Infrastructure Monitoring Market Size 2024-2028

The infrastructure monitoring market size is forecast to increase by USD 9.40 billion at a CAGR of 8.9% between 2023 and 2028.

- Infrastructure monitoring is a critical aspect of maintaining the efficiency and reliability of various sectors, including telecommunications, utilities, transportation, and smart cities. The market for infrastructure monitoring solutions is witnessing significant growth due to several key trends. The increasing adoption of Internet of Things (IoT) technologies and real-time data analysis is enabling more effective monitoring and predictive maintenance. Sensor technologies are becoming more advanced, allowing for more precise and accurate monitoring. Additionally, the push towards automation and standardization in infrastructure maintenance and repair is driving demand for monitoring solutions. However, this growth comes with challenges, such as the vulnerability to cyberattacks and the need for strong data analytics capabilities to make sense of the vast amounts of data generated. These trends and challenges are shaping the market and will continue to do so in the coming years.

What will the size of the market be during the forecast period?

- The market is a significant sector that plays a crucial role in ensuring the optimal performance and security of critical assets. This market encompasses various technologies, including wired and wireless, to provide real-time data on the status and health of infrastructure. Wired technology and wireless technology are two primary approaches used in infrastructure monitoring. Wired technology relies on physical connections between sensors and monitoring systems, providing reliable and accurate data. Structural monitoring systems and sensor technologies are key components of this market, providing real-time data on the condition of assets and enabling predictive maintenance. On the other hand, wireless technology offers flexibility and ease of deployment, making it ideal for monitoring large and geographically dispersed infrastructure.

- Moreover, vibration monitoring and damage detection are essential applications of infrastructure monitoring. These technologies help detect anomalies and potential issues in structures, enabling timely intervention and preventing costly repairs or replacements. Construction sites and aerospace and defense industries are significant users of infrastructure monitoring, as they rely on the reliable operation of critical assets. Cybersecurity is a critical aspect of infrastructure monitoring. With the increasing integration of IoT and cloud computing in monitoring solutions, ensuring the security of data and systems is paramount. Real-time monitoring and data management platforms are essential components of effective infrastructure monitoring, providing actionable insights and enabling proactive maintenance.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Wireless

- Wired

- Geography

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- Europe

By Technology Insights

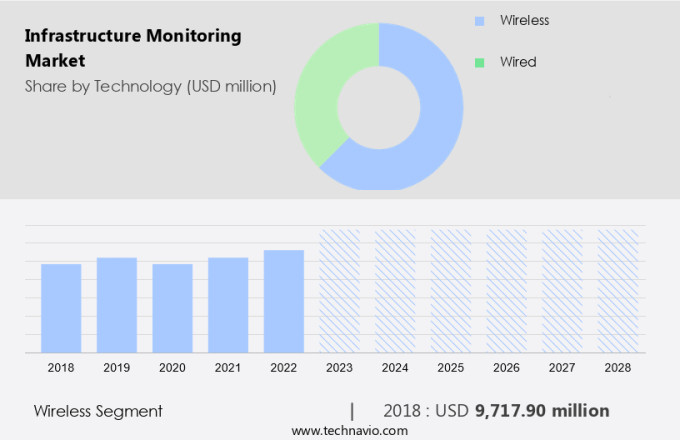

- The wireless segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing demand for real-time data and advanced monitoring solutions. Wireless infrastructure monitoring systems utilize connected devices to assess the status of critical infrastructure such as bridges, buildings, and pipelines. These systems provide continuous, real-time data, allowing for early identification of potential issues and enhancing safety and operational efficiency. Key factors driving the growth of the wireless market include advancements in sensor technology, wireless communication, and the Internet of Things (IoT). IoT applications enable more effective monitoring solutions, facilitating seamless data transmission from remote locations and enabling timely decision-making.

In the context of smart cities, infrastructure monitoring plays a crucial role in various sectors such as telecommunications, utilities, and transportation. By implementing wireless infrastructure monitoring systems, cities can improve their operational efficiency, enhance safety, and reduce downtime. Sensor technologies, data analytics, and wireless communication are at the forefront of this growth, providing valuable insights and enabling proactive maintenance.

Get a glance at the market report of share of various segments Request Free Sample

The wireless segment was valued at USD 9.72 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

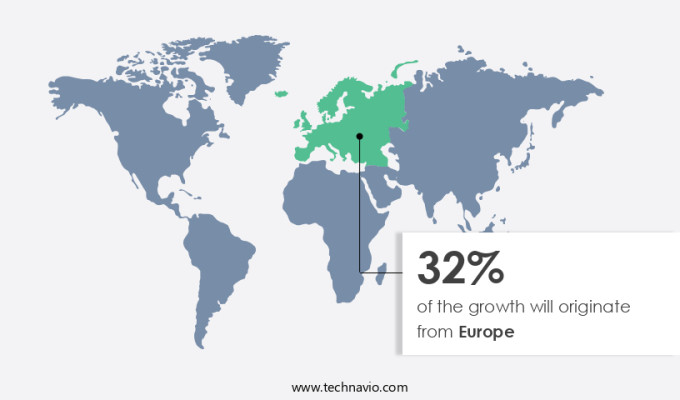

- Europe is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The European construction industry is a significant economic contributor, accounting for approximately 9% of the EU's GDP and employing over 18 million people. Given its substantial influence on the performance of CECE's member companies, the sector's growth is of great importance. Furthermore, government initiatives, such as increasing the EU's renewable energy infrastructure, present opportunities for companies in the market. This is due to the necessity of regular monitoring to prevent damage and ensure the longevity of such infrastructure.

For instance, the EU's recent increase in its greenhouse gas emissions reduction target from 40% to 55% by 2030, and the proposed raise of the EU's renewable energy target from 32% to 40% by 2030, underscores the significance of this trend. Infrastructure monitoring encompasses both wired and wireless systems, including sensor systems and predictive analytics software. Applications span various sectors, such as aerospace and defense, energy, mining, civil infrastructure, and more. companies in this market stand to benefit from the growing demand for reliable and efficient infrastructure monitoring solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Infrastructure Monitoring Market?

The rise in global construction and infrastructure development activities is the key driver of the market.

- The market is experiencing growth due to the increasing construction activities in both developed and emerging economies. In the United States, the economic recovery has fueled a growth in new residential construction projects, with single-family and multi-family homes in high demand. This trend is driven in part by historically low mortgage rates, which have made homeownership more affordable for many Americans. As a result, construction spending in the US reached an all-time high in November 2020.

- In addition to residential construction, critical infrastructure assets such as transportation systems, energy facilities, and water and wastewater treatment plants also require continuous monitoring to ensure their optimal performance. To accomplish this, advanced infrastructure monitoring systems, including data management platforms and equipment monitoring systems, are being adopted. Cloud computing technology is also playing a significant role in infrastructure monitoring, enabling real-time data acquisition and analysis. These solutions help organizations mitigate risks, improve operational efficiency, and enhance overall infrastructure performance.

What are the market trends shaping the Infrastructure Monitoring Market?

The adoption of automation and standardization in the maintenance and repair of civil infrastructure is the upcoming trend in the market.

- The construction industry has experienced a gradual shift towards digitization and automation in key processes, including maintenance and repair, in recent times. The ongoing pandemic has disrupted work at construction sites, necessitating social distancing and reduced capacity, leading to lost time and financial setbacks. To mitigate these challenges, the industry is embracing automation and standardization of maintenance and repair processes. This trend is expected to accelerate the adoption of remote working solutions, bringing about significant transformational changes to the construction sector. Hardware and services are integral components of infrastructure monitoring systems, with wired and wireless technologies playing crucial roles.

- Moreover, vibration monitoring and damage detection are essential features of these systems, ensuring the structural integrity of buildings and other infrastructure. Cybersecurity is another critical aspect, as the increasing use of Internet of Things (IoT) technology in infrastructure monitoring necessitates strong security measures. The market players offer comprehensive solutions, catering to various industries and applications. These solutions enable real-time monitoring, predictive maintenance, and early damage detection, ensuring optimal performance and longevity of infrastructure. As the construction industry continues to digitize and automate, infrastructure monitoring is poised to play a pivotal role in enhancing productivity, efficiency, and safety.

What challenges does Infrastructure Monitoring Market face during the growth?

Vulnerability to cyberattacks is a key challenge affecting the market growth.

- Infrastructure monitoring is a critical aspect of maintaining the productivity and efficiency of industrial processes, particularly in sectors such as power generation, oil and gas, telecommunications, and hospitality. However, the increasing automation of these systems brings new challenges, including heightened vulnerability to cyberattacks. Cybersecurity threats, such as data hacking, alteration, and security breaches, can disrupt operations and even lead to unethical use of sensitive information. With the proliferation of connected devices and reliance on web-based communication, networks are increasingly at risk.

- However, smart materials and real-time data collection are essential components of infrastructure monitoring, but they also introduce new complexities. Infrastructure digital twins, asset management, and thermal monitoring are key strategies for mitigating these risks and ensuring the smooth functioning of industrial processes. As inflation continues to impact industries, investing in strong cybersecurity measures is essential to protect against potential losses and maintain operational excellence.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acellent Technologies Inc.

- AES Engineering

- Campbell Scientific Inc.

- Digitexx Systems Ltd.

- Emerson Electric Co.

- Geocomp Corp.

- GEOKON LLC

- Geomotion Singapore Pte. Ltd.

- Mabey Holdings Ltd.

- Mistras Group Inc.

- Monnit Corp.

- Nova Ventures Group Corp.

- OYO Corp.

- RST Instruments Ltd.

- Sisgeo S.r.l.

- Sixense Group

- Spectris Plc

- STRUCTURAL MONITORING SYSTEMS plc

- Toshiba Corp.

- Xylem Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Infrastructure monitoring is a critical aspect of maintaining the reliability and efficiency of various industries, including telecommunications, utilities, transportation, construction, aerospace and defense, energy, mining, and civil infrastructure. The market is driven by the need for real-time data collection and analysis to ensure optimal performance and prevent damage or downtime. This market encompasses both hardware and services, with wired and wireless technology playing essential roles. Vibration monitoring, damage detection, and cybersecurity are key components of infrastructure monitoring solutions. The Internet of Things (IoT) and sensor technologies have revolutionized infrastructure monitoring, enabling smart cities, smart gadgets, and wearable technology to collect and analyze data in real-time.

Furthermore, critical infrastructure assets, such as power generation, transportation systems, and structural health, require advanced monitoring systems to ensure their safety and reliability. Cloud-based infrastructure and data management platforms facilitate data acquisition, storage, and analysis, while predictive analytics and structural monitoring systems help prevent potential issues before they become major problems. Inflation and the increasing importance of cybersecurity are key challenges in the market. However, advancements in technology integration, wireless monitoring, and the development of infrastructure digital twins offer significant opportunities for growth. Smart infrastructure and performance monitoring are also crucial areas of focus, as the market continues to evolve and adapt to the changing needs of industries and societies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.9% |

|

Market growth 2024-2028 |

USD 9.40 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.1 |

|

Key countries |

US, Germany, China, UK, Japan, Canada, India, South Korea, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch