Alpha Methylstyrene Market Size 2024-2028

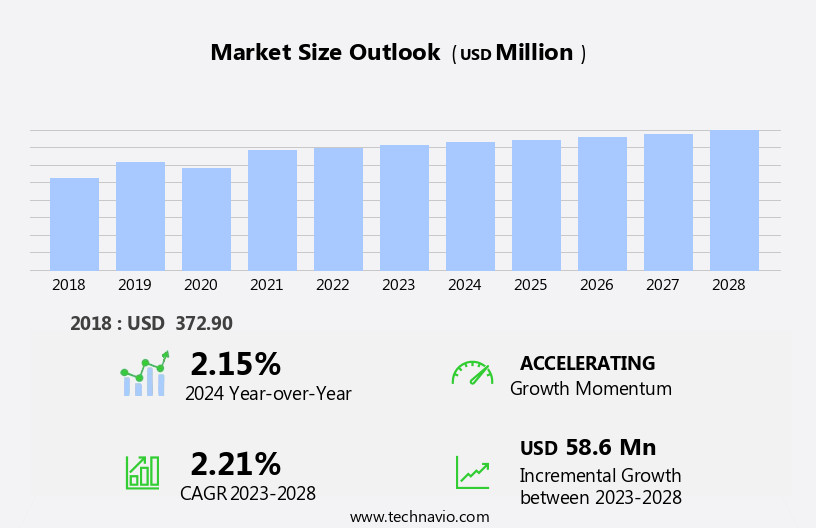

The alpha methylstyrene market size is forecast to increase by USD 58.6 million at a CAGR of 2.21% between 2023 and 2028.

- The alpha methylstyrene market is experiencing growth, largely driven by the increasing demand for acrylonitrile butadiene styrene (ABS) from China. As a key component in the production of ABS, alpha methylstyrene is benefiting from the expanding automotive, electronics, and consumer goods industries in the region.

- However, a significant challenge to the market is the rising demand for biopolymers, which are seen as more sustainable alternatives to traditional plastics. The shift toward biopolymers presents competition to petrochemical-based products like alpha methylstyrene, potentially limiting growth opportunities. Addressing this challenge while capitalizing on the demand from China will be essential for the market's continued development.

What will be the Size of the Alpha Methylstyrene Market During the Forecast Period?

- The Alpha Methylstyrene (AMS) market encompasses the production, sale, and utilization of this inorganic compound, which is a colorless liquid with an aromatic odor. AMS is a crucial ingredient In the manufacturing of various products, including Abs resins, durable waxes, heat-resistant adhesives, and para-cumylphenol. The electronics segment is a significant consumer of AMS, utilizing it In the production of electronic appliances and consumer goods. Additionally, AMS finds applications In the automotive industry for producing lightweight ABS thermoplastic parts. In the plastics industry, AMS acts as a heat stabilizer, solvent, and pigment in industrial adhesives and coatings, as well as in the production of isopropenyl benzene.

- The market dynamics are influenced by factors such as the demand for weight reduction in automotive parts and the need for hazardous waste release reduction. The AMS market also caters to various industries, including metal, consumer durables, and paint, where it serves as an essential raw material.

How is this Alpha Methylstyrene Industry segmented and which is the largest segment?

The alpha methylstyrene industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Assay Above 99 percent

- Assay Up To 99 percent

- End-user

- Automobile

- Electronics

- Plastics

- Chemicals

- Others

- Geography

- APAC

- China

- India

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

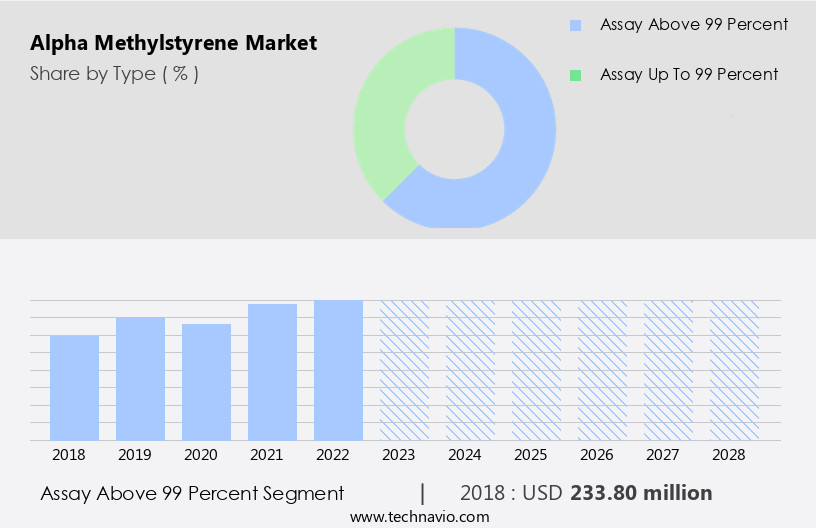

- The assay above 99 percent segment is estimated to witness significant growth during the forecast period.

Alpha Methylstyrene (AMS), a colorless liquid organic chemical with an aromatic odor, holds significant importance in various industries due to its heat-resistant properties. The largest revenue share In the AMS market is attributed to the segment above 99% purity level. This segment is extensively utilized in end-use industries, including paints and coatings, plastics, and adhesives. The increasing industrialization and urbanization in emerging economies, such as China and India, fuel the demand for AMS. The automotive sector, particularly In these markets, has experienced significant growth, leading to increased demand for AMS In the production of durable waxes, heat-resistant adhesives, and automotive parts.

Additionally, AMS is employed as a co-monomer In the manufacture of ABS thermoplastic, which is used in dashboard components, seat backs, seat belt components, handles, door liners, pillar trim, and instrument panels. Electric vehicles (EVs), battery electric vehicle (BEV), and plug-in hybrid vehicle (PHEV) markets also contribute to the demand for AMS In the tire industry and plastic products. In chemical processing, AMS is used as a feedstock in polymerization processes and as a solvent. It is also used as a pigment in paints and a paint adhesive agent in consumer durables. The AMS market is expected to grow due to its applications In the electronics segment, including as a heat stabilizer and In the production of Para-Cumylphenol used in adhesives and coatings, waxes, and resins and additives.

Get a glance at the Alpha Methylstyrene Industry report of share of various segments Request Free Sample

The Assay Above 99 percent segment was valued at USD 233.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

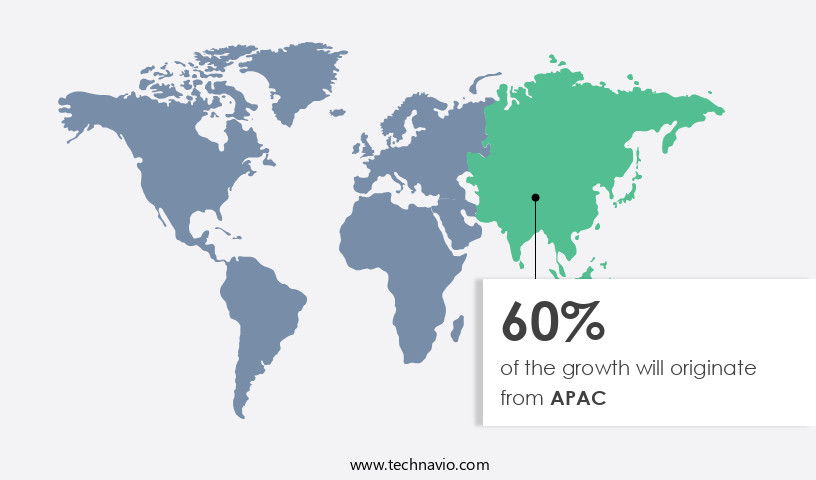

- APAC is estimated to contribute 60% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Alpha Methylstyrene (AMS), an organic compound with a aromatic odor, is a significant player In the global chemical industry. In 2023, the Asia Pacific (APAC) region accounted for the largest market share in AMS consumption, driven by the expanding automotive, chemicals, and electronics sectors. The automotive industry's demand for heat-resistant materials in dashboard components, seat backs, seat belt components, handles, door liners, pillar trim, and instrument panels is a major driver for AMS consumption in APAC. China, India, Indonesia, Vietnam, and Thailand are key markets for automotive production and are expected to continue leading in this segment. Additionally, the electronics industry's requirement for heat stabilizers, solvents, pigments, and paint adhesive agents in electronic appliances also fuels the demand for AMS in APAC.

The chemicals market, including the production of ABS thermoplastics, coatings, adhesives, and tire industry, also contributes to the growth of the AMS market. AMS is used as a co-monomer In the polymerization process for manufacturing ABS, which is widely used in various industries. Furthermore, AMS is employed as a plastic additive In the production of durable waxes, heat-resistant adhesives, and metal coatings. Despite its benefits, AMS production involves potential hazardous waste release, necessitating waste management solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Alpha Methylstyrene Industry?

Growing adoption of AMS in manufacturing of ABS is the key driver of the market.

- Alpha-methylstyrene (AMS), an organic chemical with the molecular formula C9H10, is a significant co-monomer in polymerization processes, contributing to the production of heat-resistant and impact-resistant materials. AMS is extensively used in the manufacture of acrylonitrile-butadiene-styrene (ABS) thermoplastic resins, which are integral to various industries, including automotive, consumer electronics, and tire. In the automotive sector, AMS-based ABS resins are employed in the production of durable components such as dashboard components, seat backs, seat belt components, handles, door liners, pillar trim, and instrument panels. In the electronics segment, AMS enhances the thermal stability of plastics, contributing to the production of heat-resistant adhesives and coatings for electronic appliances and BEVs, HEVs, and EV volumes.

- Additionally, AMS is used In the chemical processing industry to produce para-cumylphenol, a specialized intermediate In thermoplastics and polycarbonate resins. The versatility of AMS in various applications, including consumer goods and waste management solutions, further boosts its market potential. Isopropenyl benzene, a related compound, is also used as a feedstock in the production of AMS. Overall, the market for alpha-methylstyrene is expected to grow significantly due to its wide applications in various industries.

What are the market trends shaping the Alpha Methylstyrene Industry?

Increasing demand for ABS from China is the upcoming market trend.

- Alpha Methylstyrene (AMS), a colorless liquid organic chemical, is a valuable co-monomer used In the production of ABS thermoplastic resins. ABS resins are widely utilized in various industries, including electronics, automotive, and tire manufacturing. In the electronics segment, AMS is employed In the manufacture of heat-resistant adhesives, coatings, and plastic additives for electronic appliances. In the automotive industry, AMS is used In the production of durable waxes, heat-resistant adhesives, and various automotive parts such as dashboard components, seat backs, seat belt components, handles, door liners, pillar trim, and instrument panels. The chemical processing industry also utilizes AMS as a feedstock In the production of Para-Cumylphenol, Adhesives and Coatings, Waxes, Resins and additives.

- AMS is also used in the tire industry for tire manufacturing, where it enhances the heat resistance and durability of the tires. The increasing demand for electric vehicles (EVs), battery electric vehicles (BEVs), and plug-in hybrid electric vehicles (PHEVs) is expected to boost the demand for AMS In the plastics industry. AMS is used as a co-monomer In the polymerization processes for producing ABS, which is used in various automotive and consumer goods applications. Despite its benefits, the production and use of AMS involve hazardous waste release, which requires effective waste management solutions. Impurities in AMS, such as Isopropenyl benzene, can negatively impact its thermal stability and require the use of heat stabilizers as additives.

- In the chemical market, AMS is an essential organic chemical used In the production of various plastics and chemicals, including acetone, petroleum resins, and other inorganic compounds. Its aromatic odor is also used as a pigment in paints and as a paint adhesive agent in consumer durables and automobiles. Alpha Methylstyrene is a versatile organic chemical used in various industries, including electronics, automotive, tire manufacturing, and chemical processing. Its unique properties, such as heat resistance and durability, make it an essential co-monomer In the production of ABS resins, which are used in a wide range of applications.

- However, the production and use of AMS require effective waste management solutions and the careful handling of impurities to ensure optimal performance and safety.

What challenges does the Alpha Methylstyrene Industry face during its growth?

Increasing demand for biopolymers is a key challenge affecting the industry growth.

- Alpha Methylstyrene (AMS), a colorless liquid organic chemical with an aromatic odor, is a co-monomer used In the manufacture of various plastic products, including ABS resins. ABS thermoplastic is widely used In the automotive industry for producing durable and heat-resistant parts such as dashboard components, seat backs, seat belt components, handles, door liners, pillar trim, and instrument panels. In the electronics segment, AMS is employed in heat-resistant adhesives and coatings. The chemical processing industry uses AMS as a feedstock In the production of chemicals like Para-Cumylphenol, which is used in adhesives and coatings. The tire industry also utilizes AMS In the production of rubber.

- However, the release of hazardous waste during the production and disposal of AMS poses environmental concerns. The global AMS market is driven by the increasing demand from the plastics industry, particularly In the production of electronic appliances and consumer durables. The automotive industry's demand for lightweight and heat-resistant materials is also a significant factor. However, the growing trend towards the use of biodegradable and renewable polymers, such as polylactic acid and polyhydroxyalkanoates, may negatively impact the market growth during the forecast period. Isopropenyl benzene, an impurity in AMS, affects its thermal stability and requires the use of heat stabilizers.

- AMS is also used as a solvent in various applications, including In the production of acetone and petroleum resins. The chemical is produced through polymerization processes, and its production involves the use of inorganic compounds like cumene and phenol. In conclusion, Alpha Methylstyrene is a versatile chemical used in various industries, including plastics, electronics, and chemical processing. Its demand is driven by the increasing use In the production of ABS resins and other plastic products. However, environmental concerns and the growing trend towards renewable polymers may pose challenges to the market growth during the forecast period.

Exclusive Customer Landscape

The alpha methylstyrene market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the alpha methylstyrene market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, alpha methylstyrene market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2M Holdings Ltd.

- AdvanSix Inc.

- ALTIVIA

- AO GC Titan

- Compania Espanola de Petroleos SA

- Domo Chemicals GmbH

- Eni SpA

- INEOS AG

- Kumho Petrochemical Co. Ltd.

- LG Chem Ltd.

- Merck KGaA

- Mitsubishi Chemical Group Corp.

- Mitsui Chemicals Inc.

- Parsol chemicals Ltd.

- Rosneft Oil Co.

- SEQENS GROUP

- SI Group Inc.

- Solvay SA

- The Plaza Group

- Yangzhou Lida Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Alpha-methyl styrene, an organic chemical with the molecular formula C9H10, is a colorless liquid used as a co-monomer In the production of various polymers. This inorganic compound is derived from the chemical processing of other organic compounds, such as cumene and phenol, through polymerization processes. The market for alpha-methyl styrene is diverse and expansive, with applications spanning various industries. One significant sector is the plastics industry, where it is used In the manufacture of ABS thermoplastics. ABS thermoplastics are known for their heat-resistance and durability, making them suitable for use in a range of applications, including electronics, automotive parts, and consumer goods.

In the electronics segment, alpha-methyl styrene is used in the production of heat-resistant adhesives and coatings. These materials are essential In the manufacturing of electronic appliances and components, where high temperatures are common. The chemical's heat stability and resistance to thermal degradation make it an ideal choice for these applications. The automotive industry is another major consumer of alpha-methyl styrene. The chemical is used In the production of various automotive parts, including dashboard components, seat backs, seat belt components, handles, door liners, and pillar trim. The use of ABS thermoplastics In these applications helps to reduce weight, leading to improved fuel efficiency and reduced emissions.

The tire industry is another significant market for alpha-methyl styrene. The chemical is used as a feedstock In the production of rubber, which is then used In the manufacturing of tires. The use of alpha-methyl styrene in tire production helps to improve the tires' heat resistance and durability, leading to longer tire life and improved safety. The use of alpha-methyl styrene In the production of plastics and rubber is not without its challenges. The chemical is known to release hazardous waste during its production and disposal. As a result, there is a growing demand for waste management solutions to mitigate the environmental impact of alpha-methyl styrene production.

Alpha-methyl styrene is also used as a solvent and a pigment in the production of paints and coatings. In this application, it acts as a paint adhesive agent, improving the bonding of paint to various surfaces. The chemical's aromatic odor, which is reminiscent of that of cumene and phenol, is often used as a marker for the presence of alpha-methyl styrene in various products. Despite its widespread use, the production of alpha-methyl styrene is not without its challenges. Impurities In the feedstock used in its production can lead to reduced product quality and increased production costs. As a result, there is a growing demand for advanced purification technologies to ensure the production of high-quality alpha-methyl styrene.

In conclusion, alpha-methyl styrene is a versatile organic chemical with a wide range of applications in various industries, including plastics, electronics, automotive, and tire production. Its unique properties, such as heat resistance and durability, make it an essential component In the production of various products. However, the challenges associated with its production, such as the release of hazardous waste and the presence of impurities in the feedstock, require ongoing research and innovation to ensure the sustainable and efficient production of this important chemical.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.21% |

|

Market growth 2024-2028 |

USD 58.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.15 |

|

Key countries |

China, Germany, India, US, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Alpha Methylstyrene Market Research and Growth Report?

- CAGR of the Alpha Methylstyrene industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the alpha methylstyrene market growth of industry companies

We can help! Our analysts can customize this alpha methylstyrene market research report to meet your requirements.