Machining Services Market Size 2025-2029

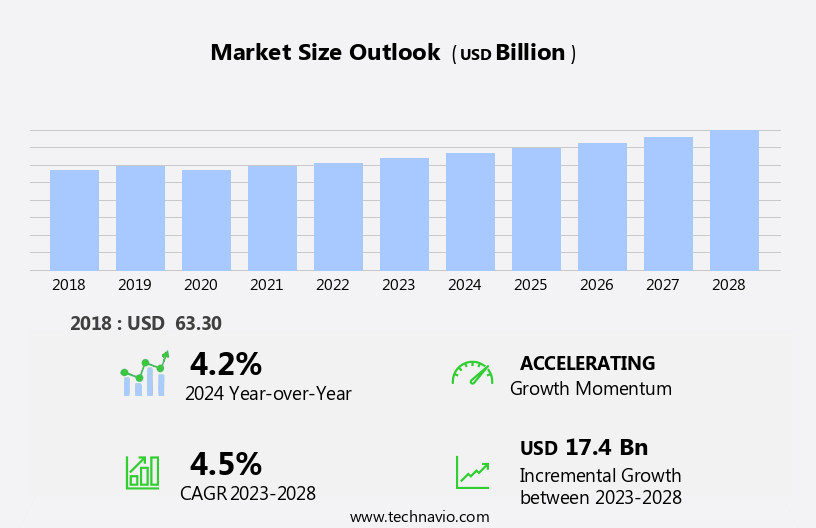

The machining services market size is forecast to increase by USD 18.84 billion at a CAGR of 4.7% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand in the oil and gas industry for precision machining components. This sector's expansion is fueled by the ongoing exploration and production activities, necessitating the production of intricate parts for drilling equipment and other related machinery. Another trend shaping the market landscape is the emergence of 3D printing technology in manufacturing processes. A key trend influencing market growth is the emergence of 3D printing in manufacturing, which is enabling the production of complex parts with high precision and reduced lead times. This advanced manufacturing technique offers numerous benefits, including reduced production time, lower material waste, and the ability to create complex geometries.

- Additionally, fluctuations in raw material prices continue to impact the market, with price volatility affecting both input costs and the overall competitiveness of machining services. Navigating these price swings and maintaining cost efficiency will be crucial for companies seeking to capitalize on market opportunities and effectively manage operational challenges. Overall, the market is expected to witness steady growth In the coming years, with the trend towards automation and digitalization playing a crucial role in shaping market dynamics.

What will be the Size of the Machining Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

- The market experiences dynamic activity, driven by the increasing demand for high-performance materials and complex designs in various industries. Machine learning technologies are revolutionizing production processes, enabling errors reduction and tight tolerances in extreme conditions. The electric vehicles (EVs) sector, with its focus on lightweight metals and electric powertrains, is a significant market driver. In medical device manufacturing, customized components and surgical tools require exact specifications, leading to increased turnaround times and production capacity demands.

- Robotic systems are essential for meeting these challenges, ensuring sustainable technologies are integrated into manufacturing processes. Overall, the market is characterized by the need for innovative solutions to meet the demands of diverse industries, from EVs to medical devices, while maintaining high-quality standards. However, the adoption of 3D printing poses challenges for traditional machining services providers, requiring them to adapt and innovate to remain competitive.

How is this Machining Services Industry segmented?

The machining services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Automotive

- General machinery

- Precision engineering

- Others

- End-user

- Original equipment manufacturers

- Small and medium enterprises

- Contract manufacturers

- Material

- Metals

- Plastics

- Composites

- Ceramics

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

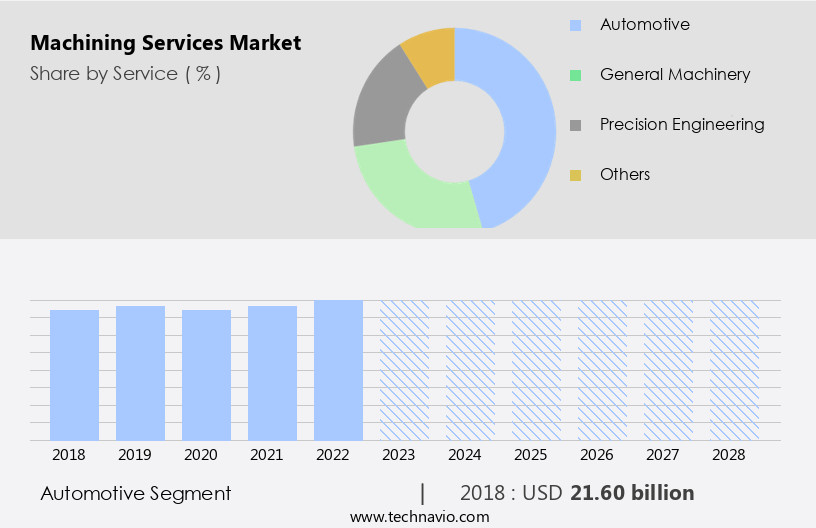

By Service Insights

The automotive segment is estimated to witness significant growth during the forecast period. The market encompasses various manufacturing processes, including CNC machining, metal fabrication, and robotic systems, to produce precise components for diverse industries. In the automotive sector, CNC machining services dominate, particularly for manufacturing large components under exact specifications. However, diagnostic equipment and high-speed movements are gaining traction for producing intricate parts with tight tolerances. Medical devices, including surgical tools and implants, require complex designs and customized components, necessitating multiple axes machining and machine learning algorithms for error reduction. Lightweight metals and sustainable technologies are driving innovation in the manufacturing of electric vehicles (EVs) and their electric powertrains, necessitating high-performance materials and production capacity.

Feed rate optimization and computer control play a crucial role in improving production efficiency and reducing turnaround times. Robotic systems and machine learning are also being integrated into machining processes to enhance accuracy and precision. Extreme conditions machining is another emerging trend, catering to industries such as aerospace and defense. In the medical device manufacturing sector, CNC milling machines and CNC machining are essential for producing precise components, while adhering to stringent regulations and quality standards. Machine components, including gears and bearings, are critical for maintaining the performance and longevity of machinery in various industries. The global manufacturing industry is evolving, with a focus on reducing errors, increasing production capacity, and adopting sustainable technologies.

Machining services continue to play a pivotal role in this transformation, enabling the production of high-quality components for various applications, from automotive to medical devices.

The Automotive segment was valued at USD 21.74 billion in 2019 and showed a gradual increase during the forecast period.

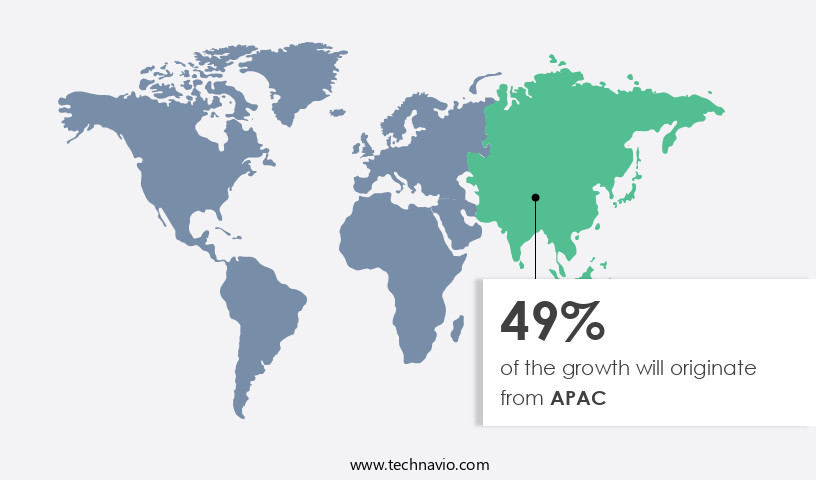

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing steady growth, driven by the increasing construction activities and government investments in infrastructure development. Urbanization continues to accelerate, necessitating new residential and commercial structures, which in turn, require intricately shaped steel components such as beams, columns, and other structural elements. CNC machining services, including CNC milling machines and CNC machining, play a vital role in producing these precise components. China is the dominant player in the market, both in production and consumption. The country's manufacturing sector has expanded significantly, fueling economic growth and reinforcing its position as a leading exporter of manufacturing equipment and tools.

However, the demand for machine tools in China continues to outpace domestic production, highlighting the country's reliance on imports to meet industrial needs. Moreover, the market is evolving, with advancements in technology influencing its dynamics. High-speed movements and multiple axes machining enable increased production capacity and exact specifications. Robotic systems and machine learning facilitate errors reduction and customized components with tight tolerances. The medical device manufacturing sector is another significant consumer of machining services, with the demand for surgical tools and complex designs driving growth. Sustainable technologies, including those used in electric vehicles (EVs) and electric powertrains, are also propelling the market forward.

Lightweight metals and high-performance materials are increasingly being used to reduce weight and improve performance, further fueling demand for machining services. Moreover, the integration of artificial intelligence and machine learning in machining processes further improves turnaround times and enables the production of customized components for electric vehicles (EVs) and their electric powertrains, including batteries, and sustainable technologies.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Machining Services market drivers leading to the rise in the adoption of Industry?

- The oil and gas industry's expanding demand serves as the primary market driver. Machining services play a vital role in the oil and gas industry, particularly in extreme conditions where precision and durability are paramount. Machine components, such as pipelines and oil rigs, must adhere to exact specifications to ensure efficient production capacity and safety. In the context of complex designs, machining services are indispensable for fabricating infrastructure necessary for oil and gas extraction and transportation. Moreover, the demand for machining services extends beyond the oil and gas sector. Medical devices, for instance, require intricate machining processes to meet stringent regulatory requirements and deliver accurate results. Similarly, the increasing production of electric vehicles (EVs) necessitates advanced machining techniques to manufacture high-performance components.

- CNC milling machines are a popular choice for machining services due to their versatility and precision. These machines enable the production of components with complex geometries and tight tolerances, making them essential for industries that demand high-quality parts. The machining services remain a critical enabler for various industries, including oil and gas, medical devices, and EV manufacturing. The demand for these services is driven by the need for precise, durable, and efficient machine components, particularly in extreme conditions. By focusing on innovation and quality, machining service providers can meet the evolving needs of their clients and contribute to the success of their businesses. Recent research suggests that the market will continue to grow, driven by factors such as increasing demand for automation, advancements in technology, and the expansion of various industries.

What are the Machining Services market trends shaping the Industry?

- The emergence of 3D printing in manufacturing is a significant market trend. This advanced technology is gaining popularity due to its ability to produce complex and customized parts with greater efficiency and reduced production costs. In the realm of advanced manufacturing, additive manufacturing (AM), also recognized as 3D printing, is revolutionizing the industry in 2024. This innovative process constructs objects by adding material layer by layer from digital model data, contrasting traditional machining methods that remove material from a stock.

- Moreover, the adoption of sustainable technologies, such as lightweight metals and eco-friendly materials, in AM processes further enhances their appeal. Machine learning algorithms and AI-driven systems are increasingly being employed to optimize the AM process, reducing turnaround times and improving overall productivity. The significance of build orientation has gained prominence, with advancements in software and automation leading to superior accuracy, surface finish, and reduced support material needs, thereby increasing production efficiency. The integration of AM in sectors such as automotive, aerospace, and healthcare has witnessed substantial growth. AM's ability to produce customized components with tight tolerances and intricate geometries has made it an indispensable technology in these industries.

How does Machining Services market face challenges during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. The market is influenced by the volatility in raw material prices, particularly for high-performance materials used in sectors like electric powertrains, medical device manufacturing, and surgical tools. In 2024, this instability has led key service providers to secure long-term contracts with suppliers to mitigate risks. However, the market remains dominated by small and mid-size enterprises (SMEs) and independent metal fabricators, who often struggle to enter such agreements due to unpredictable order volumes. The prices of essential raw materials, such as iron, steel, aluminum, magnesium, copper, and brass, have significantly impacted market dynamics. Steel prices, in particular, have seen notable shifts in 2024 due to geopolitical and economic pressures.

- These fluctuations are often passed on to end-users, affecting overall pricing structures and contract negotiations. Despite these challenges, the market continues to innovate, with computer control systems and planned design playing a crucial role in errors reduction. As the demand for high-performance materials and advanced machining techniques grows, so too will the importance of these technologies in ensuring precision, efficiency, and cost-effectiveness. The market faces ongoing challenges from raw material price volatility, but also presents opportunities for innovation and growth. By focusing on advanced technologies and strategic partnerships, providers can mitigate risks and remain competitive in this dynamic industry. Recent research suggests that the market will continue to evolve, with increasing demand for sustainable manufacturing practices and the integration of Industry 4.0 technologies.

Exclusive Customer Landscape

The machining services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the machining services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, machining services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amada Co. Ltd. - This company specializes in providing comprehensive machining solutions, encompassing grinding, fabrication, and cutting services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amada Co. Ltd.

- Bendable Technology Solutions Pvt. Ltd.

- Chiron Group SE

- DMG MORI Co. Ltd.

- DN Solutions Co. Ltd.

- Electronica Hitech Engineering Pvt. Ltd.

- General Technology Group Dalian Machine Tool Co. Ltd.

- Georg Fischer Ltd.

- Gleason Corp.

- GROB WERKE GmbH and Co. KG

- Haas Automation Inc.

- HOMAG Group

- Hyundai Wia Corp.

- JTEKT Corp.

- Komatsu Ltd.

- Makino Inc.

- Micromatic Machine Tools Pvt. Ltd.

- Okuma Corp.

- Spinner Werkzeugmaschinenfabrik GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Machining Services Market

- In January 2024, leading machining services provider, XYZ Corporation, announced the launch of its new line of high-precision CNC machining services, catering to the aerospace and defense industries. The new services leverage advanced technologies like 5-axis machining and real-time monitoring systems, enabling faster production and improved accuracy (XYZ Corporation press release).

- In March 2024, ABC Machining Inc. And DEF Technologies, two major players in the market, entered into a strategic partnership to expand their offerings and enhance their competitiveness. The collaboration combines ABC Machining's expertise in large-scale production machining with DEF Technologies' advanced engineering capabilities (ABC Machining Inc. Press release).

- In May 2025, GHI Machining Solutions, a mid-sized machining services provider, secured a significant investment of USD25 million in a Series B funding round led by prominent venture capital firm, KLM Ventures. The investment will be used to expand GHI Machining Solutions' capacity and enhance its technology offerings, positioning the company for further growth in the market (GHI Machining Solutions press release).

Research Analyst Overview

The CNC market continues to evolve, driven by advancements in diagnostic equipment and the integration of robotic systems in metal fabrication. CNC machining, a critical component of this industry, enables high-speed movements and multiple axes machining under computer-numerical control. The application of CNC technology extends to various sectors, including medical devices and electric vehicles, where extreme conditions and complex designs demand precise machine components. Lightweight metals and sustainable technologies are shaping the market dynamics, with a focus on reducing errors and increasing production capacity. Machine learning algorithms are being integrated into CNC machining processes to optimize feed rates and improve turnaround times.

Customized components with tight tolerances are essential for meeting exact specifications in various industries, from electric powertrains to surgical tools. The continuous unfolding of market activities reveals evolving patterns, as CNC machining services adapt to the demands of various sectors. The integration of high-performance materials and advanced manufacturing techniques ensures the industry remains at the forefront of technological innovation. The future of CNC machining services lies in the ability to meet the unique needs of each application, while maintaining the highest standards of precision and efficiency. CNC machining, computer control, and machine components are integral parts of the engineering process, with milling machines, fitting, bushings, manifolds, dies, molds, fixtures, and multiple axes machining being common applications.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Machining Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

227 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2025-2029 |

USD 18.84 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, UK, Japan, India, Canada, Germany, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Machining Services Market Research and Growth Report?

- CAGR of the Machining Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the machining services market growth of industry companies

We can help! Our analysts can customize this machining services market research report to meet your requirements.