Laundry Care Market Size 2025-2029

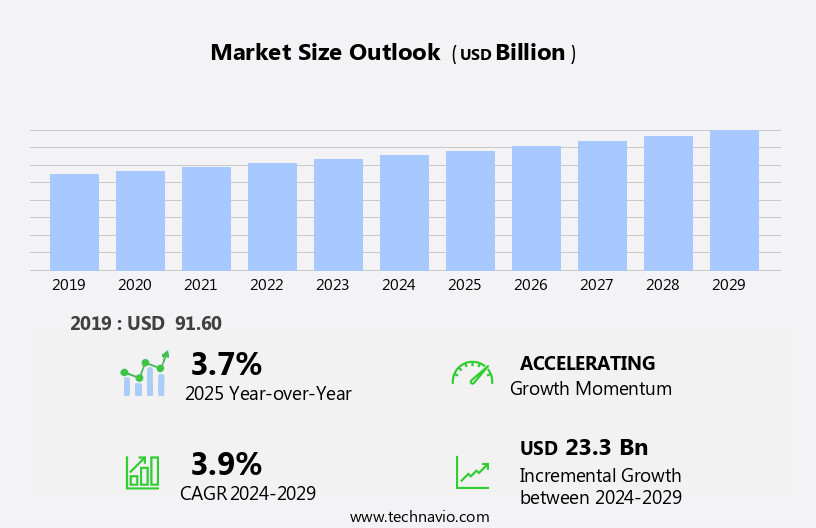

The laundry care market size is forecast to increase by USD 23.3 billion at a CAGR of 3.9% between 2024 and 2029.

- The market is experiencing significant growth driven by the increasing demand for convenience and effectiveness in home laundry solutions. Product innovation and portfolio extension are key trends in the market, with companies investing in research and development to introduce eco-friendly and sustainable offerings that cater to evolving consumer preferences. However, balancing production cost, price, and quality remains a significant challenge for market players. The global population's rising disposable income and the increasing number of nuclear families are fueling the demand for products. Furthermore, the growing trend of outsourcing laundry services and the increasing adoption of automation are creating new opportunities for market participants.

- Companies seeking to capitalize on these trends should focus on developing innovative and sustainable products while maintaining a competitive price point and ensuring consistent quality. Effective supply chain management and strategic partnerships can also help companies navigate the challenges of production costs and regulatory compliance. Technological advancements, such as the increasing popularity of liquid detergent, capsules, and e-commerce platforms, have transformed the way consumers access and purchase products. Overall, the market presents a promising landscape for growth, with opportunities in emerging economies and the continued demand for convenient and effective laundry solutions. Companies that can successfully navigate the challenges of production costs, price, and quality while staying ahead of the competition through innovation and strategic partnerships are well-positioned to thrive in this dynamic market.

What will be the Size of the Laundry Care Market during the forecast period?

- The market encompasses a range of products, including home cleaning solutions such as laundry detergents, fabric softeners, and related fabric care items. This market exhibits growth, driven by several factors. Consumers' preferences for fragranced and eco-friendly goods have fueled demand for laundry detergents and fabric softeners with appealing scents and plant-based ingredients.

- The shift towards healthier lifestyles and consumer concerns for the environment have also influenced the market's direction, leading to the rise of eco-friendly and plant-based laundry care solutions. Rapid urbanization and infrastructural developments in emerging economies have expanded the market's reach and size. Overall, the market continues to evolve, catering to the diverse needs and preferences of consumers worldwide.

How is this Laundry Care Industry segmented?

The laundry care industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Laundry detergent

- Fabric softner

- Others

- Laundry detergent

- Application

- Residential

- Commercial

- Type

- Liquids

- Powders

- Pods

- Sheets

- Bar soaps

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- South America

- Brazil

- Middle East and Africa

- APAC

By Distribution Channel Insights

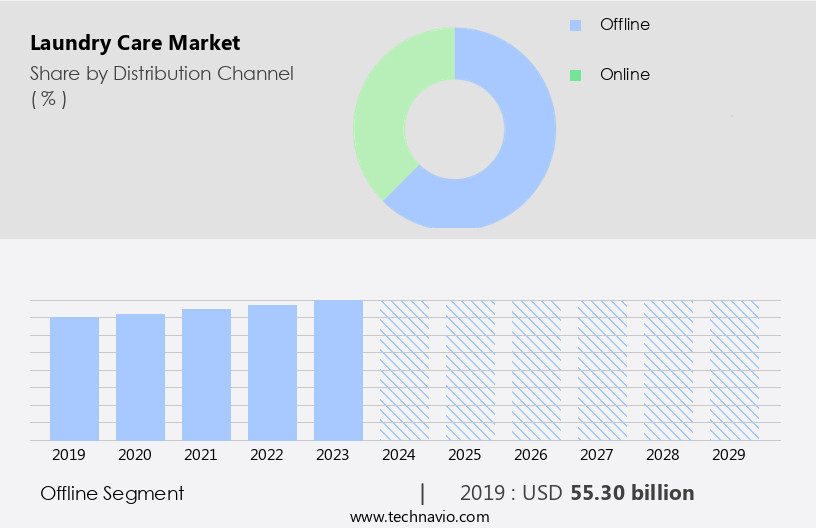

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses various product categories, including laundry detergents (powder and liquid), fabric softeners, fragrances, eco-friendly goods, and disinfectants. These products are primarily sold through offline channels, such as supermarkets, hypermarkets, convenience stores, and warehouse clubs. Consumers prefer these retail formats due to their wide product range, convenience, and quick results. The growing trend towards eco-friendly and sustainable alternatives is driving demand for laundry care products with plant-based ingredients and minimal artificial colorants. The liquid detergent segment holds a significant market share, with capsules gaining popularity due to their convenience and eco-friendliness. Online platforms, including e-commerce sites and FMCG marketplaces, are increasingly becoming a preferred channel for purchasing laundry care products.

The young population and rapid urbanization are key factors contributing to the market's growth. Fabric care and washing machine accessories are also gaining traction as consumers prioritize the care of their premium clothes. The demand for disinfectants and sanitizers has grown due to the ongoing pandemic. Overall, the market is expected to continue its growth trajectory, driven by consumer preferences for quick results, eco-friendly alternatives, and the convenience of online shopping.

Get a glance at the market report of share of various segments Request Free Sample

The offline segment was valued at USD 55.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

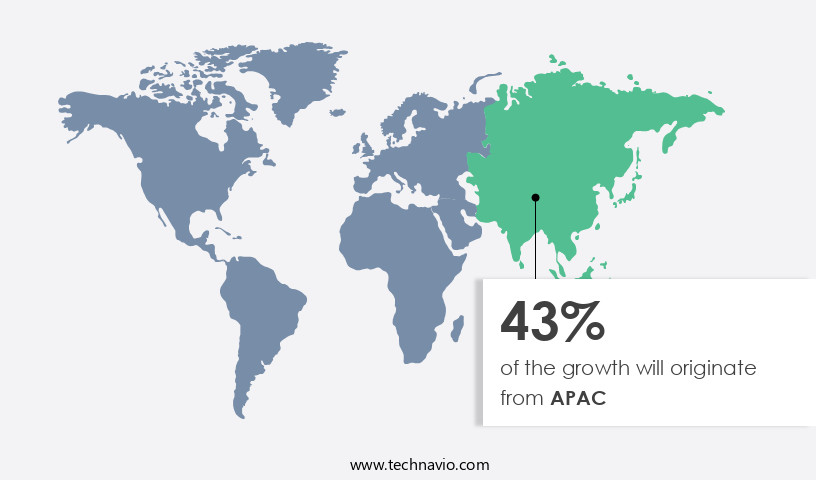

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific (APAC) region dominates The market due to factors such as rapid urbanization, a large population, and increasing penetration of washing machines. In 2024, China, Japan, and India were the leading contributors to the market in APAC. Key drivers include consumer preferences for advanced laundry care products, the growing number of households, and the rising popularity of e-commerce platforms. Innovative offerings, such as eco-friendly goods, fragrances, fabric softeners, and sustainable alternatives made from plant-based ingredients, are gaining traction.

Manufacturers sell their products through both third-party e-retailers and their own websites, catering to the demand for quick results and premium clothes among the young population. The market for laundry detergents, fabric softeners, disinfectants, and sanitizers is expected to continue growing, with the liquid detergent segment, particularly capsules, leading the way.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Laundry Care Industry?

- The product innovation and portfolio extension is the key driver of the market. In The market, the demand for superior-quality and innovative laundry care products, such as fabric softeners and liquid detergents, is on the rise due to their convenience and effectiveness. These products, which often come with advanced cleaning technology and unique features, command higher prices than traditional laundry care items. Companies are responding to this trend by expanding their product offerings and differentiating themselves through product premiumization. This strategy involves developing laundry care solutions with unique technology, packaging, quality, and pricing to attract consumers.

- For instance, the growing preference for eco-friendly laundry care products, including liquid detergents and fabric softeners, is a notable trend in the market. By focusing on product innovation and sustainability, companies can meet the evolving needs of consumers and stay competitive in The market.

What are the market trends shaping the Laundry Care Industry?

- The emergence of eco-friendly and sustainable products in laundry care is the upcoming market trend. The market is witnessing significant shifts as consumers become more conscious of the environmental impact of their choices. With growing concerns over water pollution caused by laundry care products, there is a heightened awareness of the need for eco-friendly alternatives. Chemical-based laundry care products not only harm the environment but also pose risks to human health and the quality of clothes in the long term. In response, consumer goods marketers are embracing green initiatives, driving the demand for organic, natural laundry care products.

- These products are free from artificial additives, chemicals, preservatives, and synthetics, making them a healthier and more sustainable option for consumers. The shift towards eco-friendly laundry care is a trend that is expected to continue, as consumers become increasingly informed and discerning in their purchasing decisions.

What challenges does the Laundry Care Industry face during its growth?

- Balancing production cost, price, and quality of products is a key challenge affecting the industry growth. The market is experiencing significant growth as manufacturers introduce innovative products to gain a competitive edge. However, producing high-quality laundry care items while adhering to labeling, packaging, and regulatory standards presents challenges. To maintain profitability, manufacturers must optimize production costs, including raw material, logistics, and labor expenses, which are increasing worldwide. Some major players, like Unilever and P and G, have localized their manufacturing processes to produce large volumes of laundry care products using low-margin commodity surfactants.

- This strategy helps them mitigate the impact of rising transportation and supply chain costs. In summary, manufacturers in the market must balance product quality with cost-effective production to remain competitive in a rapidly evolving industry.

Exclusive Customer Landscape

The laundry care market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the laundry care market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, laundry care market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Unilever PLC: The company offers hair care, skin cleansing, deodorants, skincare, and skin care products along with other beauty and personal care products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amway Corp.

- Church and Dwight Co. Inc.

- Colgate Palmolive Co.

- Fena Pvt. Ltd.

- Godrej and Boyce Manufacturing Co. Ltd.

- Grab Green Home

- Henkel AG and Co. KGaA

- Jyothy Labs Ltd.

- Kao Corp.

- Lion Corp.

- Puracy

- PZ Cussons Plc

- Reckitt Benckiser Group Plc

- RSPL Ltd.

- S.C. Johnson and Son Inc.

- Saraya Co. Ltd.

- The Clorox Co.

- The Procter and Gamble Co.

- Unilever PLC

- Venus Laboratories DBA Earth Friendly Products

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad range of home cleaning products specifically designed for washing and maintaining the cleanliness and freshness of textiles. This market includes laundry detergents, fabric softeners, and various eco-friendly alternatives. Fragrance is a significant factor in consumer preferences, as it contributes to the overall appeal and satisfaction of these products. Eco-consciousness is a growing trend in the market, with an increasing demand for sustainable alternatives. These alternatives often utilize plant-based ingredients and organic sources, catering to consumers who prioritize environmental friendliness and ethical production. The liquid detergent segment dominates the market, offering quick results and easy dispensing.

However, capsules have gained popularity due to their convenience and space-saving design, making them a viable option for consumers. The rapid urbanization and growth of e-commerce platforms have significantly impacted the market. Consumers now have access to a wide range of products, including specialty stores and niche brands, from the comfort of their homes. The FMCG (Fast-Moving Consumer Goods) industry, which includes laundry care products, has seen a shift towards premiumization. Consumers are increasingly willing to pay more for high-quality, effective, and eco-friendly laundry care solutions. The young population plays a significant role in market dynamics, as they are more likely to adopt new trends and technologies.

Quick results and convenience are essential factors in their purchasing decisions. Disinfectants and sanitizers have become increasingly important in the market, as consumers seek to maintain cleanliness and protect their health. Artificial colorants remain a common ingredient, although there is a growing demand for natural alternatives. The liquid form segment continues to dominate the market due to its ease of use and effectiveness. Washing machines have become a staple appliance in households worldwide, driving the demand for fabric care products. In summary, the market is a dynamic and evolving industry, driven by consumer preferences for eco-friendliness, quick results, and premium products. The growth of e-commerce and the influence of the young population are significant market trends, shaping the future of this sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2025-2029 |

USD 23.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.7 |

|

Key countries |

US, China, Japan, India, Germany, South Korea, UK, Brazil, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laundry Care Market Research and Growth Report?

- CAGR of the Laundry Care industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laundry care market growth of industry companies

We can help! Our analysts can customize this laundry care market research report to meet your requirements.