Less-Than-Truckload Market Size 2025-2029

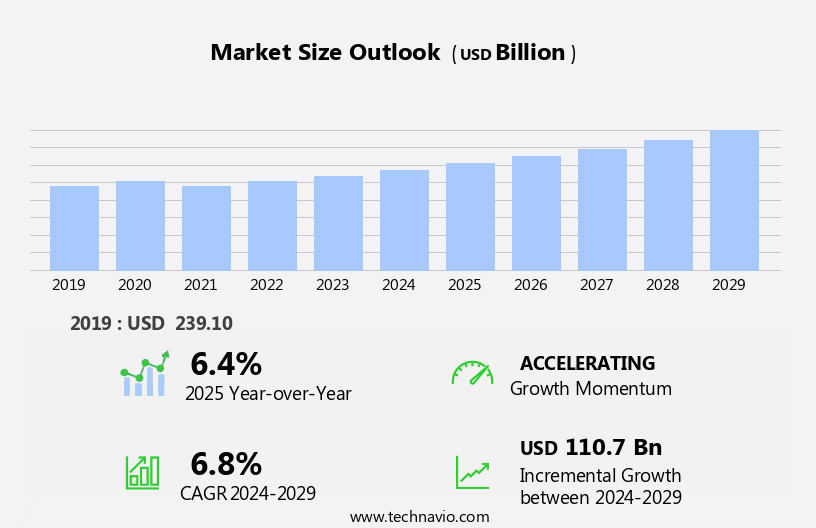

The less-than-truckload market size is forecast to increase by USD 110.7 billion at a CAGR of 6.8% between 2024 and 2029. The market is experiencing significant growth, driven primarily by an increase in e-commerce sales in the retail sector. The increasing preference for faster and more flexible delivery options is fueling the demand for LTL services, as they offer cost-effective solutions for transporting smaller shipments over shorter distances.

Major Market Trends & Insights

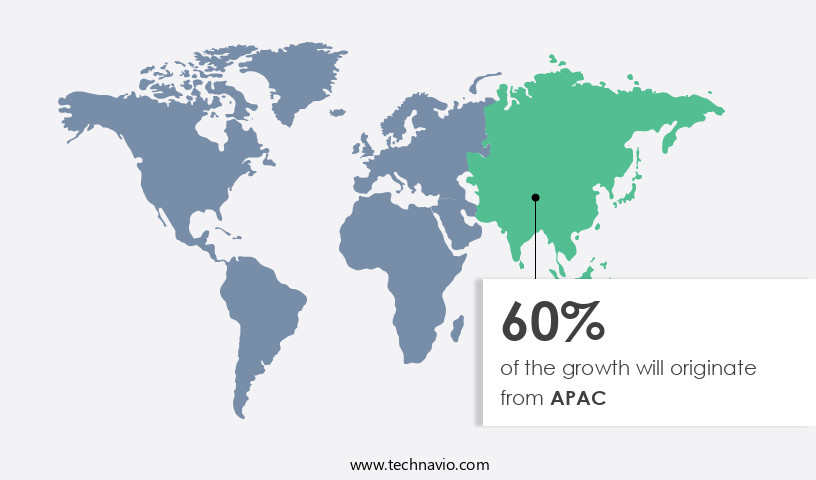

- APAC dominated the market and contributed 60% to the growth during the forecast period.

- The market is expected to grow significantly in North America region as well over the forecast period.

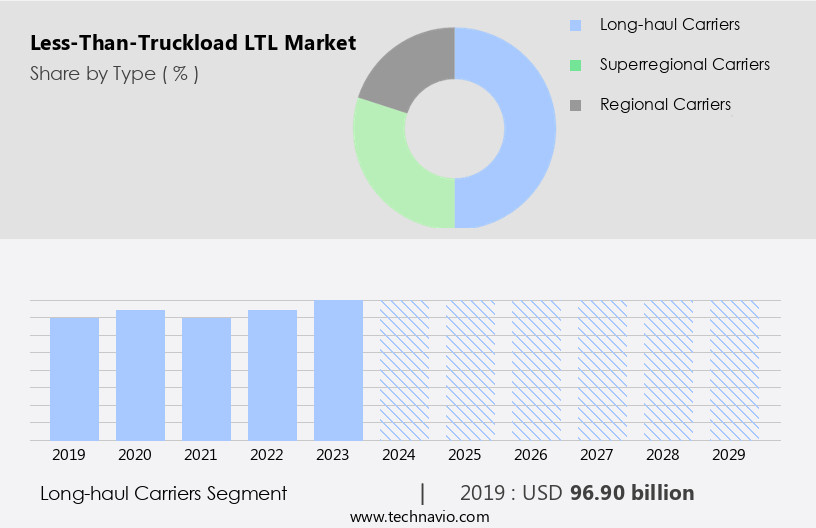

- Based on the Type, the Long-haul carriers segment led the market and was valued at USD 110.30 billion of the global revenue in 2023.

- Based on the Capacity, the Light Shipments (Up to 1,000 lbs) segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 65.08 Billion

- Future Opportunities: USD 110.7 Billion

- CAGR (2024-2029): 6.8%

- APAC: Largest market in 2023

Another key trend shaping the market is the emergence of big data, which is enabling LTL carriers to optimize their operations and improve customer service through real-time tracking and predictive analytics. However, the market is not without challenges, as rising prices and increasing competition are putting pressure on carriers to maintain profitability. Companies seeking to capitalize on the opportunities in this market must focus on innovation, operational efficiency, and customer service to differentiate themselves from competitors and meet the evolving demands of their customers. By staying abreast of these trends and challenges, LTL carriers can position themselves for long-term success in this dynamic and competitive market.

What will be the Size of the Less-Than-Truckload (LTL) Market during the forecast period?

- The market encompasses logistics services that cater to the transportation of smaller freight volumes, typically ranging from 150 to 20,000 pounds. This segment of the freight industry has experienced significant growth due to increasing demand for cost-effective and efficient shipping solutions. Carrier services in the LTL market employ advanced route optimization strategies to maximize shipping capacity and minimize freight costs. Freight volume in the LTL market is driven by various industries, including manufacturing, retail, and e-commerce, which require frequent and reliable cargo delivery. The market's direction is influenced by trends such as freight transport solutions that offer logistics efficiency, supply chain management, and freight tracking capabilities.

- Last-mile delivery and LTL technology continue to shape the market, enabling shipment consolidation and the expansion of delivery networks. Regional freight transportation in the LTL market is characterized by competitive pricing models and a focus on small parcel shipping. The market's growth is further fueled by the increasing popularity of truckload alternatives, which offer cost savings and flexibility for businesses with lower shipping volumes. Freight optimization remains a key focus for LTL carriers, ensuring that freight transport remains competitive and responsive to the evolving needs of the market.

How is this Less-Than-Truckload (LTL) Industry segmented?

The less-than-truckload (LTL) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Long-haul carriers

- Superregional carriers

- Regional carriers

- Capacity

- Light Shipments (Up to 1,000 lbs)

- Medium Shipments (1,000-5,000 lbs)

- Heavy Shipments (5,000 - 15,000 lbs)

- End-User

- Agriculture, Fishing, and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

- Distribution Channel

- Direct Freight Carriers

- Third-Party Logistics (3PL) Providers

- Online Freight Marketplaces

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- South America

- Brazil

- Rest of World (ROW)

- APAC

By Type Insights

The long-haul carriers segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 110.30 billion in 2023. It continued to the largest segment at a CAGR of 6.53%.

The market encompasses medium shipments transported via ground shipping and, at times, air shipping. The long-haul carriers segment, comprising national LTL carriers, dominates the market. These carriers transport shipments over long distances, typically within 3 to 5 days, with an average haul length of around 1,200 miles. Long-haul LTL carriers often operate through a hub-and-spoke network and are subject to labor union agreements. The growth of the long-haul carriers segment is contingent on economic conditions. Other players in the market include specialized carriers catering to niche industries like agriculture, industrial shipping, and retail shipping. Freight pricing trends incorporate density-based pricing and fuel surcharges for affordability.

E-commerce and retail shipping have increased demand for small shipments, requiring operational efficiency and flexibility in the supply chain. Logistics startups and oil marketing companies also impact freight transportation through rail shipping and truckload services. The LTL market is expected to maintain steady growth during the forecast period, with cost optimization and delivery times remaining crucial factors.

Get a glance at the market report of share of various segments Request Free Sample

The Long-haul carriers segment was valued at USD 96.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 60% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the APAC region estimates to be around USD 128.70 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth due to the region's large population and increasing demand for goods through both retail and e-commerce channels. According to recent data, the population in China and India has risen from 1.39 billion and 1.35 billion, respectively, in 2018 to 1.40 billion and 1.38 billion in 2020. This population growth has led to an increase in demand for ground shipping, particularly in sectors like agriculture, retail, and industrial shipping. The LTL market in APAC is driven by the region's thriving e-commerce industry in countries such as China, India, and Japan.

Density-based pricing and operational efficiency are key factors contributing to the affordability and flexibility of LTL services in the region. However, economic conditions, fuel prices, and delivery times remain critical factors influencing freight pricing trends. Freight carriers, including full truckload carriers and specialized carriers, are leveraging big data and logistics startups to optimize costs and improve operational efficiency. Rail shipping and air shipping are also gaining popularity for their cost-effectiveness and faster delivery times. The logistics sector is witnessing increased competition from oil marketing companies offering fuel surcharges to attract shippers. In summary, the LTL market in APAC is expected to continue its growth trajectory due to the region's large and growing population, the rise of e-commerce, and the increasing affordability and flexibility of LTL services.

Freight carriers and logistics startups are leveraging technology and operational efficiency to meet the evolving demands of shippers while navigating economic and fuel price challenges.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Less-Than-Truckload (LTL) Industry?

- Advances in e-commerce in retail sector is the key driver of the market. The LTL market has experienced notable growth due to several factors. Improving economic conditions and the expansion of the manufacturing sector have led to an increase in LTL shipments. Domestically, rising consumption is driven by the growing middle-class population and advancements in the retail sector, which is witnessing an expansion of well-organized retail spaces. The e-commerce sector's tremendous growth, fueled by the increased adoption of the Internet and mobile services, has significantly impacted consumer spending.

- Technological innovations have further boosted e-commerce, leading to an online retail boom. This shift in retailing has significantly influenced the global logistics industry.

What are the market trends shaping the Less-Than-Truckload (LTL) Industry?

- Emergence of big data in global less-than-truckload (LTL) market is the upcoming market trend. LTL logistics companies and shippers are leveraging big data to transform voluminous data into a competitive edge. Big data's benefits are evident in service customization, market demand, and agility-driven new business models. However, the European logistics industry faces significant IT disparities, hindering the full implementation of big data analytics. In the logistics sector, big data offers a unique competitive advantage in the following areas: operational efficiency, customer experience, and new business models. Big data optimizes core activities such as resource utilization, delivery time, and geographical coverage.

- By analyzing historical and real-time data, logistics providers can make data-driven decisions, enhance operational efficiency, and improve customer satisfaction. Additionally, big data enables the creation of new business models, such as on-demand and real-time freight matching, leading to increased competitiveness and growth.

What challenges does the Less-Than-Truckload (LTL) Industry face during its growth?

- Rising prices of LTL carriers is a key challenge affecting the industry growth. The market is experiencing significant challenges due to rising costs, increasing demands, and surging e-commerce deliveries. These factors, coupled with a shortage of qualified drivers and tightening truckload capacity, are leading to an increase in LTL prices. LTL carriers are responding by making substantial investments in their trucks, drivers, and facilities to remain competitive. However, they face risks associated with fuel pricing, as fuel expenses represent a major cost and can impact fuel surcharge revenues. Consequently, volatility in fuel prices is a critical concern for LTL carriers, impacting their profitability.

- Another significant challenge for LTL carriers is maintaining profitability while ensuring transparency and improving delivery efficiency during last-mile operations. This requires the implementation of advanced technologies and strategies to optimize routes, streamline processes, and enhance customer experience. Despite these challenges, LTL carriers continue to innovate and adapt to meet the evolving needs of their customers and the market.

Exclusive Customer Landscape

The less-than-truckload (LTL) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the less-than-truckload (LTL) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, less-than-truckload (ltl) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allcargo Logistics Ltd.:- The company offers less-than-truckload services such as less than container load consolidation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ArcBest Corp.

- Averitt Express Inc.

- Challenger Motor Freight Inc.

- CMA CGM Group

- Debon Logistics Co. Ltd.

- Deutsche Post AG

- Estes Express Lines

- FedEx Corp.

- J B Hunt Transport Services Inc.

- JRC Dedicated Services Co.

- Knight Swift Transportation Holdings Inc.

- Kuehne Nagel Management AG

- Nippon Express Holdings Inc.

- Old Dominion Freight Line Inc.

- R L Carriers Inc.

- SouthEastern Freight Lines

- United Parcel Service Inc.

- XPO Inc.

- Yellow Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses the transportation of medium-sized freight shipments, typically ranging from 150 to 20,000 pounds, using road freight services. This segment of the freight transportation industry caters to various industries, including agriculture, retail, industrial, and e-commerce. LTL carriers offer flexibility and affordability to shippers, enabling them to transport smaller volumes without incurring the cost of a full truckload. However, the pricing dynamics in the LTL market differ from those in full truckload shipments. Density-based pricing is a common pricing model in the LTL sector, where freight rates are determined based on the density of the cargo being shipped.

Ground shipping is the most prevalent mode of transportation in the LTL market due to its affordability and efficiency. However, air shipping is an option for time-sensitive and high-value shipments, particularly in the retail and e-commerce sectors. The logistics sector is increasingly leveraging big data and operational efficiency to optimize delivery times and reduce costs. The LTL market is witnessing significant innovation, with startups and logistics companies introducing new technologies and business models to enhance operational efficiency and scalability. For instance, some carriers are offering volume LTL services, which allow shippers to consolidate their smaller shipments into larger volumes to reduce costs.

The LTL market is influenced by various factors, including economic conditions, fuel prices, and oil demand. Fuel surcharges are a common component of LTL freight pricing, with diesel and crude oil prices significantly impacting the overall cost structure. The availability of trailer capacity and rail transport also plays a crucial role in determining freight transport volume. The logistics sector is undergoing a transformation, with a growing focus on cost optimization and supply chain flexibility. Specialized carriers catering to specific industries, such as agriculture and industrial shipping, are gaining popularity due to their expertise and ability to provide tailored solutions.

In the LTL market is a dynamic and evolving sector that caters to the transportation needs of various industries. The pricing dynamics, operational efficiency, and technological innovation are key drivers of growth and competitiveness in this market. The flexibility and affordability offered by LTL carriers make them an attractive option for shippers looking to transport smaller volumes efficiently.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

205 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 110.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

China, US, Japan, Germany, Canada, India, France, South Korea, UK, Italy, Brazil, UAE, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Less-Than-Truckload (LTL) Market Research and Growth Report?

- CAGR of the Less-Than-Truckload (LTL) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the less-than-truckload (LTL) market growth of industry companies

We can help! Our analysts can customize this less-than-truckload (LTL) market research report to meet your requirements.