Insurance Claims Services Market Size 2025-2029

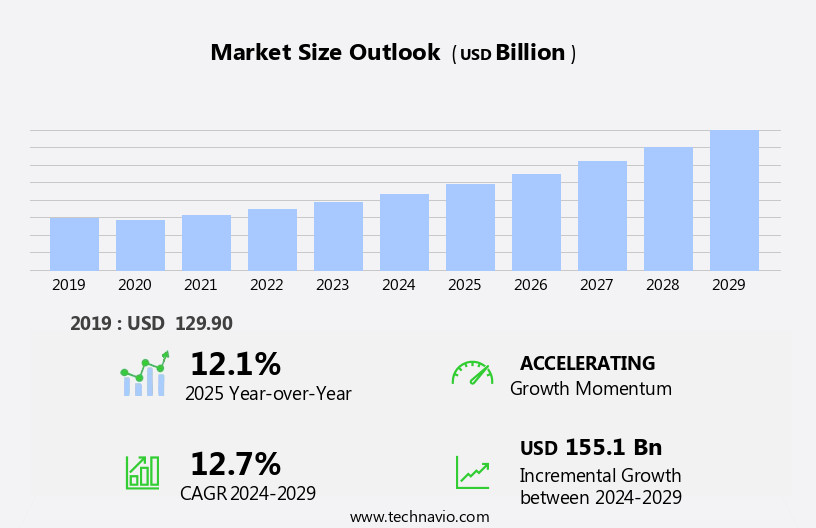

The insurance claims services market size is forecast to increase by USD 155.1 billion at a CAGR of 12.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the ongoing urbanization and economic development worldwide. This trend is increasing the demand for efficient and effective claims processing services to cater to the expanding population and growing number of insured individuals. Furthermore, the digital transformation in the insurance industry is revolutionizing claims services, enabling faster and more accurate processing through advanced technologies such as artificial intelligence and machine learning. However, the market faces challenges that must be addressed to fully capitalize on its growth potential. Stringent regulatory compliance, particularly in the areas of data privacy and security, poses a significant hurdle for market participants.

- Additionally, inconsistencies in the supply chain, including the availability and reliability of data from various sources, can hinder the efficiency and accuracy of claims processing. To succeed in this dynamic market, companies must navigate these challenges by investing in robust compliance frameworks and implementing advanced technologies to streamline their operations and ensure data accuracy. By doing so, they will be well-positioned to meet the evolving needs of their customers and capture new opportunities in the rapidly expanding the market.

What will be the Size of the Insurance Claims Services Market during the forecast period?

- The market is characterized by a growing emphasis on efficiency and accuracy in claims processing. Claims documentation and best practices are crucial for effective claims settlement, while claims insights derived from data analysis help insurers identify trends and improve performance. Fraud detection algorithms and claims benchmarking are essential tools for mitigating fraud and ensuring fair pricing. Claims management solutions, including digital claims processing and mobile reporting, streamline the claims journey for policyholders. Remote claims assessment and customer self-service portals enable faster resolution of disputes through claims negotiation and litigation. Insurance companies leverage claims analytics platforms to measure performance, forecast costs, and assess risks.

- Policy validation and claims cost management are integral components of these solutions. Claims triage and audit help insurers prioritize claims and maintain compliance with industry regulations. Insurtech innovations, such as claims dashboards and automation tools, facilitate real-time claims processing and analysis. These advancements enable insurers to respond promptly to claims and deliver a superior customer experience. Overall, the market is evolving to meet the demands of a digital age, prioritizing transparency, accuracy, and efficiency.

How is this Insurance Claims Services Industry segmented?

The insurance claims services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Property and casualty claims

- Health insurance claims

- Motor insurance claims

- Life insurance claims

- End-user

- Individual policyholder

- Commercial policyholder

- Government and public sector

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

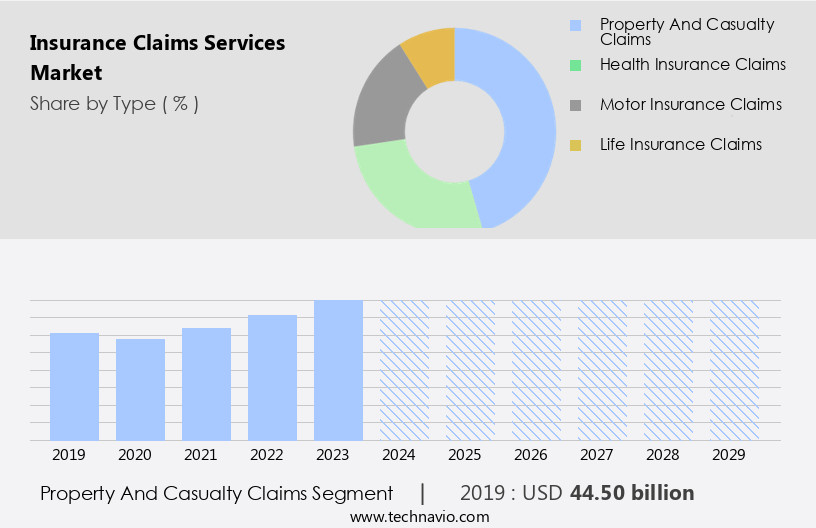

The property and casualty claims segment is estimated to witness significant growth during the forecast period.

The market, notably in the property and casualty sector, is marked by its handling of losses involving property damage and accidents or injuries' liability. This segment addresses incidents such as fires, theft, natural disasters, and various forms of liability. The intricacy of property and casualty insurance claims necessitates comprehensive assessment, rigorous investigation, and collaboration with external adjusters to guarantee fair and precise settlements. A key factor fueling growth in the property and casualty claims segment is the rising frequency and intensity of natural disasters. Events like hurricanes, floods, and wildfires are increasingly common, resulting in a surge in claims.

Machine learning, claims data analytics, and artificial intelligence are increasingly being integrated into claims platforms to streamline the claims process, improve operational efficiency, and reduce costs. Personal lines insurance and commercial insurance each present unique challenges in claims handling. Personal lines insurance involves managing claims for individual policies, while commercial insurance encompasses claims for businesses. Industry best practices and insurance regulation play a crucial role in ensuring a consistent and fair claims process across the board. Claims automation, fraud detection, and risk management are essential components of the claims process. Health insurance claims, though distinct from property and casualty, share similarities in the need for thorough investigation and coordination with providers.

Cloud computing and mobile applications are transforming the insurance industry, enabling claims reporting, processing, and adjudication in real-time. Claims software and technology are essential tools for claims specialists, adjusters, and examiners, facilitating data security, customer satisfaction, and claims cycle time reduction. Policy administration, claims payables, and claims workflow are interconnected aspects of the claims process, requiring seamless integration and coordination. Cost reduction, claims ratios, and claims severity are critical metrics for insurance carriers, agents, and brokers to monitor and manage effectively.

The Property and casualty claims segment was valued at USD 44.50 billion in 2019 and showed a gradual increase during the forecast period.

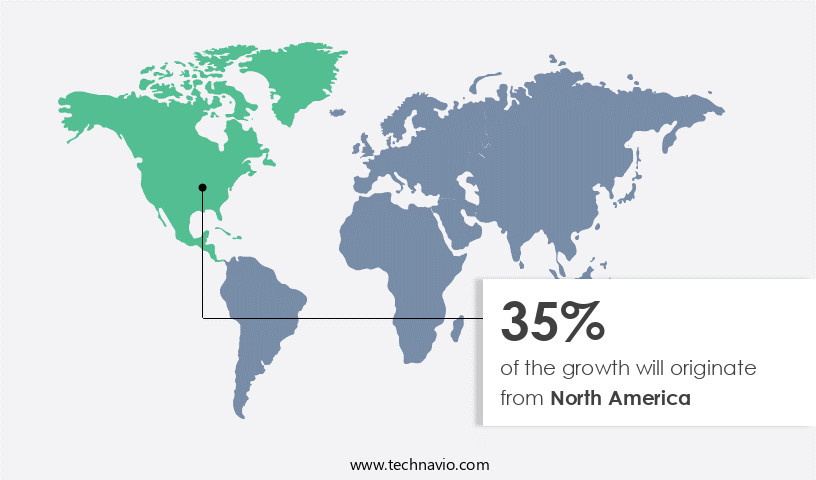

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the vast and intricate landscape of the insurance industry, North America, specifically the United States, emerges as a significant player in The market. The region's well-established insurance sector, coupled with a large population and extensive insurance coverage across various sectors like life, health, property, casualty, and motor insurance, fuels considerable demand for insurance claims services. This mature market is marked by a robust infrastructure and regulatory framework that fosters efficient claims processing and management. Natural disasters, such as hurricanes, floods, and wildfires, are common occurrences in North America, significantly impacting the property and casualty insurance sectors.

For example, on January 7, 2025, California was hit by devastating wildfires due to a Santa Ana wind event in Los Angeles County. In response to these events, claims handling becomes a critical function, necessitating the use of advanced technologies like machine learning, claims data analytics, and artificial intelligence to expedite claims resolution and enhance operational efficiency. Personal lines and commercial insurance companies employ claims platforms, claims software, and mobile applications to streamline the claims process and improve customer experience. Claims management, claims adjudication, claims reporting, and risk management are all integral components of this process. Moreover, the integration of fraud prevention measures, such as fraud detection and claims investigators, ensures cost reduction and maintains claims ratios.

Industry best practices and insurance regulation guide the market in North America. Regulatory changes and policy administration updates necessitate continuous adaptation and innovation. Insurance carriers, agents, brokers, and adjusters collaborate to provide comprehensive claims services, ensuring customer satisfaction and data security throughout the claims lifecycle. The digital transformation of the insurance industry further propels the adoption of claims technology, including claims automation, claims workflow, and claims payables, to optimize the claims process and enhance overall operational efficiency.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Insurance Claims Services market drivers leading to the rise in the adoption of Industry?

- Urbanization and economic development serve as the primary catalysts for market growth.

- The market experiences significant growth due to the increasing urbanization and economic development worldwide. With over half of the Asia-Pacific (APAC) region's population residing in urban areas as of 2024, the demand for various insurance products, such as property, health, and motor insurance, escalates. Urban environments introduce unique risks, making insurance essential for individuals and businesses to protect their assets. Economic growth, particularly in countries like China, further fuels market expansion. As businesses thrive and populations grow, the need for effective claims services becomes increasingly important. Claims specialists and adjusters play a crucial role in managing the claims lifecycle, ensuring data security, and reducing costs through accurate claims reporting, processing, and claims severity analysis.

- Risk management is a critical aspect of the insurance industry, and claims services are an integral part of this process. Cost reduction and claims ratios are essential metrics for insurers, making the efficiency and accuracy of claims services vital for business success. Insurance brokers also play a significant role in connecting clients with suitable insurance policies and claims services.

What are the Insurance Claims Services market trends shaping the Industry?

- Digital transformation is an essential and growing trend in today's market. Expanding the use of digital technologies to enhance business operations and customer experiences is a mandatory step for organizations seeking to remain competitive.

- The market is experiencing a notable shift towards digital transformation, with insurers integrating advanced technologies such as artificial intelligence (AI), machine learning, and claims data analytics to automate claims processing and enhance accuracy. This trend is fueled by the imperative to streamline operations, enhance customer experiences, and maintain industry competitiveness. AI technologies, like DXC Technology's AI Impact solution, optimize various insurance processes, including claims handling, underwriting, risk assessment, and customer service. Machine learning algorithms analyze historical claims data to identify patterns, predict potential claims, and assess risk, thereby reducing settlement times and improving overall efficiency. Cloud computing enables secure, real-time access to claims data, enabling insurers to make informed decisions and respond promptly to customer needs.

- Compliance with industry best practices and insurance regulations is ensured through automation and data analytics, ensuring transparency and accountability. Commercial and personal lines insurers alike are embracing these technological advancements to stay competitive and meet evolving customer expectations.

How does Insurance Claims Services market faces challenges face during its growth?

- The stringent regulatory compliance requirements pose a significant challenge to the industry's growth trajectory. In order to maintain business operations and expand, companies must adhere to complex and evolving regulations, which can be resource-intensive and costly. Ensuring regulatory compliance is a critical priority for industry professionals, as failure to do so can result in penalties, reputational damage, and legal consequences.

- The market is characterized by stringent regulatory compliance, with insurers required to adhere to a complex and evolving regulatory landscape. In the US, regulations such as the Health Insurance Portability and Accountability Act (HIPAA) impose strict rules on the handling and sharing of patient data in health insurance claims. Similarly, the General Data Protection Regulation (GDPR) in the European Union emphasizes data privacy and security during claims processing. Claims resolution is a critical aspect of the insurance industry, with claims cycle time being a key performance indicator. To improve efficiency and reduce cycle time, insurers are leveraging technology, including claims management systems, claims fraud detection, natural language processing, and mobile applications.

- Outsourcing claims processing to third-party service providers is also becoming increasingly common. Claims examiners and investigators play a crucial role in ensuring fair and accurate claims processing, while regulatory changes continue to shape the market landscape. Businesses across various sectors, including auto, life, and business insurance, are adopting advanced claims processing solutions to streamline operations and enhance customer experience.

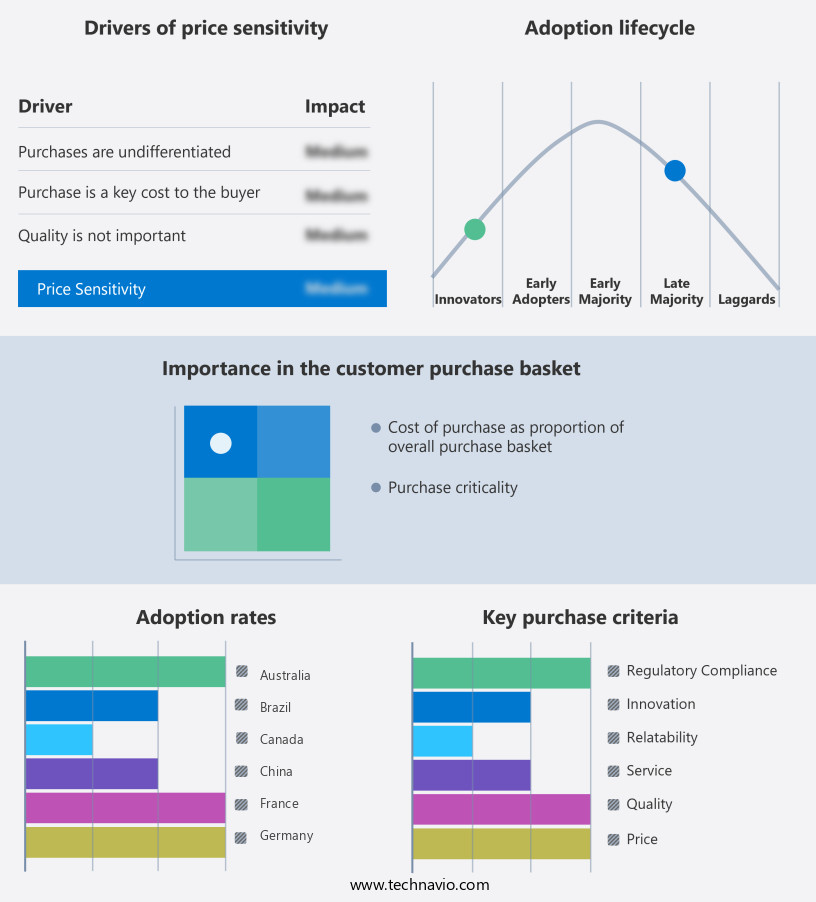

Exclusive Customer Landscape

The insurance claims services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the insurance claims services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, insurance claims services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - The company specializes in insurance business process services and outsourcing, enhancing claim processing efficiency, quality, and reducing administrative expenses through innovative solutions. Our offerings encompass Accenture Insurance BPS, designed to streamline claims handling and optimize operational performance. By leveraging advanced technologies and industry expertise, we deliver cost savings and improved customer experience for our clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- Capgemini Services SAS

- CGI Inc.

- Cognizant Technology Solutions Corp.

- Conduent Inc.

- DXC Technology Co.

- Fiserv Inc.

- HCL Technologies Ltd.

- Infosys Ltd.

- International Business Machines Corp.

- Oracle Corp.

- Pegasystems Inc.

- Riddhi Corporate Services Ltd.

- Sedgwick

- Sutherland

- Tata Consultancy Services Ltd.

- WNS Holdings Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Insurance Claims Services Market

- In February 2024, Allstate Insurance Company, a leading provider of insurance claims services, announced the launch of its new artificial intelligence (AI) powered claims assessment tool, ClaimCare AI. This innovation significantly enhances the speed and accuracy of claims processing, reducing the average time taken by 30% (Allstate press release).

- In October 2025, Chubb Limited, another major player in the market, entered into a strategic partnership with IBM to leverage IBM's Watson AI technology for claims handling. This collaboration aims to improve claim processing efficiency and accuracy, enabling Chubb to offer more personalized services to its customers (IBM press release).

- In March 2025, Munich Re, the world's largest reinsurer, acquired a significant stake in a leading digital claims management platform, ClaimGenius. This investment will enable Munich Re to expand its digital capabilities and offer more efficient claims services to its clients (Munich Re press release).

- In May 2024, the European Commission approved the revised Insurance Distribution Directive (IDD), which includes new requirements for insurance intermediaries and distributors. This regulatory change will significantly impact the market, necessitating increased transparency, enhanced customer protection, and stricter compliance measures (European Commission press release).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and shifting industry dynamics. Claims investigation and handling are increasingly leveraging machine learning and claims data analytics to enhance accuracy and efficiency. Personal lines insurance and commercial insurance sectors are adopting claims platforms to streamline processes and improve operational efficiency. Industry best practices and insurance regulation are shaping the market, with a focus on claims automation and fraud prevention. Health insurance is exploring artificial intelligence and cloud computing to optimize claims resolution and enhance customer experience. Claims backlog and claims cycle time are critical metrics, with claims examiners utilizing natural language processing and claims software to expedite claims processing.

Auto insurance and business insurance sectors are integrating mobile applications and claims technology to improve accessibility and convenience. Regulatory changes and claims frequency are influencing the market, with insurance carriers, agents, brokers, and adjusters adopting digital transformation to reduce cost and improve customer satisfaction. Claims payables, claims workflow, claims adjudication, and claims reporting are all areas undergoing significant innovation. Risk management and claims processing are becoming more sophisticated, with a focus on big data, data security, claims severity, and cost reduction. The claims lifecycle is being optimized through claims ratios and claims specialists, ensuring a seamless claims experience for policyholders.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Insurance Claims Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.7% |

|

Market growth 2025-2029 |

USD 155.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.1 |

|

Key countries |

US, China, UK, Germany, India, France, Japan, Canada, Brazil, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Insurance Claims Services Market Research and Growth Report?

- CAGR of the Insurance Claims Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the insurance claims services market growth of industry companies

We can help! Our analysts can customize this insurance claims services market research report to meet your requirements.