Laboratory Automation Systems Market Size 2024-2028

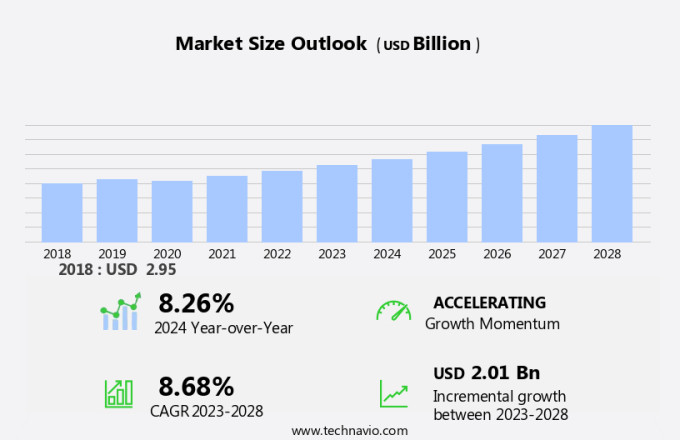

The laboratory automation systems market size is forecast to increase by USD 2.01 billion at a CAGR of 8.68% between 2023 and 2028.

- In the laboratory industry, the demand for automation systems is on the rise due to several factors. The need for high-volume testing in healthcare applications, such as hospitals and diagnostic laboratories, is driving the market. Additionally, regulatory requirements in food safety and healthcare industries necessitate the use of automated solutions to ensure accuracy and compliance. Automation in laboratories is transforming the way clinical chemistry analysis, immunoassay analysis, and high-throughput analysis are conducted.

- However, budget constraints and the lack of adoption by smaller laboratories present challenges. The market is witnessing an increase in the adoption of automated workstations and tables with accessories to streamline processes and enhance productivity. Developing nations are also witnessing a growth in FDA-approved manufacturing facilities, leading to further growth opportunities. Despite these trends, the market faces challenges in gaining traction among small-scale and medium-scale laboratories due to cost constraints. Overall, the market is poised for growth, offering significant opportunities for companies and stakeholders.

What will be the Laboratory Automation Systems Market Size During the Forecast Period?

- The market is witnessing significant growth due to the increasing demand for reliable results and safe working conditions in clinical laboratories. Laboratory automation systems are designed to streamline various laboratory processes, including sample handling, liquid handling, and data analysis. These systems enable laboratories to handle large volumes of samples efficiently and accurately, reducing human intervention and minimizing errors. The healthcare sector, particularly diagnostic laboratories, is the primary consumer of laboratory automation systems. These systems help laboratories meet the growing demand for quick and accurate diagnostic tests, ensuring that patients receive timely and reliable results. Automated workstations and robotic systems are the most popular types of laboratory automation systems. These systems offer advanced data management capabilities, allowing laboratories to store, retrieve, and analyze data efficiently.

- Furthermore, they also help ensure consistent and standardized results, which is crucial in the healthcare industry. Sample preparation is a critical process in laboratory analysis, and laboratory automation systems are increasingly being used to automate this process. Automated sample preparation reduces the risk of human error and ensures consistent results, leading to increased productivity and improved patient outcomes. Liquid handling is another process that is being automated in laboratories. Automated liquid handling systems offer precise and accurate measurement and dispensing of liquids, reducing the risk of errors and minimizing the need for manual intervention. The total automation segment of the market is expected to grow significantly in the coming years. This growth is driven by the increasing demand for fully automated laboratory processes, which offer significant benefits in terms of increased productivity, reduced errors, and improved safety.

- In conclusion, laboratory automation systems are becoming an essential tool for clinical laboratories, enabling them to deliver reliable results in a safe and efficient manner. These systems offer numerous benefits, including reduced human intervention, improved data management, and increased productivity. As the demand for quick and accurate diagnostic tests continues to grow, the market is expected to continue its growth trajectory.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical and biotechnology companies

- Clinical and reference laboratories

- Academic institutions and research organizations

- Others

- Type

- Equipment

- Software

- services

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

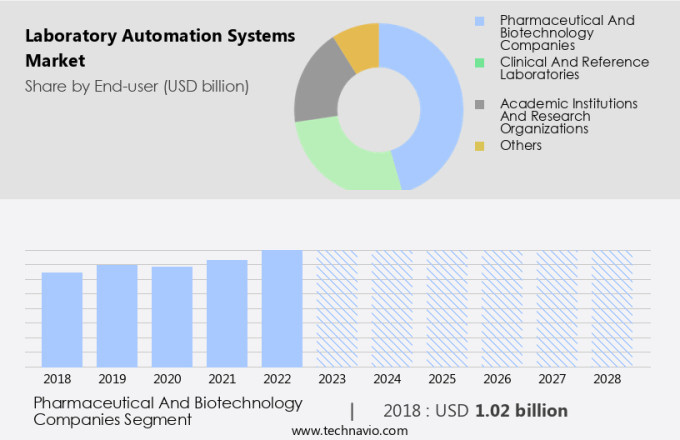

- The pharmaceutical and biotechnology companies segment is estimated to witness significant growth during the forecast period.

In the realm of pharmaceutical and biotechnology research, the implementation of automated work cells, including robotic systems, has significantly increased efficiency in laboratories, particularly within the diagnostics segment. These advanced technologies have revolutionized processes in drug discovery and genomics, as well as proteomics solutions. Laboratories and forensic facilities are major end users of these systems, which reduce repetitiveness and human intervention.

Furthermore, automated liquid handling systems are integral to the drug discovery process, enabling high-throughput screening of clinically relevant compounds. These systems precisely measure and analyze liquid samples in a timely and accurate manner, expediting the identification of compounds with desirable properties for drug development. The pharmaceutical and biotechnology companies segment is experiencing substantial growth due to these advancements, streamlining the drug discovery process and enhancing overall productivity.

Get a glance at the market report of share of various segments Request Free Sample

The pharmaceutical and biotechnology companies segment was valued at USD 1.02 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

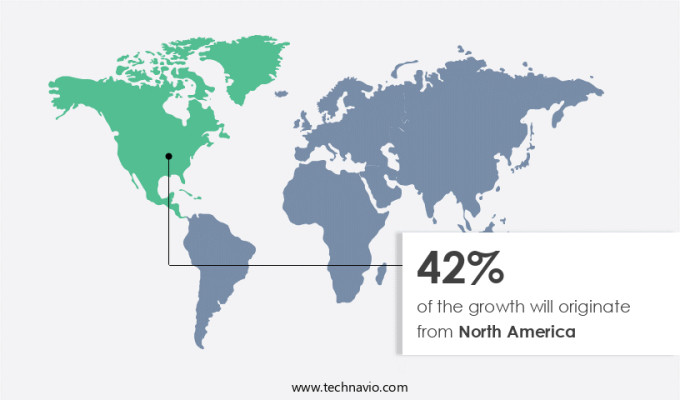

- North America is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the global landscape, North America led the market in 2023, with the United States being the frontrunner. Factors such as substantial investments in areas like precision medicine, genomics, and proteomics; robust distribution networks; intense focus of pharmaceutical companies on drug discovery and development; and the presence of major players, including Abbott Laboratories, Agilent Technologies Inc., and Thermo Fisher Scientific Inc., fuel the market growth in the US. Companies in this region are continually launching innovative products and associated services, such as software solutions, which are drawing end-users to procure laboratory automation systems.

Furthermore, these systems offer significant benefits, including increased productivity, safe working conditions, reliable results, time savings, and cost efficiency, making them indispensable in various industries, including clinical laboratories and research institutions. The US market for laboratory automation systems is poised for continued expansion due to these advantages and the ongoing technological advancements in the field of automated instruments and process automation.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Laboratory Automation Systems Market?

Increasing demand for laboratory automation software services is the key driver of the market.

- Laboratory automation systems have gained significant traction in the scientific community due to their ability to streamline processes and enhance accuracy in various applications, including sample handling, verifications, and labeling tubes. companies are now integrating software services with their laboratory equipment to cater to the evolving needs of customers and ensure consistent, high-quality results. These software solutions offer an intuitive and adaptable user interface, enabling users to analyze data from samples. Compliance with regulatory standards, such as Certificates of Analysis (COA) and Certificates of Conformance (COC), is a priority for these software services.

- Furthermore, they can be customized to meet the specific requirements of end-users. For instance, Thermo Fisher Scientific Inc.'s Versette ControlMate Software enables users to create and execute pipetting programs for intricate pipetting sequences, such as plate reformatting, serial dilutions, or immunoaffinity sample preparations, using mass spectrometric immunoassay (MSIA) pipette tips. Overall, these software services are essential tools for laboratories in microbiology, biotechnology, clinical chemistry, and other fields, enabling miniaturization and physical strain reduction while maintaining the highest standards of precision and accuracy.

What are the market trends shaping the Laboratory Automation Systems Market?

The rising number of FDA-approved manufacturing facilities in developing nations is the upcoming trend in the market.

- In the healthcare sector, outsourcing laboratory needs to trusted partners is a significant trend. Companies prioritize partners with US FDA-approved facilities, a competent workforce, and cost-effective operations when outsourcing drug discovery and medical device manufacturing. For instance, US-based firms prefer partners that adhere to WHO-Good Manufacturing Practice (GMP) standards.

- Furthermore, these criteria have led to increased investments in laboratory automation systems and contract research outsourcing in developing countries. High-volume laboratories in these regions offer healthcare applications, including diagnostics, food safety testing, and regulatory compliance, at competitive prices. Hospitals and diagnostic laboratories in the US face budget constraints, making it essential to collaborate with reliable outsourcing partners. Automated workstations and tables with accessories are crucial for high-volume laboratories to meet the growing demand for efficient and accurate testing.

What challenges does Laboratory Automation Systems Market face during the growth?

The lack of adoption of automated solutions by small-scale and medium-scale laboratories is a key challenge affecting the market growth.

- In the realm of laboratory operations, medium and small-sized facilities face unique challenges due to their limited budgets, staff, and space. These laboratories primarily focus on specific applications, such as diagnostic testing and analysis of biological samples, and thus prioritize manual processes over automation. However, the significance of data analysis and accuracy in laboratory work cannot be overstated. Laboratory Automation Systems (LAS) offer solutions to enhance data management, sample preparation, and integration, thereby improving efficiency and flexibility. Government legislation mandates stringent quality control measures, making it essential for laboratories to maintain accuracy in their results.

- Furthermore, immunoassay analysis, a critical process in various industries, benefits significantly from LAS. Data analysis is a crucial aspect of LAS, enabling labs to gain valuable insights from the vast amounts of data generated. Total automation segments of LAS offer advanced capabilities, including customization services, to cater to the unique requirements of various applications. Despite the benefits, small and medium-sized laboratories often shy away from investing in LAS due to space constraints and budget limitations. Nevertheless, the integration of LAS with existing infrastructure can lead to substantial improvements in productivity and accuracy, making it a worthwhile investment in the long run.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Agilent Technologies Inc.

- Becton Dickinson and Co.

- Bee Robotics Ltd.

- Biosero Inc.

- Cognex Corp.

- Eppendorf SE

- F. Hoffmann La Roche Ltd.

- Gilson Inc.

- LabVantage Solutions Inc.

- LabWare Inc.

- Olympus Corp.

- PerkinElmer Inc

- QIAGEN NV

- SCINOMIX

- Siemens AG

- SPT Labtech Ltd.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Laboratory automation technology is revolutionizing the way scientific research and diagnostic processes are carried out in various industries. Automated instruments play a significant role in process automation, particularly in clinical laboratories, where productivity, safe working conditions, reliable results, and cost efficiency are crucial. Miniaturization of laboratory equipment, such as automated systems for liquid handling, data analysis, sample preparation, and immunoassay analysis, have become essential in microbiology, biotechnology, clinical chemistry, and other fields. Automation in laboratories reduces physical strain, repetitiveness, and human intervention, enhancing workflow scope, improving data quality, and reducing time cycles. Government legislation and regulatory requirements have increased the demand for automated systems in healthcare applications, including hospitals, diagnostic laboratories, and forensic laboratories.

Furthermore, the total automation segment of the laboratory automation market is growing due to budget constraints and the need for high volume processing in emerging countries. Customization services cater to the unique laboratory needs of various end users, including healthcare, food safety, and research institutions. Automated workstations, off-the-shelf automated workcells, and robotic systems are transforming laboratories by offering flexibility capabilities, integration, and increased efficiency. Automated liquid handlers, data management, and data analysis systems are critical components of these systems. Sample contamination and automation dependence are key challenges that need to be addressed in the development of integrated systems. Advancements in technology, such as machine learning, Insilico Medicine, and precision medicine development, are driving the market for automated systems in drug discovery, genomics solutions, and proteomics solutions. FDA clearance, wireless connectivity, and robots restocking shelves are some of the emerging trends in the laboratory automation market.

Laboratory automation systems have revolutionized the scientific landscape, particularly in the drug discovery market. These integrated systems leverage the power of the Internet of Things (IoT) to streamline workflows, reduce repetitiveness, and enhance scope. By automating large volumes of sample tests, they save significant time and cost. The development of automation systems has led to time cycle reductions in high-throughput compound screening, including fragment screening, computer modeling, and insilico medicine. These techniques help identify potential therapeutic candidates more efficiently. Maintenance and service costs are minimized due to the precision and durability of these systems. Tables and accessories are designed for efficient dispensing of dead volumes, ensuring accurate results.

Automation systems have become essential in various industries, from lifesaving medical equipment to manufacturing machinery. Their immersive experience offers a competitive edge, enabling scientists to focus on innovation rather than manual labor. Key market trends include the integration of automation in drug discovery processes, such as high-throughput compound screening, which saves effort and improves data quality. The future of laboratory automation lies in its ability to continue driving advancements in research and development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.68% |

|

Market growth 2024-2028 |

USD 2.01 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.26 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch