Internet Of Things (IoT) Enabled Industrial Wearables Market Size 2025-2029

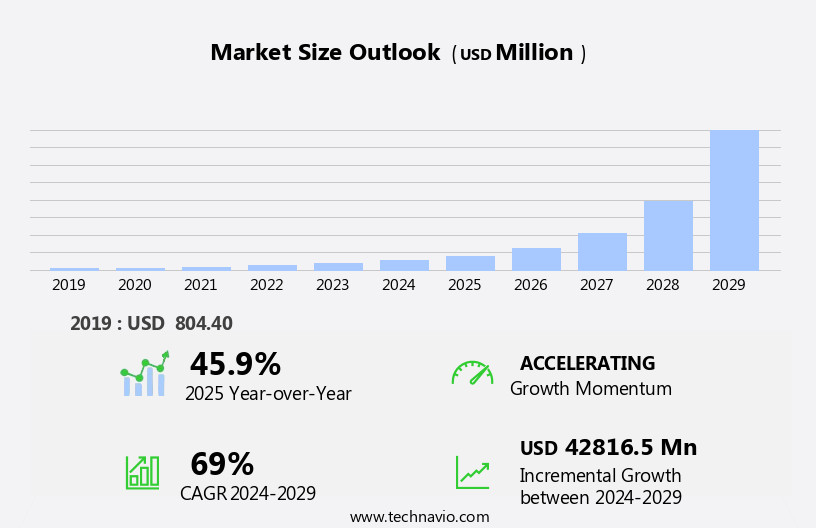

The internet of things (iot) enabled industrial wearables market size is forecast to increase by USD 42.82 billion, at a CAGR of 69% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing digitalization and automation within industries. This trend is leading to the widespread adoption of wearable technologies that enhance productivity, improve operational efficiency, and facilitate real-time data collection. However, one of the key challenges facing this market is the high cost of wearable devices and associated technology. This cost barrier can limit the adoption of these solutions, particularly among smaller and mid-sized businesses. Another challenge is the need to extend battery life, as prolonged usage is essential for effective industrial applications. Despite these hurdles, the potential benefits of IoT wearables in industries are substantial, including enhanced worker safety, predictive maintenance, and optimized workflows.

- Companies seeking to capitalize on these opportunities must address the cost and battery life challenges through innovative design, partnerships, and pricing strategies. By doing so, they can effectively navigate the market landscape and stay competitive in the rapidly evolving industrial wearables space.

What will be the Size of the Internet Of Things (IoT) Enabled Industrial Wearables Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with new applications and technologies shaping its dynamics. In various sectors, including virtual reality, military and defense, and industrial automation, wearable devices are being integrated to enhance productivity and efficiency. IoT connectivity and wireless communication enable real-time data exchange between wearables and other systems. Edge computing allows for local data processing, reducing latency and increasing responsiveness. Industrial wearables, such as motion capture sensors, smart gloves, and smart helmets, are being used to optimize worker performance and ensure safety. Virtual reality and augmented reality technologies are being incorporated into industrial wearables to provide immersive training experiences, enabling remote training and real-time feedback.

Military and defense applications include the use of biometric monitoring, motion capture, and voice recognition for enhanced situational awareness and mission success. Wearable sensors, including those for environmental monitoring and asset tracking, are becoming increasingly common in industrial settings. Data security and privacy concerns are being addressed through compliance standards and advanced encryption techniques. The market's continuous unfolding is driven by ongoing advancements in IoT, wireless communication, and edge computing technologies. Industrial wearables are becoming an integral part of industrial automation, remote assistance, and public safety initiatives, with water resistance and shock resistance being essential features for harsh environments.

The integration of IoT, wireless communication, edge computing, and industrial wearables is transforming industries, enabling new levels of productivity, efficiency, and safety. The market's evolution is ongoing, with new applications and technologies continually emerging.

How is this Internet Of Things (IoT) Enabled Industrial Wearables Industry segmented?

The internet of things (iot) enabled industrial wearables industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Hand-worn wearables

- Head-mounted wearables

- Smart eyewear

- End-user

- Automotive

- Manufacturing

- Aerospace

- Others

- Connectivity

- Bluetooth

- Wi-Fi

- Cellular networks

- NFC

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The hand-worn wearables segment is estimated to witness significant growth during the forecast period.

Hand-worn wearables, including smart gloves and wrist-worn devices, are gaining traction in various industries for enhancing productivity and streamlining processes. These devices, which are primarily used in logistics for administrative tasks and in manufacturing for production activities, are witnessing increased adoption due to the Industry 4.0 revolution. The IoT-driven transformation of factories into smart factories is fueling the demand for hand-worn wearables. Biometric monitoring and environmental sensors integrated into these devices enable workers to monitor their health and working conditions in real-time. Voice and gesture recognition technologies facilitate hands-free operation, enhancing ergonomics and worker safety. Compliance with industry standards, such as dust and water resistance, is crucial for these devices to function effectively in industrial settings.

Privacy concerns and data security are essential considerations in the implementation of hand-worn wearables. Cellular networks and IoT connectivity ensure seamless communication and data transfer. Public safety applications, such as smart helmets and virtual reality training, further expand the scope of hand-worn wearables. Edge computing and cloud computing enable real-time data analytics and industrial automation, enhancing worker efficiency and productivity. Military and defense sectors are also exploring the potential of hand-worn wearables for motion capture and remote assistance. Smart glasses and augmented reality technologies offer immersive experiences, enabling remote training and real-time data visualization. Asset tracking and remote monitoring further extend the functionality of hand-worn wearables.

In conclusion, hand-worn wearables are an integral part of the evolving industrial landscape. Their integration with advanced technologies, such as IoT, edge computing, and virtual reality, is revolutionizing various industries by enhancing worker efficiency, safety, and productivity.

The Hand-worn wearables segment was valued at USD 752.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The IoT enabled industrial wearables market in North America is experiencing significant growth, with the US and Canada leading the charge. Prominent tech companies, including Alphabet and Microsoft, based in this region, are driving market expansion through their expertise and financial resources. Wearable devices, such as smart glasses from Vuzix, are gaining traction in various industries, with GE Electric and Ford Motors being notable adopters. These end-users are integrating wearables into their manufacturing processes for biometric monitoring, environmental sensing, and real-time data analytics, among other applications. Compliance with industry standards, such as those related to data security and privacy, is essential.

Wearables come equipped with features like voice recognition, gesture recognition, shock resistance, and water resistance to cater to diverse industrial needs. The market's evolution includes the integration of cellular networks, edge computing, and cloud computing for seamless communication and data processing. IoT connectivity, asset tracking, and remote assistance are also key trends. Military and defense, public safety, and industrial automation sectors are exploring the potential of these advanced wearables for enhanced worker efficiency and safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Internet Of Things (IoT) Enabled Industrial Wearables Industry?

- The relentless advancement of digitalization and automation within industries serves as the primary catalyst for market growth.

- The Industrial Wearables Market, driven by Internet of Things (IoT) technology, is witnessing significant growth due to the increasing demand for enhancing workplace efficiency, ensuring worker safety, and optimizing asset tracking. Wearable sensors, including smart helmets, are gaining popularity in industries due to their dust resistance and ergonomic design. However, privacy concerns and data security remain critical challenges for market growth. To address these issues, cellular networks are being employed to ensure secure data transmission. Furthermore, the integration of IoT in public safety applications is expected to fuel market expansion.

- The emphasis on immersive and harmonious user experiences is also driving innovation in this space. Asset tracking and real-time monitoring are other key applications of IoT-enabled industrial wearables. Despite privacy concerns and data security challenges, the market is expected to continue its growth trajectory, driven by the increasing focus on digitization and automation in industries.

What are the market trends shaping the Internet Of Things (IoT) Enabled Industrial Wearables Industry?

- The growing emphasis on extending battery life is a significant market trend. This priority is reflected in the latest technological advancements and consumer preferences.

- In the realm of industrial wearables, the integration of Internet of Things (IoT) connectivity and wireless communication technologies has revolutionized various industries, particularly those requiring real-time data collection and remote training. Military and defense, for instance, utilize motion capture technology for worker efficiency optimization and virtual reality simulations for remote training. However, a significant challenge persists in the form of battery life in these devices. The accommodation of heavy equipment in wearables compromises the quality of the battery used due to the considerable space batteries occupy in battery-operated devices. To mitigate issues related to limited battery life, companies are focusing on innovative solutions.

- They are redefining battery life by employing low-power consumption technologies such as Bluetooth 5.0 and a combination of system-level and circuit-level innovations. Energy harvesting is another approach to make the battery a genuinely viable power source. By reducing power consumption to a minimum, these advancements enable industries to collect and process data in real-time without the concern of battery failure. This is crucial in industries where extended operating periods are essential. In conclusion, the integration of IoT connectivity, wireless communication, edge computing, and innovative battery solutions in industrial wearables is transforming various sectors, particularly military and defense, by enhancing worker productivity, optimizing training, and improving overall operational efficiency.

What challenges does the Internet Of Things (IoT) Enabled Industrial Wearables Industry face during its growth?

- The high cost of wearable devices and technology represents a significant challenge to the industry's growth trajectory. This financial hurdle limits market expansion and may deter potential consumers from adopting these innovative technologies.

- The Industrial IoT (Internet of Things) wearables market has been gaining traction due to the integration of advanced technologies such as cloud computing, augmented reality, and real-time data analytics. Industrial automation is a significant area where IoT wearables have been making an impact, with remote assistance and water resistance being crucial features. IoT-enabled industrial wearables, such as smart glasses, are more complex than their consumer counterparts due to the need for robust networking solutions and software development. These complexities contribute to the higher cost of industrial IoT wearables, which can be a barrier to adoption for some businesses.

- Despite the cost, the benefits of IoT wearables in industrial settings, including increased efficiency, improved safety, and real-time data analysis, make them a valuable investment for many organizations. Cloud computing plays a vital role in the functioning of IoT wearables by enabling the processing and storage of large amounts of data generated by these devices. Overall, the integration of IoT technology in industrial wearables is transforming the way industries operate, offering numerous opportunities for growth and innovation.

Exclusive Customer Landscape

The internet of things (iot) enabled industrial wearables market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the internet of things (iot) enabled industrial wearables market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, internet of things (iot) enabled industrial wearables market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ASUSTeK Computer Inc. - The company specializes in IoT-enabled industrial wearables, featuring advanced wrist-worn computers such as the Zypad WL1500, WR 11xx, and WL1100 series. These cutting-edge devices enhance operational efficiency and productivity by integrating real-time data collection, analysis, and communication capabilities directly onto the worker's wrist. By leveraging IoT technology, these wearables enable seamless data exchange between machines, systems, and personnel, fostering a connected and intelligent industrial ecosystem.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ASUSTeK Computer Inc.

- EUROTECH Spa

- Fujitsu General Ltd.

- Generalscan

- Hitachi Ltd.

- Honeywell International Inc.

- Intellinium

- Iristick NV

- Magic Leap Inc.

- Microsoft Corp.

- Optinvent

- RealWear Inc.

- Samsung Electronics Co. Ltd.

- SAP SE

- Seiko Epson Corp.

- ThirdEye Gen Inc.

- Vuzix Corp.

- WESTUNITIS Co. Ltd.

- Workaround GmbH

- WORKERBASE GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Internet Of Things (IoT) Enabled Industrial Wearables Market

- In February 2023, Honeywell announced the launch of its new line of industrial wearables, the Honeywell Forge GT100 and GT1000, featuring real-time location tracking and advanced data analytics for industrial workers. These wearables aim to enhance worker safety and productivity in industries such as oil and gas, mining, and manufacturing (Honeywell Press Release, 2023).

- In May 2024, Siemens and Microsoft entered into a strategic partnership to integrate Microsoft Azure IoT and Siemens' MindSphere industrial IoT platform. This collaboration aims to offer advanced analytics and machine learning capabilities to industrial wearable users, enabling predictive maintenance and improved operational efficiency (Microsoft News Center, 2024).

- In January 2025, Bosch and Google Cloud signed a multi-year agreement to develop and deploy IoT solutions for industrial wearables. This collaboration includes the integration of Google Cloud's AI and machine learning capabilities with Bosch's wearable devices, aiming to improve productivity and safety in industries such as manufacturing and logistics (Bosch Press Release, 2025).

- In March 2025, Vodafone Business completed the acquisition of IoT wearables provider, Wearable Technologies, to expand its IoT portfolio and strengthen its position in the industrial wearables market. The acquisition includes Wearable Technologies' proprietary software platform, which provides real-time monitoring and analytics for industrial workers (Vodafone Business, 2025).

Research Analyst Overview

- The market is experiencing significant growth, driven by advancements in wearable computing, cloud-based platforms, and data management. These technologies enable real-time data collection and analysis using sensors, MEMS, and machine learning. Wearable devices, such as smart clothing and smart fabrics, are integrating AI and predictive analytics for enhanced user experience (UX) and human-machine interaction. Cloud-based platforms provide data storage and visualization, enabling network management and system integration. Software development and deployment strategies are crucial for seamless integration of wearable technology into industrial processes.

- Energy harvesting and power management are also key considerations for extending battery life and reducing maintenance costs. Sensor fusion and data management enable efficient data processing and analysis, leading to improved productivity and operational efficiency. Adoption rates of industrial wearables are increasing, with companies recognizing the potential for enhanced productivity, improved safety, and reduced costs.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Internet Of Things (IoT) Enabled Industrial Wearables Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 69% |

|

Market growth 2025-2029 |

USD 42816.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

45.9 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Internet Of Things (IoT) Enabled Industrial Wearables Market Research and Growth Report?

- CAGR of the Internet Of Things (IoT) Enabled Industrial Wearables industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the internet of things (iot) enabled industrial wearables market growth of industry companies

We can help! Our analysts can customize this internet of things (iot) enabled industrial wearables market research report to meet your requirements.