IQF Vegetable Market Size 2024-2028

The IQF vegetable market size is forecast to increase by USD 839.8 million at a CAGR of 3.27% between 2023 and 2028. The IQF (Individually Quick Frozen) vegetable market is experiencing significant growth due to several key factors. Lifestyle and eating habits have shifted towards convenience food, with major retail chains increasingly offering a wide range of frozen meals. The extended shelf life of IQF vegetables, attributed to advanced freezing techniques, is another major driver. However, the concern over bacterial growth during freezing and thawing remains challenging. To mitigate this, continuous research and development in freezing technologies are essential. The market in the United States is witnessing notable expansion due to various influencing factors. The trend towards convenience food and the growing popularity of fast-food restaurants are significantly driving market growth. Consumers' increasing demand for healthier food alternatives and the extended shelf life offered by IQF vegetables is another significant factor. However, the potential for bacterial growth during freezing and thawing remains a challenge. To address this concern, ongoing research and innovation in freezing technologies are crucial.

The IQF (Individual Quick Freezing) vegetables market has witnessed significant growth in recent years, driven by the changing lifestyle and eating habits of consumers. Major retail chains have increasingly incorporated IQF frozen vegetables into their offerings due to the convenience factor and extended shelf life. The frozen meals category, which includes IQF vegetables, has seen a steady increase in sales, as consumers look for time-saving solutions for their busy schedules. The freezing technique used in IQF vegetables ensures that the nutritional value and texture of the vegetables are preserved, making them a popular choice among consumers.

Moreover, bacterial growth is a major concern in the fresh vegetable industry, leading to increased demand for hygienic vegetable products. IQF technology addresses this issue by quickly freezing the vegetables at their peak freshness, thereby reducing the risk of bacterial growth. Advances in technology have led to improvements in the freezing technique, allowing for better preservation of the vegetables' texture, taste, and nutritional value. The global IQF vegetables market is expected to continue its growth trajectory, with a focus on expanding product offerings to include a wider variety of vegetables and fruits. Historical Analysis: The IQF vegetables market has experienced steady growth over the past decade, driven by increasing consumer demand for convenient and healthy food options.

Also, major retail chains have responded to this trend by expanding their offerings of IQF frozen vegetables, and fast-food restaurants and quick-service restaurants have also incorporated them into their menus. Forecast Outlook: The market position of IQF vegetables is expected to strengthen further in the coming years, as consumers continue to seek out convenient and healthy food options. The convenience factor, extended shelf life, and preservation of nutritional value are key drivers of growth in the IQF vegetables market.

In conclusion, the market is expected to benefit from advances in technology, which will enable better preservation of the vegetables' texture, taste, and nutritional value. Retail stores, fast-food restaurants, and quick-service restaurants are expected to remain key players in the market, as they cater to consumers' demand for healthy and convenient food options. The market is expected to remain competitive, with a focus on expanding product offerings to include a wider variety of vegetables and fruits.

Market Segmentation

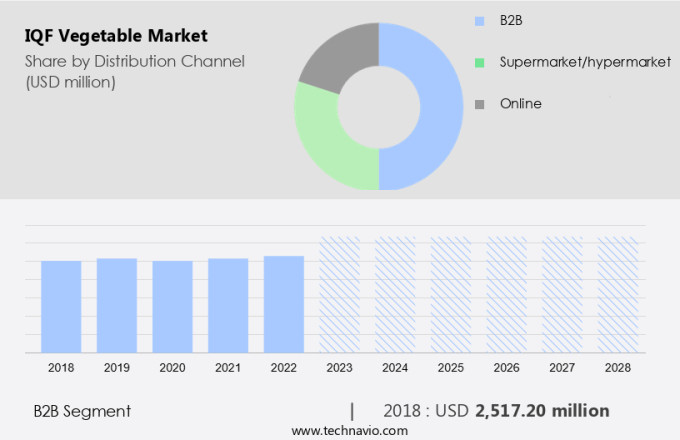

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- B2B

- Supermarket/hypermarket

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

The B2B segment is estimated to witness significant growth during the forecast period. The distribution of Individually Quick Frozen (IQF) vegetables is projected to continue thriving in the business-to-business (B2B) sector. IQF vegetables are an innovative alternative to traditional frozen meals, as they are flash-frozen individually to preserve their freshness, color, and flavor. This freezing technique, unlike conventional methods, significantly reduces the risk of bacterial growth during storage, extending the shelf life of these vegetables.

Get a glance at the market share of various segments Request Free Sample

The B2B segment was valued at USD 2.52 billion in 2018 and showed a gradual increase during the forecast period. Major retail chains have increasingly incorporated IQF vegetables into their offerings, catering to the evolving eating habits and lifestyle preferences of consumers. The convenience and versatility of IQF vegetables make them a popular choice for both commercial and residential kitchens. The frozen food market in the United States is expected to grow steadily, driven by the increasing demand for healthier, convenient food options.

Regional Insights

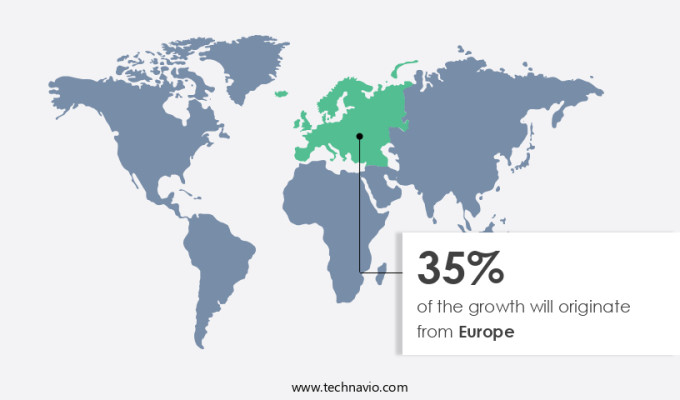

Europe is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the IQF (Individually Quick Frozen) vegetable market holds a significant position within the frozen food industry. The convenience factor of IQF vegetables, coupled with their longer shelf life and hygienic nature, aligns with the time-restricted lifestyles and health-conscious preferences of American consumers.

Additionally, cold storage methods ensure the vegetables maintain their freshness and nutritional value, making them an attractive alternative to fresh produce. However, challenges such as increasing competition and fluctuating raw material prices may pose obstacles to market growth during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increase popularity of fast-food restaurants is the key driver of the market. In today's fast-paced world, the convenience of quick meals has led to a growth in popularity for fast-food restaurants, particularly in malls and strategic locations. The rise of these restaurants can be attributed to the increasing number of working individuals and families who lack the time for meal preparation.

Additionally, the frequency of takeout orders has increased due to the convenience of free delivery services offered by some restaurants. One key component of the fast-food industry is the use of Individual Quick Freezing (IQF) vegetables. These vegetables offer numerous advantages, including time savings as they do not require washing, chopping, or peeling before use. Moisture control is crucial in the IQF process, which is achieved through the use of nitrogen. This method ensures that the vegetable cells remain intact during freezing, minimizing the risk of spoilage. With the convenience and benefits they provide, it is clear that IQF vegetables will continue to be a valuable asset in the fast-food industry.

Market Trends

The increasing consumers demand for convenience food is the upcoming trend in the market. In today's fast-paced world, consumers seek convenience in their food choices without compromising on health and flavor. Convenience foods, including frozen, canned, ready-to-eat snacks, meals, and chilled options, have gained popularity due to their time-saving benefits. As people's expectations for food quality, flavors, and formats continue to rise, manufacturers and retailers must capitalize on this trend. The organic and natural food market, a subset of convenience foods, is experiencing significant growth. Consumers are increasingly demanding nutritious and customizable options that align with their health goals. The LAMEA (Middle East, Africa, and Latin America) region, in particular, is witnessing a growth in demand for organic and conventional produce.

Moreover, the pandemic has further accentuated the need for pre-packaged and ready-to-go foods. Commercial and residential consumers alike have turned to online stores for their grocery needs, making B2B (business-to-business) and B2C (business-to-consumer) sales channels crucial. Manufacturers and retailers must adapt to these changing market dynamics to cater to the evolving needs of their customers. In summary, the convenience food market, driven by the organic and natural food segment, is a growing opportunity for businesses in the LAMEA region. Meeting the increasing demand for nutritious, customizable, and natural food options while maintaining high-quality standards is essential for success in this market.

Market Challenge

The health risks associated with consumption of frozen vegetables is a key challenge affecting the market growth. The IQF (Individually Quick Frozen) vegetable market in the United States is experiencing growth in the food service sector, particularly in fast-food and quick-service restaurants. However, there are concerns regarding the nutritional content of these frozen vegetables. The freezing process, while essential for preserving the produce, can lead to a loss of vitamins due to heat processing. For example, peas, carrots, black-eyed peas, and beans undergo pre-cooking or blanching to eliminate bacteria and parasites, which may result in some vitamin destruction.

Moreover, the transportation of frozen vegetables from processing units to retail stores poses a risk of contamination due to improper freezing or temperature fluctuations in cold storage containers. Consumers' perception of the nutritional value of these vegetables may be negatively impacted, potentially hindering market growth. Retailers and food service providers must prioritize maintaining optimal freezing conditions to ensure the nutritional integrity and safety of IQF vegetables.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AK Food International - The company offers IQF vegetables such as green peas, carrots, and French beans.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B.Y. Agro and Infra Ltd.

- Capricorn Food Products India Ltd.

- Conrax Agro And Food Pvt. Ltd.

- Cropotto Foods International LLP

- Dawtona Frozen SP Zoo

- Fujian Uniland Foods Co. Ltd.

- Ghousia Food Products Pvt. Ltd.

- Givrex

- Hongchang International Co. Ltd.

- Lizaz Food Processing Industries

- NAFOODS GROUP JSC

- Qingdao Elite Foods Co. Ltd.

- Relish Agro Food India Pvt. Ltd.

- Royal Foodstuffs Pvt. Ltd.

- Shimla Hills (SHOP Ltd.)

- Sonderjansen BV

- Varun Agro Processing Foods Pvt. Ltd.

- Vimo Foods Pvt. Ltd

- Xiamen Sinocharm Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The IQF (Individual Quick Freezing) vegetable market has gained significant traction in recent years due to the changing eating habits and lifestyle preferences of consumers. Major retail chains have increasingly included frozen meals in their offerings, catering to the demands of time-restricted consumers. The freezing technique used in IQF vegetables ensures that the nutritional content and texture of the vegetables are preserved, providing hygienic and convenient options for consumers. The longer shelf life of IQF vegetables addresses spoilage concerns, making them a popular choice for both the food service sector and retail stores.

Additionally, advances in technology, such as BQF (Blast Freezing) and fast freezing, enable quick freezing of vegetables at specific temperature conditions, ensuring moisture control and preventing bacterial growth. The use of nitrogen in the freezing process further enhances the quality and freshness of the IQF vegetables. The market has undergone historical analysis and forecast outlook, revealing steady growth in sales. The convenience factor and longer shelf life have made IQF vegetables a preferred choice for consumers in various sectors, including fast-food restaurants, quick-service restaurants, and online stores.

In summary, the market position of IQF vegetables is strengthened by the increasing demand for organic, conventional, commercial, and residential IQF vegetable products. Fruits and vegetables are increasingly being offered as IQF products, catering to the diverse needs of consumers. The consumer perception of IQF vegetables as nutritious and convenient continues to drive the growth of the market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

132 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.27% |

|

Market growth 2024-2028 |

USD 839.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.13 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 35% |

|

Key countries |

US, Germany, China, France, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AK Food International, B.Y. Agro and Infra Ltd., Capricorn Food Products India Ltd., Conrax Agro And Food Pvt. Ltd., Cropotto Foods International LLP, Dawtona Frozen SP Zoo, Fujian Uniland Foods Co. Ltd., Ghousia Food Products Pvt. Ltd., Givrex, Hongchang International Co. Ltd., Lizaz Food Processing Industries, NAFOODS GROUP JSC, Qingdao Elite Foods Co. Ltd., Relish Agro Food India Pvt. Ltd., Royal Foodstuffs Pvt. Ltd., Shimla Hills (SHOP Ltd.), Sonderjansen BV, Varun Agro Processing Foods Pvt. Ltd., Vimo Foods Pvt. Ltd, and Xiamen Sinocharm Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch