Liquid Fertilizer Market Size 2024-2028

The liquid fertilizer market size is forecast to increase by USD 2.35 billion at a CAGR of 3.57% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for nutrient-rich fertilizers that address issues of soil erosion and soil pollution. Nitrogen-based fertilizers, particularly those containing NPK (Nitrogen, Phosphorus, and Potassium), remain popular choices for farmers. However, concerns over water pollution from phosphates and nitrates, as well as the presence of heavy metals in fertilizers, have led to stricter regulations on their handling, storage, and transportation. To meet these regulations, there is a growing trend towards high-efficiency fertilizers that minimize nutrient runoff and reduce the risk of eutrophication and soil contamination. This report provides a comprehensive analysis of market trends, growth drivers, and challenges in the liquid fertilizer industry.

What will be the Size of the Market During the Forecast Period?

- The market has witnessed significant growth due to the increasing demand for high-value crops, such as fruits and vegetables, and the need to address micronutrient deficiencies in various crops. Liquid fertilizers offer several advantages over traditional solid fertilizers, including faster absorption by plant foliage and better compatibility with irrigation systems, including sprinklers. Farmers in the US have been turning to liquid fertilizers to improve the quality of their crops and ensure optimal yields. Fruit crops, such as tomatoes, potatoes, onions, cabbage, and cauliflower, particularly benefit from the use of liquid fertilizers, as they enable farmers to address specific nutrient deficiencies and provide a more consistent nutrient supply to the plants.

- However, the adoption of liquid fertilizers is not without challenges. Concerns regarding potential toxicity and environmental pollution have arisen due to the use of certain liquid fertilizers. Therefore, it is essential for farmers to choose liquid fertilizers that have been tested for safety and are free from harmful contaminants. The market in the US is expected to continue growing. The growth of the market can be attributed to the increasing demand for high-quality fruits and vegetables, the need to address micronutrient deficiencies, and the compatibility of liquid fertilizers with modern irrigation systems.

How is this market segmented and which is the largest segment?

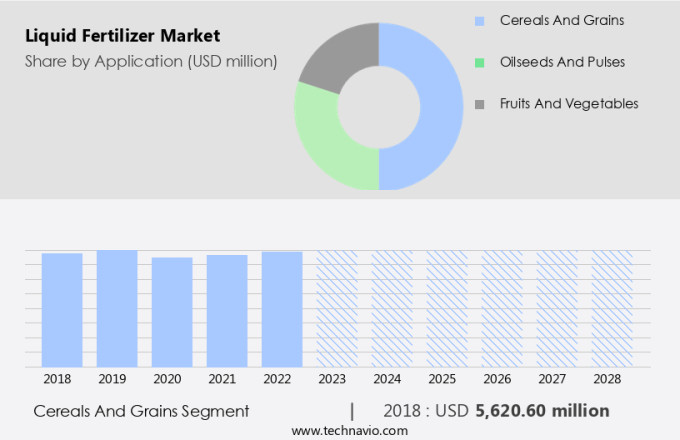

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Cereals and grains

- Oilseeds and pulses

- Fruits and vegetables

- Type

- Nitrogen

- Phosphate

- Potassium

- Micronutrients

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- France

- South America

- Middle East and Africa

- APAC

By Application Insights

- The cereals and grains segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the large-scale cultivation of cereals and grains, which accounted for the largest application segment in 2023. According to the Organization for Economic Co-operation and Development (OECD), the production of cereals is projected to increase by approximately 336 million tons over the next decade, with significant contributions from major grain-producing nations like India, Russia, and Ukraine for wheat, and the US, China, and Brazil for maize. This expansion in agricultural production is crucial to meet the growing demand for food, particularly in light of the anticipated population growth. However, the use of liquid fertilizers also raises concerns regarding environmental pollution.

Get a glance at the market report of share of various segments Request Free Sample

The cereals and grains segment was valued at USD 5.62 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region, home to over half of the world's population, is witnessing significant population growth and shifting food preferences, leading to an increased demand for high-yield crops, particularly in India and China. By 2050, APAC's population is projected to reach 5.3 billion, up from approximately 4.6 billion in 2021. This demographic shift is driving the need for advanced agricultural practices, including the use of liquid fertilizers to produce protein-rich crops such as potato, onion, cabbage, and cauliflower. Irrigation systems, including sprinklers and micro-irrigation systems, are essential tools in this regard. The cost of application for these fertilizers is a crucial consideration for farmers, making market competition intense. Major players in The market include suppliers from North America and Europe, who are expanding their presence in APAC to cater to the burgeoning demand.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Liquid Fertilizer Market?

Increasing demand for nitrogen-based fertilizers is the key driver of the market.

- Liquid fertilizers, derived from nitrogenous sources, are essential for plant growth as atmospheric nitrogen is not readily accessible to them. Nitrogen is a primary nutrient, well-known for enhancing the green coloration of lawns. The agricultural sector's expansion worldwide will fuel the demand for nitrogen-based liquid fertilizers. In India, for instance, agriculture accounted for nearly 20% of the country's GDP in 2020-2021, highlighting the sector's significance.

- Moreover, the market is poised for growth due to the increasing agricultural activities and the resulting demand for nitrogenous fertilizers. These fertilizers are easily soluble in water, making them a popular choice for seedlings and mature plants alike. The human population's continuous increase and the subsequent need for food production further underline the importance of nitrogen-based liquid fertilizers in agriculture.

What are the market trends shaping the Liquid Fertilizer Market?

Increasing demand for high-efficiency fertilizers is the upcoming trend in the market.

- The global population is projected to reach approximately 9.7 billion by the year 2050, leading to a significant increase in the demand for food production. Agriculture remains the primary livelihood for over 60% of the world's population, yet current production levels may not be sufficient to meet this growing demand.

- Moreover, in response, farmers are turning to advanced agricultural solutions, including the adoption of liquid fertilizers. These fertilizers offer improved production yields and contribute to more efficient, eco-friendly, and sustainable farming practices. Notable industry players such as Yara and K+S are investing in technological advancements to increase feedstock availability and meet the demands of the expanding population.

What challenges does Liquid Fertilizer Market face during the growth?

Stringent regulations on handling, storage, and transportation of liquid fertilizers is a key challenge affecting the market growth.

- Liquid fertilizers, a crucial component of modern agriculture, offer essential nutrients for soil growth. However, their handling and disposal can pose significant risks. Spills from conveyor belts or containers must be addressed promptly to prevent contamination of soil, water, and air. Improper disposal of non-compliant fertilizers can lead to health and environmental hazards, including soil erosion, soil pollution, water pollution, and eutrophication. Nitrogen and phosphorus-containing fertilizers, such as NPK, can contribute to heavy metal accumulation and eutrophication if not managed responsibly. Ammonium nitrate, a common liquid fertilizer, poses additional challenges due to its potential for decomposition during transport and storage, leading to the release of toxic gases and hazardous situations.

- Furthermore, regulations governing the transport, storage, and handling of liquid fertilizers, particularly ammonium nitrate, are stringent to mitigate these risks. Failure to adhere to these guidelines can result in severe consequences for both human health and the environment. Proper disposal methods, such as dissolving or making the contaminated product inert, are essential to minimize these risks.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AgroLiquid

- Agrotiger Philippines Corp.

- EuroChem Group AG

- Grupa Azoty SA

- Haifa Negev technologies Ltd.

- Indian Farmers Fertiliser Cooperative Ltd.

- Israel Chemicals Ltd.

- KS Aktiengesellschaft

- Kugler Co.

- Nutri Tech Solutions Pty Ltd.

- Nutrien Ltd.

- OCP Group

- Plant Food Co. Inc.

- Plant Fuel Nutrients LLC

- Polski Koncern Naftowy ORLEN SA

- RLF AgTech

- SQM S.A.

- Tessenderlo Group NV

- Twin State Inc.

- Yara International ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Liquid fertilizers have gained significant traction in the global agricultural sector due to their ease of application and uniform distribution. These fertilizers, which contain nitrogenous compounds like UAN (Urea Ammonium Nitrate), micronutrients, and other essential nutrients, cater to various crops, including turf & ornamental, field crops, and horticultural crops. Farmers increasingly prefer these fertilizers for high-value crops like fruits and vegetables, such as tomato, potato, onion, cabbage, and cauliflower. The quality of fruits and vegetables significantly depends on the nutrient content of the soil. Micronutrient deficiency and soil acidity can negatively impact plant growth. Liquid fertilizers offer an absorbable form of nutrients, ensuring optimal plant foliage health.

However, their acidic nature and potential leaching losses pose challenges. Irrigation systems, including sprinklers and micro-irrigation systems, facilitate the application of liquid fertilizers. Despite their benefits, the use of liquid fertilizers comes with concerns regarding toxicity and environmental pollution. Soil erosion, soil pollution, water pollution, and eutrophication are potential risks associated with their excessive use. Heavy metals and phosphates in fertilizers can contribute to soil and water pollution. Nitrogenous compounds, such as nitrates, can lead to eutrophication in water bodies. The consumption of liquid fertilizers, measured in metric tons, is worth billions, reflecting their importance in agriculture. The human population's increasing demand for food, urbanization, and agriculture expansion drive the market's growth. Despite these challenges, liquid fertilizers remain an indispensable tool for farmers, ensuring the productivity and quality of their crops.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.57% |

|

Market growth 2024-2028 |

USD 2.35 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.29 |

|

Key countries |

China, US, India, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch