Intermittent Catheters Market Size 2024-2028

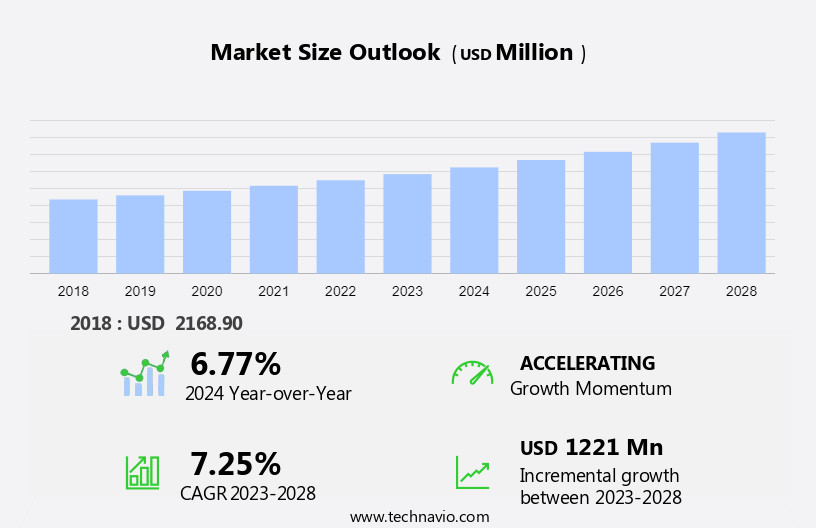

The intermittent catheters market size is forecast to increase by USD 1.22 billion, at a CAGR of 7.25% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the rising incidence of urinary incontinence, particularly among the aging population. This demographic trend, coupled with the increasing awareness and acceptance of intermittent catheterization as a viable treatment option, presents a substantial market opportunity. Companies in this market are responding to this demand by focusing on the development and use of advanced biocompatible materials for their products. These materials aim to minimize complications and enhance patient comfort, addressing a key challenge in the market.

- However, risks and complications associated with intermittent catheterization, such as urinary tract infections and injury to the urethra, remain significant obstacles that must be addressed through continued research and innovation. Companies seeking to capitalize on market opportunities and navigate these challenges effectively should prioritize the development of user-friendly, safe, and effective intermittent catheter solutions.

What will be the Size of the Intermittent Catheters Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse needs of various sectors. Bladder dysfunction, a common condition leading to urinary retention, necessitates the use of these devices for urine collection. Open system catheters, although effective, pose infection risks, leading to the increasing preference for closed system catheters. Multiple sclerosis patients often require intermittent self-catheterization (ISC) for managing neurogenic bladder. Healthcare costs, a significant concern, are influenced by the adoption of cost-effective catheter types, such as single-use and multi-use catheters. Post-operative care and urological procedures necessitate the use of various catheter types, including foley catheters and indwelling catheters.

Catheter valves and antimicrobial coatings enhance infection prevention, while patient comfort is ensured through the use of hydrophilic coatings and various catheter materials. Quality of life is a crucial factor, with patient education and catheter care essential for optimal use. Catheter lengths, French sizes, and catheter removal techniques cater to individual patient needs. Advancements in technology include antireflux valves, drainage bags, and coupling systems, streamlining supply chain management. Condom catheters and diagnostic catheters cater to specific applications. Spinal cord injury patients and those with prostate enlargement also benefit from these devices. The market's continuous dynamism reflects the ongoing unfolding of market activities and evolving patterns.

How is this Intermittent Catheters Industry segmented?

The intermittent catheters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Ambulatory surgery center

- Medical research center

- Product

- Uncoated intermittent catheters

- Coated intermittent catheters

- Closed system intermittent catheters

- Geography

- North America

- US

- Europe

- Finland

- Germany

- Italy

- APAC

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

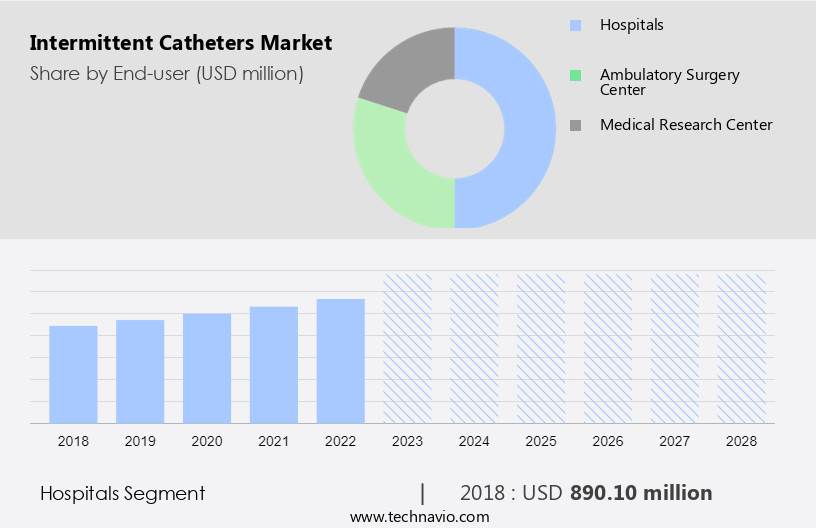

The hospitals segment is estimated to witness significant growth during the forecast period.

The intermittent catheter market is experiencing significant growth due to the increasing prevalence of bladder dysfunctions, such as urinary retention and neurogenic bladder, which require the use of intermittent catheters for urine collection. Hospitals are the largest consumers of intermittent catheters, accounting for a substantial market share, due to the high volume of urological procedures and post-operative care. Infection prevention is a major concern in the market, leading to the widespread adoption of closed system catheters and antimicrobial coatings. Latex catheters have been largely replaced by silicone and hydrophilic-coated catheters for improved patient comfort and ease of use. Sterile packaging and catheter securement devices are also essential components of the market, ensuring the prevention of healthcare-associated infections (HAIs).

The market is witnessing the introduction of advanced catheter designs, such as catheter valves and anti-reflux valves, for improved patient comfort and catheter care. Intermittent self-catheterization (ISC) is gaining popularity, especially among patients with spinal cord injuries and multiple sclerosis, for enhanced quality of life. The market is also witnessing the emergence of single-use and multi-use catheters, as well as home healthcare solutions, for long-term catheterization. The market's growth is, however, challenged by the high healthcare costs associated with catheterization and the need for effective supply chain management. Catheter removal and proper catheter care are crucial aspects of the market, ensuring patient safety and reducing the risk of urinary tract infections.

Overall, the intermittent catheter market is expected to continue its growth trajectory, driven by the increasing demand for advanced catheter designs and the need for effective infection prevention measures.

The Hospitals segment was valued at USD 890.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

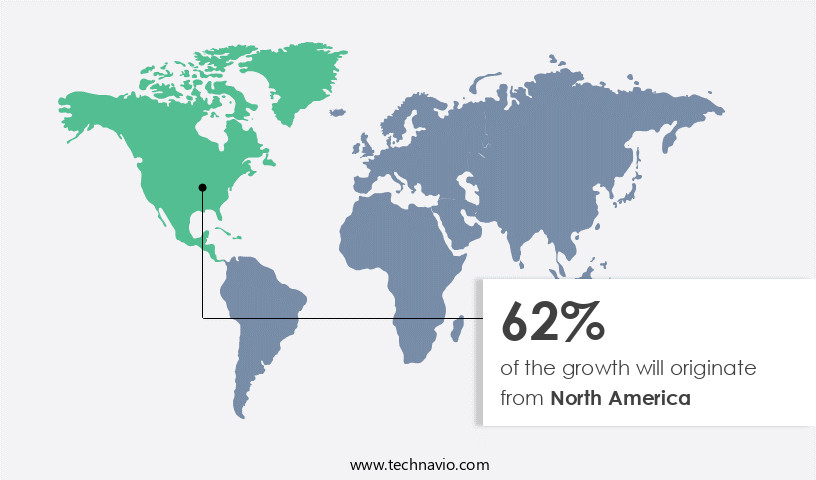

North America is estimated to contribute 62% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing notable growth, driven by the increasing prevalence of bladder dysfunction and the rising number of urological procedures. In this region, the US holds a significant market share due to its aging population and high incidence of urinary incontinence. Advanced intermittent catheters with improved tip designs are gaining popularity, contributing to market expansion. Reimbursement coverage by Medicare for up to 200 intermittent catheters per month in the US further boosts sales. Infection prevention remains a critical concern, leading to the increasing adoption of closed system catheters and antimicrobial coatings. Patient education and catheter care are essential aspects of the market, with a focus on ensuring patient comfort and minimizing healthcare-associated infections (HAIs).

Neurogenic bladder, spinal cord injury, and multiple sclerosis are significant conditions driving market growth. The market is also witnessing the introduction of various catheter materials, sizes, and catheter care products, catering to diverse patient needs. The use of catheter valves, drainage bags, and catheter securement devices further enhances patient convenience and comfort. The market is expected to continue its growth trajectory, with ongoing research and development in catheter technologies and materials.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Intermittent Catheters Industry?

- The rising prevalence of urinary incontinence among an aging population serves as the primary market driver.

- Intermittent catheters serve a crucial role in managing bladder dysfunction for individuals experiencing urinary incontinence. This condition, characterized by the involuntary leakage of urine, affects approximately one-third of men and women in the US, with a higher prevalence among older adults. According to the Centers for Disease Control and Prevention (CDC), over ten million people in the US live with urinary incontinence. Intermittent catheters are preferred over urine collection bags due to their ability to maintain normal bladder function and reduce the risk of urinary tract infections (UTIs). These catheters come in various types, including open system catheters and suprapubic catheters.

- Open system catheters require external connection to a drainage bag, while suprapubic catheters are surgically inserted into the bladder through an incision in the abdomen. To prevent infections, infection prevention measures such as sterile packaging, catheter flushing, and coupling systems are essential. Catheter materials and hydrophilic coatings are critical factors in infection prevention and patient comfort. Latex catheters, though widely used, may cause allergic reactions in some individuals. Therefore, alternative materials like silicone and polyurethane are increasingly popular. Healthcare-associated infections (HAIs) are a significant concern in the use of intermittent catheters. Proper catheter insertion, maintenance, and disposal practices are essential to minimize the risk of HAIs.

- Regular monitoring and follow-up care are crucial to ensure optimal patient outcomes.

What are the market trends shaping the Intermittent Catheters Industry?

- The use of advanced biocompatible materials is gaining increasing importance among companies, representing a significant market trend in the industry. This shift towards more sophisticated and compatible materials is a notable development in the sector.

- Intermittent catheters are essential medical devices used for the drainage of urine in individuals with bladder dysfunction or those undergoing post-operative care. The selection of appropriate catheters depends on various factors, including medical need, expected duration of use, and personal preference. These catheters are available in different shapes, sizes, materials, and coatings. Commonly used materials include silicone, PVC, and latex rubber, with silicone being the most widely adopted due to its intrinsic biocompatibility and proven safety record. Although silicone is more expensive than other materials, its widespread use results in economies of scale, reducing the overall cost. Intermittent catheters come in various forms, such as closed system catheters, which feature integrated catheter valves to prevent leakage and reduce the risk of infection.

- Additionally, antimicrobial coatings are available on some catheters to minimize the risk of urinary tract infections. Patients with conditions like multiple sclerosis often benefit from intermittent self-catheterization (ISC), which can significantly improve their quality of life. In healthcare settings, intermittent catheters are used extensively, particularly in post-operative care and for patients with spinal cord injuries or neurogenic bladder dysfunction. Night drainage bags and larger French sizes are often used for patients with higher urine output or those requiring extended periods of drainage. Overall, intermittent catheters play a crucial role in managing bladder dysfunction and improving patient outcomes.

What challenges does the Intermittent Catheters Industry face during its growth?

- Intermittent catheters are widely used medical devices, but their implementation is not without risks and complications, which pose a significant challenge and hinder the growth of the industry.

- Intermittent catheterization is a common solution for managing bladder incontinence in individuals who struggle to empty their bladder completely. However, this procedure carries risks, particularly for those who self-catheterize long-term. Complications can manifest in various forms, including urethral and bladder issues. Urethral complications, such as meatal inflammation and bleeding, can occur frequently in self-catheterized patients. Approximately one-third of these patients may experience persistent urethral bleeding, which could indicate a urinary tract infection (UTI). Bladder complications, including UTIs, bleeding, and stone formation, can also arise from intermittent catheterization. Patient comfort and safety are paramount in managing these risks.

- Supplies like single-use catheters, anti-reflux valves, drainage bags, and leg bags play a crucial role. Effective supply chain management and patient education are essential for minimizing complications and ensuring optimal patient care. Neurogenic bladder patients, in particular, require careful attention due to the increased risk of complications. Silicone catheters are a popular choice due to their comfort and flexibility. By prioritizing patient comfort, thorough education, and efficient supply chain management, healthcare providers can help mitigate the risks associated with intermittent catheterization.

Exclusive Customer Landscape

The intermittent catheters market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the intermittent catheters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, intermittent catheters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASID BONZ GmbH - This company specializes in providing intermittent catheters, including the Coloplast Self Cath and HR TruCath Straight Tip models, for individuals requiring urinary catheterization.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASID BONZ GmbH

- At Home Medical Products Inc.

- B.Braun SE

- Becton Dickinson and Co.

- Cardinal Health Inc.

- Catheter Medical

- Coloplast AS

- COMFORT MEDICAL LLC

- CompactCath Inc.

- ConvaTec Group Plc

- Dentsply Sirona Inc.

- Hollister Inc.

- HR Pharmaceuticals Inc.

- McKesson Corp.

- Medline Industries LP

- Optimum Medical Ltd.

- Paralogic Pty Ltd

- Pennine Healthcare

- Romsons

- Teleflex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Intermittent Catheters Market

- In January 2024, B. Braun Melsungen AG, a leading medical device manufacturer, announced the launch of its new Intermittent Catheter System, called "CareFusion Intermittent Catheter System," designed for long-term care facilities and home care settings (B. Braun press release, 2024). This system offers enhanced infection prevention features and improved patient comfort.

- In March 2024, Coloplast A/S, a Danish medical device company, entered into a strategic partnership with Medtronic plc to expand its intermittent catheter business in Europe and the Middle East. This collaboration allowed Coloplast to leverage Medtronic's sales and marketing capabilities, broadening its reach in these regions (Medtronic press release, 2024).

- In April 2025, ConvaTec Group plc, a global medical technologies company, completed the acquisition of the intermittent catheter business of C. R. Bard, Inc. This acquisition significantly increased ConvaTec's market share in the intermittent catheter segment and provided the company with a broader product portfolio (ConvaTec press release, 2025).

- In May 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Smiths Medical, a global leader in medical devices, for its new intermittent catheter product, the CADD-Legacy Autoclavable Intermittent Catheter. This clearance marked the company's entry into the autoclavable intermittent catheter market, expanding its product offerings (Smiths Medical press release, 2025).

Research Analyst Overview

- The market experiences dynamic trends, driven by advancements in surface chemistry and material science. Direct-to-consumer sales and marketing strategies expand market access, while regulatory compliance and safety standards ensure ethical business practices. Ethylene oxide sterilization and gamma irradiation maintain product quality, and remote patient monitoring enables effective post-market surveillance. Wholesale distributors and retail pharmacies broaden distribution channels, and pricing strategies adjust to accommodate various market segments. Training programs and patient support initiatives foster customer loyalty, and online sales platforms streamline access.

- Catheterization techniques evolve with minimally invasive procedures, and clinical trials test new polymer chemistries. Predictive modeling and data analytics optimize inventory management and forecast demand, and durability testing ensures product longevity. Adherence to medical device regulations and addressing adverse events through safety standards are crucial for market growth.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Intermittent Catheters Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.25% |

|

Market growth 2024-2028 |

USD 1221 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.77 |

|

Key countries |

US, Italy, Germany, Japan, and Finland |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Intermittent Catheters Market Research and Growth Report?

- CAGR of the Intermittent Catheters industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the intermittent catheters market growth of industry companies

We can help! Our analysts can customize this intermittent catheters market research report to meet your requirements.