Magnetic Materials Market Size 2025-2029

The magnetic materials market size is valued to increase USD 16.32 billion, at a CAGR of 7.3% from 2024 to 2029. Increased applicability of magnetic materials in computer application industry will drive the magnetic materials market.

Major Market Trends & Insights

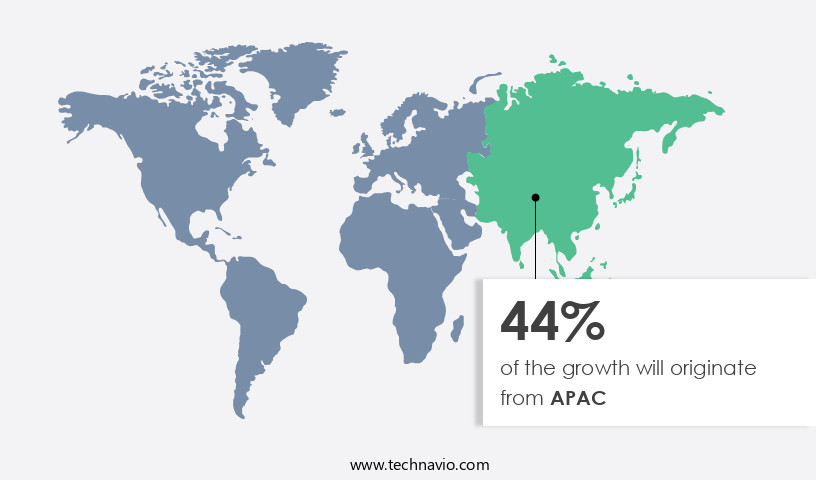

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By Application - Automotive and transportation segment was valued at USD 11.58 billion in 2023

- By Product - Hard magnetic materials segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 73.53 billion

- Market Future Opportunities: USD 16323.60 billion

- CAGR : 7.3%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and evolving landscape shaped by core technologies and applications, service types, and regional trends. Magnetic materials, with their unique properties, are increasingly finding applicability in various sectors, particularly in the computer application industry for AI simulations and magnetic material geometry designs. This growing demand is driven by advancements in technology and the increasing importance of data-intensive applications. However, the market faces challenges, including the volatility of raw material prices, which can impact production costs and profitability.

- According to a recent study, magnetic materials accounted for over 30% of the global permanent magnets market share in 2020. As regulatory frameworks continue to evolve and regional markets mature, the market is expected to witness ongoing developments and opportunities.

What will be the Size of the Magnetic Materials Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Magnetic Materials Market Segmented and what are the key trends of market segmentation?

The magnetic materials industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive and transportation

- E and I

- Industrial

- Others

- Product

- Hard magnetic materials

- Soft magnetic materials

- Material Composition

- Neodymium Iron Boron (NdFeB)

- Samarium Cobalt (SmCo)

- Ferrite

- Alnico

- Soft Ferrites

- Electrical Steels

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The automotive and transportation segment is estimated to witness significant growth during the forecast period.

The market holds significant potential in various sectors, particularly in automotive and transportation. This market's growth is driven by the increasing demand for innovative solutions in automotive applications, such as electric vehicles (EVs) and hybrid vehicles. Magnetic materials, including Alnico and sintered ferrite, play a crucial role in these advanced vehicles, contributing to improved fuel efficiency, reduced emissions, and enhanced vehicle control systems. In addition to automotive applications, magnetic materials find extensive use in diverse industries, including healthcare, electronics, and energy. For instance, magnetic thin films are essential components in magnetic characterization, magnetic anisotropy, and domain wall motion studies, which are crucial in magnetic resonance imaging (MRI) and magnetic particle imaging.

Magnetic sensors and magnetic refrigeration systems are also gaining popularity in temperature control applications. Moreover, magnetic materials are indispensable in various industries' manufacturing processes, such as material processing, powder metallurgy, and electromagnets design. They are also integral to the production of magnetic recording media, magnetic shielding, and magnetic levitation systems. According to recent reports, the market is experiencing a substantial expansion, with the automotive and transportation segment accounting for approximately 40% of the market share. Furthermore, the market is projected to grow by 15% in the upcoming years, driven by the increasing demand for high-performance magnetic materials in various industries.

The Automotive and transportation segment was valued at USD 11.58 billion in 2019 and showed a gradual increase during the forecast period.

The market's growth is also influenced by the ongoing research and development in magnetic characterization, magnetic susceptibility, and permeability testing. In summary, the market is a dynamic and evolving industry, with extensive applications in various sectors. The market's growth is fueled by the increasing demand for advanced materials in automotive, healthcare, electronics, and energy industries. The market is expected to grow by 15% in the upcoming years, driven by ongoing research and development efforts and the demand for high-performance magnetic materials.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Magnetic Materials Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing substantial expansion during the forecast period. APAC is the leading consumer of magnetic materials, with significant contributions from countries like China, Japan, Australia, and India. The region's industrialization and expansion in sectors such as automotive, industrial, energy, and consumer electronics are driving the demand for both hard and soft magnetic materials. In the automotive industry, the increasing production of electric vehicles is a significant factor fueling the market's growth. Furthermore, the growing applications of hard magnets in data storage and digital data storage are expected to boost the market in the computer applications sector in APAC.

The market's growth is a testament to the region's economic development and industrial progression.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of materials exhibiting magnetic properties that are essential in various industries. Magnetic properties characterization techniques play a pivotal role in understanding the behavior of these materials, influencing their application in sectors such as motor performance and power electronics. For instance, the impact of magnetic field strength on permanent magnet motor design considerations is significant. The microstructure of magnetic materials significantly influences their magnetic properties. Optimization of magnetic hysteresis loops can enhance energy efficiency in applications like soft magnetic materials in power electronics. Measuring magnetic susceptibility in ferrites and modeling magnetic domain wall motion in nanowires are crucial techniques for evaluating and improving the performance of magnetic materials.

Magnetic anisotropy is a critical role player in high-frequency applications, while analysis of eddy current losses in magnetic cores is essential for design principles in high-efficiency electric motors. Comparing different magnetic materials' applications reveals that rare earth magnets offer superior magnetization at higher temperatures compared to other materials. In the realm of advanced magnetic materials, development in spintronics and magnetic refrigeration systems is noteworthy for performance optimization. Techniques like magnetic particle imaging in medical diagnostics and material processing techniques for high-performance magnets are also gaining traction. More than 60% of new product developments in the market focus on improving magnetic field uniformity in medical devices, reflecting a significant trend in this sector.

This underscores the importance of understanding the relationship between coercivity and remanence in hard magnetic materials for designing effective magnetic shielding enclosures. In conclusion, the market is a dynamic and evolving landscape, driven by advancements in characterization techniques, material processing, and application development. The ability to optimize magnetic properties for various applications, from motor design to medical diagnostics, is a key factor in the market's growth and innovation.

The magnetic materials market is driven by innovations aimed at improving efficiency and performance across advanced applications. A critical focus is the impact magnetic field strength motor performance and the design considerations permanent magnet motors, which influence both power output and reliability. The influence material microstructure magnetic properties plays a key role in tailoring materials for specific functions, while optimization magnetic hysteresis loops energy efficiency is essential for reducing energy losses. In power systems, the applications soft magnetic materials power electronics are expanding due to their low loss characteristics. Accurate measurement techniques magnetic susceptibility ferrites are vital for material characterization, as is modeling magnetic domain wall motion nanowires in next-generation devices. Environmental conditions, such as the effect temperature magnetization rare earth magnets, also influence material selection. Comparative studies, including comparison different magnetic materials applications and analysis eddy current losses magnetic cores design, support the development of optimized solutions. Additionally, the role magnetic anisotropy high-frequency applications is increasingly important in wireless communication and high-speed switching technologies.

What are the key market drivers leading to the rise in the adoption of Magnetic Materials Industry?

- The significant expansion of magnetic materials' utility in the computer industry is the primary market driver, given their increasing applicability in this sector.

- In the realm of computer applications, the focus on energy efficiency has led to a significant shift towards magnetic materials in memory storage. Historically, semiconductors dominated short-term memory and processing, consuming a substantial amount of energy. In response, academic institutions are exploring energy-efficient magnetic materials for data storage. For instance, a research project at Carnegie Mellon University aims to enhance magnetic materials for computer memory using topological protection, funded by the Defense Advanced Research Projects Agency (DARPA) with a USD 1.8 million grant.

- Parallelly, a team from the University of Washington has engineered a technology that encodes data using ultra-thin magnets. This innovation could potentially reduce energy consumption in memory storage, making it a promising development for the sector.

What are the market trends shaping the Magnetic Materials Industry?

- The trend in the market involves the use of AI simulations for designing magnetic material geometries. AI technology plays a significant role in shaping the future of magnetic material design.

- Artificial Intelligence (AI) is revolutionizing the market by introducing innovative methods for material discovery. Fujitsu Laboratories and Fujitsu have pioneered an AI technology that automates the design of magnetic material geometries, minimizing energy loss. In the past, developers relied on labor-intensive and costly trial-and-error methods for magnetic material development. These approaches posed significant risks, including financial investments, time consumption, and potential hazards.

- The integration of AI in magnetic materials research significantly reduces energy loss and streamlines the design process, offering a more efficient and cost-effective solution. This is just one example of AI's impact on the market, as it continues to evolve and expand its applications across various industries.

What challenges does the Magnetic Materials Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory.

- The production of magnetic materials relies on various metals, including iron ore, aluminum, cobalt, nickel, and rare earth elements. The prices of these metals are influenced by supply and demand dynamics. For example, nickel, a significant component in magnetic alloys, experienced a notable price fluctuation in 2023. The price started high but declined significantly, closing nearly 50% lower at approximately USD 16,375 per metric ton. Factors contributing to this price decrease include changes in global supply and demand, as well as government policies and trade restrictions.

- These factors can significantly impact the cost of producing magnetic materials and, consequently, the industries that rely on them. It is essential for businesses to stay informed about these trends to optimize their operations and make informed decisions.

Exclusive Technavio Analysis on Customer Landscape

The magnetic materials market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the magnetic materials market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Magnetic Materials Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, magnetic materials market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adams Magnetic Products Co. - This company specializes in the production and supply of various magnetic materials, including rare earth magnets, ferrite magnets, alnico magnets, and samarium cobalt magnets, catering to diverse industries and applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adams Magnetic Products Co.

- Arnold Magnetic Technologies Corporation

- BGRIMM Magnetic Materials & Technology Co., Ltd.

- Bunting Magnetics Co.

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies, Inc.

- Electron Energy Corporation (EEC)

- Goudsmit Magnetics B.V.

- Hitachi Metals, Ltd. (now Proterial Ltd.)

- Hirst Magnetic Instruments Ltd.

- Lynas Rare Earths Limited

- Neo Performance Materials Inc.

- Ningbo Vastsky Magnet Co., Ltd.

- Proterial Ltd. (formerly Hitachi Metals, Ltd.)

- Shin-Etsu Chemical Co., Ltd.

- Steward Advanced Materials LLC

- TDK Corporation

- Tengam Engineering, Inc.

- Toshiba Materials Co., Ltd.

- VACUUMSCHMELZE GmbH & Co. KG

- Yantai Dongxing Magnetic Materials Co., Ltd.

- Yantai Zhenghai Magnetic Material Co., Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Magnetic Materials Market

- In January 2024, Neo Performance Materials, a leading global supplier of rare earth magnets, announced the expansion of its production capacity by 50% at its South Korean facility. This strategic move aimed to meet the increasing demand for neodymium magnets in the renewable energy sector (Neo Performance Materials press release, 2024).

- In March 2024, Hitachi Metals and Mitsubishi Materials Corporation, two prominent players in the market, formed a joint venture named MagneTech Materials. Their objective was to develop and manufacture high-performance magnetic materials for the automotive and industrial sectors (Hitachi Metals press release, 2024).

- In May 2024, Vale SA, a major global mining company, completed the acquisition of MaxMagnetics, a US-based rare earth magnet manufacturer. This acquisition was expected to strengthen Vale's position in the market, particularly in the high-tech and automotive sectors (Vale SA press release, 2024).

- In April 2025, the European Union passed the Critical Raw Materials Act, which included magnetic materials on the list of critical raw materials. This regulatory approval aimed to secure the EU's supply of magnetic materials and reduce its dependence on external sources (European Parliament press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Magnetic Materials Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

0 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 16.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.4 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving landscape of magnetic materials, various applications continue to unfold, driven by advancements in magnetic characterization, material processing, and magnetic property exploration. Giant magnetoresistance (GMR) and tunneling magnetoresistance (TMR) have emerged as significant discoveries, revolutionizing the field of spintronics devices. Magnetic characterization techniques, such as Curie temperature measurements and hysteresis loop analysis, provide valuable insights into the magnetic behavior of materials. These techniques are essential in the development of magnetic thin films, magnetic sensors, and magnetic shielding applications. Material processing, including powder metallurgy and electromagnets design, plays a crucial role in producing high-quality magnetic materials for various industries.

- Magnetic anisotropy, coercivity measurements, and permeability testing are essential in understanding the magnetic properties of materials and optimizing their performance. Magnetic shielding, magnetic refrigeration, and magnetic particle imaging are among the many applications that benefit from these advancements. Alnico magnets, ferrite materials, and rare earth magnets are widely used in these applications due to their unique magnetic properties. Domain wall motion, magnetostriction effects, and magnetic resonance imaging are other areas of ongoing research, driving innovation in magnetic materials and their applications. Microwave absorbers, magnetic levitation, and magnetic remanence are additional applications that showcase the versatility and importance of magnetic materials in modern technology.

- Magnetic sensors, soft magnetic materials, and high-frequency applications are other growing areas of interest, with nanocrystalline magnets and amorphous magnetic alloys offering potential solutions for improved performance and efficiency. Magnetic recording media and hard magnetic materials continue to be essential components in data storage and recording technologies. These evolving trends and applications underscore the continuous growth and importance of magnetic materials in various industries, from healthcare and technology to energy and transportation.

What are the Key Data Covered in this Magnetic Materials Market Research and Growth Report?

-

What is the expected growth of the Magnetic Materials Market between 2025 and 2029?

-

USD 16.32 billion, at a CAGR of 7.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Automotive and transportation, E and I, Industrial, and Others), Product (Hard magnetic materials and Soft magnetic materials), Geography (APAC, North America, Europe, South America, and Middle East and Africa), and Material Composition (Neodymium Iron Boron (NdFeB), Samarium Cobalt (SmCo), Ferrite, Alnico, Soft Ferrites, and Electrical Steels)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increased applicability of magnetic materials in computer application industry, Volatile prices of raw materials

-

-

Who are the major players in the Magnetic Materials Market?

-

Key Companies Adams Magnetic Products Co., Arnold Magnetic Technologies Corporation, BGRIMM Magnetic Materials & Technology Co., Ltd., Bunting Magnetics Co., Daido Steel Co., Ltd., Dexter Magnetic Technologies, Inc., Electron Energy Corporation (EEC), Goudsmit Magnetics B.V., Hitachi Metals, Ltd. (now Proterial Ltd.), Hirst Magnetic Instruments Ltd., Lynas Rare Earths Limited, Neo Performance Materials Inc., Ningbo Vastsky Magnet Co., Ltd., Proterial Ltd. (formerly Hitachi Metals, Ltd.), Shin-Etsu Chemical Co., Ltd., Steward Advanced Materials LLC, TDK Corporation, Tengam Engineering, Inc., Toshiba Materials Co., Ltd., VACUUMSCHMELZE GmbH & Co. KG, Yantai Dongxing Magnetic Materials Co., Ltd., and Yantai Zhenghai Magnetic Material Co., Ltd.

-

Market Research Insights

- The market encompasses a diverse range of materials exhibiting magnetic properties, including those with significant magnetic moments, high magnetic field strength, and distinct magnetic anisotropy energies. Magnetic domains within these materials can be manipulated through magnetic component design, enabling applications in various industries. For instance, high coercivity materials are essential in magnetic force microscopy and magnetic particle inspection, while low coercivity materials are preferred in magnetic data storage. Magnetic moment measurement and magnetic field strength are crucial factors in material selection criteria. For example, permanent magnet motors rely on high magnetic flux densities and strong magnetic fields for efficient operation.

- In contrast, magnetic torque sensors require materials with high magnetic susceptibility and low eddy current losses for accurate measurements. Magnetization reversal and magnetic hysteresis modeling are essential in understanding the magnetic behavior of materials. Dipolar interactions and exchange interactions significantly impact magnetic properties optimization. Magnetic field simulation and magnetic losses calculation are critical in electric motor design and magnetic storage devices. Material degradation, material microstructure, and magnetic field gradients are essential considerations in the development and application of magnetic materials.

We can help! Our analysts can customize this magnetic materials market research report to meet your requirements.