Juicer Market Size 2024-2028

The juicer market size is forecast to increase by USD 9.04 billion at a CAGR of 38.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. Firstly, the increasing urbanization and changing consumer lifestyles have led to a higher demand for convenient and healthy food and beverage options. This has resulted in a rising focus on manufacturing energy-efficient and lightweight juicers. Antioxidants, vitamins, and minerals are essential nutrients that our bodies need to function optimally. Additionally, fluctuations in raw material prices and operational costs continue to impact the market. Producers are striving to mitigate these challenges by implementing cost-effective manufacturing processes and sourcing raw materials from reliable suppliers. Overall, these trends are driving the growth of the market and presenting both opportunities and challenges for market participants.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing health consciousness among households. With a focus on consuming natural and nutrient-dense foods, juicers have emerged as essential kitchen appliances. These appliances are not only limited to fruits but also cater to vegetables, herbs, and raw fruits. Juicers play a vital role in extracting these essential nutrients from fruits and vegetables, making them an indispensable dietary food item. The market for juicers is diverse, catering to various segments, including electric juicers, centrifugal juicers, multicasting juicers, triturating juicers, reamers, juicing press, and steam juice extractors.

- In addition, technology innovation and design are key drivers in the juicers market. Goodnature, for instance, has introduced a unique design that ensures minimal oxidation during the juicing process, preserving the nutrients' natural state. The integration of technology in juicers has led to the development of smart homes' appliances, allowing users to control their juicers remotely. The kitchenware segments, including juicers, have become a lifestyle statement. Television shows and social media influencers have popularized the use of juicers, making them a must-have in modern kitchens. Juicers are no longer just appliances; they are a symbol of health and wellness. The market for juicers is expected to continue growing as more households embrace a healthier lifestyle.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Centrifugal juicer

- Masticating juicer

- Triturating juicer

- End-user

- Residential

- Commercial

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Product Insights

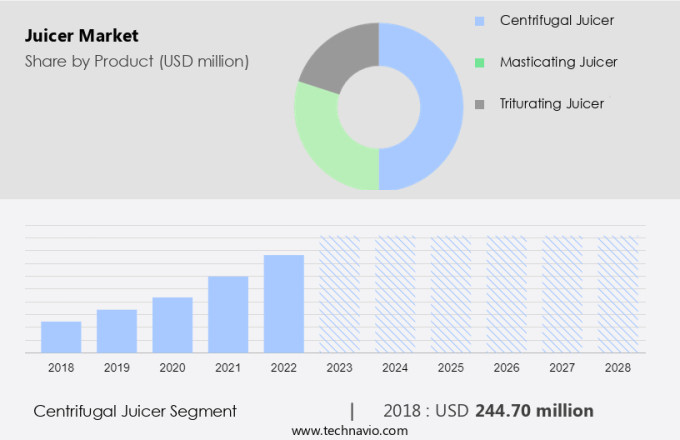

- The centrifugal juicer segment is estimated to witness significant growth during the forecast period.

Centrifugal juicers are the preferred choice for household use due to their efficiency in extracting juice from fruits and vegetables. These juicers utilize a mesh chamber with sharp teeth and a high-speed metal blade, operating between 3,000 and 10,000 rpm, to shred and separate the juice from the pulp. Primarily used for juicing fiber-rich fruits and vegetables, such as apples, carrots, and beetroot, centrifugal juicers offer superior juice extraction compared to other types. However, their fast operation results in increased noise levels and rapid heating. Centrifugal juicers are a popular choice in smart homes and among health-conscious consumers seeking natural, raw fruit and vegetable juices for dietary purposes.

Get a glance at the market report of share of various segments Request Free Sample

The centrifugal juicer segment was valued at USD 244.70 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

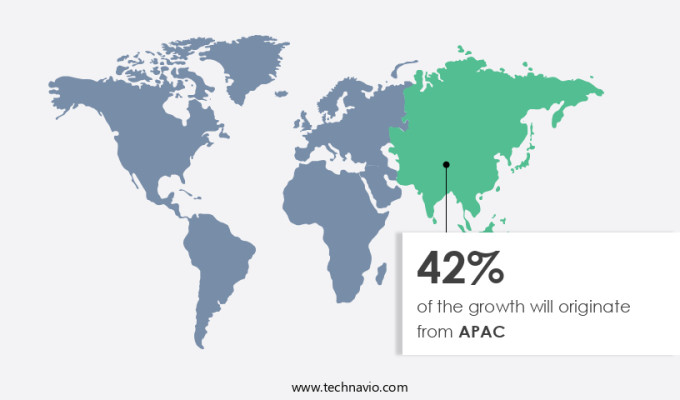

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in APAC is experiencing significant growth, driven by the expanding middle-class population and their increasing disposable income. This demographic segment is investing in kitchen appliances, including juicers, due to the health and wellness trend. The region is projected to be the fastest-growing segment during the forecast period, with China and India leading the way. Consumers in countries such as Australia, South Korea, and China are increasingly preferring functional fruit and vegetable juices, incorporating ingredients like baobab, barley grass powder, spirulina powder, chlorella, and collagen. The demand for juicers is rising in both residential and commercial sectors due to the growing awareness of the health benefits of consuming vitamins and minerals naturally. Juicer technology innovation and sleek designs are also contributing to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Juicer Market?

Rising urbanization and changing consumer lifestyles is the key driver of the market.

- The market has experienced substantial growth due to the rising health consciousness among consumers and the increasing popularity of antioxidant-rich fruits and vegetables as a dietary food item. Juicers, as essential kitchen appliances, have gained prominence in both commercial and residential settings. Technology innovation and design have significantly influenced the market, with electric juicers, such as centrifugal, masticating, and triturating juicers, becoming increasingly popular. The juice shops, bars, and mixers in the foodservice industry have further fueled the demand for juicers. The tourism industry has also contributed to the market growth, as many hotels and resorts offer fresh juice as part of their amenities.

- In addition, households and smart homes have embraced juicers as a convenient and healthy addition to their kitchenware segments. Europe, North America, and emerging economies in Asia Pacific (APAC) are attractive markets for juicers. The growing urban population and increasing purchasing power in these regions have led to a significant rise in the consumption of homemade juices. Moreover, health awareness campaigns and the availability of discounts, coupons, and vouchers have encouraged more consumers to invest in juicers. Juicers come in various types, including centrifugal, masticating, triturating, and steam juice extractors. These juicers can extract juice from a wide range of fruits, vegetables, and herbs, providing consumers with a raw and nutrient-dense beverage.

What are the market trends shaping the Juicer Market?

Rising focus on manufacturing energy-efficient and lightweight juicers is the upcoming trend in the market.

- Juicers, as essential kitchen appliances, have gained significant popularity in the US market due to the increasing health consciousness and breakfast culture. These appliances extract antioxidants, vitamins, and minerals from fruits, vegetables, herbs, and raw fruits, making them a dietary food item for numerous households and smart homes. Technology innovation has led to various types of juicers, including centrifugal, masticating, and triturating juicers, each offering unique benefits. Energy efficiency is a crucial factor in both residential and commercial applications.

- In addition, consumers' growing preference for eco-friendly and energy-efficient products has driven this trend. The kitchenware segments, including juicers, mixers, grinders, and reamers, have witnessed substantial growth due to health awareness campaigns and the tourism industry's influence. Juice shops and bars have become common, offering fresh juice blends and promoting a healthy lifestyle. Manufacturers are focusing on producing juicers with antimicrobials, conditioners, and moisturizers to enhance the juice's taste and shelf life. They are also eliminating parabens, propellants, and other harmful additives to cater to consumers' demands for natural and organic products. Discounts, coupons, and vouchers are common marketing strategies to attract customers and increase sales.

What challenges does Juicer Market face during the growth?

Fluctuations in raw material prices and operational costs is a key challenge affecting the market growth.

- The market is driven by the increasing health consciousness among households and the growing popularity of raw fruits, vegetables, and herbs as dietary food items. Juicers, as essential kitchen appliances, are integral to the breakfast culture and are increasingly being adopted in smart homes. Technology innovation has led to the development of various types of juicers, including centrifugal, masticating, and triturating juicers, each offering unique benefits in terms of extraction efficiency and nutrient retention. Antioxidants and vitamins and minerals are key components of fruits and vegetables that are extracted during the juicing process. Juice shops and bars have become popular destinations for consumers seeking quick and convenient access to these health benefits.

- In addition, the market for juicers also includes various kitchenware segments, such as mixers, grinders, reamers, and juicing presses, as well as steam juice extractors. The price of juicers is influenced by several factors, including manufacturing costs, labor costs, and prices of raw materials. Fluctuations in the prices of raw materials, such as steel, iron, plastic, glass, electronic equipment, and paint, directly impact the price of juicers and the profit margins of manufacturers. The market for juicers is also influenced by health awareness campaigns and the tourism industry, which promotes the consumption of fresh juices as a healthy and refreshing beverage.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Electrolux

- Bajaj Electricals Ltd.

- Borosil Ltd.

- Breville Group Ltd.

- Cuisinart

- DeLonghi Group

- Donlim

- Hamilton Beach Brands Holding Co.

- Havells India Ltd.

- Hurom America Inc.

- Joyoung Co. Ltd.

- Koninklijke Philips N.V.

- Kuvings

- MIDEA Group Co. Ltd.

- Newell Brands Inc.

- Omega Juicers

- Panasonic Holdings Corp.

- SEB Developpement SA

- Treasure Retail Pvt. Ltd.

- TTK Prestige Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a dynamic and evolving sector within the kitchen appliances industry. This market caters to the increasing health consciousness of consumers, who are seeking convenient and effective ways to incorporate fruits, vegetables, and other dietary food items into their daily routines. Juicers have gained immense popularity due to their ability to extract essential antioxidants, vitamins, and minerals from a wide variety of raw fruits, vegetables, and herbs. These nutrient-dense extracts offer numerous health benefits, making juicers an essential kitchenware segment for many households. Technology innovation plays a pivotal role in the market.

In addition, advancements in design and functionality have led to the creation of various types of juicers, including centrifugal, masticating, and triturating juicers. Each type caters to different consumer preferences and requirements. Centrifugal juicers use a high-speed spinning mechanism to separate juice from pulp. They are known for their fast processing time and affordability. Masticating juicers, on the other hand, employ a slow, continuous pressing process to extract juice. They yield higher nutrient content and are suitable for juicing hard fruits, vegetables, and leafy greens. Triturating juicers, also known as twin-gear juicers, combine the functions of a juicer and a grinder.

Furthermore, the tourism industry has also contributed to the market's growth, with many hotels and resorts offering juice bars and in-room juicers as amenities. Discounts, coupons, and vouchers are common marketing strategies used by manufacturers and retailers to attract consumers to the market. Residencies and partnerships with television shows and health awareness campaigns further boost the market's visibility and reach. The market is not limited to residential use. Commercial applications, such as juice bars and restaurants, also contribute significantly to the market's growth. Antimicrobials, conditioners, and other additives are used in commercial juicers to ensure the highest level of hygiene and product quality.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 38.2% |

|

Market growth 2024-2028 |

USD 9.04 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

29.38 |

|

Key countries |

US, China, India, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch