US Gasoline Market Size 2023-2027

The US gasoline market size is forecast to decrease by -258 mn L, at a CAGR of -4.18% between 2022 and 2027.

- The Gasoline Market in the US is driven by the increasing number of automobiles and the rise in oil and gas production. These factors contribute to the market's growth, as the demand for gasoline continues to escalate. However, the market faces challenges due to the fluctuation in prices of gasoline. This volatility can significantly impact market dynamics, making it essential for companies to navigate these price swings effectively. The oil industry's production levels, geopolitical tensions, and economic conditions are key factors influencing gasoline prices.

- To capitalize on market opportunities and mitigate challenges, companies must adopt strategic initiatives such as price differentiation, supply chain optimization, and innovation in fuel efficiency technologies. By staying agile and responsive to market trends and price fluctuations, market participants can effectively position themselves for long-term success in the Gasoline Market.

What will be the size of the US Gasoline Market during the forecast period?

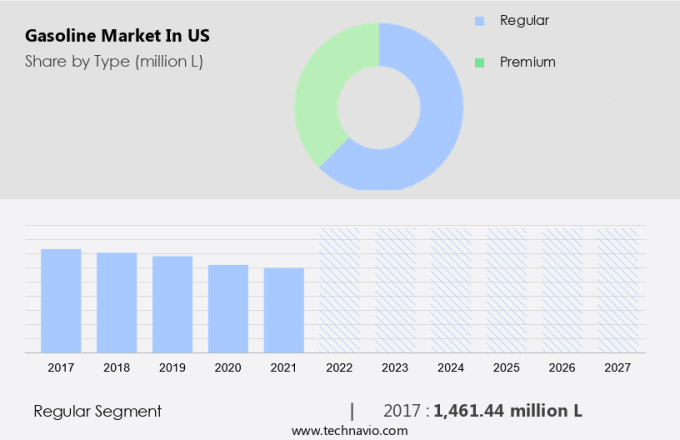

Explore in-depth regional segment analysis with market size data - historical 2017-2021 and forecasts 2023-2027 - in the full report.

Request Free Sample

- The gasoline market in the US is influenced by various factors, including the composition of gasoline, energy policy impact, fuel additives chemistry, and fuel demand forecasting. The refining process of crude oil plays a significant role in producing high-quality gasoline that meets consumer preferences and regulatory requirements. Gasoline pricing models are shaped by the cost of crude oil, production process, and fuel market analysis. Fuel blending technology and gasoline quality assurance are crucial in optimizing engine performance and reducing emissions. Innovations in engine performance optimization and emissions reduction technologies continue to shape the gasoline industry. Fuel efficiency optimization and fuel policy analysis are essential in assessing the environmental impact of gasoline use.

- The future of gasoline involves research into fuel alternatives, such as renewable fuels, and the development of new testing methods for fuel quality assessment. The use of fuel additives and their chemistry plays a vital role in enhancing fuel performance and reducing emissions. The gasoline industry remains dynamic, with ongoing efforts to improve fuel production processes and respond to changing consumer preferences and regulatory requirements.

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD mn L" for the period 2023-2027, as well as historical data from 2017-2021 for the following segments.

- Type

- Regular

- Premium

- End-user

- Transportation

- Power generation

- Others

- Geography

- North America

- US

- North America

By Type Insights

The regular segment is estimated to witness significant growth during the forecast period.

The US gasoline market is a significant sector within the global energy industry, shaped by various factors including consumer behavior, climate change, and technological advancements. Regular gasoline, a hydrocarbon mixture derived from crude oil, is the most commonly used fuel for standard internal combustion engines. It typically contains around 10% ethanol for octane enhancement, with an octane rating of 87 or 88. Higher-performance engines may require higher-octane fuels to prevent engine damage from knocking or pinging. The petroleum industry's refining process produces regular gasoline, which is distributed through an extensive pipeline infrastructure to retailers. Gasoline retailing involves marketing and selling the fuel to consumers, with prices influenced by factors such as crude oil prices, taxes, and regional variations.

Government regulations play a crucial role in the gasoline market, with emissions standards and fuel efficiency requirements driving innovation in fuel technology. Alternative fuels, such as ethanol blends, renewable fuels, and electric vehicles, are gaining popularity due to their environmental benefits and potential to reduce carbon emissions. Fuel efficiency standards, such as Corporate Average Fuel Economy (CAFE) regulations, have led to advancements in engine performance and fuel economy. Fuel additives, including biofuel additives and octane enhancers, are used to improve fuel quality and performance. Geopolitical influences and fuel volatility can impact the gasoline market, with supply chain disruptions and price fluctuations affecting both domestic and international markets.

The energy sector's transition towards sustainable fuels and decarbonization is also shaping the future of the gasoline market. Regular gasoline remains widely available and affordable, making it a popular choice for most consumers. However, the evolving market dynamics and technological advancements are driving the adoption of alternative fuels and more efficient vehicles, potentially impacting the demand for regular gasoline in the future.

The Regular segment was valued at USD 1,461.44 mn L in 2017 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2022 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the US Gasoline Market drivers leading to the rise in adoption of the Industry?

- The significant growth in the usage of automobiles is the primary factor fueling market expansion.

- The US gasoline market plays a significant role in the country's energy sector, with gasoline being the primary fuel for powering internal combustion engines in various vehicles, including passenger cars, two-wheelers, and light trucks. To ensure optimal engine performance and prevent damage, it is crucial that gasoline burns smoothly without knocking or premature detonation. In 2020, the US Energy Information Administration reported that the transportation sector was the largest consumer of petroleum products, accounting for over 60% of total petroleum consumption. Within this sector, gasoline was the most widely used petroleum product, representing approximately 90% of the transportation sector's petroleum consumption.

- This strong dependence on gasoline underscores the importance of the automobile industry to the US economy. The consumption of gasoline is influenced by the number of passenger cars and light trucks in operation, as well as environmental regulations, fuel technology, and gasoline blending regulations. Alternative fuels, such as electric vehicles, are gaining popularity, but gasoline remains a dominant player in the market. Fuel additives and vehicle emissions standards also impact gasoline demand. Government regulations continue to shape the market dynamics, emphasizing fuel security and reducing emissions.

What are the US Gasoline Market trends shaping the Industry?

- The current market trend indicates a significant increase in oil production. This upward trend is a noteworthy development in the energy sector.

- The global gasoline market has experienced significant growth due to increased crude oil production in key regions, including the US and Canada. This expansion in production has resulted in a larger gasoline supply, leading to lower prices and heightened consumption. According to the US Energy Information Administration, US crude oil production surged from 8.8 million barrels per day in 2014 to 11.6 million barrels per day in 2022. A substantial portion of this increase originated from the Permian Basin in Texas and New Mexico. Parallelly, Canadian oil production has been on an upward trend over the past decade, with the country producing approximately 4 million barrels per day in 2022.

- Consumer behavior is also influencing the gasoline market, with a growing emphasis on climate change mitigation and sustainability. Renewable fuels, such as ethanol blending and biodiesel, are gaining popularity. Additionally, the adoption of fuel cell vehicles, hybrid vehicles, and green gasoline is increasing. Fuel innovation, including advancements in fuel injection systems and fuel handling, is also contributing to market growth. Pipeline infrastructure remains a crucial factor in the gasoline market, ensuring the efficient transportation of fuel from production sites to consumers. Fuel marketing strategies continue to evolve, with companies focusing on improving gasoline quality and meeting the evolving needs of consumers.

- The gasoline market is expected to continue its growth trajectory, driven by these market dynamics and the ongoing shift towards cleaner, more sustainable energy sources.

How does US Gasoline Market face challenges during its growth?

- The volatile gasoline prices pose a significant challenge to the industry's growth trajectory.

- The gasoline market in the US is influenced by several factors that impact its growth. One significant factor is the price of gasoline compared to other fuels. When prices rise, consumers may reduce their consumption or even switch to alternative fuels, leading to decreased demand and slower market growth. Crude oil prices, supply and demand, geopolitical tensions, and weather events are among the factors that can influence gasoline prices. According to the US Energy Information Administration, the average retail price of regular gasoline in the US was USD2.25 per gallon in 2020, a 44% decrease from the previous year.

- Another factor that affects the gasoline market is fuel economy. Consumers are increasingly seeking vehicles with better fuel efficiency to save money on gasoline. Fuel storage and distribution also play a role in market dynamics, with regional variations in fuel quality control and engine performance affecting consumer preferences. The petroleum industry is responding to these trends by investing in sustainable fuels, such as biofuel additives and reformulated gasoline, to improve fuel quality and reduce reliance on crude oil. Fuel taxes and energy security concerns also influence market dynamics. Overall, the gasoline market in the US is subject to various market forces, requiring ongoing analysis and adaptation by industry stakeholders.

Exclusive US Gasoline Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abraxas

- BP Plc

- Chesapeake Energy Corp

- Chevron Corp.

- ConocoPhillips Co.

- Delek US Holdings Inc.

- Devon Energy Corp

- Enterprise Products Partners LP

- EOG Resources Inc

- Exxon Mobil Corp.

- Marathon Petroleum Corp.

- Occidental Petroleum Corp.

- Ovintiv Inc.

- Phillips 66

- Pioneer Natural Resources Co

- Schlumberger Ltd.

- Shell plc

- SouthWestern Energy Co.

- Sunoco LP

- Valero Energy Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gasoline Market In US

- In March 2023, ExxonMobil and BP announced a strategic collaboration to build three hydrogen production facilities in the US, marking a significant stride towards the decarbonization of the gasoline market. The partnership aims to produce up to 10 million tons per year of blue hydrogen, which is produced using natural gas with carbon capture and storage technology (ExxonMobil press release, 2023).

- In August 2024, Tesla, the electric vehicle (EV) market leader, unveiled its new Supercharger V3, capable of delivering up to 25 miles of range per minute. This rapid charging technology is expected to further accelerate the shift from gasoline-powered vehicles towards EVs, potentially disrupting the traditional gasoline market (Tesla press release, 2024).

- In November 2024, the US Environmental Protection Agency (EPA) approved the use of 15% ethanol (E15) fuel year-round, expanding the market for bioethanol-blended gasoline. This decision is expected to reduce greenhouse gas emissions and increase the use of renewable energy sources in the transportation sector (EPA press release, 2024).

- In January 2025, Shell and Chevron announced a joint venture to construct a major refinery in Pennsylvania, representing a significant investment in the US gasoline market. The new refinery, with an estimated capacity of 300,000 barrels per day, will help meet the growing demand for gasoline in the region (Shell and Chevron press release, 2025).

Research Analyst Overview

The global gasoline market is a dynamic and evolving entity, influenced by various factors that shape its landscape and applications across diverse sectors. Climate change and consumer behavior are two significant drivers shaping the market's trajectory. The adoption of green gasoline, renewable fuels, and sustainable fuels is on the rise, driven by increasing environmental consciousness and regulatory pressures. Fuel injection systems and fuel handling technologies continue to advance, optimizing fuel efficiency and reducing carbon emissions. Fuel cell vehicles and hybrid vehicles are gaining popularity, further disrupting the traditional gasoline market. Ethanol blending and biofuel additives are becoming increasingly common, as the petroleum industry explores alternatives to crude oil.

Gasoline quality, pipeline infrastructure, and fuel marketing are essential components of the market, with fuel innovation and fuel technology playing a crucial role in enhancing fuel economy and engine performance. Fuel consumption patterns are subject to regional variations, influenced by factors such as energy security, fuel pricing strategies, and government regulations. Fuel efficiency standards, emissions regulations, and fuel safety are critical concerns for the energy sector, with geopolitical influences and fuel volatility adding complexity to the market. The petroleum industry is continually adapting to these challenges, implementing reformulated gasoline and gasoline blending regulations to meet evolving consumer demands and regulatory requirements.

Brand loyalty and fuel blends remain essential factors in the gasoline retailing and distribution landscape, with fuel taxes and fuel pricing strategies influencing consumer behavior and market dynamics. The gasoline supply chain is subject to numerous influences, including fuel efficiency standards, fuel technology, and alternative fuels, such as electric vehicles and alternative fuel additives. In summary, the gasoline market is a complex and dynamic entity, shaped by a multitude of factors that include climate change, consumer behavior, global market trends, and technological innovations. The ongoing unfolding of market activities and evolving patterns underscores the importance of continuous research and analysis to stay abreast of the latest developments and trends.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gasoline Market in US insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

128 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Decelerate at a CAGR of -4.18% |

|

Market growth 2023-2027 |

-258 mn L |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

-3.81 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2023 and 2027

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch