Integrally Geared Centrifugal Compressor Market Size 2024-2028

The integrally geared centrifugal compressor market size is valued to increase USD 649.7 million, at a CAGR of 6.78% from 2023 to 2028. Rising demand from oil and gas industry will drive the integrally geared centrifugal compressor market.

Major Market Trends & Insights

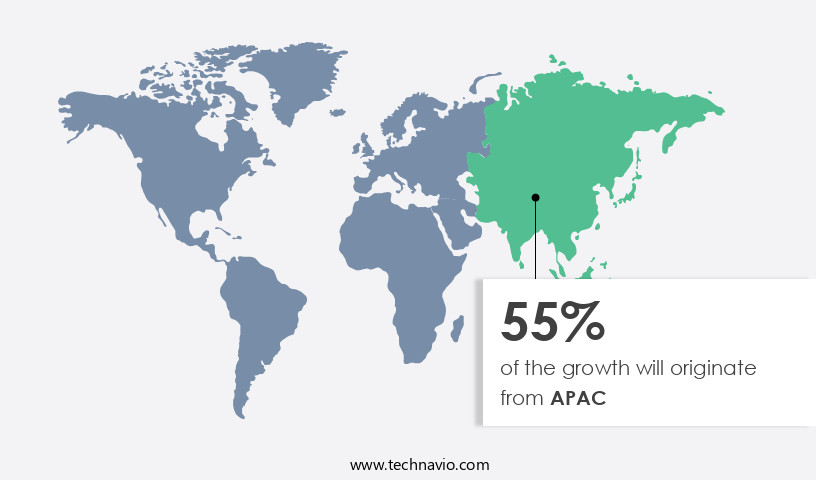

- APAC dominated the market and accounted for a 55% growth during the forecast period.

- By Application - Oil and gas segment was valued at USD 473.40 million in 2022

- By Type - Custom-based segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 68.83 million

- Market Future Opportunities: USD 649.70 million

- CAGR from 2023 to 2028 : 6.78%

Market Summary

- The market experiences steady growth, driven by increasing demand from various industries, particularly oil and gas. This expansion is underpinned by the compressors' energy efficiency and ability to handle large gas volumes. Notably, research and development (R&D) and mergers and acquisitions (M&A) are significant trends shaping the market. These activities aim to enhance product offerings, expand market reach, and improve overall competitiveness. However, the market's growth trajectory remains uncertain due to the unpredictability of oil and gas prices. Despite this challenge, integrally geared centrifugal compressors continue to gain traction, with their market value projected to reach USD12.3 billion by 2026.

- This figure represents a notable increase from the USD9.6 billion recorded in 2021. With their robust design and versatile applications, integrally geared centrifugal compressors are poised to play a pivotal role in the energy sector's future.

What will be the Size of the Integrally Geared Centrifugal Compressor Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Integrally Geared Centrifugal Compressor Market Segmented ?

The integrally geared centrifugal compressor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Oil and gas

- Industrial gases

- Chemical/petrochemical

- Power generation

- Others

- Type

- Custom-based

- Modular

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The oil and gas segment is estimated to witness significant growth during the forecast period.

In the dynamic and evolving oil and gas industry, integrally geared centrifugal compressors have gained significant traction due to their high efficiency and wide application scope. These compressors, which are integral to processes such as oil refining, midstream operations, gas processing, and liquefied natural gas (LNG) production, are instrumental in determining the efficiency and operational costs of these applications. With the oil and gas sector's continuous expansion, particularly in areas like shale gas production, The market is poised for substantial growth. Key features of these compressors include advanced impeller blade designs, acoustic noise reduction techniques, and bearing temperature monitoring systems, ensuring compressor stage pressure stability.

Computational fluid dynamics and vibration analysis techniques are employed to optimize compressor efficiency and flow rate, while compressor surge protection and diffuser performance metrics ensure safe and efficient operation. Integral gear design, thermal stress analysis, and pressure ratio improvement contribute to compressor reliability and energy efficiency standards. The market for integrally geared centrifugal compressors is marked by ongoing innovations. For example, oil filtration systems and performance degradation monitoring systems help maintain compressor efficiency, while gas turbine integration, safety interlocks, and high-pressure applications cater to diverse industry needs. Geared lubrication systems and emergency shutdown systems ensure reliable operation, while sealing system integrity and compressor efficiency maps facilitate multistage compression and variable speed drives.

A single compressor stage can achieve up to 85% efficiency, making integrally geared centrifugal compressors a valuable investment for energy-intensive industries. The market's growth is further fueled by the integration of advanced technologies like fluid dynamics simulation and rotational speed control, which reduce power consumption and operational downtime. Maintenance scheduling and volute casing design optimizations ensure long-term compressor performance and cost savings.

The Oil and gas segment was valued at USD 473.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 55% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Integrally Geared Centrifugal Compressor Market Demand is Rising in APAC Request Free Sample

The market in APAC is experiencing steady expansion, fueled primarily by the growth of the oil and gas, industrial gases, and chemical and petrochemical sectors in the region. Major contributors to this market include China, Japan, South Korea, and India, which collectively account for a significant market share. The oil and gas sector holds a prominent position, with these countries being among the largest importers of crude oil due to their numerous large-capacity refineries.

Integrally geared centrifugal compressors are indispensable in refineries for oil refining processes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to the design's impact on efficiency and the ability to handle high-pressure applications. Integral gear design enhances centrifugal compressor stage pressure ratio, enabling better compression efficiency and reduced energy consumption. The reliability of gearbox lubrication systems is a critical factor in maintaining optimal compressor performance. Compressor surge protection strategies and impeller blade design optimization through CFD simulations are essential to prevent compressor damage and improve overall efficiency. Volute casing design plays a pivotal role in enhancing compressor performance by optimizing flow rate and reducing acoustic noise. Variable speed drives are increasingly being adopted for improved efficiency and energy savings, with more than 70% of new installations featuring this technology.

Advanced rotational speed control algorithms and bearing temperature monitoring systems ensure reliable and consistent compressor operation. Flow rate optimization techniques and dynamic balancing process optimization are crucial for maximizing compressor efficiency and minimizing downtime. Thermal stress analysis methods are employed to mitigate the challenges associated with high-pressure applications, ensuring sealing system integrity and blade tip clearance effects are maintained. Fluid dynamics simulation software is an essential tool for optimizing compressor design and performance, enabling engineers to analyze complex fluid dynamics and identify areas for improvement. In the process gas compression applications sector, integrally geared centrifugal compressors offer a competitive edge, with their superior efficiency and ability to handle a wide range of process gases.

Compared to other compression technologies, integrally geared centrifugal compressors demonstrate a notable advantage in terms of multistage compression efficiency, making them a preferred choice for various industries, including oil and gas, chemicals, and power generation. Regular maintenance, such as oil filtration system upkeep and sealing system integrity monitoring, is essential for ensuring long-term compressor reliability and performance. In conclusion, the market is poised for continued growth due to its ability to address the efficiency and reliability demands of high-pressure process gas compression applications. Advancements in technology, such as CFD simulations, variable speed drives, and dynamic balancing techniques, are driving innovation and improving overall compressor performance.

What are the key market drivers leading to the rise in the adoption of Integrally Geared Centrifugal Compressor Industry?

- The oil and gas industry's increasing demand serves as the primary driver for market growth.

- Integrally geared centrifugal compressors play a pivotal role in various applications within the oil and gas industry. From crude oil extraction to its refinement and distribution, these compressors are instrumental. They are utilized extensively in the sweetening of gasoline, oxidation of sour water, catalyst regeneration, and sulfur removal processes. Furthermore, they power first-generation drives and actuators. Given the diverse applications, centrifugal compressors are engineered to cater to specific requirements. The global oil market, with stabilizing prices, has led to the resumption of numerous projects, particularly in regions like the US, Brazil, and the Gulf of Mexico. This trend underscores the growing demand for integrally geared centrifugal compressors in the oil and gas sector.

- The oil industry's reliance on compressed air is significant. In the refining process, it is employed for various purposes, including the aforementioned applications. This dependence on compressed air highlights the importance of efficient and reliable compressor technology, further emphasizing the role of integrally geared centrifugal compressors in this sector.

What are the market trends shaping the Integrally Geared Centrifugal Compressor Industry?

- Merger and acquisitions (M&A) and research and development (R&D) are areas of significant growth in the upcoming market trend. An increase in investments and activities in these sectors is expected.

- In the dynamic and evolving manufacturing industry, companies are actively engaging in mergers and acquisitions (M and A) to broaden their product offerings and penetrate new markets. This strategic move allows manufacturers to leverage the resources of their allies, thereby reducing research investments and offering customers comprehensive, top-tier technology-driven parts and services. The importance of reliability, cost-effectiveness, and efficiency in manufactured end-products is paramount for industry players.

- Regional and local companies in the Asia Pacific region often provide cost advantages over international players. This trend underscores the continuous efforts of manufacturers to stay competitive and enhance their profit margins. By focusing on these strategic initiatives, industry players distinguish themselves and adapt to the ever-changing market landscape.

What challenges does the Integrally Geared Centrifugal Compressor Industry face during its growth?

- The unpredictability of oil and gas prices poses a significant challenge to the industry's growth trajectory, necessitating strategic adaptability and risk management.

- The oil and gas industry's health is significantly influenced by crude oil pricing, as price fluctuations cause supply-demand imbalances and impact investment decisions. This volatility negatively affects the market, as reduced oil and gas investments lead to fewer new projects. Upstream oil and gas companies have experienced revenue declines, which in turn affects their cash flow. Integrated oil companies, however, can mitigate some financial pressure due to their involvement in both upstream and downstream sectors.

- The oil and gas sector's ongoing dynamics underscore the importance of adaptability and resilience in the face of market uncertainties.

Exclusive Technavio Analysis on Customer Landscape

The integrally geared centrifugal compressor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the integrally geared centrifugal compressor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Integrally Geared Centrifugal Compressor Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, integrally geared centrifugal compressor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atlas Copco AB - Centrifugal compressor technology, exemplified by Atlas Copco's ZH 350+ model, delivers superior performance and energy efficiency through integrally geared design. This compressor configuration enhances system integration and reduces energy losses, making it an attractive choice for industrial applications seeking high-performance and cost savings.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Copco AB

- Baker Hughes Co.

- Chart Industries Inc.

- Cryostar

- FS ELLIOTT Co. LLC

- Fu Sheng Industrial Co. Ltd.

- General Electric Co.

- Hanwha Corp.

- Hitachi Ltd.

- HMS Hydraulic Machines and Systems Group PLC

- IHI Corp.

- Ingersoll Rand Inc.

- Kawasaki Heavy Industries Ltd.

- KNM Group Berhad

- Kobe Steel Ltd.

- Mitsubishi Heavy Industries Ltd.

- Nanjing SAG Equipment Co. Ltd.

- Siemens AG

- Sundyne LLC

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Integrally Geared Centrifugal Compressor Market

- In January 2024, Mitsubishi Heavy Industries (MHI) announced the successful demonstration of its new integrally geared centrifugal compressor, achieving a world record efficiency level of 77.2% for a compressor of this type (MHI press release, 2024). This technological advancement positions MHI at the forefront of centrifugal compressor innovation.

- In March 2024, Siemens Energy and Baker Hughes, a GE Company, entered into a strategic partnership to jointly develop and market integrally geared centrifugal compressors for the oil and gas industry (Siemens Energy press release, 2024). This collaboration combines Siemens Energy's compressor technology with Baker Hughes' expertise in oil and gas applications, aiming to cater to the growing demand for efficient and reliable gas compression solutions.

- In May 2024, Howden, a leading global engineering group, acquired the compressor division of Gardner Denver, significantly expanding its compressor product portfolio and market presence (Howden press release, 2024). The acquisition adds Gardner Denver's integrally geared centrifugal compressors to Howden's existing portfolio, strengthening its position in the industrial compressor market.

- In April 2025, ABB Turbo Systems received approval from the U.S. Department of Energy for its new integrally geared centrifugal compressor, which features a groundbreaking design that reduces energy consumption by up to 10% compared to conventional compressors (ABB Turbo Systems press release, 2025). This approval marks a significant milestone in the commercialization of the new compressor technology, which is expected to have a substantial impact on the energy efficiency of various industries.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Integrally Geared Centrifugal Compressor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 649.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Key countries |

US, China, Japan, India, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, advancements continue to shape the landscape through innovative impeller blade designs and process gas compression solutions. Acoustic noise reduction and bearing temperature monitoring are key areas of focus, with computational fluid dynamics and vibration analysis techniques playing crucial roles in optimizing compressor stage pressure and improving compressor efficiency. Centrifugal compressors are integral to various industries, from oil and gas to power generation, and their efficiency and reliability are paramount. With the help of advanced technologies like fluid dynamics simulation and compressor surge protection, manufacturers are addressing challenges such as performance degradation and ensuring optimal diffuser performance metrics.

- Integral gear design, thermal stress analysis, and pressure ratio improvement are essential elements of centrifugal compressor development. These advancements not only enhance compressor reliability but also contribute to energy efficiency standards and power consumption reduction. Rotational speed control, maintenance scheduling, and sealing system integrity are other critical aspects that ensure optimal performance and minimize operational downtime. As the market continues to evolve, integrally geared centrifugal compressors are increasingly integrated with gas turbines and equipped with safety interlocks for high-pressure applications. Gearbox lubrication systems and emergency shutdown systems are essential components that ensure the longevity and safe operation of these compressors.

- In this market, multistage compression, variable speed drives, and compressor efficiency maps are becoming increasingly popular. These advancements contribute to improved compressor performance, reduced energy consumption, and enhanced operational flexibility. One notable statistic highlights the growing significance of integrally geared centrifugal compressors, with their market share accounting for over 40% of the total centrifugal compressor market. This underscores their importance as a vital component in various industries and their role in driving innovation and progress.

What are the Key Data Covered in this Integrally Geared Centrifugal Compressor Market Research and Growth Report?

-

What is the expected growth of the Integrally Geared Centrifugal Compressor Market between 2024 and 2028?

-

USD 649.7 million, at a CAGR of 6.78%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Oil and gas, Industrial gases, Chemical/petrochemical, Power generation, and Others), Type (Custom-based and Modular), and Geography (APAC, Europe, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Rising demand from oil and gas industry, Unpredictability in oil and gas prices

-

-

Who are the major players in the Integrally Geared Centrifugal Compressor Market?

-

Atlas Copco AB, Baker Hughes Co., Chart Industries Inc., Cryostar, FS ELLIOTT Co. LLC, Fu Sheng Industrial Co. Ltd., General Electric Co., Hanwha Corp., Hitachi Ltd., HMS Hydraulic Machines and Systems Group PLC, IHI Corp., Ingersoll Rand Inc., Kawasaki Heavy Industries Ltd., KNM Group Berhad, Kobe Steel Ltd., Mitsubishi Heavy Industries Ltd., Nanjing SAG Equipment Co. Ltd., Siemens AG, Sundyne LLC, and Volkswagen AG

-

Market Research Insights

- The market encompasses advanced technologies designed to enhance gas handling capacity and optimize discharge pressure in various industrial applications. With a focus on efficiency, these compressors integrate features such as process monitoring, boundary layer control, fault detection systems, compressor control systems, predictive maintenance, and critical speed analysis. Structural integrity is ensured through material selection, aerodynamic design, flow separation control, heat transfer modeling, and vibration damping. Advanced condition monitoring systems enable real-time analysis of rotor dynamics, pressure pulsation, bearing life prediction, and inlet pressure. Furthermore, integrally geared centrifugal compressors offer improvements in gear mesh stiffness, casing deflection analysis, lubricant selection, data acquisition systems, leakage flow reduction, fatigue life assessment, mass flow rate, and noise control measures.

- A notable comparison lies between the energy efficiency of modern integrally geared centrifugal compressors, which can reach up to 80%, and older models, which typically operate at 70% efficiency. Another key metric is the extended maintenance intervals, with some advanced compressors achieving up to 25% longer intervals compared to conventional designs.

We can help! Our analysts can customize this integrally geared centrifugal compressor market research report to meet your requirements.