Luxury Car Ambient Lighting System Market Size 2024-2028

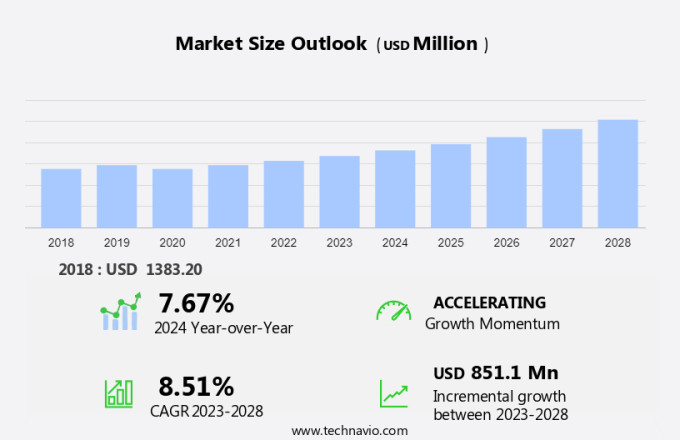

The luxury car ambient lighting system market size is forecast to increase by USD 851.1 million at a CAGR of 8.51% between 2023 and 2028.

- The market is experiencing steady growth, driven by the increasing demand for comfort features in high-end vehicles. One of the primary drivers is the increasing adoption of configurable ambient lighting systems, which offer customizable color options and patterns to enhance the interior ambiance of luxury car. Automotive lighting technology continues to evolve, with advanced ambient lighting systems offering a range of customizable colors and patterns.

- However, challenges persist in the form of economic slowdown and shipping delays, which can impact the market's year-on-year growth. Additionally, the price volatility of raw materials used in the production of these systems can add to the manufacturing costs. Despite these challenges, the market is expected to continue its expansion as consumers seek out the latest comfort and safety features in their luxury vehicles.

Luxury Car Ambient Lighting System Market Analysis

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Executive luxury cars

- Super luxury cars

- Geography

- Europe

- Germany

- France

- APAC

- China

- Japan

- North America

- US

- South America

- Middle East and Africa

- Europe

By Application Insights

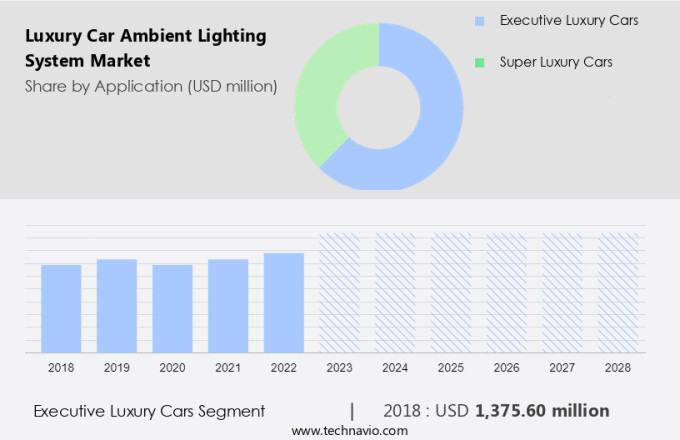

The executive luxury cars segment is estimated to witness significant growth during the forecast period. Executive luxury cars, priced between USD40,000 and USD220,000, are a popular choice among consumers seeking premium automotive experiences. German manufacturers, including BMW AG, AUDI AG, and Mercedes-Benz Cars GmbH (a Daimler AG subsidiary), lead the global executive luxury cars market. These companies collectively accounted for a significant portion of the market revenue. The luxury SUV segment is experiencing the most significant growth, particularly in North America and Europe, as well as emerging countries in Asia Pacific. This increasing demand for executive luxury cars is expected to boost sales of ambient lighting systems in the coming years. Ambient lighting systems, also known as mood lighting, enhance the aesthetic appeal of vehicle interiors.

They provide a soothing and customizable lighting experience for drivers and passengers. In emergency situations, these systems can also serve as a safety feature by illuminating the cabin and making it easier to navigate. As research and development activities continue in the automotive sector, product pipelines for advanced ambient lighting systems are expanding. These systems offer a unique selling proposition for luxury car manufacturers, making them an essential component of executive luxury cars.

Get a glance at the market share of various segments Request Free Sample

The executive luxury cars segment accounted for USD 1.38 billion in 2018 and showed a gradual increase during the forecast period.

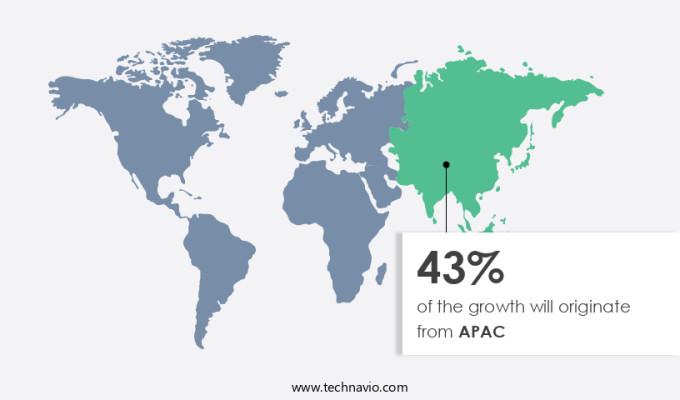

Will APAC become the largest contributor to the Luxury Car Ambient Lighting System Market?

APAC is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The escalating demand for premium vehicles among consumers in Europe has intensified competition among automakers. To differentiate their offerings, Original Equipment Manufacturers (OEMs) are integrating advanced technologies into their vehicles. Ambient lighting, now a standard feature in luxury cars, is witnessing increased preference as a means of product differentiation. This trend is gaining traction in the competitive European luxury car market. Key players are focusing on enhancing the customer experience by offering customizable lighting options and advanced features. The influence of social and political factors, such as changing consumer preferences and government regulations, further impact the market dynamics.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Dynamics

- The market is a niche segment in the automotive industry, focusing on smart lighting systems for vehicle interiors. Dashboard Lights have evolved from basic functional tools to Ambient Lighting systems, enhancing the aesthetic appeal of Luxury vehicles. These systems include Head-Up Displays, Reading Lights, and Mood lighting using technologies like Halogen, LED, and Xenon. The automotive industry offers a range of vehicle types, including Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), with advancements in features like footwall design, halogen technology, ambient lighting upgrades, and sophisticated centre consoles, all contributing to the diverse options and pricing strategies for domestic and fleet customers.

- Further, heavy Commercial Vehicles and Battery Electric Vehicles (BEVs), as well as Hybrid Electric Vehicle (HEVs), are also integrating ambient lighting systems into their vehicle interiors. Automotive door module Doors, Centre consoles, switches and Dashboards are common areas for ambient lighting implementation. LED light strips and Organic Light-Emitting Diodes (OLEDs) are popular choices for ambient lighting due to their energy efficiency and long lifespan. Technical breakthroughs and consumer preferences continue to drive research activities and product pipelines in this market. Ambient lighting systems provide a human-machine interface that comfort and safety. They can create a different atmosphere, improve mood lighting, and provide emergency situation illumination. The Automotive sector's continuous focus on enhancing vehicle interiors and the growing demand for luxury features are key factors fueling the growth of the market.

What are the key market drivers leading to the rise in adoption of Luxury Car Ambient Lighting System Market ?

Increasing adoption of configurable ambient lighting systems is the key driver of the market.

- In the luxury automotive industry, ambient lighting has emerged as an essential aesthetic element. This feature not only enhances the visual appeal of a vehicle's interior but also provides a sense of comfort and warmth for its occupants. With advancements in technology, ambient lighting systems have become more intelligent and interactive.

- One such innovation is the configurable ambient lighting system, also known as the adjustable or dynamic ambient lighting system. This technology allows occupants to customize the color and intensity of the dashboard lights, head-up display, reading lights, and other ambient lighting features based on their mood and personal preferences. This customization enhances the overall luxury experience in a vehicle and is a significant growth driver for the global market for ambient lighting systems in luxury cars.

What are the trends shaping the Luxury Car Ambient Lighting System Market?

The development of integrated comfort features in luxury cars is the key trend in the market.

- Ambient lighting systems in luxury cars have gained significant popularity due to their ability to enhance both aesthetics and safety. These upgrades are an essential aspect of vehicle customization, catering to changing lifestyles and consumer preferences. Integrated ambient lighting systems combine features such as climate control, seat heating/cooling, automotive seat massage system functions, audio system programming, and automatic fragrance dispensing systems.

- By consolidating these attributes, power and space consumption are reduced in luxury vehicles. For instance, Mercedes-Benz S-Class offers a 64-hue ambient lighting system that adjusts according to the car's ambient temperature, allowing for five intensity levels in four separate cabin zones.

- Similarly, the BMW X3 features integrated ambient lighting with ambient contour lighting in the front and rear doors, available in six dimmable light designs in white, blue, orange, bronze, lilac, and green. Economic conditions, vehicle types, and both political and social factors influence the market for ambient lighting systems in the automotive fleet. Domestic vehicles and automotive fleets are significant consumers of these systems due to their emphasis on comfort and luxury. Product pricing remains a critical factor in the market, with manufacturers striving to offer competitive pricing while maintaining high-quality features. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Luxury Car Ambient Lighting System Market face during the growth?

Price fluctuation of raw materials is the major challenge that affects the growth of the market.

- The market is witnessing significant growth due to the increasing trend of vehicle customization, reflecting changing lifestyles. This market caters to various vehicle types, including domestic and automotive fleet. Economic conditions and political factors also influence the market's growth. Ambient lighting upgrades are becoming increasingly popular, offering a different driving experience. LED lighting is gaining popularity due to its energy efficiency and long lifespan.

- However, the high cost of manufacturing LED lights, primarily due to the use of precursors like Trimethylgallium (TMGa), poses a challenge to the market. Social factors, such as the desire for luxury and personalization, further fuel the demand for advanced ambient lighting systems. Despite the high product pricing, the market is expected to continue its growth trajectory. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

APAGCoSyst - The company offers ambient lighting for door handle lighting and interior ambient.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CML Technologies GMBH and Co. KG

- Elmos Semiconductor AG

- Embitel Technologies Pvt. Ltd.

- Flex Ltd.

- Fritz Draxlmaier GmbH and Co. KG

- Grupo Antolin Irausa SA

- HELLA GmbH and Co. KGaA

- Innotec Corp.

- Koito Manufacturing Co. Ltd.

- Koninklijke Philips N.V.

- Marelli Holdings Co. Ltd.

- OSRAM Licht AG

- Prettl Produktions Holding GmbH

- Robert Bosch GmbH

- Saudi Basic Industries Corp.

- SCHOTT AG

- Stanley Electric Co. Ltd.

- TE Connectivity Ltd.

- Valeo SA

- Yanfeng Automotive Interior Systems Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market for ambient lighting systems in luxury vehicles is experiencing significant growth due to the increasing demand for comfort and aesthetic appeal in automobiles. Advanced display solutions, such as head-up displays and dashboard lights, are becoming increasingly popular in both traditional and electric vehicles, including heavy commercial vehicles, battery electric vehicles, and hybrid electric vehicles. These lighting systems are not limited to the dashboard and center console; they now extend to doors, footwells, and other vehicle interiors. The use of LED, OLED, halogen, and xenon technologies in ambient lighting systems is driving innovation in the automotive lighting technology sector. Consumer preferences for customization and mood lighting are also fueling the market's year-on-year growth.

However, economic slowdowns and shipping delays can impact the market's progress. The automotive sector's research activities and product pipelines are focused on developing advanced ambient lighting systems that offer both comfort and safety features. These systems can enhance the aesthetic appeal of ultra-luxurious vehicles and provide mood lighting for passengers in emergency situations. Geographical coverage, technical breakthroughs, human machine interface, and vehicle customization are key factors influencing the market's growth. Changing lifestyles and the automotive fleet's increasing size are also contributing to the market's expansion. However, economic conditions, political factors, and social factors can impact the market's growth trajectory.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 851.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 43% |

|

Key countries |

China, US, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

APAGCoSyst, CML Technologies GMBH and Co. KG, Elmos Semiconductor AG, Embitel Technologies Pvt. Ltd., Flex Ltd., Fritz Draxlmaier GmbH and Co. KG, Grupo Antolin Irausa SA, HELLA GmbH and Co. KGaA, Innotec Corp., Koito Manufacturing Co. Ltd., Koninklijke Philips N.V., Marelli Holdings Co. Ltd., OSRAM Licht AG, Prettl Produktions Holding GmbH, Robert Bosch GmbH, Saudi Basic Industries Corp., SCHOTT AG, Stanley Electric Co. Ltd., TE Connectivity Ltd., Valeo SA, and Yanfeng Automotive Interior Systems Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch