Industrial Thermostatic Control Valves Market Size 2024-2028

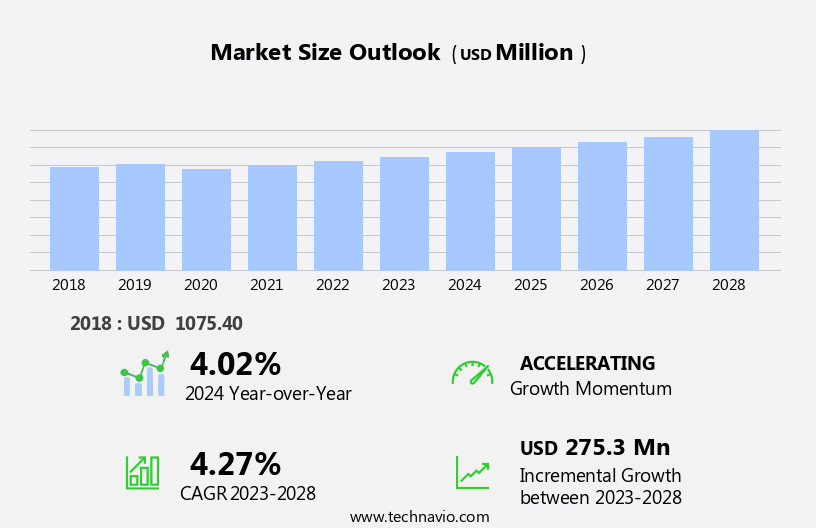

The industrial thermostatic control valves market size is forecast to increase by USD 275.3 million, at a CAGR of 4.27% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing automation in industrial facilities. Automation in manufacturing processes necessitates precise temperature control, making thermostatic control valves an essential component. Additionally, the emerging demand for smart industrial thermostatic control valves, which offer advanced features such as remote monitoring and real-time temperature adjustment, is further fueling market expansion. However, the market faces challenges, including the fluctuating prices of raw materials used in manufacturing these valves. This volatility can impact the cost structure of manufacturers and potentially affect their profitability.

- To capitalize on market opportunities and navigate these challenges effectively, companies must focus on optimizing their supply chains, exploring alternative raw material sources, and continuously innovating to meet the evolving demands of the industrial sector.

What will be the Size of the Industrial Thermostatic Control Valves Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market showcases a continuous and evolving nature, driven by the diverse applications across various sectors. These valves play a pivotal role in steam systems, ensuring optimal temperature control and pressure regulation. Corrosion resistance is a critical factor, as these valves often operate in harsh environments. Relief valves, an essential safety component, are integrated into the system to prevent damage from excessive pressure. IoT integration is transforming the industry, enabling remote monitoring and predictive maintenance. Water systems, chemical processing, and regulatory compliance are other sectors where thermostatic control valves are in high demand. Valve repair and failure modes analysis are ongoing activities to ensure optimal performance and prolong valve life cycle.

Valve body materials, leak detection, and temperature sensors are essential considerations in valve selection and valve actuator sizing. Pressure drop, flow control, and valve trim are crucial factors in materials processing and fluid dynamics. Energy efficiency, response time, and data analytics are key aspects of process optimization and cost optimization. HVAC systems, heating systems, plumbing systems, and cooling systems all benefit from thermostatic control valves. PID control, flow coefficient (CV), and control loops are integral to maintaining consistent temperature and pressure levels. Valve testing, vibration analysis, and safety valves are essential for ensuring system reliability and safety. Valve maintenance, noise reduction, and material selection are ongoing concerns for industrial applications.

Butterfly valves, globe valves, and solenoid valves each have unique applications and advantages. The market dynamics of this industry are ever-evolving, with new technologies and applications continually emerging.

How is this Industrial Thermostatic Control Valves Industry segmented?

The industrial thermostatic control valves industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Oil and gas industry

- Water and wastewater treatment industry

- Power industry

- Others

- Type

- Pneumatic thermostatic control valves

- Electric thermostatic control valves

- Geography

- North America

- US

- Europe

- France

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

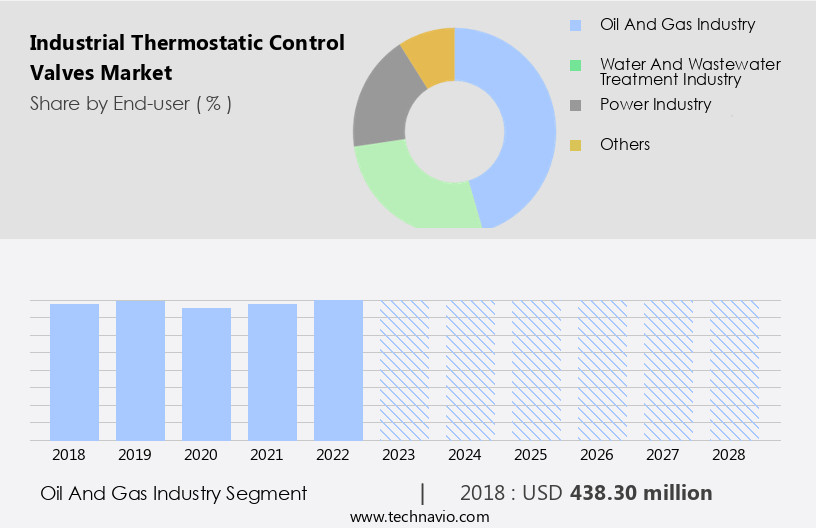

The oil and gas industry segment is estimated to witness significant growth during the forecast period.

In the realm of industrial automation, thermostatic control valves play a pivotal role in various sectors, including power generation, HVAC systems, and chemical processing. These valves are integral to pid control, enabling process optimization and cost savings through precise flow control and temperature regulation. In power generation, they ensure efficient energy transfer in heating systems and cogeneration processes. Smart valves, equipped with IoT integration and remote monitoring capabilities, facilitate predictive maintenance and enhance safety standards. Valve selection and actuator sizing are crucial factors in optimizing system performance and minimizing pressure drop. Corrosion resistance and leak detection are essential considerations for valve body materials in water systems and chemical processing applications.

Valve repair and maintenance are integral to maintaining system reliability and safety. Failure analysis and understanding failure modes help prevent future issues. Regulatory compliance is a significant concern, with safety valves and pressure regulators ensuring adherence to industry standards. Butterfly valves, globe valves, and solenoid valves each offer unique advantages for specific applications. Materials processing and fluid dynamics are essential aspects of valve design, with flow coefficient (cv) and response time impacting overall system efficiency. In the oil and gas industry, thermostatic control valves are indispensable for steam systems, relief valves, and process automation. Despite the recent downturn in oil prices, the demand for these valves remains robust due to their role in maintaining critical operations.

Valve trim and temperature sensors contribute to accurate flow control and pressure regulation. Energy efficiency is a growing concern, with cooling systems and heating systems benefiting from advanced valve technologies. Valve testing and vibration analysis are essential for ensuring optimal performance and longevity. In the realm of industrial automation, thermostatic control valves continue to evolve, with electric valves and pneumatic valves offering distinct advantages. The integration of data analytics and process optimization further enhances their value proposition.

The Oil and gas industry segment was valued at USD 438.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

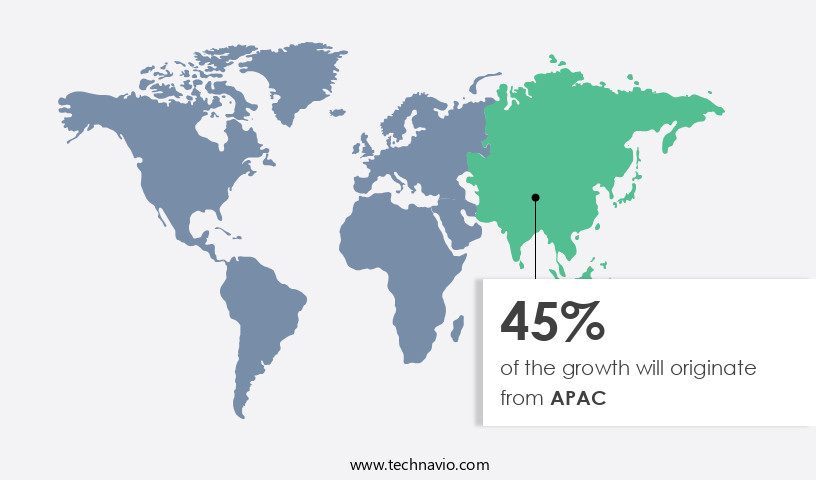

APAC is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In APAC, the market is experiencing significant growth due to the region's rapid industrial development and increasing automation requirements. Countries like China, India, South Korea, Indonesia, and Taiwan are driving this growth, with many manufacturers entering the price-sensitive market while maintaining product quality. The power industry is also witnessing substantial investment in the region, as developing countries undergo industrialization and urbanization. In the context of industrial automation, PID control is a critical factor for the adoption of thermostatic control valves. Proper valve selection, actuator sizing, and failure analysis are essential for optimizing processes and ensuring safety standards.

Power generation applications, including steam systems and heating systems, require high-performance thermostatic control valves for efficient energy use and regulatory compliance. Smart valves, remote monitoring, and IoT integration are trends that are gaining traction in the market, enabling process optimization, cost savings, and improved control loop performance. HVAC systems, water systems, and materials processing industries rely on thermostatic control valves for precise temperature control and leak detection. Corrosion resistance, relief valves, and safety valves are crucial considerations for industries dealing with hazardous fluids and high-pressure applications. Valve repair and maintenance are essential for extending valve life cycle and minimizing downtime.

Butterfly valves, globe valves, and solenoid valves are popular valve types used in various industries, each with its unique advantages in terms of pressure drop, flow control, and response time. Temperature sensors and flow coefficient (CV) play a vital role in ensuring accurate process control and energy efficiency. In the power generation sector, cooling systems and heating systems require thermostatic control valves for efficient temperature management. Valve testing, plumbing systems, pneumatic valves, ball valves, and electric valves are other applications where thermostatic control valves are essential. Process automation, data analytics, and vibration analysis are essential for optimizing valve performance and minimizing maintenance costs.

Regulatory compliance and safety standards are critical considerations for industries dealing with hazardous fluids and high-pressure applications. In conclusion, the market in APAC is experiencing robust growth due to the region's industrial development, automation requirements, and investment in the power industry. Proper valve selection, actuator sizing, and failure analysis are essential for optimizing processes and ensuring safety standards. Smart valves, remote monitoring, and IoT integration are trends that are gaining traction, enabling process optimization, cost savings, and improved control loop performance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector in the automation industry, characterized by continuous growth and innovation. These valves play a crucial role in maintaining optimal temperature levels in industrial processes, enhancing energy efficiency and product quality. Industrial thermostatic control valves are designed with advanced technologies, such as PID controllers and digital sensors, ensuring precise temperature regulation. They are widely used in various industries, including food and beverage, pharmaceuticals, and HVAC, to name a few. Key players in this market focus on product development, mergers and acquisitions, and strategic partnerships to expand their market share. Industrial thermostatic control valves offer benefits such as reduced energy consumption, improved process control, and increased productivity. With the increasing demand for energy-efficient solutions and stringent regulations, the market is poised for substantial growth in the coming years.

What are the key market drivers leading to the rise in the adoption of Industrial Thermostatic Control Valves Industry?

- In industrial markets, the primary catalyst for growth is the heightened implementation of automation technologies in facilities.

- The manufacturing sector, particularly in Asia Pacific, has experienced significant growth, attracting numerous foreign investors to establish production facilities in the region. The integration of industrial automation has become a prevailing trend, enabling efficient and optimized processes. To gain a competitive edge, manufacturers are investing heavily in automation technologies, including PID control systems and advanced valve technologies. Valve selection and actuator sizing are critical aspects of industrial thermostatic control valve applications. Failure analysis and adherence to safety standards are essential for ensuring valve longevity and reliability, especially in power generation and HVAC systems. Process optimization and cost optimization are key drivers for the adoption of smart valves, remote monitoring, and control loops in industrial applications.

- These technologies provide real-time data, enabling manufacturers to make informed decisions and improve overall efficiency. Valve sizing and selection are crucial factors in ensuring the successful implementation of industrial automation projects. By considering the specific requirements of each application, manufacturers can choose the most appropriate valve technology and optimize their control systems for maximum performance and cost savings.

What are the market trends shaping the Industrial Thermostatic Control Valves Industry?

- The emergence of smart industrial thermostatic control valves represents a significant market trend. These advanced valves are increasingly in demand due to their ability to optimize energy usage and enhance industrial processes through automated temperature control.

- The market is experiencing significant growth due to the integration of diagnostics and smart technology. These advanced valves offer numerous benefits, including real-time monitoring of process variables such as pressure, temperature, stem position, and flow rate. They facilitate the transfer of information, including diagnostics, control instructions, and documentation, between the valve and control units, making repair and maintenance more efficient and reducing the need for manual documentation and processing. Moreover, the demand for corrosion-resistant materials in valve body materials, such as stainless steel, is increasing due to their ability to withstand harsh conditions in steam and water systems commonly used in chemical processing.

- Additionally, regulatory compliance is a crucial factor driving the market's growth, as industries must adhere to strict safety regulations, particularly in relief valves. Smart valves come in various types, including butterfly valves, globe valves, and solenoid valves, each with its unique advantages. For instance, butterfly valves offer a low-pressure drop, while globe valves provide precise flow control. Solenoid valves, on the other hand, offer quick response times and are easy to operate. Leak detection is another essential feature of industrial thermostatic control valves, ensuring process safety and minimizing downtime. Overall, the market's growth is driven by the need for efficient, reliable, and cost-effective solutions in various industries, including chemical processing.

What challenges does the Industrial Thermostatic Control Valves Industry face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory.

- Industrial thermostatic control valves play a crucial role in maintaining optimal temperature levels in various industries, including materials processing and heating systems. These valves utilize temperature sensors to monitor and regulate fluid temperature, ensuring efficient flow control and energy savings. Valve trim materials, such as stainless steel, hardened steel, cast iron, brass, bronze, and aluminum, are essential for withstanding harsh operating conditions. However, the volatile pricing of these raw materials poses a challenge for small and medium-sized manufacturers, potentially impacting their market position. Fluid dynamics and valve dynamics are significant factors in the market. The market caters to diverse applications, including plumbing systems, pneumatic valves, ball valves, heating systems, and cooling systems.

- Valve testing is a critical aspect of ensuring product reliability and performance, with energy efficiency being a key consideration. The integration of process automation further enhances the efficiency and precision of thermostatic control valves. Industrial thermostatic control valves are subjected to various operating conditions, necessitating robust designs and materials. Material selection is crucial in ensuring the valves can withstand the rigors of fluid flow, temperature fluctuations, and pressure changes. The market encompasses a wide range of products, including pneumatic valves, ball valves, and temperature sensors, each designed to address specific application requirements. The focus on energy efficiency and cost savings continues to drive innovation in the market.

Exclusive Customer Landscape

The industrial thermostatic control valves market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial thermostatic control valves market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial thermostatic control valves market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Albert Richter GmbH and Co. KG - This company specializes in innovative sports product solutions, leveraging cutting-edge research and analysis to enhance consumer experiences. Our offerings cater to diverse athletic needs, fostering improved performance and overall wellness. By staying at the forefront of industry trends, we deliver high-quality, differentiated solutions to the global market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Albert Richter GmbH and Co. KG

- AMOT Controls Corp.

- Armstrong International Inc.

- BOLA spol s.r.o.

- Cole Parmer

- Danfoss AS

- Dover Corp.

- Dwyer Instruments Inc.

- Fluid Power Energy

- Fushiman Co. Ltd.

- Honeywell International Inc.

- Huegli Tech AG LTD.

- Metrex Valve Corp.

- Micromax Pty Ltd.

- Relevant Solutions LLC

- Reliance Worldwide Corp. Ltd.

- ThermOmegaTech Inc.

- Thermoreg International Ltd.

- Watts Water Technologies Inc.

- ZIMCO Instrumentation Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Industrial Thermostatic Control Valves Market

- In January 2024, Emerson Electric Company, a leading provider of industrial automation and software solutions, announced the launch of its new Rosemount 3051 Series of thermostatic control valves. These valves offer enhanced accuracy and reliability, with a built-in temperature sensor and advanced diagnostics (Emerson Electric Company Press Release).

- In March 2024, Danfoss, a global leader in engineering technologies, entered into a strategic partnership with Honeywell International to expand its presence in the North American market for thermostatic control valves. The collaboration includes joint marketing efforts and the co-development of new solutions (Danfoss Press Release).

- In May 2024, Honeywell International completed the acquisition of Elster, a leading global provider of gas and water metering technologies. The acquisition strengthened Honeywell's position in the market, providing access to Elster's advanced flow measurement and control technologies (Honeywell International Securities and Exchange Commission Filing).

- In February 2025, Schneider Electric, a major player in energy management and automation, received regulatory approval for its new line of Masterpact MTZ thermostatic control valves in the European Union. These valves offer improved energy efficiency and ease of installation, positioning Schneider Electric as a competitive force in the European market (Schneider Electric Press Release).

Research Analyst Overview

- The market encompasses various technologies, including pneumatic systems, electro-pneumatic systems, hydraulic systems, and electro-hydraulic systems. Closed loop control, a critical aspect of temperature control in process industries, is increasingly favored over analog control for its precision and stability. Valve isolation and feedback control ensure efficient performance testing and maintenance schedules. Wireless communication and cloud connectivity facilitate remote actuation and spare parts management, streamlining supply chain operations. Three-way valves and proportional valves are popular choices for flow measurement and pressure control in manufacturing processes. Quality control is paramount, with material selection and design optimization essential for ensuring durability and reliability.

- Valve manifolds and valve positioning systems enable seamless integration with SCADA systems, PLC systems, and industrial communication protocols like Ethernet/IP. Level control and performance testing are crucial aspects of industrial thermostatic control valves, with predictive modeling aiding in optimizing installation procedures and minimizing downtime. Open loop control and on-off valves are also essential components in various applications. Valve commissioning and maintenance procedures require adherence to industry standards and best practices, ensuring optimal performance and longevity. Overall, the market is dynamic, with ongoing advancements in digital control, pressure control, and temperature control systems driving innovation and growth.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Industrial Thermostatic Control Valves Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.27% |

|

Market growth 2024-2028 |

USD 275.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.02 |

|

Key countries |

China, US, UK, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Thermostatic Control Valves Market Research and Growth Report?

- CAGR of the Industrial Thermostatic Control Valves industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial thermostatic control valves market growth of industry companies

We can help! Our analysts can customize this industrial thermostatic control valves market research report to meet your requirements.