Managed IT Infrastructure Services Market Size 2025-2029

The managed IT infrastructure services market size is forecast to increase by USD 84.1 billion, at a CAGR of 6.4% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing adoption of cloud-based managed security services (MSS). Businesses are recognizing the benefits of outsourcing their IT security needs to specialized service providers, leading to a rise in demand for MSS. Additionally, the increasing demand for low-cost IT infrastructure solutions is fueling market expansion. This trend is particularly prevalent in small and medium-sized enterprises (SMEs) that seek cost-effective alternatives to building and maintaining their own IT infrastructure. However, the market faces challenges as well. The lack of IT security professionals is a major obstacle, as organizations struggle to find and retain skilled personnel to manage their IT infrastructure and security needs.

- This shortage of talent can lead to increased vulnerability to cyber threats and data breaches. Furthermore, the rapid pace of technological change in the IT infrastructure landscape poses challenges for service providers, requiring them to continually innovate and adapt to meet evolving customer needs. Security remains a top priority, with cloud security and risk management taking center stage. Companies seeking to capitalize on market opportunities must invest in building a strong talent pool and staying abreast of emerging technologies to effectively navigate these challenges and meet the evolving demands of their customers.

What will be the Size of the Managed IT Infrastructure Services Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Entities such as penetration testing, business continuity, network security, data centers, system integration, unified communications, IT audit, public cloud, collaboration tools, vulnerability management, help desk support, and others are seamlessly integrated into comprehensive offerings. The ongoing digital transformation drives the demand for managed services, with organizations seeking to optimize their IT infrastructure and improve operational efficiency. IT strategy is increasingly centered around cloud computing, with hybrid and private cloud solutions gaining traction.

Network engineering and database administration are crucial components of IT infrastructure management, ensuring optimal performance and availability. Endpoint management and incident response are essential for securing the digital workplace, while network virtualization and IT consulting offerings help organizations navigate complex IT landscapes. Agile methodology and project management are critical for successful IT infrastructure implementations. Performance monitoring, capacity planning, and server management are key components of IT infrastructure management, ensuring that systems run smoothly and efficiently.

How is this Managed IT Infrastructure Services Industry segmented?

The managed IT infrastructure services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- SMEs

- Large enterprise

- Deployment

- Cloud-based

- On-premises

- Service

- Server management

- Networking services

- Virtualization services

- Storage services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

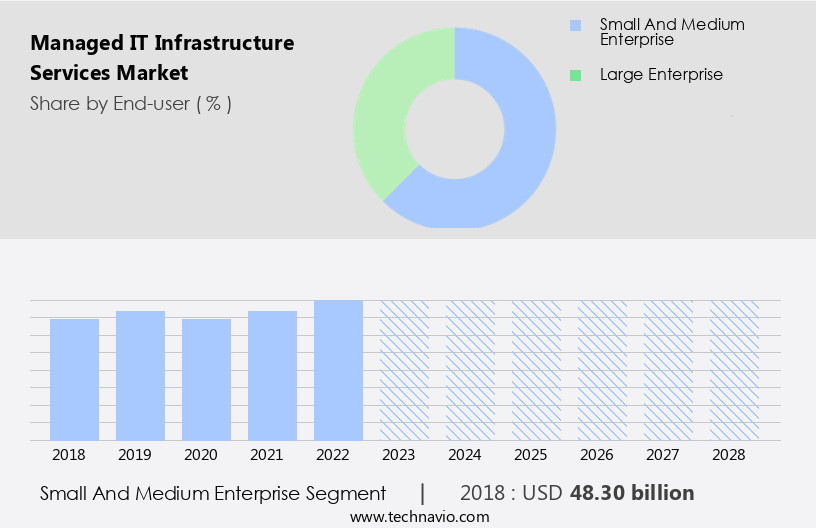

By End-user Insights

The SMEs segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth, driven by the increasing adoption of digital transformation initiatives and the need for advanced IT strategies. SMEs continue to dominate the market, accounting for the largest revenue share, as they invest heavily in upgrading and maintaining their IT infrastructure. This includes the implementation of hybrid cloud solutions, machine learning, and IT outsourcing, among other services. Security audits and risk management are also critical priorities, with businesses seeking to enhance their cloud security and network security. Managed services, including network engineering, database administration, and endpoint management, are increasingly popular as companies seek to improve performance monitoring, incident response, and capacity planning.

The adoption of agile methodologies and system administration practices is driving the demand for IT consulting and project management services. Cloud migration and system integration are also key areas of focus, as businesses look to optimize their IT infrastructure and leverage the benefits of public, private, and hybrid cloud solutions. Unified communications and collaboration tools are becoming essential for businesses, particularly in the wake of the remote work trend. Vulnerability management and help desk support are also critical services, ensuring businesses can address security threats and IT issues promptly. Artificial intelligence and machine learning are transforming IT infrastructure management, enabling businesses to automate processes, improve efficiency, and gain valuable insights from their data.

Ongoing activities in the market include the adoption of artificial intelligence and machine learning for IT infrastructure management and the continued evolution of IT governance and compliance frameworks. Disaster recovery and business continuity planning are also crucial, as companies seek to minimize downtime and protect their data in the event of an emergency. Overall, the market is evolving rapidly, with businesses increasingly recognizing the importance of investing in advanced IT solutions to remain competitive. From data backup and server management to network virtualization and performance monitoring, managed IT infrastructure services are essential for businesses looking to optimize their IT operations and drive growth.

The SMEs segment was valued at USD 146.90 billion in 2019 and showed a gradual increase during the forecast period.

The Managed IT Infrastructure Services Market is witnessing robust growth as enterprises increasingly outsource critical operations to boost agility and efficiency. Core services like technical support ensure minimal downtime and seamless user experiences, making them indispensable for modern businesses. In parallel, data recovery capabilities are becoming vital, safeguarding organizations against cyber threats and accidental loss. A transformative trend in the market is the integration of machine learning (ML), which enhances predictive maintenance, security analytics, and automated responses. Another game-changer is Hyperconverged Infrastructure (HCI)âa unified system that combines storage, computing, and networking to streamline management and reduce costs.

Big data is revolutionizing the market, offering opportunities for innovation and competitive advantage. The Managed IT Infrastructure Services Market is undergoing rapid transformation, fueled by demand for proactive insights and real-time decision-making. At the heart of this evolution are powerful monitoring tools, which enable IT teams to track system performance, detect anomalies, and prevent downtime before it impacts business operations. Complementing these are advanced data visualization platforms, which translate complex metrics into intuitive dashboards and visual formats.

Regional Analysis

North America is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic IT landscape, North America continues to be a significant market for managed IT infrastructure services. Advanced technologies, such as machine learning, artificial intelligence, and cloud computing, are increasingly adopted in industries like manufacturing, retail, and finance, driving the demand for these services. The region's strong economic foundation, home to some of the world's leading economies, further boosts the need for managed services, encompassing data processing, outsourcing, internet services, and infrastructure. Major players, including IBM, Cisco, DXC Technology, and Rackspace Technology, have a robust presence in the region, fueling the market's growth. Advanced offerings, such as hybrid cloud, private cloud, network engineering, database administration, endpoint management, and IT consulting, are in high demand.

Predictive analytics and prescriptive analytics offer insights into future trends and potential issues, allowing for proactive intervention. Risk management, security audits, incident response, network virtualization, and performance monitoring are essential components of managed IT infrastructure services. Business continuity, disaster recovery, capacity planning, and project management are also critical elements, ensuring minimal downtime and optimal system performance. Moreover, the adoption of agile methodologies and system administration best practices further strengthens the market's growth. The integration of unified communications, collaboration tools, and vulnerability management enhances the overall value proposition of managed IT infrastructure services. The North American market is thriving, driven by technological advancements, strong economic foundations, and the presence of key players.

The market's evolution is characterized by the increasing adoption of advanced technologies and the integration of various services, including data backup, network security, and system integration.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Managed IT Infrastructure Services Industry?

- The increasing adoption of cloud-based managed security services (MSS) serves as the primary growth driver in this market. Managed services have become an essential component of IT infrastructure for businesses seeking to mitigate risks and optimize operations. The increasing complexity of IT environments and the growing threat landscape have led organizations to outsource network engineering, database administration, endpoint management, IT governance, incident response, network virtualization, and IT consulting to managed service providers (MSPs). MSPs are responding to this demand by offering innovative solutions for risk management. For instance, cloud migration is a popular trend, with enterprises moving their IT infrastructure to the cloud for enhanced security and scalability.

- Performance monitoring is another critical managed service, enabling businesses to optimize their IT infrastructure and ensure uptime. MSPs use advanced tools to monitor network performance, identify bottlenecks, and resolve issues proactively. Additionally, IT consulting services help businesses navigate the complexities of IT infrastructure and make informed decisions about technology investments. In summary, the demand for managed services is driven by the need for effective risk management, enhanced security, and optimized operations. MSPs are responding to this demand by offering innovative solutions for network engineering, database administration, endpoint management, IT governance, incident response, network virtualization, and IT consulting.

What are the market trends shaping the Managed IT Infrastructure Services Industry?

- The increasing demand for affordable IT infrastructure is a notable trend in the current market. This requirement is driven by businesses seeking cost-effective solutions to support their growing digital needs. Managed IT infrastructure services have become essential for businesses to maintain their IT systems and remain competitive. The market for these services has seen significant growth, with companies increasing their IT infrastructure budgets to accommodate the demands of digital transformation. This increased spending includes expenses on network security, system integration, unified communications, business continuity, IT audit, vulnerability management, help desk support, collaboration tools, and penetration testing.

- Cloud storage costs approximately 4 cents per gigabyte, a significant reduction compared to the cost of maintaining internal IT infrastructure. Furthermore, managed IT infrastructure services provide businesses with access to advanced technologies, allowing them to focus on their core competencies while experts manage their IT needs. These services also offer the added benefits of enhanced security, improved disaster recovery, and increased efficiency. Cloud-based managed services, including security and performance monitoring, are particularly popular, providing businesses with scalable, cost-effective, and secure solutions.

What challenges does the Managed IT Infrastructure Services Industry face during its growth?

- The insufficient supply of IT security experts poses a significant challenge to the expansion and progression of the industry. The market faces a significant challenge due to the shortage of IT and cybersecurity professionals. This limitation hinders enterprises from achieving optimal IT security standards, leaving them vulnerable to cyberattacks and resulting in potential data loss and reputational damage. As cybersecurity threats continue to evolve, the demand for advanced security solutions to counteract these attacks is escalating rapidly. To address this skills gap, cybersecurity training is crucial to bring in new talent and fortify organizational security.

- These solutions enable businesses to focus on their core competencies while ensuring the efficient and secure management of their IT infrastructure. With the emphasis on agile methodologies and project management, organizations can effectively respond to changing business needs and prioritize their IT infrastructure investments. Artificial intelligence (AI), disaster recovery, server management, capacity planning, agile methodology, system administration, IT infrastructure, data backup, project management, and cloud computing are integral components of managed IT infrastructure services.

Exclusive Customer Landscape

The managed IT infrastructure services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the managed IT infrastructure services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, managed IT infrastructure services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accenture PLC - This company specializes in managed IT infrastructure services, delivering solutions through Cloud and Infrastructure Managed Services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture PLC

- AT and T Inc.

- Atos SE

- Canon Inc.

- Cisco Systems Inc.

- Citrix Systems Inc.

- Cognizant Technology Solutions Corp.

- Dell Technologies Inc.

- DXC Technology Co.

- Fujitsu Ltd.

- Happiest Minds Technologies Ltd.

- Hewlett Packard Enterprise Co.

- International Business Machines Corp.

- Lenovo Group Ltd.

- Microsoft Corp.

- Tata Consultancy Services Ltd.

- Telefonaktiebolaget LM Ericsson

- Toshiba Corp.

- Verizon Communications Inc.

- Xerox Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Managed IT Infrastructure Services Market

- In January 2024, IBM announced the acquisition of GreenBlue Data Centers, a leading European provider of sustainable data center solutions, to expand its hybrid cloud capabilities and strengthen its managed infrastructure services offerings in the European market (IBM Press Release, 2024).

- In March 2024, Amazon Web Services (AWS) introduced AWS Outposts, an extension of AWS services to on-premises infrastructure, allowing businesses to run workloads on-premises while using the same tools and services as in the cloud (AWS Press Release, 2024).

- In May 2024, Microsoft and Google Cloud formed a strategic partnership to provide joint solutions for enterprise customers, combining Microsoft's Teams communication platform with Google's cloud services, aiming to enhance productivity and collaboration (Microsoft Blog, 2024).

- In February 2025, Dell Technologies completed the acquisition of HPE's IT services business, expanding its managed infrastructure services portfolio and enhancing its position in the market (Dell Technologies Press Release, 2025).

Research Analyst Overview

The market is witnessing significant growth, driven by the adoption of automation tools to streamline operations and enhance efficiency. Energy efficiency is a key focus area, with businesses integrating Green IT initiatives to reduce their carbon footprint and save costs. Business Intelligence (BI) and data analytics are transforming decision-making processes, while compliance frameworks such as PCI DSS ensure secure data handling. Cost optimization and resource optimization are top priorities, leading to the increased use of cloud storage and configuration management. High availability and remote monitoring enable businesses to maintain continuity and respond to issues swiftly.

Security tools are essential for safeguarding data, with log management and data governance ensuring compliance and data integrity. Remote access and monitoring enable businesses to manage their infrastructure from anywhere, ensuring business continuity and agility. Cloud solutions, such as cloud backup and recovery, have become popular as they offer cost savings. These solutions enable organizations to store data off-site, reducing the need for costly internal power and storage. Cloud-based managed security services are particularly in demand, providing protection against cyber threats such as email viruses, Distributed Denial-of-Service (DDOS) attacks, firewalls, and intrusion detection.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Managed IT Infrastructure Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 84.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

US, Canada, UK, Germany, China, France, Brazil, India, Italy, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Managed IT Infrastructure Services Market Research and Growth Report?

- CAGR of the Managed IT Infrastructure Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the managed IT infrastructure services market growth of industry companies

We can help! Our analysts can customize this managed IT infrastructure services market research report to meet your requirements.