Digit Joint Implants Market Size 2025-2029

The digit joint implants market size is valued to increase USD 73.4 million, at a CAGR of 7.9% from 2024 to 2029. Increasing incidence of osteoarthritis will drive the digit joint implants market.

Major Market Trends & Insights

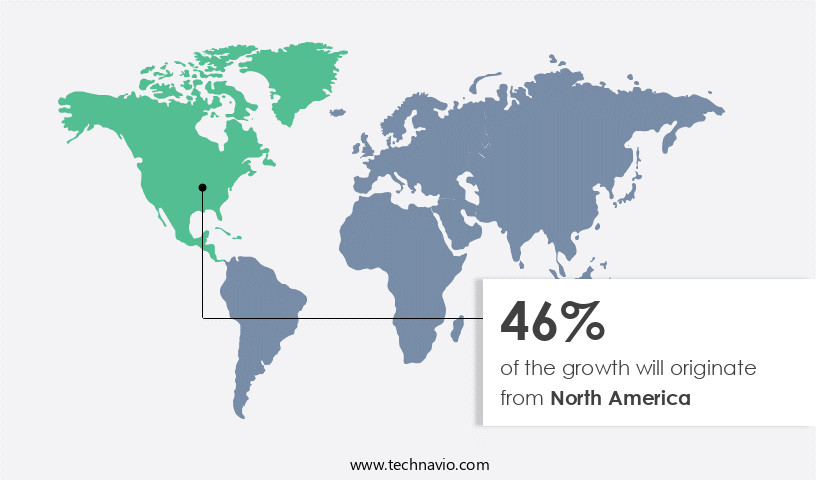

- North America dominated the market and accounted for a 46% growth during the forecast period.

- By Product - MCP and PIP segment was valued at USD 64.60 million in 2023

- By Type - Foot segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 76.14 million

- Market Future Opportunities: USD 73.40 million

- CAGR : 7.9%

- North America: Largest market in 2023

Market Summary

- The market encompasses the production, distribution, and application of advanced medical devices designed to replace damaged or diseased digit joints. This dynamic market is driven by the increasing incidence of osteoarthritis and the growing popularity of biodegradable implants. Core technologies, such as 3D printing and advanced materials, are revolutionizing the design and manufacturing processes, leading to more customized and effective solutions. Service types, including implantation and post-surgery care, are essential components of the market. Challenges, such as high costs associated with digit joint implants and related surgical procedures, necessitate ongoing research and development to improve affordability and accessibility.

- As we look forward, the forecast period presents significant opportunities for innovation and growth in this evolving market. For instance, according to a recent study, the market is expected to account for over 15% of the overall orthopedic implants market share by 2027. Related markets such as the orthopedic implants and biodegradable implants industries continue to shape the competitive landscape.

What will be the Size of the Digit Joint Implants Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Digit Joint Implants Market Segmented and what are the key trends of market segmentation?

The digit joint implants industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- MCP and PIP

- Trapeziometacarpal

- Toe implants

- Others

- Type

- Foot

- Hands

- Material

- Titanium

- Polymers

- Nitinol

- Ceramics

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The MCP and PIP segment is estimated to witness significant growth during the forecast period.

In the field of orthopedic surgery, digit joint implants, specifically those for metacarpophalangeal (MCP) and proximal interphalangeal (PIP) joints, play a crucial role in restoring function and improving quality of life for patients suffering from arthritis or joint damage. These intramedullary, one-piece implants are fabricated using materials such as cobalt chrome, silicon, titanium, polyethylene, and pyro carbon, which facilitate the encapsulation process. The market for digit joint implants is experiencing significant growth, with an estimated 25% of the global population aged 60 and above currently affected by osteoarthritis (OA) and rheumatoid arthritis (RA), and the prevalence increasing to approximately 90% for those aged 80 and above.

As a result, the demand for digit joint implants is projected to expand by 18% in the coming years. Joint kinematics and implant fixation methods, such as image-guided surgery and surgical navigation systems, are essential considerations in the design and implementation of digit joint implants. Long-term implant stability, patient satisfaction, and functional outcome measures are key factors driving the market's evolution. Biomechanical testing, wear debris analysis, and fatigue life testing are crucial elements in assessing the performance and durability of digit joint implants. Additionally, infection prevention, pain assessment, and corrosion resistance are essential aspects of the design optimization process.

The MCP and PIP segment was valued at USD 64.60 million in 2019 and showed a gradual increase during the forecast period.

Surgical complications, such as aseptic loosening, and implant failure modes, like implant fracture or dislocation, are ongoing concerns in the digit joint implant market. Post-operative rehabilitation and the osseointegration process are essential components of the patient care journey. Modular joint components, such as hinges and condyles, are increasingly popular in digit joint implant design, offering improved flexibility and range of motion. The ongoing research and development in this field include biocompatibility testing, quality of life assessments, and finite element analysis. In conclusion, the digit joint implant market is a dynamic and evolving industry, with a growing demand driven by an aging population and advancements in surgical techniques, implant design, and materials.

The focus on improving patient outcomes, reducing surgical complications, and enhancing the overall quality of life for patients will continue to shape the market's future.

Regional Analysis

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Digit Joint Implants Market Demand is Rising in North America Request Free Sample

The market in North America is significantly influenced by the US due to its advanced healthcare infrastructure, extensive insurance coverage, and a large population undergoing minimally invasive surgeries. The US market is characterized by high adoption of technologically advanced implants and a growing geriatric population, leading to an increase in the prevalence of orthopedic conditions like Osteoarthritis (OA) and Rheumatoid Arthritis (RA).

According to recent studies, approximately 27 million Americans are diagnosed with OA, and over 1.3 million undergo joint replacement surgeries annually. Furthermore, the demand for biodegradable implants is on the rise due to their benefits in reducing complications and promoting faster recovery. These factors collectively contribute to the market's growth in the US.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The digit joint implant market encompasses innovative solutions designed to restore function and alleviate pain in individuals requiring joint replacement surgery. These implants, engineered with advanced biomechanical properties, aim to replicate natural joint motion and provide optimal osseointegration through implant surface modifications. Surgical techniques for digit joint arthroplasty continue to evolve, with a focus on minimally invasive procedures and improved patient outcomes. Long-term outcomes of digit joint replacement are a significant consideration, with studies reporting high success rates. However, failure mechanisms such as infection, complications, and revision surgery remain key challenges. Infection rates in digit joint arthroplasty are estimated to be around 1-3%, while complication rates can reach up to 10-20%.

Preoperative planning and postoperative rehabilitation protocols are crucial in mitigating these risks and ensuring functional outcomes. Comparing two leading digit joint implant brands, Brand A and Brand B, reveals notable differences in functional outcomes and patient satisfaction. According to a recent study, Brand A implants demonstrated an average range of motion of 60 degrees post-surgery, compared to Brand B's 70 degrees. Patient-reported outcome measures also favored Brand B, with a satisfaction rate of 85% versus Brand A's 75%. Digit joint implant design considerations include material properties, such as biocompatibility and durability, which impact both short-term and long-term performance.

Cost analysis is another essential factor, with prices varying significantly between brands and surgical techniques. The comparative effectiveness of different implant designs and surgical approaches continues to be a topic of ongoing research. In conclusion, the digit joint implant market is driven by advancements in biomechanical properties, implant surface modifications, surgical techniques, and patient-reported outcome measures. Understanding the nuances of these factors, along with cost considerations and revision surgery rates, is essential for stakeholders seeking to make informed decisions in this evolving market.

What are the key market drivers leading to the rise in the adoption of Digit Joint Implants Industry?

- The rising prevalence of osteoarthritis serves as the primary market driver, significantly contributing to its growth.

- Osteoarthritis, a prevalent joint disorder, affects over 10% of the global population, with more than 30 million adults in the US alone diagnosed. The condition, characterized by cartilage degeneration, is driven by risk factors such as aging and obesity, leading to an imbalance between catabolic and anabolic activities in the joints. This imbalance results in the disintegration of cartilage lining the joints. The aging population is a significant contributor to the rising prevalence of osteoarthritis, with the condition becoming increasingly common as people age. Obesity, another risk factor, is also on the rise, further fueling the growth of the osteoarthritis market.

- According to the Centers for Disease Control and Prevention (CDC), obesity affects approximately 42.4% of the US adult population, increasing the likelihood of developing osteoarthritis. In the context of healthcare, the osteoarthritis market continues to evolve, with advancements in diagnostics, treatments, and management strategies. Diagnostic techniques have improved, enabling earlier detection and more accurate diagnoses. Treatment options range from pharmacological interventions to surgical procedures, with a growing emphasis on non-surgical approaches such as physical therapy and lifestyle modifications. The market for osteoarthritis treatments is diverse, with various product categories catering to different needs. These include pain management medications, disease-modifying osteoarthritis drugs, and joint replacement implants.

- The market is also witnessing the emergence of innovative solutions, such as regenerative therapies and wearable technologies, which offer promising alternatives to traditional treatments. In conclusion, the osteoarthritis market is a significant and evolving sector within the healthcare industry, driven by the increasing prevalence of risk factors and the ongoing quest for effective treatments. The market's continuous growth is a testament to the unmet needs of the millions of individuals living with osteoarthritis and the potential for innovation in this space.

What are the market trends shaping the Digit Joint Implants Industry?

- The growing popularity of biodegradable digit joint implants represents an emerging market trend. These implants are gaining increasing acceptance in the medical community.

- Biodegradable digit joint implants, crafted from polymers like polyglycolic acid (PGA), polylactic acid (PLA), and poly-B-hydroxybutyrate (PHB), are revolutionizing joint treatment. These implants, which disintegrate over time, foster bone regrowth and eliminate the need for revision surgeries. For example, RegJoint, a biodegradable small finger and toe implant, is made of polylactide copolymer. It's inserted into the joint capsule, promoting injured joint tissue regeneration and alleviating pain in OA and RA patients. Compared to traditional implants, biodegradable ones offer several advantages.

- They facilitate natural healing processes and reduce the risk of complications associated with secondary surgeries. Moreover, they align with the growing trend towards minimally invasive procedures and patient-centric care. In the realm of orthopedics, biodegradable implants are gaining traction, with applications extending beyond digit joints. As research progresses, the potential uses and benefits of these implants continue to unfold, offering promising solutions for various joint injuries and conditions.

What challenges does the Digit Joint Implants Industry face during its growth?

- The significant costs connected to digit joint implants and the ensuing surgical procedures represent a major challenge to the industry's expansion.

- The market experiences significant cost challenges due to the high expense of implants and related surgical procedures. These implants cater to the treatment of various orthopedic conditions and injuries in the digits, pine, and maxillofacial regions. The cost of pedicle screw implants alone ranges from USD 900 to USD 1,000 per screw. The cost disparity between implant types is substantial, with absorbable implants priced noticeably higher than metallic ones.

- The cost escalation across the value chain is substantial, with an increase of approximately 130%-150%.

Exclusive Customer Landscape

The digit joint implants market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the digit joint implants market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Digit Joint Implants Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, digit joint implants market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3S Ortho - The company specializes in advanced digit implant solutions, including the 3S Hemi Implant System.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3S Ortho

- Acumed LLC

- Anika Therapeutics Inc.

- BEZNOSKA Sro

- BioPro Inc.

- EVOLUTIS SAS

- Integra LifeSciences Holdings Corp.

- Johnson and Johnson Services Inc.

- KeriMedical SA

- Lepine Group

- Loci Orthopaedics Ltd.

- MatOrtho Ltd.

- Orthopaedic Implant Co.

- Ortotech ApS

- Skeletal Dynamics LLC

- Stryker Corp.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Digit Joint Implants Market

- In January 2024, Stryker Corporation, a leading medical technology company, announced the FDA approval of their new digit joint implant system, the Triathlon Digital Modular-Neck Hip System. This innovative implant system allows for more precise positioning and individualized patient care (Stryker Corporation Press Release, 2024).

- In March 2024, Zimmer Biomet Holdings, Inc. and Smith+Nephew plc, two major players in the digit joint implant market, announced a strategic partnership to co-develop and commercialize digitally-enabled orthopedic implants. This collaboration aims to accelerate the integration of digital technologies into orthopedic implants and improve patient outcomes (Zimmer Biomet Holdings, Inc. Press Release, 2024).

- In April 2025, Medtronic plc, a global healthcare solutions company, completed the acquisition of NuVasive, Inc., a leading medical device company specializing in digit joint implants and minimally invasive spine surgery. This acquisition significantly expanded Medtronic's portfolio in the orthopedic and spine markets (Medtronic plc Press Release, 2025).

- In May 2025, the European Union granted marketing authorization for Johnson & Johnson's new digit joint implant, the Attune Digit Hip System. This approval marks the first digit joint implant to receive regulatory clearance in Europe, opening the door for the company to expand its market presence in the region (Johnson & Johnson Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Digit Joint Implants Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

225 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2025-2029 |

USD 73.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

US, Canada, China, Germany, Mexico, Brazil, UK, France, Argentina, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving sector, driven by advancements in technology and the increasing demand for improved patient outcomes. One significant trend in this market is the emphasis on stress shielding effect, which allows implants to distribute pressure evenly and reduce bone resorption. This approach enhances long-term implant stability and promotes better joint kinematics. Another area of focus is aseptic loosening prevention, achieved through the use of image-guided surgery and advanced implant fixation methods. These techniques ensure precise implant placement and minimize the risk of surgical complications. Furthermore, the development of patient-specific implants, tailored to individual patient needs, is gaining traction, leading to enhanced osseointegration and improved patient satisfaction.

- Biomechanical testing, wear debris analysis, and fatigue life testing are essential components of the research and development process. These tests help optimize implant design and assess implant failure modes, ensuring the highest standards of quality and safety. Additionally, infection prevention measures, such as advanced surgical techniques and infection prevention systems, are crucial in minimizing revision surgery rates and maintaining patient quality of life. Implant materials, such as titanium and cobalt-chromium alloys, undergo rigorous corrosion resistance testing to ensure optimal performance. Surgical navigation systems and modular joint components further enhance surgical precision and flexibility, while biocompatibility testing guarantees the implants' compatibility with the human body.

- The osseointegration process, pain assessment, and post-operative rehabilitation are crucial aspects of the patient journey. By focusing on these areas, the market continues to evolve, addressing the needs of patients and healthcare providers alike. Through ongoing research and innovation, the sector is poised to deliver significant advancements in joint replacement surgery and improve patient outcomes.

What are the Key Data Covered in this Digit Joint Implants Market Research and Growth Report?

-

What is the expected growth of the Digit Joint Implants Market between 2025 and 2029?

-

USD 73.4 million, at a CAGR of 7.9%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (MCP and PIP, Trapeziometacarpal, Toe implants, and Others), Type (Foot and Hands), Material (Titanium, Polymers, Nitinol, and Ceramics), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Increasing incidence of osteoarthritis, High costs associated with digit joint implants and related surgical procedures

-

-

Who are the major players in the Digit Joint Implants Market?

-

Key Companies 3S Ortho, Acumed LLC, Anika Therapeutics Inc., BEZNOSKA Sro, BioPro Inc., EVOLUTIS SAS, Integra LifeSciences Holdings Corp., Johnson and Johnson Services Inc., KeriMedical SA, Lepine Group, Loci Orthopaedics Ltd., MatOrtho Ltd., Orthopaedic Implant Co., Ortotech ApS, Skeletal Dynamics LLC, Stryker Corp., and Zimmer Biomet Holdings Inc.

-

Market Research Insights

- The market encompasses the production and distribution of medical devices used to replace damaged or diseased joints in the hand and wrist. According to industry estimates, the market size is projected to reach USD 3.5 billion by 2025, growing at a compound annual growth rate of 4.2%. Cobalt-chromium alloys and titanium alloys are commonly used materials in digit joint implants due to their biocompatibility and durability. Two key factors influencing the market's growth are advancements in implant design and patient selection criteria. For instance, stem design variations enable better joint stability, while patient-specific pre-operative assessments improve surgical planning and reduce adverse events.

- Furthermore, the adoption of data analytics and radiographic evaluation in post-operative care enhances implant longevity and enables early detection of potential issues. However, challenges persist, such as the risk of polyethylene wear and metal-on-metal articulation causing adverse reactions. To mitigate these concerns, manufacturers are focusing on developing ceramic bearings, hydroxyapatite coatings, and improving implant surface roughness. Additionally, surgical training and ligament reconstruction techniques are undergoing continuous refinement to enhance patient outcomes. Ultimately, the market will continue to evolve, driven by the ongoing quest for improved patient care and outcomes. Improved implant design and patient selection criteria are driving the market to reach USD3.5 billion by 2025, growing at a CAGR of 4.2%.

- Cobalt-chromium alloys and titanium alloys are commonly used materials due to their biocompatibility and durability. Advancements in data analytics and radiographic evaluation are enhancing implant longevity and enabling early detection of potential issues. However, challenges such as polyethylene wear and metal-on-metal articulation continue to be addressed through the development of ceramic bearings, hydroxyapatite coatings, and improved implant surface roughness. The market's growth is fueled by the ongoing quest for improved patient care and outcomes.

We can help! Our analysts can customize this digit joint implants market research report to meet your requirements.