Interactive Whiteboard Market Size 2024-2028

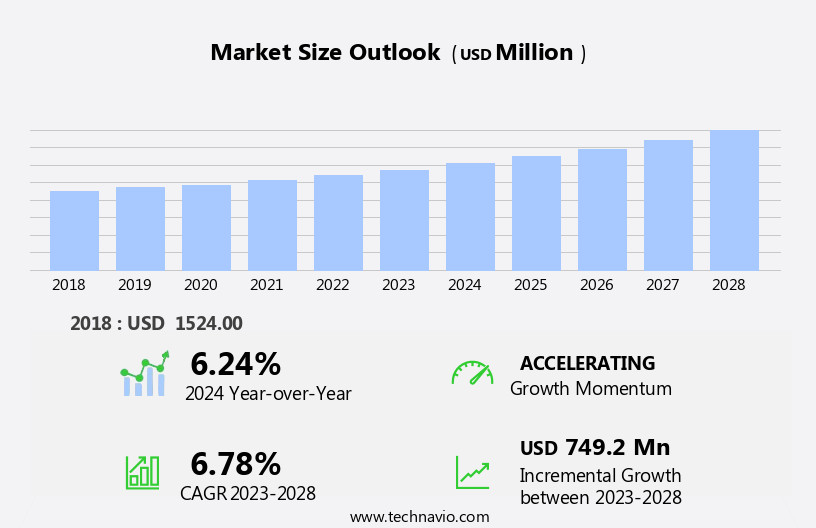

The interactive whiteboard market size is forecast to increase by USD 749.2 million at a CAGR of 6.78% between 2023 and 2028.

- The increasing use of advanced technologies in the education sector is a key driver of the interactive whiteboard market. As schools and universities adopt more tech-driven learning environments, interactive whiteboards and K-12 game-based learning are becoming essential tools for fostering engagement, collaboration, and enhanced teaching methods. These boards allow for dynamic content delivery, real-time student interaction, and better overall learning experiences.

- In the APAC market, there is a growing emphasis on digitalization and interactive learning tools. As countries in the region invest in modernizing their educational infrastructure, interactive whiteboards are gaining traction in classrooms. This shift towards e-learning solutions is driving the market's growth, with governments and educational institutions prioritizing technology integration to improve educational outcomes.

What will be the Size of the Interactive Whiteboard Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing digitalization of education sectors worldwide. Traditional whiteboards and projectors are being replaced with interactive whiteboards (IWBs), also known as smart boards or touchscreens. These advanced tools enable teachers to engage students more effectively through multi-touch functionality, gesture recognition, and split-screen capabilities.

How is this Interactive Whiteboard Industry segmented and which is the largest segment?

The interactive whiteboard industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Education sector

- Corporate sector

- Technology

- Resistive

- Capacitive

- Infrared

- Electromagnetic pen

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By End-user Insights

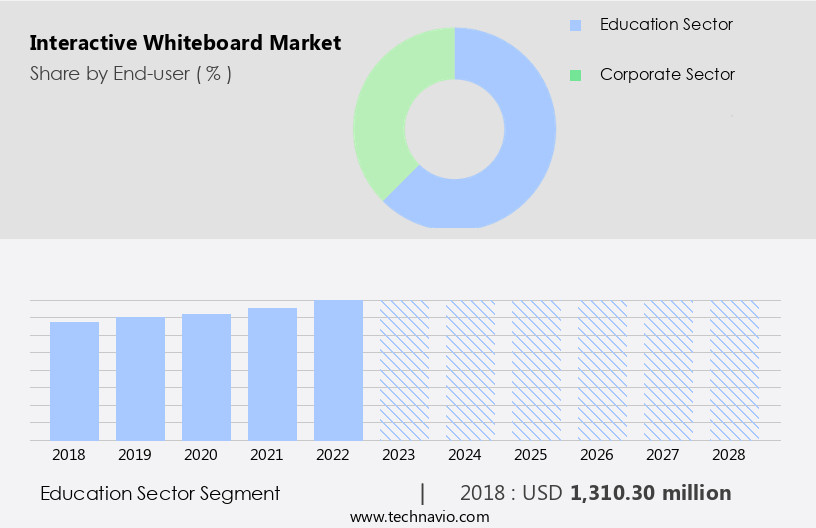

- The education sector segment is estimated to witness significant growth during the forecast period.

Interactive whiteboards have become essential tools in modern education, transforming traditional classrooms into digital and interactive learning environments. These devices enable teachers to present content more effectively than with traditional whiteboards or projectors. For instance, the introduction of interactive whiteboard apps, such as Explain Everything, allows educators to work on multiple windows and platforms simultaneously, enhancing engagement with students through multimedia and imaginative instructions. The integration of artificial intelligence (AI) and machine learning (ML) technologies further enriches digital classrooms, enabling features like gesture recognition, multi-touch, and split screen. The adoption of smart education policies and the proliferation of e-learning courses have accelerated the digitalization of education, making interactive whiteboards an indispensable component of online education.

These devices are available in various sizes and technologies, including infrared, resistive, capacitive, and electromagnetic, catering to diverse user needs. The healthcare and corporate sectors also benefit from interactive whiteboards, utilizing them for training and presentations. Advance technologies, such as touch screens and computer integration, further enhance their functionality.

Get a glance at the Interactive Whiteboard Industry report of share of various segments Request Free Sample

The Education sector segment was valued at USD 1.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

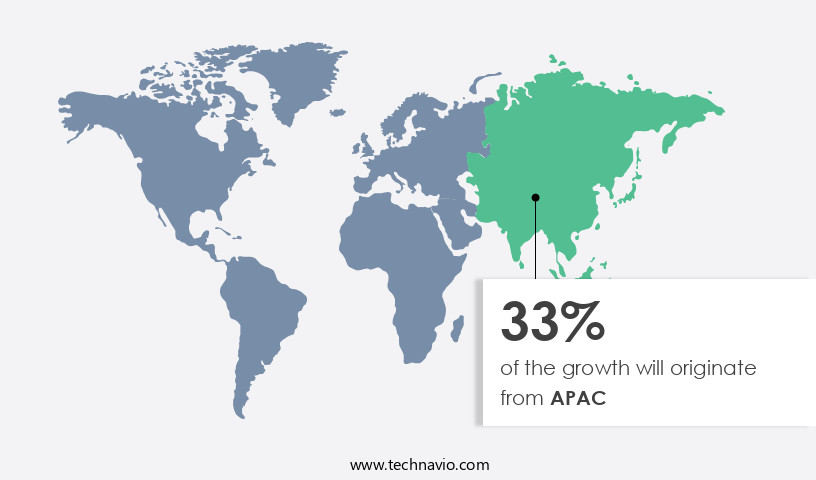

- APAC is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the North American education sector, there is a growing emphasis on digitalization and interactive learning tools. The US government's focus on enhancing education quality through Common Core Standards (CSS) in K-12 and higher education drives this trend. Active learning techniques, such as gamification and video tutorials, are increasingly popular, fueling the demand for collaborative software like learning management systems (LMS) and classroom management systems (CMS). These tools facilitate a collaborative learning environment. Digital technologies, including tablets, smartphones, and interactive whiteboards (IWB), are transforming traditional classrooms into digital and virtual ones. IWBs, also known as smart boards, are touch screen devices that allow multi-touch, gesture recognition, and split screen capabilities.

They can be integrated with digital content, projectors, and styluses, and offer multi-language features. AI and machine learning technologies are also being integrated into IWBs, enhancing their functionality. The healthcare and corporate sectors are also adopting IWBs for training purposes. The integration of advanced technologies, such as AI, ML, and digital content, is revolutionizing education and making it more accessible and effective.

Market Dynamics

The integration of artificial intelligence (AI) and machine learning (ML) further enhances the learning experience by providing personalized recommendations based on student's knowledge levels. E-learning, e-learning courses, and virtual classrooms have become increasingly popular, driving demand for portable IWBs. Tablets and smartphones are also being used as alternative input devices. Smart education policies are further fueling the adoption of IWBs, which offer multi-language features and remote class capabilities. As technology continues to evolve, IWBs are expected to become more integrated with computers and offer more advanced functionalities, such as AI-powered virtual assistants and real-time translation. Overall, the market is poised for continued growth as digital education becomes a priority in schools and businesses alike.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Interactive Whiteboard Industry?

Increasing use of advanced technologies in education sector is the key driver of the market.

- The Interactive Whiteboard (IWB) market In the education sector has experienced significant growth In the last decade, driven by the digitalization of classrooms and the integration of technology into teaching methods. Traditional whiteboards have been replaced with digital whiteboards, including smart boards and touch screens, which offer advanced features such as multi-touch, gesture recognition, and split screen. These technologies enable more engaging and interactive e-learning experiences, making education more effective and efficient. E-learning courses and virtual classrooms have become increasingly popular, allowing students to learn from anywhere using tablets, smartphones, and computers. Artificial intelligence (AI) and machine learning (ML) are also being integrated into IWBs, enhancing their capabilities with features like automatic content recognition and personalized learning.

- The IWB market is not limited to the education sector alone. It is also gaining traction in healthcare, corporate training, and other industries. The market is driven by advance technologies, digital content, and information projectors, providing a digital screen that can be used on walls, projectors, or portable IWBs. Smart education policies and investments in digital education have further fueled the growth of the IWB market. The market offers various hardware and software options, including screen sizes, infrared, resistive, capacitive, and electromagnetic technologies. The IWB market is expected to continue growing as technology continues to revolutionize education and other industries.

What are the market trends shaping the Interactive Whiteboard Industry?

Increased adoption of gamification is the upcoming market trend.

- The Interactive Whiteboard (IWB) market is experiencing significant growth in various sectors, particularly in education. In the education sector, the integration of IWBs in e-learning and digital classrooms is becoming increasingly popular. Traditional whiteboards are being replaced with digital whiteboards, which offer advanced features such as projectors, stylus, and touch screens. These technologies enable students to engage more actively In the learning process, making education more interactive and effective. Moreover, the advent of artificial intelligence (AI) and machine learning (ML) is revolutionizing the way education is delivered. Virtual classrooms, remote classes, and split screens are becoming the new norm.

- Multi-touch and gesture recognition technologies allow for a more immersive learning experience. IWBs also offer multi-language features, making education more accessible to students from diverse backgrounds. Portable IWBs and digital education courses are also gaining popularity, making learning more flexible and convenient. The digitalization of education policies and the adoption of smart education policies further fuel the growth of the IWB market. Advanced technologies such as computer, digital content, information projectors, and digital screens are essential components of IWBs. The IWB market caters to various industries, including healthcare, corporate, and education. The market offers various hardware and software options, including screen sizes, infrared, resistive, capacitive, and electromagnetic technologies.

- IWBs are also used in healthcare for telemedicine and patient education. In conclusion, the market is witnessing significant growth due to the increasing demand for digitalization, advanced technologies, and smart education policies. The integration of AI and ML is further revolutionizing the way education is delivered, making it more interactive, effective, and accessible to students from diverse backgrounds.

What challenges does the Interactive Whiteboard Industry face during its growth?

Challenges in implementation is a key challenge affecting the industry growth.

- The education sector's shift towards e-learning and digital classrooms has been accelerated by the availability of advanced technologies. Interactive whiteboards (IWB), also known as smart boards, have emerged as a popular solution for enhancing student engagement and knowledge acquisition. These digital tools offer features such as multi-touch, gesture recognition, and split screen, making learning more interactive and engaging. However, the adoption of IWBs in schools and universities faces challenges due to budget constraints and the need for institutional culture change. Traditional whiteboards, which have long been the mainstay of classrooms, are being replaced by digital whiteboards that offer more functionality.

- These digital whiteboards can be projected using a computer, projector, or even a tablet or smartphone, enabling remote learning and virtual classrooms. Artificial intelligence (AI) and machine learning (ML) technologies are also being integrated into IWBs, enhancing their capabilities further. The market for IWBs is expected to grow as digitalization continues to transform the education sector. The hardware and software components of IWBs include various technologies such as infrared, resistive, capacitive, and electromagnetic. IWBs have applications beyond the education sector, including healthcare and corporate settings. Digital content creation and delivery are essential components of IWBs, making them versatile tools for information dissemination.

- The implementation of smart education policies is expected to drive the growth of the IWB market.

Exclusive Customer Landscape

The interactive whiteboard market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the interactive whiteboard market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, interactive whiteboard market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Alphabet Inc. - Interactive whiteboards, a key collaboration tool in modern education and business environments, are offered under the brand Google Inc. These advanced technologies enable users to write, draw, and collaborate on digital surfaces, fostering interactive and engaging learning experiences or productive meetings. Google's interactive whiteboards integrate seamlessly with other Google Workspace applications, ensuring a cohesive and efficient digital workspace.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- Boxlight Corp

- Cisco Systems Inc.

- Delta Electronics Inc.

- Genee World Ltd

- Hitachi Ltd.

- Leyard Group

- LG Electronics Inc.

- Microsoft Corp.

- Newline Interactive Inc.

- Panasonic Holdings Corp.

- Promethean World Ltd.

- Qisda Corp.

- Ricoh Co. Ltd.

- Samsung Electronics Co. Ltd.

- Seiko Epson Corp.

- Sharp NEC Display Solutions of America Inc.

- SMART Technologies ULC

- Steelcase Inc.

- ViewSonic Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market represents a significant segment withIn the broader digital education and corporate sectors. This market encompasses a range of technologies designed to enhance collaboration, engagement, and productivity in various settings. Interactive whiteboards offer a more dynamic and interactive alternative to traditional whiteboards, allowing users to write, draw, and manipulate digital content in real-time. The market for interactive whiteboards is driven by several factors. One key factor is the growing trend towards digitalization in education and corporate environments. With the increasing availability of digital content and remote learning solutions, interactive whiteboards provide an essential tool for delivering and engaging with this content.

Moreover, the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) further enhances the functionality and value of these devices. Interactive whiteboards cater to various user needs through different technologies. Hardware options include infrared, resistive, capacitive, and electromagnetic. Software features include multi-touch, gesture recognition, split screen, and multi-language support. Portable options offer added flexibility for users on the go. The market for interactive whiteboards is not limited to the education sector. Corporations and healthcare institutions also utilize these devices to facilitate collaboration, training, and communication. Digital content, such as presentations, diagrams, and images, can be easily displayed and manipulated on an interactive whiteboard, making it an indispensable tool for many organizations.

Advancements in technology continue to shape the market. For instance, touch screens and computer integration have become increasingly common, enabling users to interact with digital content more intuitively. Furthermore, advancements in AI and ML allow for more sophisticated applications, such as automatic content recognition and real-time translation. In conclusion, the market represents a dynamic and evolving segment withIn the digital education and corporate sectors. Driven by the trend towards digitalization and the integration of advanced technologies, interactive whiteboards offer a versatile and engaging solution for enhancing collaboration, productivity, and learning in various settings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.78% |

|

Market growth 2024-2028 |

USD 749.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Key countries |

US, UK, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Interactive Whiteboard Market Research and Growth Report?

- CAGR of the Interactive Whiteboard industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the interactive whiteboard market growth of industry companies

We can help! Our analysts can customize this interactive whiteboard market research report to meet your requirements.