Real-Time Location Systems (RTLS) Market Size 2025-2029

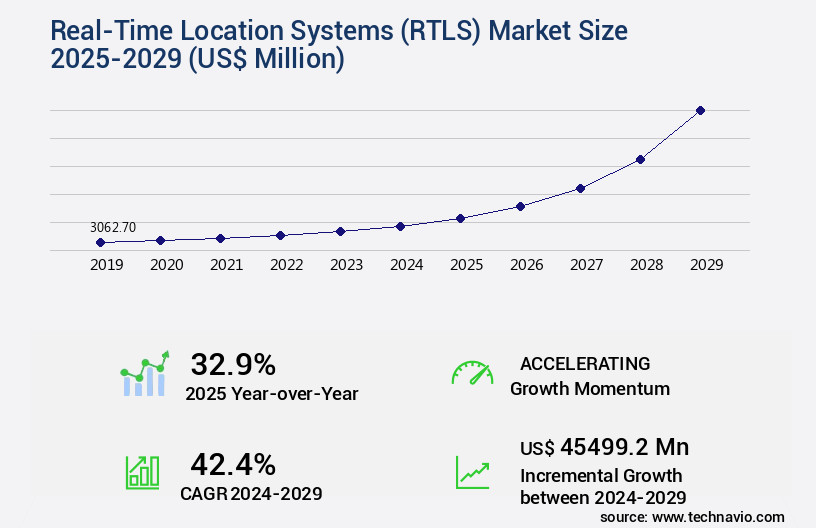

The real-time location systems (rtls) market size is forecast to increase by USD 45.5 billion, at a CAGR of 42.4% between 2024 and 2029. Low cost of RFID tags will drive the real-time location systems (rtls) market.

Major Market Trends & Insights

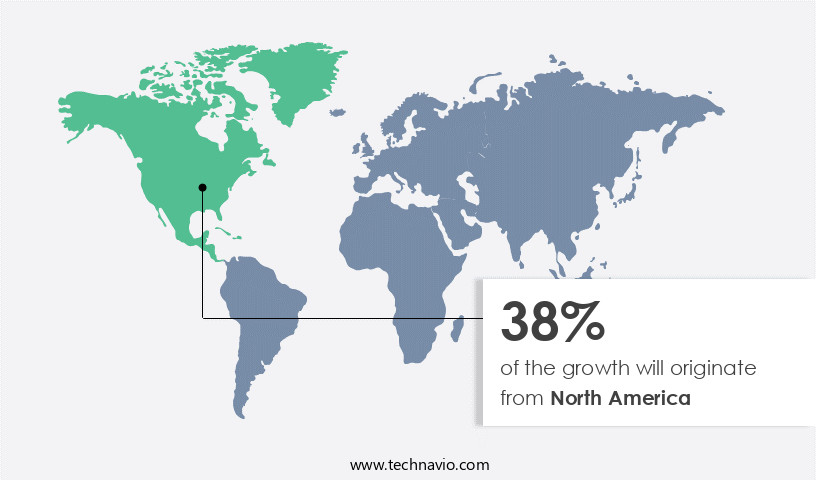

- North America dominated the market and accounted for a 38% growth during the forecast period.

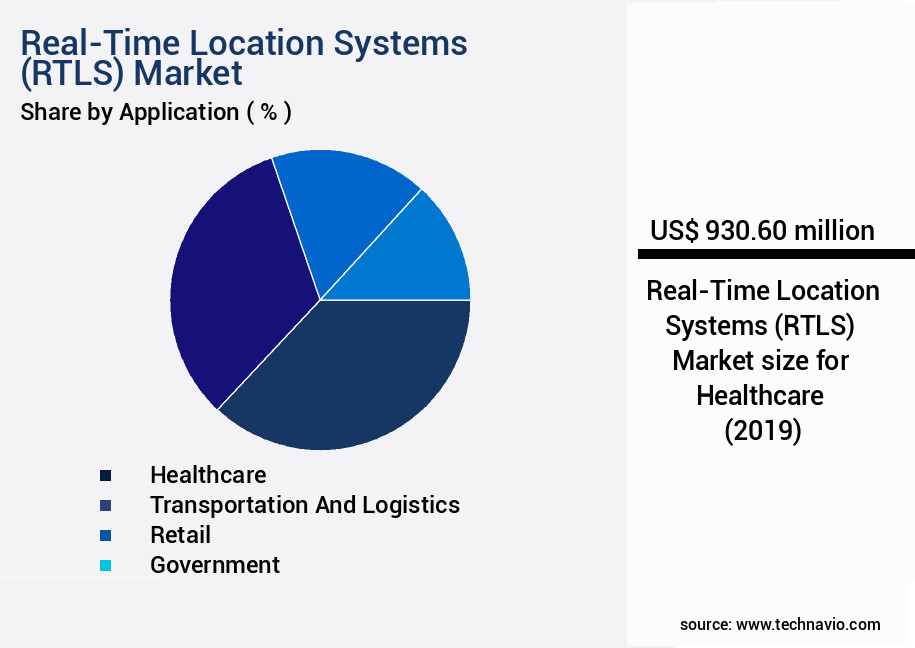

- By Application - Healthcare segment was valued at USD 930.60 billion in 2023

- By Solution - Systems segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 billion

- Market Future Opportunities: USD USD 45.5 billion

- CAGR : 42.4%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and ever-evolving landscape, driven by advancements in core technologies and applications. With the increasing adoption of Ultra-Wideband (UWB) RTLS technology and the decreasing cost of RFID tags, the market is poised for significant growth in the coming years. However, high implementation costs remain a challenge for some organizations. According to recent studies, the global RTLS market is expected to witness a substantial expansion, with RFID technology holding a market share of approximately 60% in 2021.

- As the market continues to unfold, it is essential to stay informed about the latest trends, regulations, and key companies shaping this industry. Related markets such as the Internet of Things (IoT) and Automatic Identification And Data Capture (AIDC) are also worth exploring for further insights.

What will be the Size of the Real-Time Location Systems (RTLS) Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Real-Time Location Systems (RTLS) Market Segmented and what are the key trends of market segmentation?

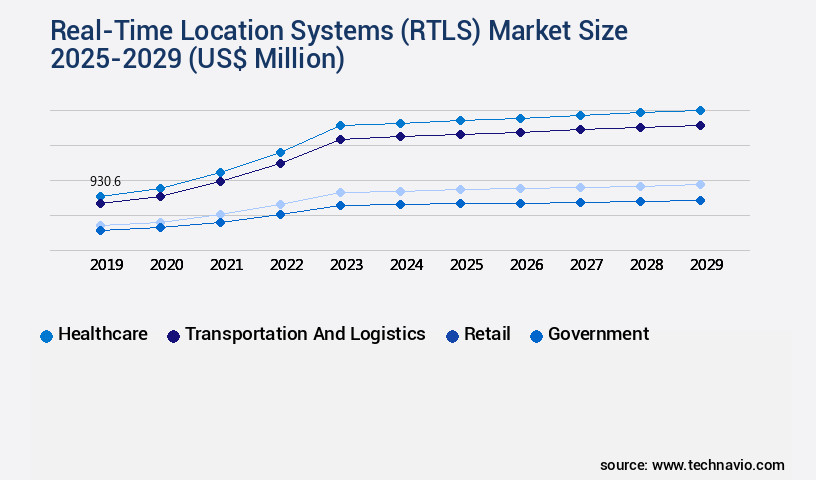

The real-time location systems (rtls) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Healthcare

- Transportation and logistics

- Retail

- Government

- Others

- Solution

- Systems

- Tags

- Technology

- Active RFID

- Passive RFID

- Others

- Management

- Inventory/asset tracking and management

- Access control and security

- Environmental monitoring

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The healthcare segment is estimated to witness significant growth during the forecast period.

The market is witnessing substantial expansion, particularly in the healthcare sector. This growth is attributed to the increasing demand for real-time patient monitoring and asset tracking in hospitals. According to recent reports, the healthcare segment is projected to account for over 40% of the market share. Positioning accuracy metrics, such as angle-of-arrival estimation and time-of-flight measurement, are crucial in ensuring accurate real-time tracking. Edge Computing infrastructure plays a vital role in reducing latency and enhancing the overall performance of RTLS systems. Asset tracking systems employ various technologies like ultra-wideband, Bluetooth Low Energy (BLE), and Radio Frequency Identification (RFID) for locating and managing assets in real-time.

Interoperability standards, such as Data synchronization protocols and Sensor Fusion algorithms, enable seamless integration of different RTLS technologies. Dead reckoning algorithms and Kalman filtering methods are employed for improving the accuracy of location estimation in the absence of direct signals. Power consumption optimization techniques, like particle filtering and Zigbee wireless protocol, are essential for extending the battery life of RTLS devices. Real-time data streaming and location data analytics are integral to the RTLS market, providing valuable insights for businesses across various industries. The market is expected to grow further due to the increasing adoption of cloud-based location platforms and the integration of GPS augmentation techniques, Wi-Fi positioning, and indoor positioning systems.

Network topology optimization and System Integration Services are essential for ensuring scalability and performance. data security protocols are crucial in safeguarding the sensitive information transmitted through RTLS systems. Latency performance analysis is an ongoing concern, with ongoing efforts to minimize latency and ensure real-time data processing. The RTLS market is continuously evolving, with new technologies and applications emerging regularly.

The Healthcare segment was valued at USD 930.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Real-Time Location Systems (RTLS) Market Demand is Rising in North America Request Free Sample

The RTLS market in North America is experiencing growth, with the US leading the charge due to the widespread adoption of RFID tags and solutions. Transportation and logistics, hospitals, enterprises, retailers, and automobile companies are among the major industries investing in RTLS to optimize operations. Zebra Technologies and Stanley Healthcare are significant providers in this region. RTLS solutions are increasingly being used to track assets, with Mexico and Canada being key markets. According to recent data, over 50% of North American businesses have adopted RTLS, and this number is projected to rise.

Additionally, the use of RTLS in healthcare settings has seen a 30% increase in patient safety and a 25% reduction in operational costs. The retail sector is also experiencing a 15% boost in sales due to the implementation of RTLS.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The RTLS market is evolving with technologies such as ultra-wideband real-time location accuracy reaching <10 cm precision, outperforming Wi-Fi positioning that often has 2–5 m errors. Zigbee network topology optimization strategies and Bluetooth low energy (BLE) battery life extension techniques now enable 30–40% longer device runtime, while infrared tracking calibration methods and RFID antenna design improve indoor navigation. Advanced sensor fusion algorithms combined with Kalman filtering and particle filtering analysis enhance accuracy by 20–25% in complex environments. Challenges remain in asset tracking integration, time-of-flight measurement errors, and trilateration limitations, but angle-of-arrival optimization and dead reckoning compensation strengthen reliability. With robust data synchronization protocol reliability and real-time engine processing pipelines, RTLS delivers scalable, high-precision solutions for healthcare, logistics, and industrial IoT.

What are the key market drivers leading to the rise in the adoption of Real-Time Location Systems (RTLS) Industry?

- The significant reduction in the cost of RFID tags serves as the primary catalyst for the market's growth.

- RFID technology, represented by tags and readers, has become a crucial component in various industries, including logistics, automotive, construction, mining, oil and gas, retail, healthcare, sports, and education. These sectors leverage RFID for enhancing operational efficiency through asset tracking and workforce management. The widespread adoption of RFID technology has led to a decrease in tag prices, with passive RFID tags costing approximately USD1.5 USD per tag.

- Active RFID tags, which offer advanced features and functionality, are priced between USD0.10 and USD20, depending on their capabilities. The continuous evolution of RFID technology and increasing competition within the industry contribute to the ongoing affordability of these tags.

What are the market trends shaping the Real-Time Location Systems (RTLS) Industry?

- The adoption of Ultra-Wideband Real-Time Location System (RTLS) technology is becoming increasingly mandatory in various industries. This emerging market trend is set to revolutionize location-based services and asset tracking.

- UWB real-time location systems (RTLS), comprised of tags, sensors, timing cables or wireless bridges, a location engine, and software applications, deliver high-accuracy positioning over short-to-medium distances at a lower cost compared to other RTLS technologies. UWB's potential in short-range and low-data-rate communications makes it an attractive solution for various applications, including communication and sensors, positioning and tracking, and radar. With a high data rate reaching 100 Mbps, UWB is an effective choice for near-field data transmission. UWB real-time location systems have gained significant attention due to their ability to provide accurate results in high-ranging applications. In the realm of communication and sensors, UWB RTLS ensures reliable and efficient data transmission.

- For positioning and tracking, it offers precise location information, making it suitable for Asset Management and personnel tracking. In radar applications, UWB RTLS can provide high-resolution imaging and detection capabilities. The benefits of UWB real-time location systems extend beyond their technical merits. They offer flexibility, as they can be used in various industries, such as healthcare, logistics, and manufacturing. Additionally, UWB RTLS is known for its low power consumption, making it an eco-friendly solution. In conclusion, UWB real-time location systems represent a valuable investment for businesses seeking accurate, cost-effective, and flexible location tracking and data transmission solutions. Their potential applications span across industries, and their eco-friendly nature adds to their appeal.

What challenges does the Real-Time Location Systems (RTLS) Industry face during its growth?

- The high implementation costs represent a significant challenge impeding the growth of the industry.

- Real-time location systems (RTLS) have gained significant traction in various industries due to their ability to enhance operational efficiency and accuracy. According to recent market research, the global RTLS market is projected to grow at a steady pace, with a compound annual growth rate (CAGR) of around 20%. This growth is driven by the increasing demand for real-time tracking and monitoring in sectors like healthcare, manufacturing, and logistics. The implementation of RTLS comes with substantial investment, including planning and design, cabling, software licenses, and location hardware costs. A large-scale deployment in a manufacturing company can range from USD10 million to USD30 million.

- Despite the high initial investment, industries are adopting RTLS to address challenges related to inventory management, asset tracking, and workforce optimization. In the healthcare sector, RTLS is utilized for tracking medical equipment, supplies, and patients, leading to improved patient care and reduced operational costs. The market for RTLS in healthcare is expected to reach USD12.3 billion by 2025, growing at a CAGR of 18.3% during the forecast period. Manufacturing industries leverage RTLS for optimizing production lines, reducing downtime, and improving safety. The global RTLS market in manufacturing is projected to reach USD55.2 billion by 2026, growing at a CAGR of 21.3% during the forecast period.

- In conclusion, the adoption of real-time location systems (RTLS) continues to grow across various industries due to their operational benefits. While the initial investment can be substantial, the long-term value in terms of efficiency, accuracy, and cost savings makes RTLS an attractive investment for businesses.

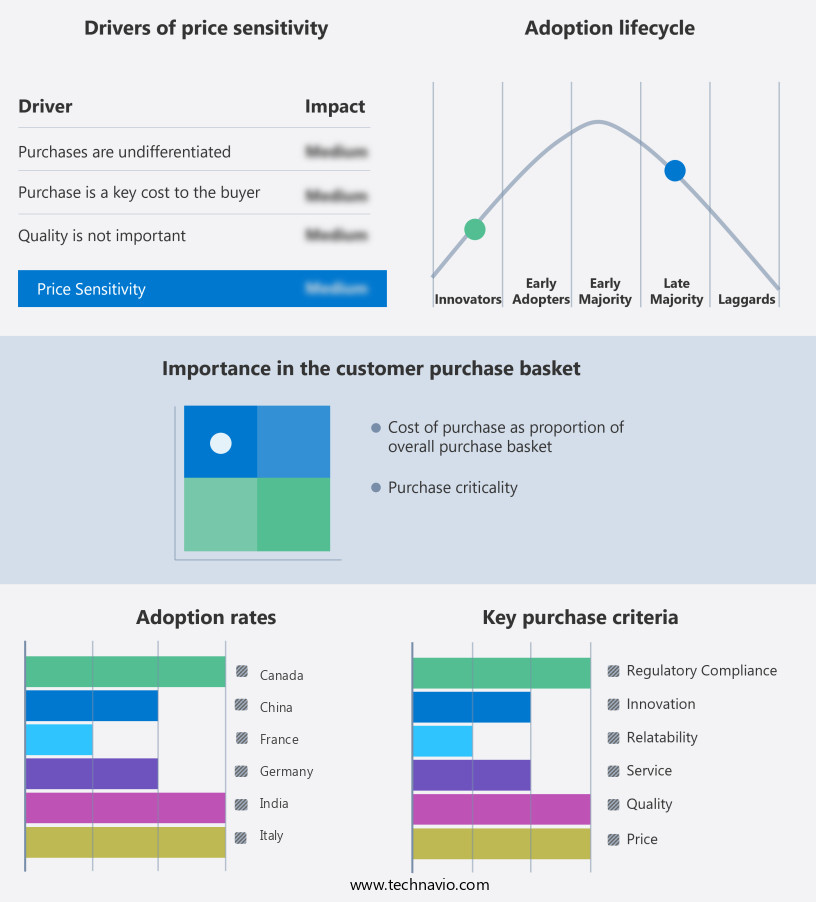

Exclusive Customer Landscape

The real-time location systems (rtls) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the real-time location systems (rtls) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Real-Time Location Systems (RTLS) Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, real-time location systems (rtls) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AiRISTA Flow Inc. - This company provides advanced real-time location solutions for asset tracking, personnel safety, and condition monitoring, enhancing operational efficiency and risk management. Their innovative technology offers real-time visibility and actionable insights.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AiRISTA Flow Inc.

- Alien Technology LLC

- General Electric Co.

- Halma Plc

- Identec Group AG

- Impinj Inc.

- Inpixon

- Leantegra Inc.

- Litum Technologies Inc.

- Mojix Inc.

- Oracle Corp.

- Qorvo Inc.

- Savi Technology Inc.

- Securitas AB

- Silicon Laboratories Inc.

- Sonitor Technologies AS

- TeleTracking Technologies Inc.

- Tracktio Group SL

- Ubisense Ltd.

- Zebra Technologies Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Real-Time Location Systems (RTLS) Market

- In January 2024, leading RTLS provider, BlueSense Networks, announced the launch of its new Bluetooth Low Energy (BLE) RTLS solution, expanding its product portfolio to cater to the growing demand for cost-effective and energy-efficient location tracking systems (BlueSense Networks Press Release).

- In March 2024, tech giants Microsoft and Honeywell International formed a strategic partnership to integrate Microsoft's Azure IoT and Honeywell's Forge platform, enabling real-time location tracking and asset management for industrial applications (Microsoft News Center).

- In April 2025, Israeli-based startup, Locatify, secured a USD15 million Series B funding round, led by Sequoia Capital, to accelerate the development and deployment of its RTLS technology for supply chain and logistics industries (Globes [Israel Business Daily]).

- In May 2025, the European Union passed the new Medical Devices Regulation (MDR), which includes provisions for RTLS systems used in healthcare applications, paving the way for increased adoption and investment in this sector (European Commission).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Real-Time Location Systems (RTLS) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

245 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42.4% |

|

Market growth 2025-2029 |

USD 45499.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

32.9 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, France, India, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- Real-time location systems (RTLS) continue to evolve, shaping the landscape of asset tracking and positioning accuracy. Edge computing infrastructure plays a pivotal role in enhancing the performance of these systems, enabling real-time data processing and analysis. Interoperability standards are another critical factor, ensuring seamless integration between various RTLS technologies. Positioning accuracy metrics, such as angle-of-arrival estimation and time-of-flight measurement, are continually improving, providing more precise location information. Ultra-wideband technology and trilateration positioning offer significant advancements, delivering centimeter-level accuracy. Meanwhile, Bluetooth Low Energy (BLE) and Wi-Fi positioning are gaining popularity due to their wide adoption and scalability. Data synchronization protocols and sensor fusion algorithms are essential components of advanced RTLS solutions.

- They optimize network topology, minimize latency, and ensure real-time data streaming. Data security protocols are another priority, safeguarding sensitive location data and maintaining privacy. Indoor positioning systems, such as those based on infrared tracking systems and particle filtering techniques, are increasingly adopted for precise location determination indoors. Real-time location engines and cloud-based location platforms offer flexibility and scalability, enabling businesses to manage and analyze location data effectively. Moreover, the integration of GPS augmentation techniques, such as dead reckoning algorithms and Kalman filtering methods, enhances the overall performance of RTLS. The Zigbee wireless protocol and power consumption optimization further contribute to the efficiency and reliability of these systems.

- In summary, the RTLS market is characterized by continuous innovation, with advancements in edge computing infrastructure, positioning accuracy metrics, data synchronization protocols, and data security. These developments enable businesses to optimize their operations, improve asset tracking, and gain valuable insights from location data.

What are the Key Data Covered in this Real-Time Location Systems (RTLS) Market Research and Growth Report?

-

What is the expected growth of the Real-Time Location Systems (RTLS) Market between 2025 and 2029?

-

USD 45.5 billion, at a CAGR of 42.4%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Healthcare, Transportation and logistics, Retail, Government, and Others), Solution (Systems and Tags), Technology (Active RFID, Passive RFID, and Others), Management (Inventory/asset tracking and management, Access control and security, Environmental monitoring, and Others), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Low cost of RFID tags, High implementation costs

-

-

Who are the major players in the Real-Time Location Systems (RTLS) Market?

-

Key Companies AiRISTA Flow Inc., Alien Technology LLC, General Electric Co., Halma Plc, Identec Group AG, Impinj Inc., Inpixon, Leantegra Inc., Litum Technologies Inc., Mojix Inc., Oracle Corp., Qorvo Inc., Savi Technology Inc., Securitas AB, Silicon Laboratories Inc., Sonitor Technologies AS, TeleTracking Technologies Inc., Tracktio Group SL, Ubisense Ltd., and Zebra Technologies Corp.

-

Market Research Insights

- The Real-Time Location Systems (RTLS) market is advancing with tagging and identification, positioning accuracy of 10–30 cm indoors (vs. >1 m in older models), and robust sensor network design. Using localization algorithms, data processing pipelines, and integration APIs, industries like healthcare and logistics achieve 20–25% efficiency gains. Predictive analytics, data visualization tools, and battery life extension improve reliability, while system monitoring tools and maintenance support cut downtime by 15% annually. To meet compliance regulations, vendors optimize system architecture design, enhance security and privacy, and use deployment cost analysis with algorithm tuning to maximize ROI and scalability

We can help! Our analysts can customize this real-time location systems (rtls) market research report to meet your requirements.