1.9% increase year-on-year, and selling 21.57 million units, a 2.4% rise. This growth highlights the importance of industrial chains in fostering the automotive industry's expansion and efficiency. Moreover, the construction and mining industries in APAC significantly contribute to the demand for industrial chains. The agricultural sector also benefits from lightweight materials and advanced machinery, driving the need for robust industrial chains. Additionally, the increasing adoption of electric vehicles (EVs) in APAC countries is expected to further boost the demand for industrial chains in the coming years.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.The market is a complex network of interconnected industries. Each sector relies on the other to ensure a smooth flow of raw materials and finished products. The use of advanced power transmission components, such as chain drives, and material handling tools, enables industries to streamline their processes and increase efficiency. In conclusion, the market plays a vital role in the production and distribution of various industries. From the extraction and processing of raw materials to the delivery of finished products, the market ensures a seamless flow of goods and materials. By focusing on cost-efficient materials, automation, and efficient power transmission components, industries can optimize their operations and remain competitive in the market.

What are the key market drivers leading to the rise in adoption of Industrial Chain Market ?

Rising industrialization and urbanization is the key driver of the market.

- The market in the United States is experiencing significant growth due to the increasing industrialization and urbanization trend. According to the United Nations, approximately 56% of the world's population, or 4.4 billion people, resided in urban areas in 2023. This percentage is projected to reach nearly 70% by 2050. This urban population growth necessitates extensive infrastructure development and efficient manufacturing processes in cities. In the US, the manufacturing sector contributed USD2.3 trillion to the GDP in 2023, representing 10.2% of the total GDP. Industrial chains play a crucial role in supporting manufacturing activities in the US, from production lines to logistics and transportation systems.

- Chain drives, including roller chains and leaf chains, are essential components in material handling tools such as conveyors and sorting systems. These systems facilitate the efficient movement of goods and raw materials in manufacturing processes. The demand for industrial chains is expected to continue growing as the US manufacturing sector adapts to meet the needs of an urbanizing population.

What are the market trends shaping the Industrial Chain Market?

Introduction of new products by vendors is the upcoming trend in the market.

- The market is experiencing notable progressions due to the launch of innovative solutions by key players. On September 17, 2024, Tsubakimoto Chain Co. Announced the introduction of the Epsilon Chain Stainless Steel Series. Scheduled for release on October 1, 2024, this groundbreaking product boasts the world's smallest roller chain, measuring only 1.905 mm in pitch. This advanced chain is designed to deliver dependable power transmission in confined areas. Its anticipated benefits include improved precision, efficiency, and compactness in medical devices, healthcare equipment, and industrial robots. By substituting conventional belts and cables, the Epsilon Chain offers more accurate, streamlined power transmission, thereby decreasing labor requirements and enhancing energy productivity in manufacturing operations.

What challenges does Industrial Chain Market face during the growth?

Fluctuations in raw material prices is a key challenge affecting the market growth.

- The market in the United States is influenced by several factors, including the cost fluctuations of key raw materials such as steel and aluminum in the e-commerce sector and cargo transportation industry. The price instability of these materials can significantly impact manufacturing expenses, thereby shaping the market landscape. For example, the price of iron ore in China rose from USD105 per tonne in August 2023 to USD135 per tonne in December 2023. Furthermore, the cost of coal has also seen a surge, contributing to the overall rise in steel prices. Given that China is the world's leading steel manufacturer, these price increases have a substantial impact on the US the market, leading to increased production costs and narrower profit margins for manufacturers.

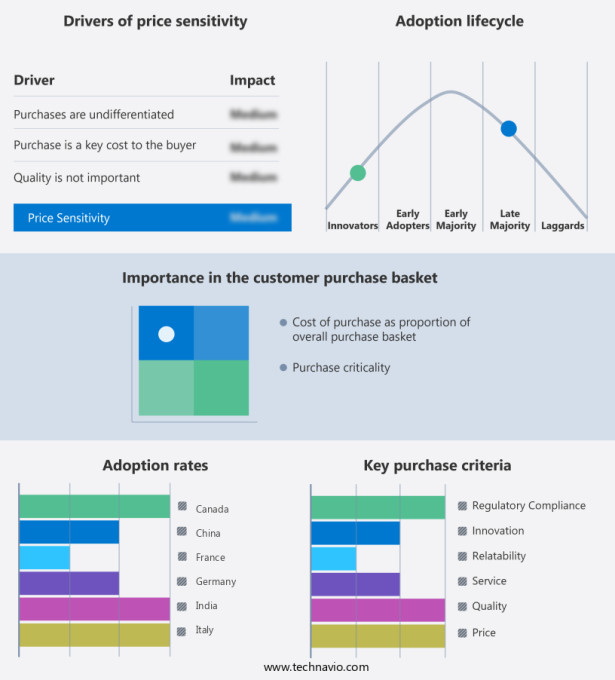

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anant Engineering - Our company provides a range of industrial chains for various applications, including extended pin chains, conveyor chains, conveyor attachment chains, and transmission chains. These chains ensure the smooth operation and efficiency of industrial processes in sectors such as manufacturing, transportation, and construction. Our offerings are of the highest quality, ensuring reliability and durability. We are committed to delivering solutions that meet the unique needs of our clients, enhancing their productivity and competitiveness in the market. Our industrial chains undergo rigorous testing to ensure they meet the highest industry standards, providing peace of mind and reducing downtime. Our team of experts is always available to provide technical support and guidance, ensuring optimal performance and longevity of our products. With a focus on innovation and continuous improvement, we strive to provide our clients with the best possible solutions for their industrial chain needs.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anant Engineering

- CAN AM CHAINS

- DAIDO KOGYO Co. Ltd.

- Diamond Drives

- EMCO Engineering

- ESBEE MACHINERY Pvt Ltd.

- Hangzhou Donghua Chain Group Co Ltd

- MAXCO Chain Ltd.

- Ming Chang Chain

- Regal Rexnord Corp.

- Regina Catene Calibrate Spa

- Renold Plc

- Rolcon Engineering Co Ltd.

- ROLLERCHAIN

- Sugiyama Chain Co. Ltd.

- Tripcon Engineering Pvt Ltd

- Webster Industries Inc.

- Wippermann junior GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various industries, including mining, agricultural equipment, construction, consumer goods, and more. A key component of this market is the production and distribution of power transmission systems, such as chain drives, roller chains, and leaf chains. These systems are essential for industries that require heavy material handling, including manufacturing, transportation, and logistics. Upstream in the industrial chain, raw materials are sourced at a low cost to produce cost-efficient materials. Midstream, these materials are transformed into semi-finished products, which are then used to manufacture finished products in the downstream sector. Industries like food and beverage, electronics, and automotive rely on material handling systems, conveyors belt, sorting systems, and automation to produce and distribute their goods.

Outdated machinery and inefficient power transmission systems can hinder the productivity and profitability of industrial operations. Therefore, there is a growing trend towards the adoption of advanced power transmission systems, such as electric drives, hydraulic systems, and direct drive systems. Additionally, the increasing popularity of electric vehicles (EVs) in industries like transportation and logistics is driving demand for roller chains and leaf chains in the market. Industrial automation and supply chain management are also critical aspects of the market. Efficient supply chain management ensures that raw materials are delivered on time and at the right place, while industrial automation improves productivity and reduces labor costs. Double-pitch chains are commonly used in industrial automation applications due to their high load capacity and durability. In summary, the market is a complex network of industries and processes that rely on each other to produce and distribute finished products. Power transmission systems, material handling tools, and automation are essential components of this market, and the trend towards cost-efficient materials and advanced technologies is driving innovation and growth.

|

Industrial Chain Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.4% |

|

Market growth 2025-2029 |

USD 970 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.0 |

|

Key countries |

China, US, Germany, India, Canada, Japan, UK, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch