Luxury SUV Market Size 2025-2029

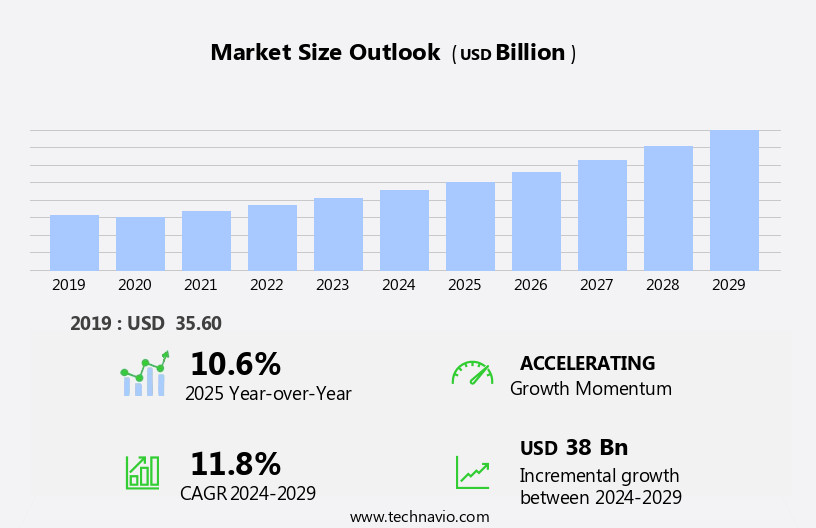

The luxury SUV market size is forecast to increase by USD 38 billion, at a CAGR of 11.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by several key factors. One major trend is the increased preference for safety and comfort, which is leading consumers to invest in luxury SUVs. Another trend is the rapid development of luxury electric vehicles, as automakers respond to growing demand for sustainable transportation options.

- Additionally, the declining exclusivity of luxury cars is making SUVs an increasingly attractive choice for consumers seeking a premium driving experience. These trends are shaping the future of the market and are expected to continue driving growth in the coming years.

What will be the Luxury SUV Market Size During the Forecast Period?

To learn more about the market report, Request Free Sample

- The market continues to thrive in the global passenger vehicle industry, with consumers seeking vehicles that offer superior performance, comfort, and prestige. These road-going passenger automobiles cater to various application niches, including off-road adventures and urban commuting. Lightweight pickups and SUVs with seating capacity for seven or more passengers have gained popularity due to their versatility and spacious interiors. Four-wheel drive (4WD) models are particularly favored for their ability to handle diverse terrain, while two-wheel drive (2WD) variants offer better fuel efficiency for those primarily focused on city driving. However, market dynamics in the luxury SUV sector face challenges. Raw material shortages and shipping delays due to economic slowdowns can impact production and delivery schedules.

- Automakers must navigate these obstacles while maintaining safety & security, CNG powertrains, and advanced features such as infotainment and connectivity systems. Battery models and driving range are increasingly important considerations for luxury SUV buyers. Consumers prioritize vehicles with long-lasting batteries and impressive driving ranges, reflecting the growing demand for electric and hybrid powertrains. Safety features remain a top priority, with exclusive features like adaptive cruise control, lane departure warnings, and automatic emergency braking becoming standard offerings. Prestige and consumer preferences continue to shape the luxury SUV landscape, with automakers investing in innovative designs and technologies to meet evolving market demands.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Individual

- Commercial

- Type

- Mid-size luxury SUVs

- Full-size luxury SUVs

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- South America

- Middle East and Africa

- North America

By Application Insights

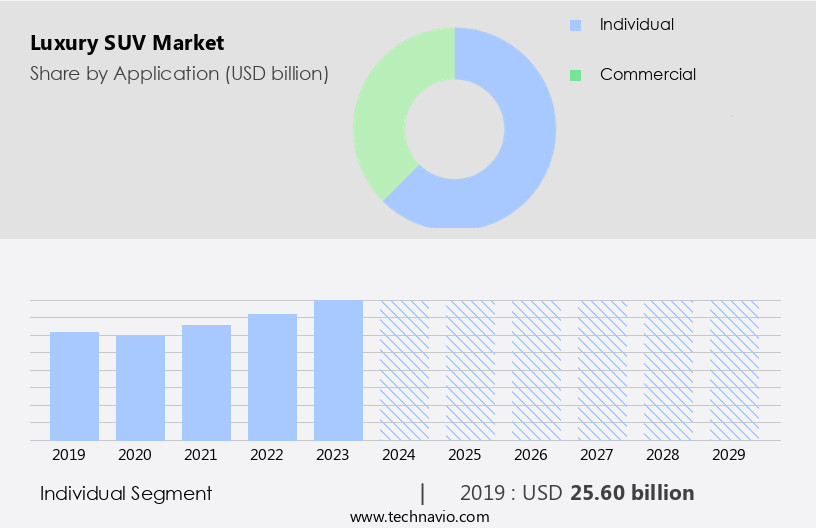

- The individual segment is estimated to witness significant growth during the forecast period.

The market caters to the demand for personal use vehicles that combine advanced features, premium materials, and high-performance capabilities. This segment includes compact and performance luxury SUVs. Compact luxury SUVs offer luxury at a more affordable price point. Performance luxury SUVs, on the other hand, prioritize high-performance driving with powerful engines, sport-tuned suspension systems, and other performance-enhancing features. Consumer preferences for luxury vehicles continue to shape market growth, with disposable incomes and emission standards influencing purchasing decisions. Environmental organizations' emphasis on reducing exhaust emissions has led to the increasing popularity of electric SUV luxury vehicles. Incentives and subsidies from governments further encourage the adoption of eco-friendly options. The market encompasses various sub-segments, with size, price, and performance being key differentiators.

Get a glance at the market report of share of various segments. Request Free Sample

The individual segment was valued at USD 25.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

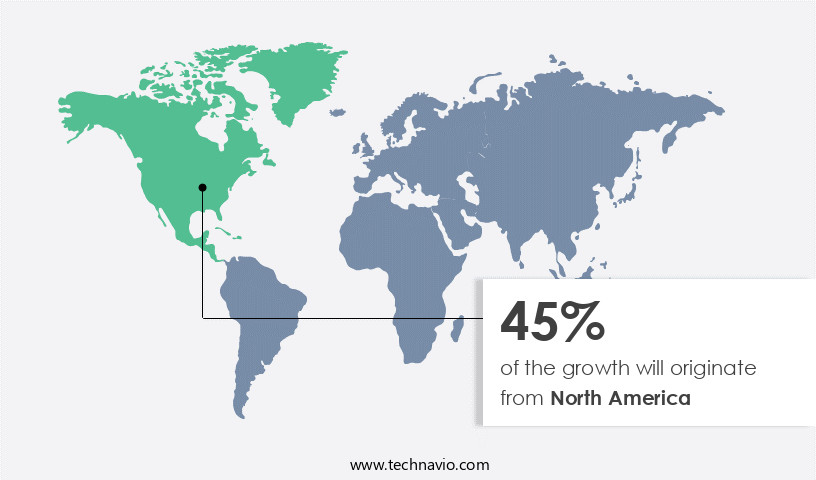

- North America is estimated to contribute 45% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America experiences significant growth due to the increasing number of high-net-worth individuals (HNWIs) in the region. These consumers seek vehicles with advanced technology, higher seating capacity, and four-wheel drive capabilities for efficient personal transportation. SUVs and crossovers, known for their powerful engines, dynamic handling, and higher ground clearance, are popular choices. Factors such as more accessible financing and lower fuel prices further boost sales. Luxury SUVs cater to this demand by offering superior comfort and performance, making them a desirable investment for consumers in North America.

Market Dynamics

Our market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Luxury SUV Market?

Increased preference for safety and comfort driving sales of luxury SUVs is the key driver of the market.

- The market is a dynamic and competitive segment of the passenger vehicle industry, characterized by its focus on performance, comfort, and prestige. According to market reports, this market is driven by consumer preferences for larger seating capacity, four-wheel drive capabilities, and exclusive features. Automakers invest heavily in research and development to offer innovative powertrains, safety features, infotainment systems, and connectivity options. However, the market faces several challenges, including raw material shortages, shipping delays, and economic slowdown. These factors can impact the production and distribution of luxury SUVs, leading to delays in delivery and increased costs. Furthermore, the shift towards electric luxury vehicles is gaining momentum, with battery models and driving range becoming key considerations for buyers.

- Despite these challenges, the market remains strong, driven by increasing disposable incomes and emission standards. Safety and security are also critical factors, with consumers seeking advanced driver-assistance systems, such as intelligent all-wheel-drive and electronic stability control. Brands strive to offer exclusive promotions, events, and after-sales services to enhance the buying experience and build brand loyalty. In summary, the market is a complex and evolving landscape, shaped by consumer preferences, technological advancements, and economic factors. Automakers must navigate these challenges to offer high-performing, comfortable, and safe vehicles that cater to the unique needs of luxury buyers.

What are the market trends shaping the Luxury SUV market?

The rapid development of electric luxury vehicles is the upcoming trend in the market.

- The market is experiencing significant shifts as automakers respond to consumer preferences, economic conditions, and regulatory pressures. Pestle analysis reveals several factors influencing this market. The increasing focus on reducing exhaust emissions is driving the adoption of electric vehicles (EVs), including luxury models. Economic slowdown, raw material shortages, and shipping delays pose challenges for automakers. Seating capacity, four-wheel drive (4WD), performance, comfort, safety & security, infotainment systems, connectivity systems, and exclusive features remain key considerations for luxury SUV buyers.

- Luxury vehicle manufacturers are emphasizing electric vehicle technology, hybrid electric powertrains, and internal combustion engines in their distribution networks. Product knowledge, brand experience, test drives, financing, after-sales services, exclusive promotions, and events contribute to the buying experience. Brand loyalty is a significant factor, with EV owners increasingly seeking incentives & subsidies to offset higher upfront costs.

What challenges does the Luxury SUV market face during the growth?

Declining exclusivity of luxury cars is a key challenge affecting the market growth.

- The market is driven by consumer preferences for exclusive features and the prestige of ownership. However, as the number of luxury brands increases and competition intensifies, some manufacturers are expanding their reach to the mass market, selling luxury SUVs through the same distribution channels as other passenger vehicles. This trend, while not directly impacting sales, may diminish the exclusivity of luxury SUVs. Technological advancements are another significant factor in the market. However, these features are increasingly being incorporated into mid-segment vehicles. Today, mid-range SUVs offer advanced safety systems such as emergency braking, collision avoidance, pedestrian detection, steering assist, blind-spot monitoring, heated seats, and sunroofs, which were once exclusive to luxury vehicles.

- Market dynamics, including raw material shortages, shipping delays, economic slowdowns, and changing consumer preferences, influence the market. For instance, the shift towards electric vehicles and the increasing focus on reducing exhaust emissions have led to the development of battery models and hybrid electric powertrains. However, concerns over driving range and the availability of charging infrastructure may limit the adoption of electric luxury vehicles. Safety and security, performance, comfort, and infotainment systems are essential considerations for luxury SUV buyers. Market reports provide insights into application niches, economic factors, and consumer trends. Automakers invest in safety features, connectivity systems, and exclusive features to differentiate their products and build brand loyalty.

- Financing, after-sales services, and exclusive promotions are crucial elements of the buying experience. The market is influenced by various external factors, including economic conditions, environmental organizations, incentives and subsidies, and the development of electric vehicle technology. These factors impact the production and distribution of luxury SUVs, as well as consumer demand and preferences. Despite these challenges, the market continues to grow, driven by consumer disposable incomes, changing lifestyles, and the desire for comfort and performance.

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market growth analysis report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACURA

- Bayerische Motoren Werke AG

- BYD Co. Ltd.

- Cadillac

- China FAW Group Co. Ltd.

- Ford Motor Co.

- Hyundai Motor Co.

- Jaguar Land Rover Ltd.

- Mahindra and Mahindra Ltd.

- Mazda Motor Corp.

- Mercedes Benz Group AG

- Mitsubishi Corp.

- Nissan Motor Co. Ltd.

- Renault SAS

- SAIC Motor Corp. Ltd.

- Tesla Inc.

- Toyota Motor Corp.

- Volkswagen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a dynamic and evolving sector within the broader automotive industry. This market is characterized by its focus on performance, comfort, and exclusivity, catering to consumers with high disposable incomes and a preference for prestige vehicles. In this analysis, we delve into the key market dynamics shaping the luxury SUV segment. The market is driven by several factors. Consumer preferences for larger vehicles with increased seating capacity and improved safety features continue to fuel demand. Additionally, technological advancements in powertrains, infotainment systems, and connectivity have become essential selling points for luxury SUVs. The market faces several challenges. Raw material shortages and shipping delays can impact production and availability, leading to increased costs for automakers. Economic slowdowns in key markets can also dampen demand, while stricter emission standards and environmental concerns put pressure on manufacturers to innovate and adapt.

Despite the challenges, the market presents several opportunities. The growing popularity of electric and hybrid electric powertrains offers a chance for automakers to differentiate themselves and cater to evolving consumer preferences. Application niches, such as off-road capabilities and enhanced safety features, can also provide unique selling points for luxury SUVs. The market is influenced by several trends. Four-wheel drive (4WD) and two-wheel drive (2WD) configurations continue to be popular, with consumer preferences leaning towards 4WD for added versatility. Safety & security features, such as advanced driver-assistance systems (ADAS), are becoming increasingly important. Additionally, luxury vehicle buyers are seeking exclusive features, including advanced infotainment systems, high-end materials, and personalized customization options. The market is expected to grow, driven by consumer demand for larger, more comfortable vehicles with advanced features. However, challenges such as raw material shortages, shipping delays, and economic slowdowns may impact growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.8% |

|

Market Growth 2025-2029 |

USD 38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.6 |

|

Key countries |

US, Canada, China, Japan, India, UK, Germany, France, South Korea, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.