Laboratory Disposables Market Size 2024-2028

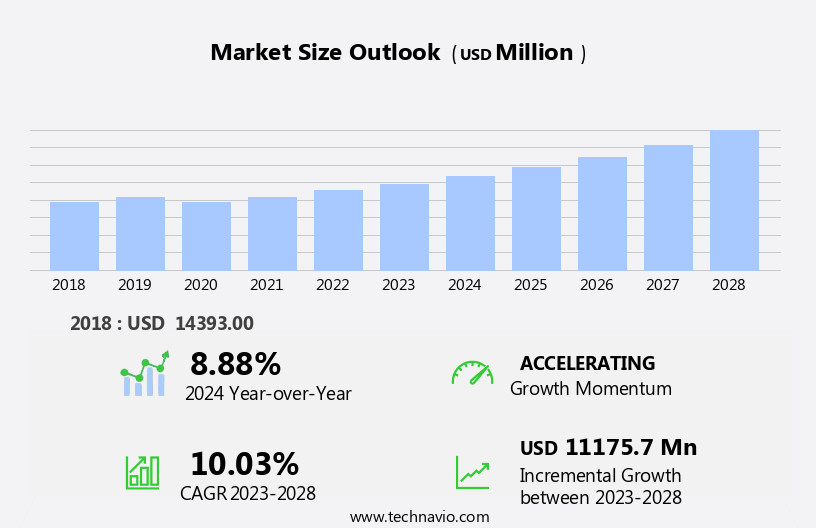

The laboratory disposables market size is forecast to increase by USD 11.18 billion, at a CAGR of 10.03% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of research studies and the rising adoption of automation systems in laboratories. These trends reflect the growing importance of scientific research and the need for efficiency and accuracy in laboratory processes. However, the market faces challenges as well. One major obstacle is the lack of differentiation among companies, making it increasingly difficult for companies to distinguish themselves and capture market share. To succeed in this competitive landscape, laboratory disposables providers must focus on innovation and value-added services to differentiate their offerings and meet the evolving needs of their customers.

- By staying abreast of market trends and addressing these challenges effectively, companies can capitalize on the opportunities presented by the expanding the market and maintain a competitive edge.

What will be the Size of the Laboratory Disposables Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market is characterized by its continuous evolution, with new products and applications emerging to meet the ever-changing needs of various sectors. Sterile pipettes, for instance, are essential tools in laboratories for transferring liquids, while biological safety cabinets provide a protective environment for handling hazardous materials. Histology cassettes and hematology slides are integral components of histology and hematology analysis, respectively. Disposable beakers and tissue culture flasks are crucial in biology research, enabling the growth and cultivation of cells. Serological pipettes and microscope slides are indispensable in diagnostic laboratories, facilitating the analysis of various samples. The market for lab coats, lab aprons, and gloves ensures the safety and comfort of laboratory personnel.

Moreover, the demand for sterile and disposable items continues to expand, with applications in fields such as biotechnology, pharmaceuticals, and clinical diagnostics. The ongoing development of new technologies and techniques further fuels the growth of this dynamic market. For instance, microarray slides are increasingly being used in gene expression analysis, while centrifuge tubes and centrifuge rotors are essential for separating and processing various samples. In summary, the market is a vibrant and ever-evolving landscape, with a diverse range of products and applications that cater to the needs of various sectors. The continuous unfolding of market activities and evolving patterns underscores the importance of staying informed and adaptable in this dynamic industry.

How is this Laboratory Disposables Industry segmented?

The laboratory disposables industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical and biotechnology companies

- Research and academic institutions

- Forensic Laboratories

- Food Testing Laboratories

- Environmental Testing Laboratories

- Pathology Laboratories

- Product Types

- Pipettes

- Tips

- Syringes

- Gloves

- Material Type

- Plastic

- Glass

- Rubber

- Application

- Cell Culture

- Diagnostics

- Molecular Biology

- Drug Development

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Netherlands

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

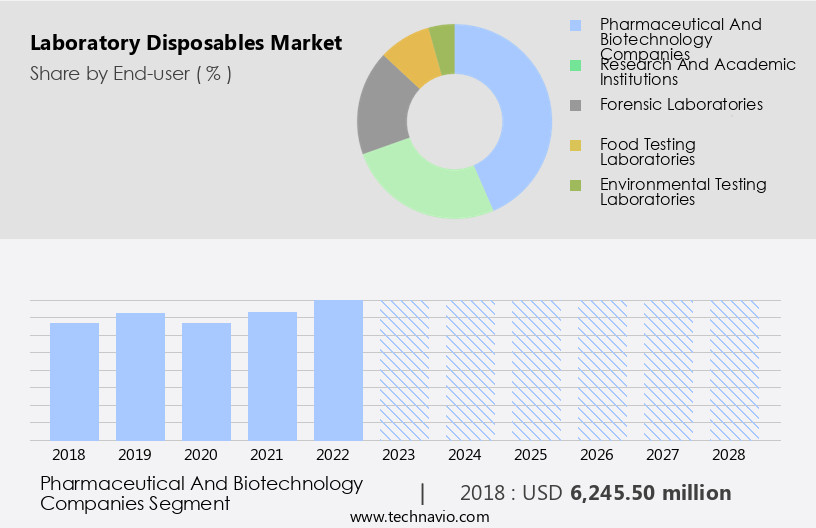

The pharmaceutical and biotechnology companies segment is estimated to witness significant growth during the forecast period.

The market experiences significant growth due to the substantial investment in research and development (R&D) within pharmaceutical and biotechnology companies. This capital-intensive R&D, focused on drug discovery, gene therapy, and nanotechnology, propels the market's expansion. Innovations in biopharmaceuticals attract investors, further fueling market growth. To ensure efficient results from R&D experiments, laboratories utilize disposable items such as pipette tips, microcentrifuge tubes, sterile pipettes, microscope slides, lab coats, and disposable petri dishes.

The rise of sub-contract laboratories conducting routine functions, like API development, also contributes to the market's growth. Overall, the market's evolution reflects the importance of these disposable products in delivering accurate and timely research outputs.

The Pharmaceutical and biotechnology companies segment was valued at USD 6.25 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

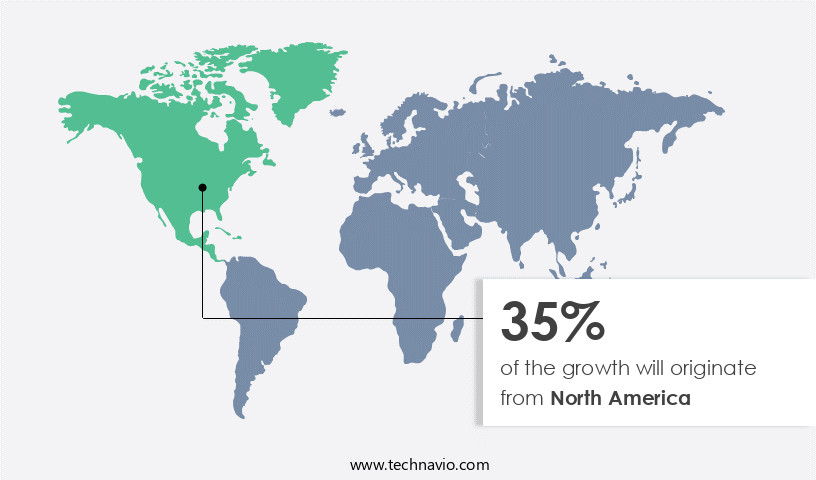

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US market for laboratory disposables experiences continuous growth due to significant investments in healthcare initiatives by the US government through the USAID. These funds contribute to the expansion of the laboratory disposables industry, with a focus on essential products such as disposable face masks, pipette tips, Erlenmeyer flasks, disposable gloves, biohazard bags, microarray slides, lab aprons, microcentrifuge tubes, sterile pipettes, biological safety cabinets, histology cassettes, hematology slides, disposable beakers, tissue culture flasks, serological pipettes, microscope slides, lab coats, sample cups, inoculating loops, disposable syringes, culture flasks, laboratory gloves, lab glassware, centrifuge tubes, cryogenic vials, safety glasses, filter paper, cell culture plates, test tubes, disposable petri dishes, centrifuge rotors, pcr tubes, and microscopy slides.

Established players in the US are expanding their reach internationally to strengthen their global presence, fueling the growth of the market. The US's commitment to research and development, with substantial investments, further supports the industry's growth trajectory. The market is expected to witness increased demand for these disposable products due to their essential role in maintaining laboratory hygiene and ensuring safety in various applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of products essential for scientific research and laboratory experiments. Key items include disposable sterile centrifuge tubes, which facilitate the separation of mixtures through centrifugation. High-throughput screening microplates enable large-scale experiments, while polypropylene cryogenic vials provide safe storage for samples at low temperatures. Sterile disposable pipettes and packaging ensure accurate and contamination-free handling of liquids. Sterile plastic petri dishes come in various sizes for culturing microorganisms, and autoclavable laboratory glassware is indispensable for chemical reactions. Disposable sterile gloves (nitrile), medical grade disposable syringes, and disposable plastic laboratory beakers are crucial for maintaining aseptic conditions during experiments. High-quality disposable lab coats protect researchers from potential contaminants, and disposable sterile microcentrifuge tubes are ideal for small-volume centrifugation. Disposable safety glasses offer eye protection, and sterile disposable inoculating loops are used for transferring bacteria from one place to another. Disposable cell culture plates, disposable PCR tubes, high-quality microscope slides, disposable sterile filter papers, and disposable biohazard bags for waste disposal are all integral components of the market. These products adhere to market research report standards, ensuring the highest quality and reliability for scientific research applications.

What are the key market drivers leading to the rise in the adoption of Laboratory Disposables Industry?

- The market is significantly driven by the escalating number of research studies.

- In response to the escalating requirements of sectors such as life sciences, chemicals, and food and beverages, research initiatives and advancements are experiencing significant growth. These industries frequently conduct lab-scale testing of new products prior to their commercialization. The research process necessitates a laboratory setup, which involves the utilization of both laboratory consumables and equipment. The substantial investment in research and development (R&D) by these industries is a key factor fueling this trend, as it enables competitors to stay competitive in the market.

- However, research studies in these industries are capital-intensive due to the high failure rate and extended timeframes for obtaining results. Consequently, the demand for laboratory consumables, including microscopy slides, remains robust.

What are the market trends shaping the Laboratory Disposables Industry?

- The adoption of laboratory automation systems is gaining momentum as the latest market trend. This trend reflects the increasing recognition of the benefits these systems bring to laboratory operations, including efficiency, accuracy, and cost savings.

- The market is witnessing significant growth due to the increasing adoption of automation in laboratories. Automation reduces overall laboratory costs and sample wastage during experiments by using disposable items such as pipette tips, microarray slides, lab aprons, microcentrifuge tubes, disposable gloves, erlenmeyer flasks, and biohazard bags. These disposables are essential components of automation devices like microplate readers, automated liquid handling systems, and synthetic biology workstations.

- By utilizing these devices, laboratories can decrease inventory depletion costs. The short expiry dates of many laboratory consumables often result in wastage and incorrect experiment results. Consequently, the shift towards automated laboratory systems is a cost-effective and efficient solution for laboratories.

What challenges does the Laboratory Disposables Industry face during its growth?

- The absence of distinct differentiation among companies poses a significant challenge to the industry's growth trajectory.

- Laboratory disposables refer to a range of products used in scientific research and diagnostic applications. These include sterile pipettes, biological safety cabinets, histology cassettes, hematology slides, disposable beakers, tissue culture flasks, serological pipettes, and microscope slides. These items are essential in all laboratories due to their standardized nature and common usage. However, the market for laboratory disposables is highly competitive, as the products offer little differentiation in terms of innovation or product capabilities. Consequently, companies struggle to establish unique selling propositions (USPs) and differentiate themselves from competitors.

- Pricing and quality are the primary factors that distinguish one brand from another. Despite the challenges, the demand for laboratory disposables remains strong due to the increasing need for research and diagnostic services in various industries.

Exclusive Customer Landscape

The laboratory disposables market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the laboratory disposables market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, laboratory disposables market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Thermo Fisher Scientific - This company specializes in providing a range of laboratory disposables, including pipette tips, AssayMAP cartridges, and microplates, catering to scientific research and experimental applications. Their offerings ensure standardization, sterility, and efficiency in laboratory processes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Thermo Fisher Scientific

- Merck KGaA

- Corning Inc.

- Eppendorf AG

- Sarstedt AG

- Greiner Bio-One

- BD Biosciences

- VWR International

- Mettler Toledo

- PerkinElmer

- Agilent Technologies

- Bio-Rad Laboratories

- QIAGEN

- Gilson Inc.

- Brand GmbH

- Sartorius AG

- Nunc AS

- Starlab Group

- Integra Biosciences

- Watson-Marlow

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Laboratory Disposables Market

- In January 2024, Thermo Fisher Scientific, a leading laboratory equipment supplier, announced the launch of its new line of single-use labware, the Nunc Easymold, designed for enhanced reproducibility and ease of use in molecular biology applications (Thermo Fisher Scientific Press Release).

- In March 2024, Danaher Corporation's subsidiary, Beckman Coulter, entered into a strategic partnership with Bio-Rad Laboratories to expand their offerings in the clinical diagnostics market through the integration of Bio-Rad's molecular diagnostics portfolio (Beckman Coulter Press Release).

- In May 2024, Merck KGaA, a significant player in the market, completed the acquisition of Versum Materials, a leading manufacturer of specialty chemicals and materials for semiconductor and advanced technologies, to strengthen its position in the life science industry (Merck KGaA Press Release).

- In April 2025, the European Union granted marketing authorization for Greiner Bio-One's new line of PCR plates, the Eppendorf REALPLATE, which features a unique design to reduce the risk of cross-contamination during PCR experiments (Greiner Bio-One Press Release).

Research Analyst Overview

- The market encompasses a wide range of products essential for scientific research and clinical applications. Key components include centrifuge tubes, lab equipment, lab consumables, sterile swabs, single-use devices, sample collection tubes, clinical disposables, glass slides, clinical supplies, sterile filters, microbiology supplies, disposable needles, blood collection tubes, laboratory supplies, analytical supplies, diagnostic disposables, plastic petri dishes, sterile containers, polypropylene tubes, syringe filters, medical disposables, pipette controllers, laboratory consumables, cell culture supplies, disposable labware, medical consumables, and research supplies. Market trends indicate a growing preference for single-use devices and disposable labware due to their convenience, ease of use, and reduced risk of contamination.

- Sterile filters and syringe filters are increasingly adopted for water and liquid filtration applications in various industries. Microbiology supplies, including sterile swabs and petri dishes, remain in high demand for diagnostic applications. Additionally, clinical disposables, such as blood collection tubes and sterile containers, continue to be crucial components in healthcare settings. Overall, the market is dynamic, driven by advancements in technology and the increasing demand for efficient and cost-effective solutions.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Laboratory Disposables Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.03% |

|

Market growth 2024-2028 |

USD 11175.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.88 |

|

Key countries |

US, China, UK, Germany, India, Japan, Canada, UAE, Brazil, South Korea, France, Netherlands, Australia, South Africa, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laboratory Disposables Market Research and Growth Report?

- CAGR of the Laboratory Disposables industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laboratory disposables market growth of industry companies

We can help! Our analysts can customize this laboratory disposables market research report to meet your requirements.