Laboratory Information System Market Size 2024-2028

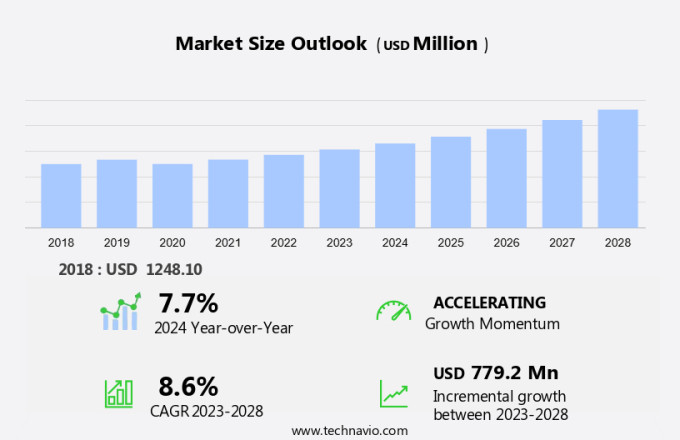

The laboratory information system market size is forecast to increase by USD 779.2 million at a CAGR of 8.6% between 2023 and 2028. In the clinical laboratory sector, the adoption of advanced Laboratory Information Systems (LIS) continues to gain traction, driven by the need for efficient specimen management, seamless information flow, and accurate result interpretation. The market is witnessing a significant trend toward cloud-based LIS solutions due to their cost-effectiveness and flexibility. However, high maintenance and service costs remain a challenge. Clinical laboratories prioritize test selection, test utilization, and clinician satisfaction. Coagulation testing is a key application area for LIS, as it requires precise result interpretation and diagnostics stewardship. Customized interpretive comments provided by advanced LIS solutions enhance clinician satisfaction and improve patient care.

Key market growth factors include the increasing demand for laboratory automation and the popularity of cloud-based LIS solutions. Despite these advantages, high maintenance and service costs remain a significant challenge for laboratories. To address this issue, companies are focusing on offering cost-effective solutions and partnership models. In summary, the clinical laboratory market is experiencing growth due to the need for automation, the popularity of cloud-based LIS, and the demand for accurate test results and clinician satisfaction. However, high maintenance and service costs remain a challenge, necessitating innovative solutions from companies.

The clinical laboratory industry plays a crucial role in the healthcare sector by providing accurate and timely diagnostic results to support patient care. The effective management of laboratory workflows, from specimen collection to result interpretation, is essential to ensure efficient and high-quality patient care. In this context, advanced Laboratory Information Systems (LIS) have emerged as a key solution to streamline laboratory operations and enhance overall performance. The primary functions of a LIS include managing patient demographics, laboratory orders, and billing data. By integrating these elements, LIS enable seamless information flow between various stages of the laboratory process. This integration facilitates accurate and efficient test selection, test utilization, and result interpretation. One of the critical aspects of laboratory operations is specimen management. LIS provide tools to manage specimen collection, inventory, and quality control data. These features help ensure the availability of reagents and minimize the risk of specimen misidentification or loss.

Furthermore, LIS can generate preliminary laboratory results, allowing clinicians to make patient-specific interventions in a timely manner. Coagulation testing is a significant component of clinical laboratory services. LIS can support coagulation testing workflows by managing orders, results, and reagent inventory. Customized interpretive comments can be integrated into the system to assist clinicians in understanding complex test results and making informed decisions. Diagnostic stewardship is another essential aspect of clinical laboratories. LIS can facilitate diagnostics stewardship by implementing reflexive testing algorithms. These algorithms help ensure appropriate test utilization and reduce unnecessary testing, ultimately leading to cost savings and improved patient outcomes. Molecular microbiology and next-generation sequencing are increasingly becoming essential components of clinical laboratories. LIS can support these advanced testing modalities by managing complex workflows, integrating results with clinical data, and facilitating quality control and utilization management. Software applications integrated with LIS can further enhance laboratory operations by automating various tasks, improving data accuracy, and enabling real-time monitoring of laboratory workflows. These applications can help optimize laboratory workflows, reduce turnaround times, and improve overall laboratory efficiency.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Deployment

- On-premises

- Cloud-based

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Deployment Insights

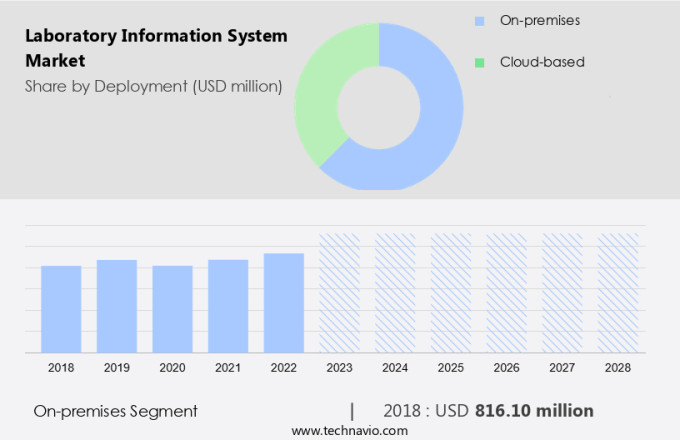

The on-premises segment is estimated to witness significant growth during the forecast period. Laboratory information systems are essential tools for clinical labs to manage specimen collection, processing, and result reporting efficiently. These systems facilitate seamless information flow between various stages of testing, enabling timely and accurate result interpretation. They also support test selection and utilization, ensuring optimal use of resources and reducing turnaround time. Coagulation testing is a critical application area where laboratory information systems play a significant role in ensuring accurate and consistent results. Clinician satisfaction is a key consideration for laboratory information systems, and customized interpretive comments can enhance the value of test results. Diagnostics stewardship is another important aspect, as these systems help ensure appropriate test utilization and reduce unnecessary testing. However, the choice between on-premises and cloud-based deployment models can impact the overall effectiveness of the system. While on-premises deployment offers better data security and control, it requires substantial infrastructure investments and lacks flexibility.

Get a glance at the market share of various segments Download the PDF Sample

The on-premises segment was valued at USD 816.10 million in 2018. The high maintenance costs associated with on-premises solutions may also deter smaller labs and those with limited budgets. As a result, the demand for cloud-based laboratory information systems is expected to increase during the forecast period due to their cost-effectiveness, flexibility, and ease of use. In conclusion, laboratory information systems are vital for managing clinical lab operations efficiently and ensuring accurate and timely test results. The choice between on-premises and cloud-based deployment models depends on various factors, including cost, security, and flexibility. The trend towards cloud-based solutions is expected to continue due to their cost-effectiveness and ease of use, making them a preferred choice for many clinical labs.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

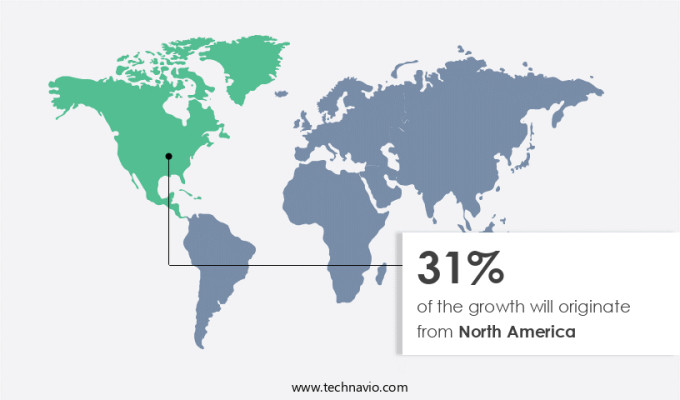

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In North America, the adoption of laboratory information systems (LIS) is gaining momentum due to the advanced infrastructural capabilities of companies in the region. These systems are increasingly being utilized in laboratories across the US to manage preliminary results, reagent availability, specimen inventories, and quality control data. The integration of reflexive testing algorithms and genotyping assays further enhances the efficiency of these systems. The healthcare sector, which accounts for a significant portion of the US economy, valued at approximately USD 1.136 trillion and representing 8% of the national GDP, is a major contributor to the LIS market. US pharmaceutical companies invest 17%-18% of their annual revenue in research and development, making it essential to employ efficient tools and technologies to manage and analyze data. Utilization management and patient data management are critical aspects of healthcare operations, and LIS solutions offer effective solutions to manage these processes.

Moreover, the integration of artificial intelligence and machine learning in LIS solutions has revolutionized the decision-making process by providing accurate and timely insights. For instance, positive HIV test results can be flagged immediately, enabling healthcare providers to take prompt action. These advanced features make LIS solutions an indispensable tool for healthcare organizations in the US. In summary, the LIS market in North America is witnessing growth due to the integration of advanced technologies, the high contribution of the healthcare sector to the US economy, and the increasing investment in research and development. LIS solutions offer significant benefits, including efficient specimen management, accurate results, and improved patient care, making them a valuable investment for healthcare organizations in the US.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The need for laboratory automation is notably driving market growth. In the realm of laboratory processes, automation is becoming increasingly popular as a solution to address labor shortages and minimize manual intervention. Dedicated workstations and software enable the configuration of instruments to automate routine laboratory tasks, thereby enhancing productivity and enabling researchers to focus on more complex duties. Automation ensures the generation of precise data and simplifies documentation processes. The implementation of regulatory standards and the necessity for error-free results foster the creation of efficiencies with consistent outcomes. According to a study published in the Journal of Lab Automation, the error rate for completely automated laboratory procedures ranges from 1% to 5%, while for semi-automated activities, it is 1% to 10%.

In contrast, manual operations exhibit error rates of 10% to 30%. By reducing human errors caused by repetitive processes, such as pipetting and plate transfer, automation significantly improves accuracy. As a professional and knowledgeable assistant, I can confirm that this trend is gaining momentum in the US and North American markets, with a focus on enhancing laboratory efficiency, reducing errors, and improving overall quality in medical testing for inpatient and outpatient settings across various disciplines, including hematology, chemistry, immunology, microbiology, and toxicology, as well as in public health. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The growing popularity of cloud-based LIS is the key trend in the market. In the US market, the shift towards cloud-based Laboratory Information Systems (LIS) has led to significant progress. The adoption of virtualization technology and the widespread availability of high-speed internet have accelerated innovation, offering cost savings without the need for large upfront investments. Cloud-based LIS solutions allow healthcare providers to pay for software subscriptions instead of expensive full licenses, thereby reducing the financial burden of in-house deployment.

Moreover, these systems do not necessitate initial capital expenditures on hardware, alleviating the pressure on healthcare organizations and minimizing the requirement for IT personnel. Cloud-based LIS solutions offer advanced capabilities such as workflow automation, outreach tools, data mining, and audit capabilities. These features enable efficient provider determination, patient health status tracking, and treatment planning. Additionally, point-of-care testing integration and secure data transfer enhance the overall functionality and usability of these systems. In summary, the transition to cloud-based LIS solutions in the US market offers numerous benefits, including cost savings, enhanced functionality, and improved data security. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The high maintenance and service costs is the major challenge that affects the growth of the market. Laboratory Information Systems (LIS) are essential software solutions for managing clinical details and test orders in clinical pathology and anatomic pathology laboratories. These systems utilize databases to store and retrieve clinical data, facilitate decision-support rules, and ensure quality control. However, the high cost of maintaining and servicing LIS is a significant challenge for market growth. Industry experts report that IT solution maintenance expenses surpass the product cost itself. Service and maintenance, which encompass software updates to accommodate evolving user needs, account for approximately 20%-30% of the total cost of ownership.

Additionally, training and implementation expenses amount to around 15% of the total cost. Small and medium-sized laboratories often face financial constraints that hinder their ability to invest in these systems, thereby limiting the adoption rate of LIS. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Cerner Corp. - The company offers a full suite of laboratory information system solutions designed to optimize workflows within the laboratory.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALLSCRIPTS HEALTHCARE SOLUTIONS INC.

- American Soft Solutions Corp.

- Cerner Corp.

- Clinlab Inc.

- Comp Pro Med Inc.

- CompuGroup Medical SE and Co. KGaA

- Computer Programs and Systems Inc.

- Epic Systems Corp.

- LabSoft Inc.

- LabWare Inc.

- Margy Tech Pvt Ltd

- McKesson Corp.

- Medical Information Technology Inc.

- Orchard Software Corp.

- Quest Diagnostics Inc.

- Soft Computer Consultants Inc

- Sunquest Information Systems Inc

- Sysmex Corp.

- Thermo Fisher Scientific Inc.

- XIFIN Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

A Laboratory Information System (LIS) is a vital healthcare software solution that streamlines clinical laboratory workflows, enabling efficient specimen management, information flow, and result interpretation. The system facilitates test selection, utilization, and interpretation in various domains, including coagulation testing, molecular microbiology, and next-generation sequencing. LIS caters to both inpatient and outpatient settings, accommodating various laboratory processes such as hematology, chemistry, immunology, microbiology, toxicology, public health, and clinical pathology. It integrates patient demographics, billing data, laboratory orders, clinical data, and quality control data to support patient-specific interventions and preliminary laboratory results. The system's customized interpretive comments, diagnostics stewardship, and reflexive testing algorithms contribute to clinician satisfaction and effective decision-making. Reagent availability, specimen inventories, and quality control data are managed to ensure optimal laboratory performance. Utilization management features help monitor test orders, laboratory analyzers, and provider determination based on patient health status and treatments. LIS offers advanced capabilities like data mining, audit, and outreach tools to enhance workflow efficiency, practice management, and overall healthcare delivery. Point-of-care testing integration and decision-support rules further augment the system's value in the clinical laboratory landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.6% |

|

Market growth 2024-2028 |

USD 779.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.7 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 31% |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ALLSCRIPTS HEALTHCARE SOLUTIONS INC., American Soft Solutions Corp., Cerner Corp., Clinlab Inc., Comp Pro Med Inc., CompuGroup Medical SE and Co. KGaA, Computer Programs and Systems Inc., Epic Systems Corp., LabSoft Inc., LabWare Inc., Margy Tech Pvt Ltd, McKesson Corp., Medical Information Technology Inc., Orchard Software Corp., Quest Diagnostics Inc., Soft Computer Consultants Inc, Sunquest Information Systems Inc, Sysmex Corp., Thermo Fisher Scientific Inc., and XIFIN Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch